Summary:

- In 3Q24, DKNG saw 39% y/y revenue growth, improved operating margin to -27.21%, and a 14% surge in new players.

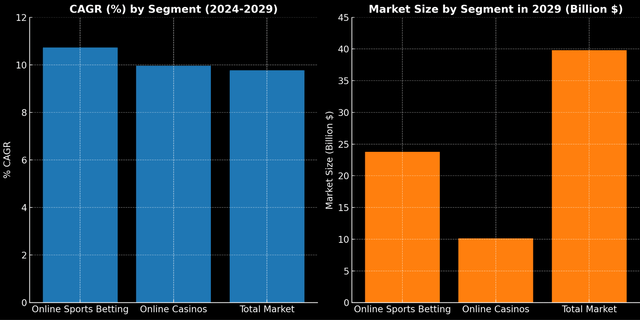

- Overall, the industry continues to expand as more states legalize online gaming. Total market size to reach $39 billion by FY2029, growing at a rate close to 10% CAGR.

- DKNG continues to roll out multiple initiatives to capture growth while improving its margins. By 2025, the company expects a positive FCF of $850 million, representing an FCF margin of 13.28%.

- Valuation analysis suggests that if DKNG can meet its guidance and consistently generate FCF in the remaining years, there is a potential upside of 29%.

Joe Hendrickson

Introduction

Based on my analysis, there is upside potential for DraftKings (NASDAQ:DKNG) for investors to capitalize on. From an industry perspective, DKNG is poised to further benefit from the continued expansion of the total addressable market. From a company perspective, we see DKNG continue improving its product offerings to maintain growth while also improving its margins. By 2025, the company expects to generate positive FCF. In this report, I will demonstrate why investors should consider DKNG in their portfolios.

Company Overview

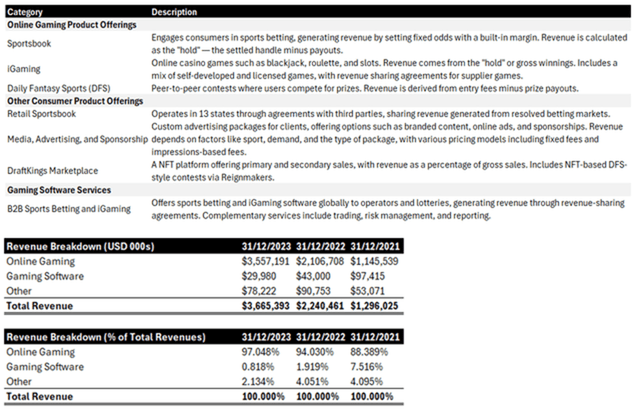

DKNG is an online gambling company based in the United States. Currently, the company employs approximately 4.4 thousand full-time employees, operating across 27 US states and Ontario, Canada. As of 2024, DKNG reports its revenue through the following segments: (1) Online Gaming, (2) Gaming Software, and (3) Others.

DraftKing’s Revenue Streams (Company Filings)

Online gaming revenues are the primary contributor of the company’s total revenues. For FY2023, revenues from online gaming account for approximately 97% of the company’s total revenues. Gaming software and revenues from other consumer products only contribute to a small percentage of the company’s revenue.

Latest Developments

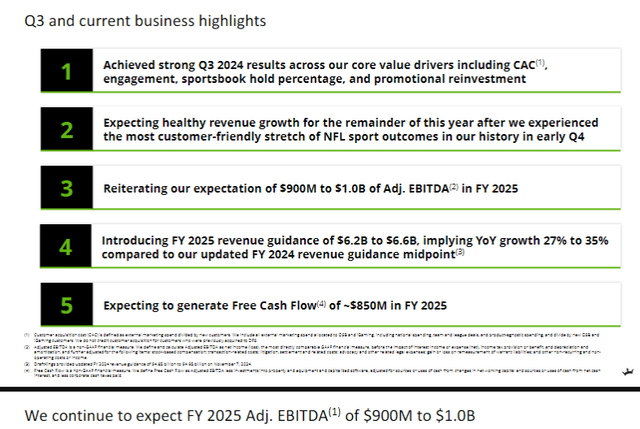

In 3Q24, DKNG generated $1.1 billion, representing a 39% y/y growth. The company’s sportsbook and online casino revenues increased by 39% and 26% respectively, while total new players surged by 14% y/y. Total monthly unique players surged to 3.6 million from 2.3 million. Due to an improvement in customer acquisition costs, operating margin, while still negative, has improved to -27.21% as compared to -36.20%.

Business Highlights (Earnings Presentation)

Although the company had made improvements in its expenses, customer friendly sports outcomes have led to headwinds in revenue and profitability. Looking forward, the company revised its guidance towards the downside. For FY2024, DKNG expects to generate revenue and adjusted EBITDA of $4.85 billion to $4.95 billion and $240 million to $280 million, respectively.

For FY2025, DKNG expects to generate between $6.2 billion and $6.6 billion, representing a 27% to 35% growth as compared to FY2024 expected revenues. Adjusted EBITDA is expected to range between $900 million and $1 billion. For the first time, DKNG expects to generate FCF of approximately $850 million in FY2025, indicating a FCF margin of about 13.28%.

Maturing Market to Continue Fuel DKNG’s Growth

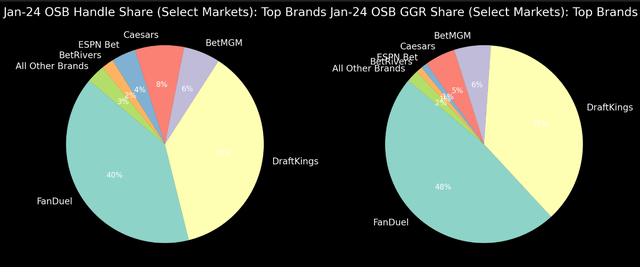

Generally, we are seeing online gaming, both online sports betting or online casinos, becoming increasingly popular. As one of the largest online gaming companies, DKNG is well-positioned to benefit from the expanding market. Apart from FanDuel by Flutter (FLUT), there are no other competitors are on par with DKNG. All of the other major players such as ESPN Bet and Caesars are lagging DKNG significantly.

DraftKing’s 2024 Market Share (next.io)

Today, close to 40 states across the country have legalized either online sports betting or online casinos. Between 2024 and 2029, based on Statista, the online gambling market is expected to grow at a CAGR of 9.77%, reaching a total market volume of $39.81 billion; specifically, online sports betting is expected to grow at a CAGR of 10.73% while online casinos is expected to grow 9.96%, reaching $23.8 billion and $10.11 billion respectively. Based on current developments, there is a strong likelihood that more states will continue to legalize gambling. According to Altenar, based on current legislative activities, by 2030, we should see Georgia, Minnesota, and Oklahoma legalize online gaming to some extent, further expanding the current online gaming total addressable market.

Outlook of Online Gambling Market (Statista)

DKNG Continues To Expand Revenue While Making Meaningful Margin Improvements

To drive further growth, DKNG continues to improve its sportsbook offering. In its NBA product, the company had introduced new and exclusive markets by expanding same game parlay offerings and introducing key game storylines to engage customers. For example, as Bronny James debuts in the NBA this year, there are multiple different ways to take a bet on King James’s son. July’s data suggest that you could bet that Bronny James wins the Rookie of the Year with +25000 odds ($10 for $2,510). Separately, on 1st December 2025, the state of Missouri has legalized gambling. Naturally, as Missouri has a population of about 6 million, DKNG will expand its service there. Currently, the company has already filed all of the administrative requirements and is awaiting approvals and licensure.

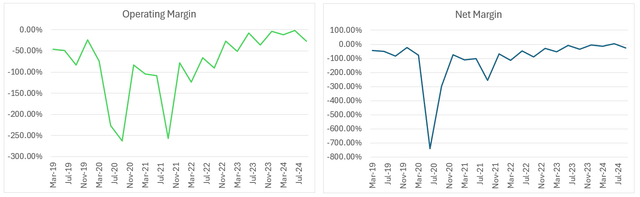

In terms of margins, with the exception of 2Q24, DKNG’s operating margin has been extremely atrocious as the company spends aggressively to capture market share. In fact, in 2Q24, DKNG’s positive net income is not even attributable to the company’s operations.

DraftKing’s Margins (Company Filings)

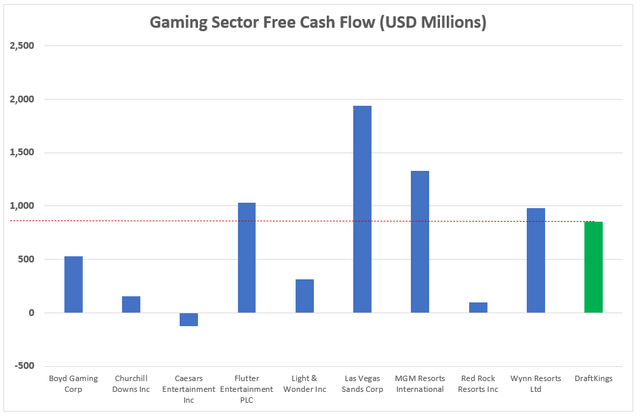

However, since November 2021, DKNG’s margins have been improving steadily. In the latest quarter, the company posted an operating and net margin of -27.21% and -26.85%. The improvement in margins is primarily due to DKNG’s reduction in customer acquisitions costs. Looking forward, we should continue to see DKNG making progress in its margins as the company’s user base matures. By 2025, the company expects to generate approximately $850 million in FCF. To put it into context, a $850 million FCF is approximately 1.61x and 8.5x more than legacy players such as Boyd Gaming and Red Rock Resorts, respectively. If DKNG can keep up its traction, by 2028, its FCF can catch up with the other bellwethers such as Las Vegas Sands and MGM Resorts.

DKNG’s Projected FCF v Peers (Company Filings, valueinvesting.io)

Valuation Analysis Suggests Potential Upside

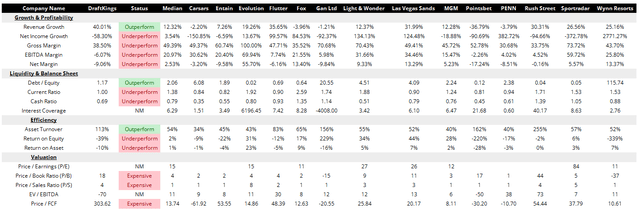

We did a comparable company analysis and the results suggest that apart from growth and revenue related metrics (e.g. Asset Turnover), DKNG underperforms its peer group. That being said, it is also interesting to note that DKNG has a better debt / equity profile as compared to its peers, suggesting that the company can tap on debt to further scale up if it is required. In terms of P/E, P/B, and P/FCF, the comparable company analysis suggests that DKNG is overvalued.

DraftKing Comps Analysis (Valueinvesting.io)

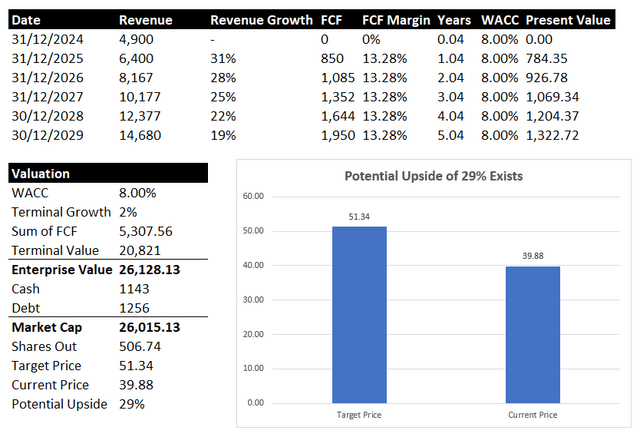

Assuming that DKNG is able to consistently generate FCF beyond 2025, it will not be unreasonable to value DKNG using a discounted cashflow. We will use the following assumption:

- DKNG to achieve its revenue guidance however to see a deterioration of revenue growth of 3% a year from 2025 to 2029.

- DKNG maintains an FCF margin of 13.28%, in-line with its FY2025 guidance.

- Terminal value of 2% and WACC of 8%.

Based on these assumptions, the implied share price of DKNG will be $51.34. Currently, DKNG trades at $39.88, suggesting a potential upside of close to 29%. It is important to iterate that this is based on the assumption that DKNG’s FCF margin stays at 13.28% while revenue growth maintains relatively high, deteriorating only by 3% a year. If revenue growth decays by more than 5% a year, then DKNG’s implied share price will indicate a downside scenario. For example, if we assume a 7% decay a year, that will imply that DKNG’s current share price is overvalued by 5.4%.

DKNG’s Valuation (Author’s Projections)

Closing Remarks & Investment Risks

Overall, DKNG presents a good opportunity for investors. Although it is in the “sin sector”, there is still value for investors to capitalize on. There are multiple reasons to own DKNG. The market is further expanding due to more states legalizing. The company is improving as it continues to make product enhancement while enhancing its operating margins. More importantly, valuation analysis suggests that there is still a potential upside of 29% for investors.

That being said, the biggest risk to DKNG will be regulation. Currently, there are multiple indicators suggesting that regulations are getting tighter as compared to before. For example, we are seeing legislators moving to impose higher tax rates of between and ban customer deposits from credit cards. All of these pose as headwinds to DKNG’s topline and bottom line. In other words, this may affect DKNG’s path to profitability. For example, Illinois will impose a tax of 40% on sports bets, increasing it from 15%.

Previously, DKNG has stated that it will implement surcharges to its customers on high tax states. However, in less than a month, the company has reversed its plans, suggesting that the company does not really have the power to “pass costs” to its customers. Ultimately, investors should continue monitoring any legislative developments; if more states decide to charge higher taxes, DKNG’s capacity to generate cashflows will deteriorate.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.