Summary:

- DraftKings has exceeded expectations by successfully growing its engagement in existing markets while accelerating its launch in new jurisdictions.

- Much of the tailwinds are attributed to its well-diversified offerings across gaming/ sports through its in-house offerings and Golden Nugget Online Gaming acquisition, on top of Jackpocket’s lottery capabilities.

- DKNG’s ability to scale its operations efficiently also underscores why the management has raised its FY2024 top/ bottom line guidance.

- Combined with its leading market share in the online gaming US market, second only to FanDuel, we believe that DKNG remains well positioned to report robust profitable growth ahead.

- It is apparent by now that market leaders never come cheap after all.

Wpadington/iStock via Getty Images

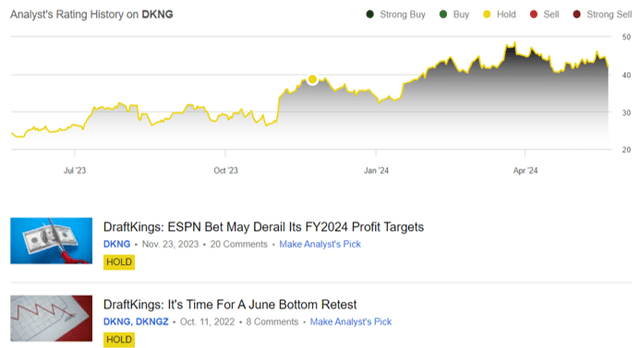

We previously covered DraftKings (NASDAQ:DKNG) in November 2023, discussing its excellent FQ3’23 earnings call, thanks to the robust growth observed in its Monthly Unique Payers [MUP] and Average Revenue Per MUP, implying the stickiness of its gaming platform and loyal consumers with robust spending power.

Even so, we had maintained our Hold rating then, since the stock continued to trade at a premium over its peers, with it remaining to be seen how the competition from PENN Entertainment’s ESPN Bet (PENN) might turn out.

By now, DKNG has exceeded expectations by reporting an impressive FY2023 and FQ1’24 earnings results, while charting a +8.5% stock price return compared to the wider market at +16.4%.

With it still reporting a leading gaming market share in the US while raising its FY2024 guidance, it is apparent that we have been too bearish thus far as DKNG continues to be a market leader, resulting in our upgraded rating to a Buy.

We shall discuss further.

The DKNG Investment Thesis Is Inherently Compelling, With Market Leaders Never Coming Cheap

For now, DKNG has reported a double beat FQ1’24 earnings call, with revenues of $1.17B (-4.5% QoQ/ +52.6% YoY) and adj EBITDA of $22.39M (-85.1% QoQ/ +110.1% YoY).

Much of the top-line tailwinds are attributed to the sustained growth in its MUP to 3.4M (-0.1M QoQ/ +0.6M YoY), implying its ability to retain its existing user base while acquire new customers in new jurisdictions, such as Vermont and North Carolina.

At the same time, with the higher Average Revenue Per MUP to $114 (-1.7% QoQ/ +23.9% YoY) in the latest quarter, it is apparent that DKNG has also grown its handle per user as it improves the overall customer experience and accelerates its penetration in new jurisdictions.

Readers must also note that part of the top-line tailwinds may be attributed to the fully integrated Golden Nugget Online Gaming acquisition completed in May 2022, with it already “enhancing cross-selling opportunities and driving increased revenue growth.”

At the same time, DKNG’s bottom lines are boosted by the management’s relatively efficient adj operating expenses of $510.22M after discounting for the non-cash Stock-Based Compensations (+14.7% QoQ/ -1.9% YoY) in the latest quarter.

The accelerating top-line and efficient operations have naturally contributed to its expanding adj EBITDA margins of 1.9% (-10.3 points QoQ/ +30.6 YoY), demonstrating its “largely at-scale fixed cost structure” thus far.

As a result, the raised FY2024 guidance is not surprising, with DKNG expecting to generate higher revenues of $4.9B (+33.8% YoY) and adj EBITDA of $500M at the midpoint (+431% YoY), compared to the original guidance of $4.77B (+30.2% YoY) and $460M (+404.5% YoY) offered in the FQ4’23 earnings call.

Readers must also note that these numbers have yet to take into account the recently completed Jackpocket acquisition, with it expected to drive up to $340M in incremental revenues and $100M in adj EBITDA by FY2026, with it eventually being accretive to DKNG’s top/ bottom lines.

Consequently, while the Jackpocket acquisition is expected to be moderately equity dilutive, we believe that the expansion into digital lottery services is highly strategic indeed, allowing DKNG to diversify its offerings while accessing the former’s “database of 6M customers, with 1.8M active ones and 700K unique users per month.”

At the same time, DKNG’s cash burn may also moderate from here, with the balance sheet potentially improving from the cash/ equivalents of $1.19B (-6.2% QoQ/ +10.1% YoY) and debts of $1.25B (inline QoQ/ inline YoY) reported in FQ1’24.

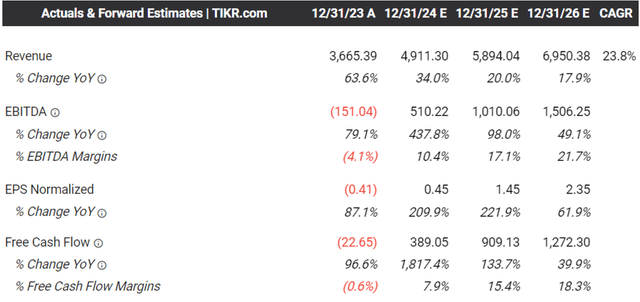

The Consensus Forward Estimates

Therefore, it is unsurprising that the consensus have raised their forward estimates, with DKNG expected to generate a top/ bottom line growth at a CAGR of +23%/ +156% through FY2026.

This is compared to the original estimates of +21%/ +148% and the historical top line growth at +63% between FY2016 and FY2023.

DKNG Valuations

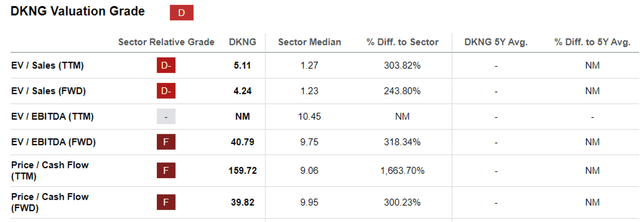

This is why we can understand why DKNG has been awarded the premium FWD EV/ EBITDA valuations of 40.79x and FWD Price/ Cash Flow valuations of 39.82x, compared to the sector median of 9.75x and 9.95x, respectively.

Even when we compare against its direct peers, such as the owner of FanDuel, Flutter Entertainment plc (FLUT) at 17.26x/ 23.26x and PENN at 9.72x/ 9.51x, it is undeniable that DKNG’s premium is justified, despite our previous concerns on ESPN Bet. (Interested readers may read up on our recent coverage on PENN here).

When comparing DKNG’s consensus forward estimates with FLUT at a top/ bottom line CAGR of +13.4%/ +26.1% through FY2026 and PENN at +5.7%/ +10.3%, respectively, it is apparent that the former’s profitable accelerated growth warrants the premium valuations.

Online Gaming Market Share

NEXT.io

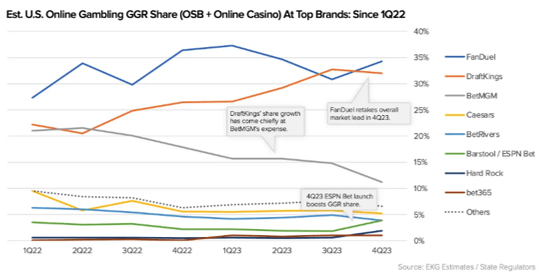

This is especially since DKNG boasts a leading gaming market share of 32% in the US by Q4’23, with it second only to FanDuel at 35%, with Q1’24 data yet available.

At the same time, the US OSB market size is estimated to reach $40B by 2030, implying that the DKNG may continue to report profitable growth over the next few years for so long that it is able to sustain its leading market share and grow user engagement.

So, Is DKNG Stock A Buy, Sell, or Hold?

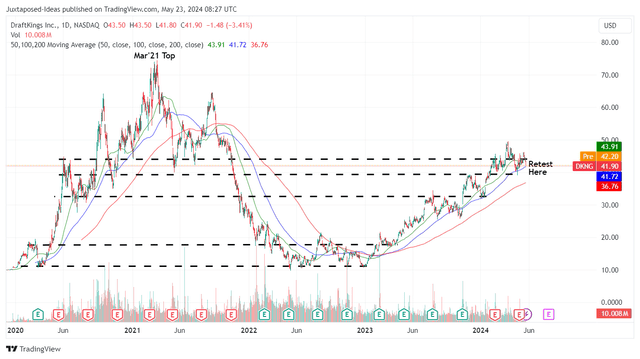

DKNG 4Y Stock Price

The same bullish support has also been observed in DKNG’s stock prices, with the +265% recovery since the start of 2023 well out performing the wider market at +38.3%.

Based on the management’s raised FY2024 adj EBITDA guidance of $500M at the midpoint (+231% YoY) and the latest shares outstanding of 474.22M, we are looking at an adj EBITDA per share of $1.05.

Combined with the FWD EV/ EBITDA valuations of 40.79x, it appears that the stock is trading near to our fair value estimates of $42.80.

Based on a similar calculation method using the consensus FY2025 adj EBITDA estimates of $1.01B, we are looking at an adj EBITDA per share of $2.10 and consequently, an excellent doubling potential to our intermediate-term price target of $85.60 as well.

Author Rating

Does this mean that we are finally taking back our words and upgrading the DKNG stock as a Buy after two Hold ratings?

Yes indeed, though with no specific recommended entry point since it depends on individual investor’s dollar cost average and risk appetite.

In this case, we believe that it is better to be late than never, especially since market leaders never come cheap.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.