Summary:

- DraftKings’ rapid growth faces challenges in customer retention and profitability due to high customer acquisition costs and intense competition from FanDuel and BetMGM.

- Regulatory risks and economic headwinds, including potential tax increases and declining personal savings, pose significant threats to DraftKings’ long-term profitability.

- The company’s liquidity is dwindling, and while recent acquisitions may lower CAC, they might not sustain long-term customer revenue.

- Despite my bearish outlook, shorting DKNG is risky due to potential investor optimism and the uncertain impact of economic trends on gambling behavior.

bluecinema/iStock via Getty Images

Since the Supreme Court allowed US states to legalize sports betting, the industry has rapidly expanded to over $10B annually. Goldman Sachs’ analysts expect the market to reach $45B eventually. Much of this growth is dominated by the giants DraftKings (NASDAQ:DKNG) and FanDuel, owned by Flutter Entertainment (FLUT). DraftKings and FanDuel have around 32% and 35% of the US sports betting market share, respectively, with many smaller competitors looking to expand.

DraftKings’ sales growth has been spectacular, rising at around 60% to 70% each year over recent years. The company’s growth rate is expected to remain at around 40% this year and slow to stagnation in the early 2030s once its sales are around $12B. The analyst consensus also expects its EPS to rise to around $5 to $6 by 2030, potentially higher in the long run.

Although the company loses much money today, it may be undervalued based solely on analyst consensus expectations. If it can achieve a $5 EPS by the decade’s end, its long-term forward “P/E” today would be around 7X. The stock was valued more in line with this potential in 2021 when it traded over $60 but crashed in 2022 to below $20 as investors pulled away from high-growth stocks. It rebounded in 2023, as did many growth stocks, but has shifted back toward a negative trend over the past six months.

Given DKNG’s stock volatility, valuation, and growth potential, I believe it is worth closer analysis. Although the stock may be a “growth at a reasonable price” investment today, that depends mainly on the company’s ability to lower customer acquisition costs while maintaining market share. Further, given the state of consumer investing and savings power, there may be negative macroeconomic implications facing the sports betting market.

CAC Highlights Competitive Pressure

Revenue and growth are meaningless if they never translate to earnings and cash flow. Many view DraftKings as having an edge simply because it is “the house.” However, customers can choose which house they’ll gamble in. These days, they’ll go with the one willing to pay the most for them to visit, akin to the casino offering the most free drinks.

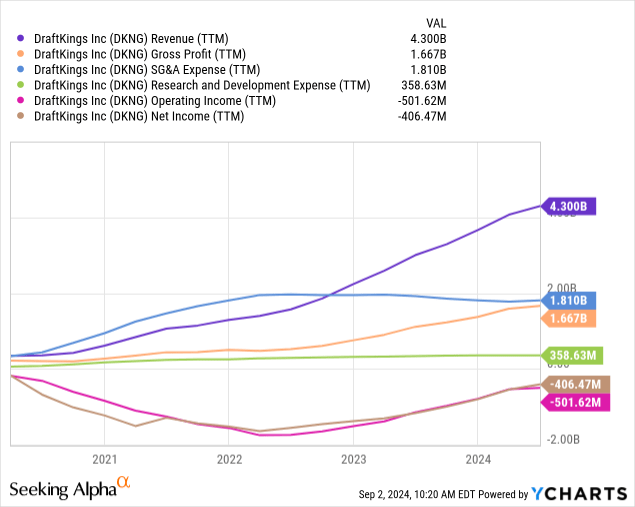

DraftKings pays a lot to get new customers, but those customers do not necessarily stick around. In the past, the company spent hundreds of dollars to acquire a new customer by offering free bets. This effort aided its sales growth, but was unsustainable. More recently, it has dramatically reduced its CAC, as a YoY rate of 40% last quarter, but still saw an 80% increase in new players. However, as seen in its 10-Q, its Q2 revenue per unique payer was $117 vs. $137 in Q2 2023, indicating that the value of customers is falling. These data are reflected in its revenue and expense trends. See below:

The company has a ways to go before it will be profitable. The fact that its SG&A and R&D are leveling while its sales continue to rise is a positive sign. Still, it remains to be seen if it can retain these customers long-term at relatively high monthly spending levels while offering fewer free bets and similar incentives.

While DraftKings is looking to reduce CAC, its smaller competitor, BetMGM (MGM), has ramped up its customer acquisition spending. Although Bet365 is more internationally focused, the same appears to be true. Barstool Sports (PENN) tried to grow without high CAC spending but failed to obtain a competitive market share.

Thus, I think it’s clear that the online sports betting market falls into the “normal” or “zero” profit condition economic law. Companies profit because they have some unique niche or locational value that increases their competitive status, allowing them to raise prices enough to earn a profit. I’d argue sports betting was more profitable when it was a legal fringe or illegal because that inherently lowered competition. However, for modern online sports betting, particularly now that it’s widely legalized, customers will ultimately flow to the platforms that provide the most value. That can be through free bets (DraftKings) or better odds (FanDuel).

Between those two, people may pick DraftKings first for its higher early bonuses but stick with FanDuel due to its better net odds. Thus, we must discount DraftKings because it may not retain customers, or more likely, the value of its customers will decline. Certainly, platform value and customer service play a role, but IOS app ratings are all similarly high for all top platforms, though FanDuel may have a slight edge.

Of course, should these companies make a decent income, that will not stop the government from taking it. Illinois recently enacted a 40% of adjusted gaming revenue (after payouts) gambling tax. This charge notably impacted DraftKings’s earnings, particularly considering it did not enact a surcharge after FanDuel decided not to. Several other states are looking to do the same, meaning it may become a nationwide trend.

I believe voters in these states will have no issue with this, mainly if it does not increase surcharges on these platforms. There’s also some evidence that the rise in sports betting results in negative household financial trends, with states with legalized sports betting seeing reduced savings, investing, lower credit scores, higher bankruptcies, and more auto loan delinquencies. The data also showed that people who bet on sports are likelier to have children. Thus, there is some evidence that we may eventually see bipartisan pushback against sports betting as more households are impacted, encouraging more taxes.

DraftKings Will Need to Earn a Profit Soon

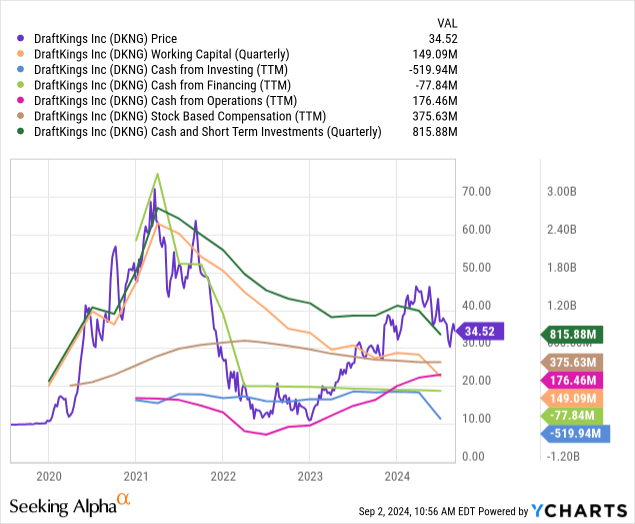

DraftKings cannot lose money forever if it wishes to keep its investors. The company’s cash and ST investment position has declined from over $2.5B to $815M, seeing its net working capital crash to just $149M. With its low working capital, it’s starting to face some liquidity needs and lose its ability to invest in customers without raising external capital. Its operational cash flow is positive because of its high stock-based compensation (dilutive to equity investors). It also spent half a billion on a recent acquisition, as seen in its investing cash flow. See below:

Overall, I would not say the company’s liquidity position is too alarming, but it may become a concern if it fails to reverse its declines. The rise in its CFO into positive territory is a good sign for the company, but the caveat is that it spends far more on stock-based compensation, which is dilutive. Equity compensation is around 2.2% of its equity value currently, which is not too dilutive, but may become a more significant issue if its market capitalization declines. For example, its outstanding shares rose by around 10% in 2022 due to higher dilution associated with a lower market capitalization.

Acquisitions To “Make or Break” DraftKings

Earlier this year, DraftKings agreed to buy the digital lottery app Jackpocket. The company also recently bought Simplebet, an in-play betting with AI capabilities. DraftKings is looking to expand into other segments, which may provide strategic value regarding customer acquisition and retention across its platforms. The AI tools are likely to aid in its retention battle with its competitors, while Jackpocket is a vertical that should aid in customer acquisition.

There’s a great deal of analysis regarding how JackPocket should lower DraftKings’ customer acquisition costs by encouraging more chronic lottery players to join DraftKings. JackPocket’s CAC was around 80% lower last year than DraftKings. While I think it’s fair to assume JackPocket will lower CAC further by acting as a funnel to DraftKings, it may be that those already spending a bit on the lottery may not spend as much on DraftKings. Thus, I expect monthly customer revenue to decline proportionately to lower CAC costs. Though I think the acquisition makes sense, I think investors may overestimate the long-term value it will provide if it results in more low-value customers. Further, lottery players are not necessarily sports watchers, meaning these customers may be willing to test DraftKings for free bets but may not have the sports interest to stick around long-term.

The Bottom Line

Overall, I think DraftKings is in a precarious situation. It lost a great deal of liquidity in its aim to gain customers, but to me, it has failed to prove it can retain these customers long-term without seeing declines in customer revenues. It has seen growth in customer revenues when it was paying more for customer acquisition. Now that its CAC costs are falling, I am not surprised to see its revenues per customer, too, and I expect I should continue to do so. With MGM making a more significant effort to expand, I also think DraftKings is at high competitive risk, since building an enduring moat in the online betting industry appears extremely difficult.

The economic backdrop may also play a negative role. While some states may still legalize online gambling, the previously mentioned data indicating negative household financial trends in OSB-legal states may halt that. It may also encourage more states to increase taxes on DraftKings, making it that much further from profitability.

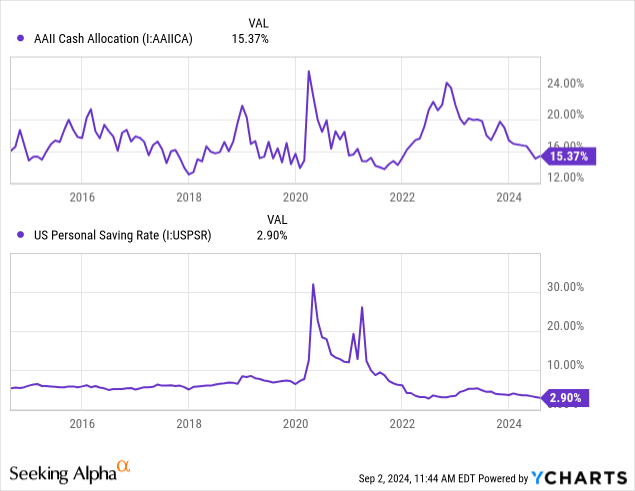

On the economic front, low personal savings and low investor cash allocations may indicate less excess liquidity that can go into gambling. Since 2021, the US personal savings rate has crashed to an extreme low, indicating household incomes are not keeping up with spending. More recently, individual investors have had less cash on the sidelines, indicating less money that can go into stocks like DKNG and potentially less household liquidity. See below:

Sports betting is a substantial negative sum game. Although gambling activity may rise in recessions, that is not necessarily true (lotteries do well, but casinos do not), and it is untested for legal online sports betting. While top-line economic figures may appear decent, the average American saves much less than usual and is much less confident in the economy than usual.

Ultimately, many DraftKings customers may not have high discretionary spending capacity to maintain a few hundred monthly dollars toward sports betting. Looking at the data indicating troubling household financial impacts of legal sports betting, I think DraftKings faces a fair amount of regulatory risk currently underappreciated by the market. Further, it may be that a cohort of DraftKings customers may be unable to maintain this habit. Given how low personal savings have become in recent months, this risk may become more evident in its Q3-Q4 earnings. The continued potential unemployment rise could significantly exacerbate it.

Overall, I think DraftKings’ outcome will be relatively binary: either the company will grow to profitability or it will not. Its ability to earn a consistent profit in a highly competitive market with high regulatory risk is limited to me. Immediate economic trends may also cause DraftKings to disappoint investors over the coming quarters. Although customer growth costs may improve with its acquisition, I expect continued declines in revenues per customer, potentially limiting its ability to earn a positive operating cash flow. If its CFO becomes negative, I expect DKNG may fall as concerns rise regarding its low working capital. Still, without tremendous regulatory pushback or economic pressure, the company likely has the liquidity to operate at a loss for quite a few years.

My outlook for DKNG is bearish, but I would not necessarily bet against it today. My view stems from the combination of what I view to be a long-term inability to earn a profit due to competition and more immediate negative economic headwinds. Those headwinds could be offset by renewed hope in the company from lower CAC costs, but I suspect that hope largely played out in 2023. In the future, I believe the combination of low personal savings and low investor cash positioning likely does not bode well for customers’ gambling activity and retail investors’ buying activity for DKNG itself.

Still, my views on DKNG are not so different from my previous outlook for Penn Entertainment. In 2020, I expected Penn’s involvement with Barstool’s would fail to improve its profits. In my opinion, my outlook was precisely correct – that online sports betting is competitively unprofitable due to insufficient barriers to entry. The stock is down 50% since then; however, it rose meteorically during the COVID lockdowns (the article written before COVID was well-known). Thus, no gains were to be found from shorting PENN in early 2020 despite its losses since.

My point is that retail investor speculation need not care for the fundamentals. Further, as in Penn’s case, DraftKing’s fundamentals may look better in Q3 and Q4 due to lower CAC, as investors may overlook revenues per customer. To me, that is the most significant risk to my thesis. It also remains unclear if negative household financial trends harm DraftKings, as I expect, since some argue poverty encourages gambling. Thus, I think DKNG may be too risky to short today, though I may still place a short against it as I feel its technical trend is somewhat bearish.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in DKNG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.