Summary:

- DraftKings is underperforming its main rival, FanDuel, losing share to its owner Flutter Entertainment.

- The company’s plan to introduce a tax surcharge in states with high tax rates was abandoned, reflecting weak competitive positioning.

- DraftKings’ valuation is problematic, trading at nearly three times Flutter’s valuation despite losing market share and being unprofitable.

- I downgrade DraftKings to a ‘Sell’.

South_agency

DraftKings (NASDAQ:DKNG) is a leader in the rapidly growing online betting market. With a significant brand name, expansive operations throughout the U.S., and a top-tier technology platform, the company is capitalizing on the industry’s attractive growth prospects.

However, the jury is out when it comes to the profit potential in this highly competitive market, whereby regulators want more tax and customers demand the best odds along with the best rewards and promotions.

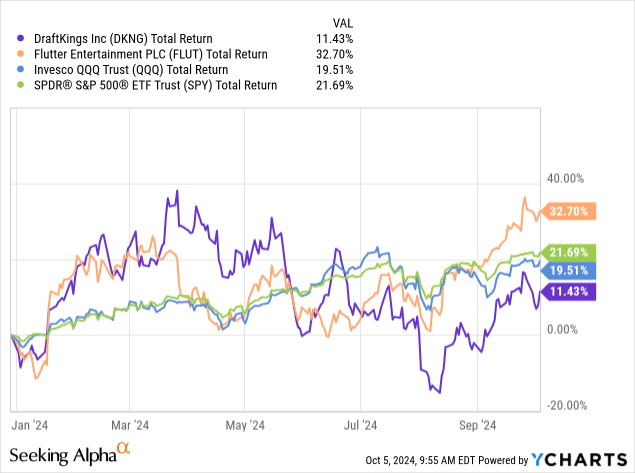

With the stock significant underperformance year-to-date, it’s time to revisit our overvaluation thesis and assess where we go from here.

Recapping DraftKings’ Underperformance Year-To-Date

I started covering DraftKings on Seeking Alpha a few months ago. In my April Article, I discussed the online-sports-betting business model, the industry outlook, and my framework for evaluating a no-moat company like DraftKings.

In my June Follow-up, I went over recent regulatory developments, showed how extremely overvalued it is relative to its main competitor in Flutter Entertainment (FLUT). I also emphasized the risk of relying on the company’s adjusted numbers for valuation.

In both articles, I rated DraftKings a ‘Hold’, which has been a correct call so far, with the company underperforming both the market and Flutter year-to-date.

Interestingly, with Flutter performing so well, it’s hard to attribute DraftKings’ poor performance to external or industry pressures. When your closest peer is outperforming you by a wide margin, it has to do with either valuation, or better performance.

Notably, it’s possible Flutter is benefitting from news related to Fox (FOX) exercising its option, but its outperformance began before those broke out.

So, let’s see what’s going on, is it valuation, performance, or maybe both?

The Tax Surcharge Debacle

In its second-quarter print, DraftKings announced a plan to introduce a tax surcharge in certain states, in response to a significant tax rate increase in Illinois.

We have seen a shift to tax rates over 20% in certain competitive markets, including a recent significant tax increase in Illinois. We now must consider the prospect that some states may choose to tax the industry at a rate that is in excess of what we can absorb while still generating a reasonable profit margin and remaining competitive against the pervasive illegal market that pays no taxes at all.

We are planning to implement a gaming tax surcharge in any state with a tax rate above 20% that has multiple sports betting operators. In Illinois, for example, it will amount to a low to mid-single digit percentage of the Net Winnings a customer would previously have received, but we believe additional upside potential exists for DraftKings’ Adjusted EBITDA in 2025 and beyond from this gaming tax surcharge. We plan to implement the surcharge in the four states that have multiple sports betting operators and tax rates above 20% starting January 1, 2025.

I don’t want to pat myself on the back, but that’s exactly what I predicted might happen in my June article, where I wrote the following:

Tax income is addicting, and when a certain market draws its legitimacy from the tax income it generates, it is exposed to the possibility that regulators would want to collect even more.

This is happening in Illinois, which is the seventh-largest state in terms of population. Investors (and other states) must ask themselves, if Illinois can raise its taxes, why wouldn’t California? Or Texas? Or Florida? After all, those are huge states, which the providers cannot give up on.

DraftKings said that those higher tax rates are exceeding what it can absorb while remaining reasonably profitable (which it isn’t yet, by the way). Its plan to deal with it, however, was abandoned, as Flutter, the other betting behemoth, didn’t play along.

This is a big drag on the company’s long-term margin potential, as reflected by their revising downwards of 2024 guidance, and adds uncertainty about terminal tax rates to the equation.

Recent Results & Competitive Outlook

In the second-quarter, DraftKings revenues rose 26% to $1.1 billion, reflecting a sharp deceleration from Q1, and slightly missing estimates. Management did upgrade the revenue guidance for 2024, but it was primarily due to the Jackpocket acquisition.

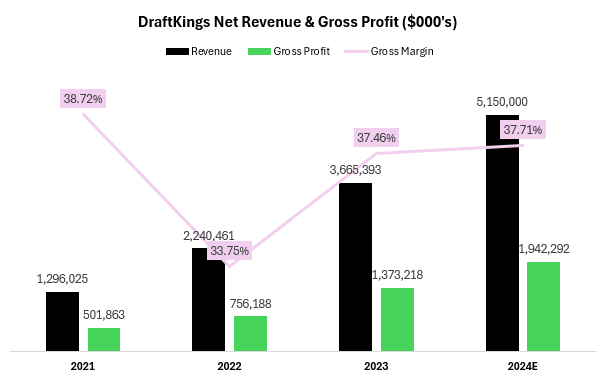

Gross margins were stable with Q1 in the 40% range, reflecting a 180 bps decline from the prior year period, resulting in $440 million in gross profit. For the year, they expect flat gross margins.

Created and calculated by the author using data from DraftKings financial reports.

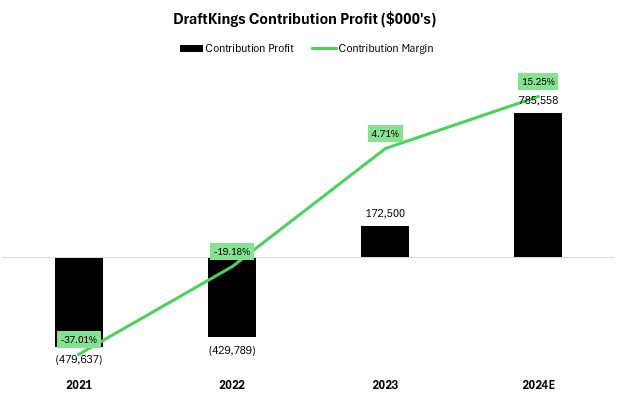

Meanwhile, sales & marketing leverage continued, coming in at 19.5% of sales compared to 23.7% in Q2-23. On a dollar basis, sales & marketing grew by less than 4%. This drove contribution margins to all-time highs, but management expects expense growth to accelerate in the second-half due to the Jackpocket acquisition, increased customer acquisition spending, and higher tax rates.

Created and calculated by the author using data from DraftKings financial reports.

Looking ahead, they see $950 million in adjusted EBITDA as achievable, although at the time they gave the guidance they still expected to implement the tax surcharge.

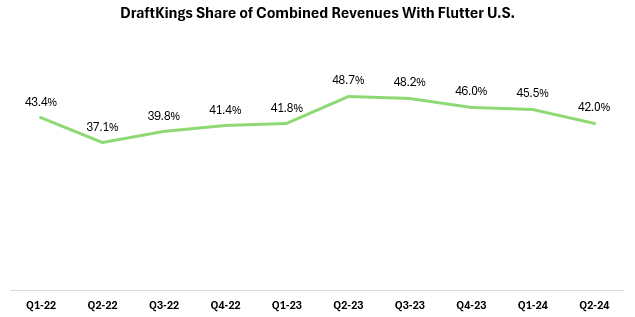

Created and calculated by the author using data from DraftKings and Flutter Entertainment financial reports.

Switching gears to the competitive outlook, DraftKings lost share in the second-quarter with Flutter U.S. (FanDuel) growing 39%, a 13 percentage points beat. This marks 4 consecutive quarters of market-share losses to FanDuel.

So, while the U.S. online gambling market seems to be much larger than many expected, now estimated at $70 billion by 2027, it becomes increasingly possible that DraftKings isn’t necessarily the right horse to pick in this race.

Avoid Valuation Acrobatics, They Rarely Work

I have to admit I’m actually surprised that DraftKings’ stock held up relatively well considering its poor performance compared to Flutter, and the whole tax surcharge mess.

I would expect such developments to send shares sharply lower, but because they didn’t, the valuation became even more problematic, in my view.

Here it is:

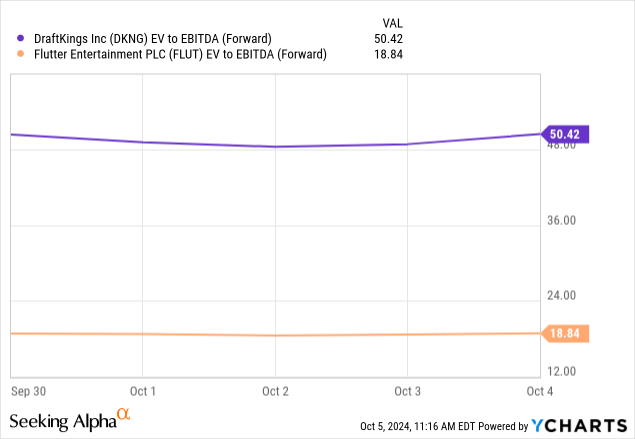

At current levels, DraftKings trade at a valuation that’s nearly three times as high that of Flutter, which is not only gaining market share and growing faster, it has a much bigger U.S. business in terms of revenue and EBITDA.

The Adjusted EBITDA Elephant In The Room

I had to give this its own heading to make sure people don’t miss the following discussion.

The above chart is based on the adjusted EBITDA numbers the companies’ provide. I wrote time and time again, this metric is extremely, extremely, flawed.

For context, DraftKings adjusted EBITDA in the second quarter was more than 4x its “regular” EBITDA.

Another one, DraftKings actually had an operating loss of $33 million, while its adjusted EBITDA was $128 million.

We can’t even use regular EBITDA to calculate DraftKings’s multiple because it’s expected to be negative.

Conclusion

So many times, investors lose their hard-earned money on companies because they’re unwilling to acknowledge a simple truth – the stock is overvalued.

In DraftKings’ case, we’re talking about an unprofitable company, that’s losing share to its biggest rival in FanDuel, and yet it’s still trading at nearly three times Flutter’s valuation.

Furthermore, DraftKings is trading at 50 times adjusted EBITDA. By itself it’s too high, but it’s even worse considering the adjustments include real shareholder costs, primarily stock-based compensation.

More often than not, situations like these end up badly for shareholders. Yes, momentum, hype, or FOMO might keep the stock from falling, and could even lead it higher.

However, with the fundamental floor so low, I think a downgrade to ‘Sell’ is due.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.