Summary:

- The DraftKings Inc. Q4 earnings release indicates sustained sales growth and falling operating losses.

- Marketing discipline had been missing but is now under control.

- Overly bullish or bearish outlooks on yesterday’s release are not as important as the long-term positive outlook for steady price growth.

Scott Olson

Above: Constant promotion is endemic to the sector–but DraftKings Inc. (NASDAQ:DKNG) has gotten discipline and is moving toward a smarter allocation of marketing assets.

DKNG reported Q4 2023 earnings yesterday—what counts

Price at writing: $44.16. Pre close $42.59

Q4 2023 revenue: $1.231b up $376m, 44% y/y 2022.

Total 2023 revenue: $3.665b

Net loss in Q4 was $44.6m vs $242.7m y/y. ($0.10).

Ad. EBITDA for 2023L (49,927m) or $0.41 per share beat many analyst estimates forecasting (%0.60) per share.

Revenue Guidance for 2024: $4.775b up from $4.65b.

Unique players up to 3.5m average monthly in 4Q up 37%.

DKNG active in 24 states with total addressable market (“TAM”) of 44m.

Projected Adj. EBITDA for 2024 of $410m to $510m.

Our takeaway: There has been a past pattern of DNG shares spiking up or down on earnings releases sprung from two data points: One, is sales growth still strong y/y? And two, are we seeing a progressive shrink of excessive promotional spend? The answer in the Q4 2023 numbers is yes to both. While y/y percentage of sales growth declined a bit, the overall sustaining average monthly bettors increased. This means DKNG is not only retaining established bettors but sharing in the acquisition of new ones with its principal competitor FanDuel of Flutter Entertainment (FLUT, OTC:PDYPY). DKNG had some adverse hold due to player wins over the quarter.

Note: Due to the at times elusive hold percentages on the already thin margins of sports betting handles, we have seen some analyst reactions trending bearish. That is misleading for investors. Sports betting is a low-hold business with historical averages consistent over time at 7%. It comes with the territory. Also, some analysts were less than happy with the relatively small decline in sales growth. Together, we believe that this is why DKNG stock just nudged north after earnings call. That, in our view, is a positive, because it suggests that the usual spiking either way on earnings calls may be past. It signals something more of a mature investor attitude toward the stock which will be a positive going forward.

Although the just-past Super Bowl action broke records, the results will obviously impact Q1 2024. However, my sources now report that the hold percentage on that massive action could trend below normalized 7% due to the outcome of the game and the imbalance of action wagered on the KC side of the bet. Our archived data sets confirm that over a 30-year period to date, the 7% normal is sustained.

Also, bettors on the over number logically assuming the two offensive juggernaut opponents would perform got killed. The game for the most part was a defensive struggle. Of course, it works two ways. There are also quarters when the hold is rich, edging up a few points which has a major upside impact on revenue. Companies always report real and normalized hold.

Long-term appraisal is where a buy decision belongs

The Q4 2023 earnings release shows DKNG settling into a viable pattern of growth with an ever-diminishing marketing spend. That is why we see this latest earnings release as a positive.

Our Price Target (“PT”): $55 by end of 2Q24

Think long term for DKNG as the basis to buy the stock no matter what the results at the close yesterday shows. Mr. Market does like the stock, but he can be fickle if expecting quarter-on-quarter explosive sales growth going forward.

We have examined the key numbers and now believe the company will turn profitable sometime this year—perhaps sooner than expected by the end of 2Q24.

But there are still sobering realities about DKNG that must be baked into a buy decision now at its current price.

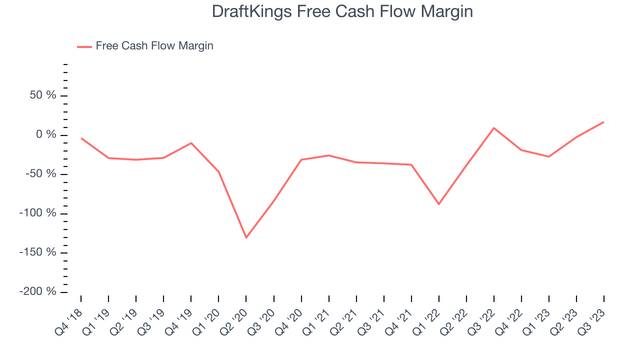

Operating margins of negative (60%) still haunt the stock. Annualized, the decline in DKNG margins over the past five years averaged is 17.2%. It is almost entirely due to the excessive bonuses promoted to both hold market share and develop new players in an overall sector of bruising price competition. But we see a 4Q revenue number of $1.2b up ~40% y/y—but somewhat below Q3’s sales gain performance.

ROIC still looks dismal at negative (143%). Yet DKNG continues to shave its losses on the way to finally turning profitable, as noted above. Much of the frenetic promos endemic to the sector now will continue at a slowing pace. So DKNG will continue to be a great sales growth story going forward. The question is this: now, at its current price, is DKNG a buy, even a buy for investors who can see past the quarter by quarter results.

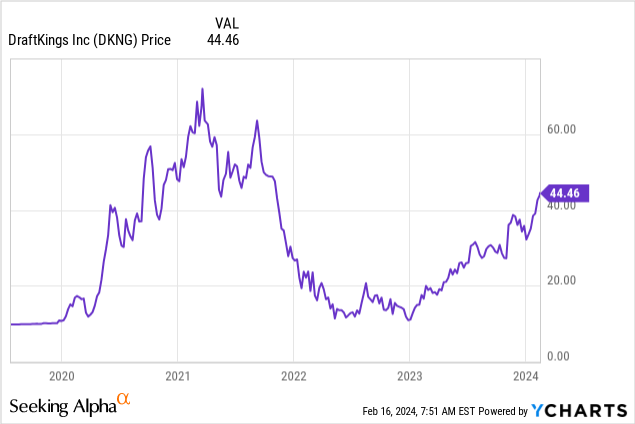

A BUY decision that needs context

DKNG shares have had two rocket rides off Mr. Market’s breathless enthusiasm about legal sports betting off of the Supreme Court’s 2016 decision. That initial ride took the stock to dizzying heights above $74. We were skeptical then and were proved right when they subsequently tanked down to single digits. We acknowledged round trippers who made money as passengers then and we also took heat from commenters for my cautious bearishness forward. Now, long after the first price collapse, the shares appear to be fueling up for another ride north, some believe, a stage two rocket with PTs all over the place, as high as +$60. This time the upside pace will be slower, but inevitably showing excellent intermediate returns.

Once more we weigh in here in a far more bullish mood on the stock than we have been, but yet throwing the yellow flag of caution as well. We have turned bullish since 2Q results for reasons not ordinarily found in many analyst reports. Those rightly focused on the sales growth story and decline of QOQ losses. Far more important a consideration in my industry point of view was the now demonstrated ability of DKNG to hold market share co-leadership with FLUT (FanDuel).

I have talked at length with industry colleagues about the sports betting sector. They agree that there is nothing more important for DKNG holders than knowing it holds share. That tells us more about management and prospects than anything else. It is an MRI, if you will, compared with an X-Ray, which is mostly what you can get from a quarterly earnings call.

Beginning with our own historic data sets archived through our years in the business, linked to the performance of the key actors in the sports betting theater, we have concluded that the DKNG market share is virtually impregnable to erosion. No one can realistically challenge either current leader in the space. Even the powerful newbies just arrived, (ESPNBet and Fanatics) have miles to travel here before scratching a meaningful share of market.

DKNG’s market share is estimated to average in a range between 35% and 39% depending on state or a snapshot of action by month. FanDuel sits at ~$42%, again varying by state or a given action on a big event. Together, they currently own—and I mean own–~74% of the total market now, and, I believe, will continue to own through the next six years.

My conviction springs out of my appraisal of management, which in my view has considerably matured since 2021. One top executive I spoke to (a former c-suite colleague) said:

“These guys have grown up since their first rocket ride up. They are more judicious in their marketing spend. They have cemented a few interesting partnerships that are not capital bleeders. Their penetration in live sports books is strong. Frankly, not at the moment, but I really think we are looking at a transaction sometime ahead that will top off the share leadership edifice. It could be a merger, or acquisition of another platform, a move globally or even buying into a brick and mortar casino operator to balance its assets. Such a move is more likely once they cross the line into sustaining black ink.” To me, that looks like around the end of 2Q24.

Their product is sound, their customer retention is positive and they are as aggressive as any competitor as new states sign on.”

I asked my colleague how he rated DKNG against the newly traded FLUT (FanDuel). He said:

“Buying either here is a good move against what I see as a very solid future for the sector. My own target for the sector by 2030 is ~$35 to $40bish in total revenue. The resources and market power databases will be sustained. But owning both is not a bad move, either. My call on DKNG revenue by 2030 runs between $11b to $12.3b.”

Ants at the DKNG picnic

There is always a lingering danger in what we have seen from time to time as DKNG management making goo goo eyes at acquisitions in the gaming space. They tried kicking the tires on ENTAIN, and rumors in the industry popped up every now and then that DKNG was moving toward buying a casino operation. At this point, it would be a wrong turn, depleting capital, increasing debt.

Moving now

DKNG stock is roaring now after a +200% gain TTM. A small competitor, Rush Street Interactive (RSI), is next in the sector posting a 36.97% price gain for the year. By contrast, the big kahunas in the gaming sector continue to puzzle many investors we speak to, are posting declines for the period:

Wynn Resorts (WYNN): -(2.3%)

Las Vegas Sands (LVS): -(2.6%)

MGM Resorts (MGM): –(3.12%)

Caesars (CZR): -(20%)

These four gaming sector leaders have turned in outstanding post-covid performance. Yet there appears to be a ho-hum by Mr. Market. We’ve deep dived on all four. We’ve been highly bullish on all four, really seeing them undervalued. We believe the core rationale for investors not seeing superior returns on those stocks is a covid hangover for one.

And second, a misinformed notion that the great ship of brick and mortar casinos has sailed. That is entirely flawed thinking. That part of the industry according to AGA is looking at a CAGR of 5.14% by next year. The U.S. alone has between 1,500 to 2,200 casinos counting both commercial and tribal properties. Most all have reported recovery in top and bottom line gains since the end of the covid period. But, in comparison with expectations, online gaming and sports betting boomed in the minds of investors due to the exponential growth segment of the gambling business.

Conclusion: Consider an entry into DKNG stock now. Sales growth may have slowed a bit, but it is still strong. Losses are shrinking and will continue to shrink. And I believe DKNG now has the chops to hold one of two dominant market shares deep into the decade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.