Summary:

- DraftKings benefits from strong growth prospects due to secular tailwinds.

- It faces intense competition with no clear customer retention advantages.

- The current valuation may be unrealistic and may reflect an overly optimistic scenario.

PM Images

DraftKings (NASDAQ:DKNG) is riding several attractive growth waves, including the legalization of online sports betting, digitalization, the rise in sports popularity, and the regulators’ never-ending appetite for more tax income.

On the flip side, it competes in a highly competitive market, with lots of players, relatively low barriers to entry, and arguably not enough ways to create customer retention, aside from pricing.

With shares 45% below their 2021 peak, let’s revisit DraftKings and assess its attractiveness as a potential investment opportunity.

Introduction

I started covering DraftKings on Seeking Alpha back in April of this year. In the article, I delved into the company’s business model and the online sports betting market.

I argued that DraftKings’ lack of a competitive moat isn’t reflected in the company’s valuation, and rated the stock a Hold (borderline Sell).

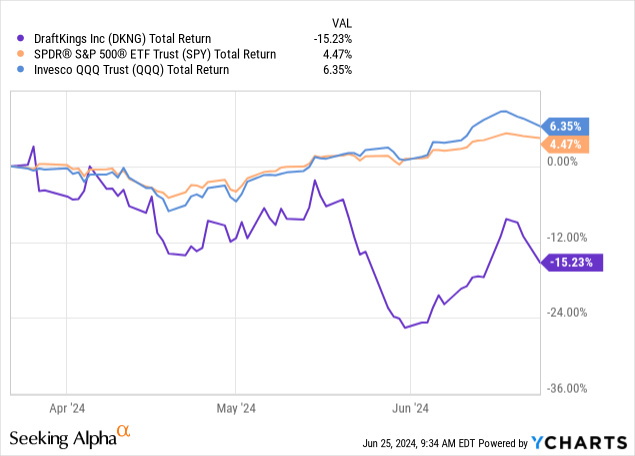

The stock underperformed the S&P 500 and the Nasdaq 100 by approximately 20% since I wrote the article, so it seems we’ve been correct so far.

The No Moat Thesis

DraftKings is the second-largest player behind FanDuel (FLUT) in a fast-growing market, where both companies have a very significant market share.

However, this is a market where scale doesn’t equal a major competitive advantage, at least not at this point.

The most important aspects for online gamblers are (1) Good odds and promotions; (2) Expansive book of betting options; (3) Availability; and (4) Reliability.

Availability (being able to use the app) and reliability (knowing that money will not be stolen and will be paid), are the basic enablers. Many companies in the industry have those.

Then, an expansive book isn’t really a differentiation driver, because all the books use external data suppliers and similar mechanisms. Lastly, good odds and promotions, or in other words, value, is where the companies compete for customers.

I don’t know any bettor who’d choose to place a bet with a certain provider if their competitor is offering better odds and/or a better monetary incentive.

All of this means that DraftKings doesn’t have a wide moat, and that’s OK.

I listed three attributes that are crucial for me to invest in companies that don’t have a wide moat:

First, it needs to have very attractive growth prospects in the near to mid-term. I’m talking about 20%+ growth for several years.

Second, it needs to be GAAP profitable, or a few quarters away from that.

Third, it needs to have a compelling near-term upside based on simple valuation metrics. In addition, I must sell the stock if it’s no longer compelling based on near-term valuation.

The problem was, that DraftKings failed to meet the second and third criteria, and that’s what ultimately led me to the bearish rating.

Illinois Tax Rate Increase

Setting aside the prohibitive valuation and low-quality attributes, there was a key development in the gambling market since my last article that is worth going over as it contributed to the inferior performance.

As published by Seeking Alpha on May 28:

The Illinois State Senate passed a bill on Sunday proposing higher taxes on online sports betting operations. Under the new proposal, online sports betting operators will begin paying higher taxes on July 1, ranging from 20% to 40% depending on their level of annual revenue. Sports betting operators in Illinois have been paying a 15% tax since June 2021. Governor J.B. Pritzker proposed an increase to 35% earlier in the year.

This is important because it exposes a very big concern about DraftKings and its peers. Online Sports Betting was illegal in the U.S. for a very long time, and it remains illegal in many countries around the world today.

The primary reason is that sports betting is heavily skewed towards the bookie, and estimates are that less than 3% of bettors are consistently profiting.

This means that most people who bet lose money. The problem gets bigger because gambling is extremely addictive, especially for the lower-income population.

Regulators essentially want to save people from their bad tendencies, which makes sense. The problem is that in countries where betting is illegal, black markets tend to form, which are even more dangerous and harmful. Even more importantly, no taxes are being paid from such markets.

From a purely economic point of view, it turns out that the best bad option is to legalize betting because at least it generates a whole lot of tax income for the country.

Well, tax income is addicting, and when a certain market draws its legitimacy from the tax income it generates, it is exposed to the possibility that regulators would want to collect even more.

This is happening in Illinois, which is the seventh-largest state in terms of population. Investors (and other states) must ask themselves, if Illinois can raise its taxes, why wouldn’t California? Or Texas? Or Florida? After all, those are huge states, which the providers cannot give up on.

Recent Results

DraftKings had a decent first quarter, with revenues growing 53% to $1.2 billion, beating consensus estimates.

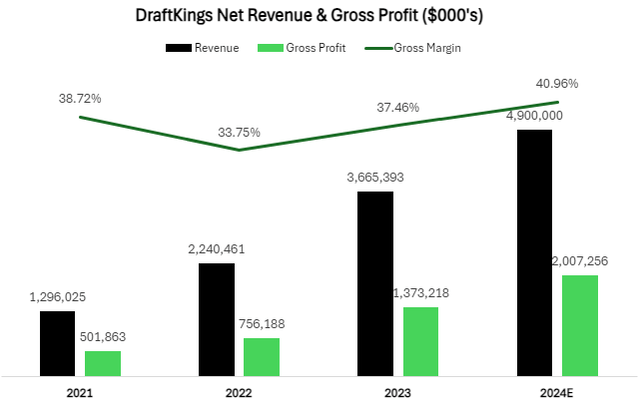

Created and calculated by the author using data from DraftKings financial reports.

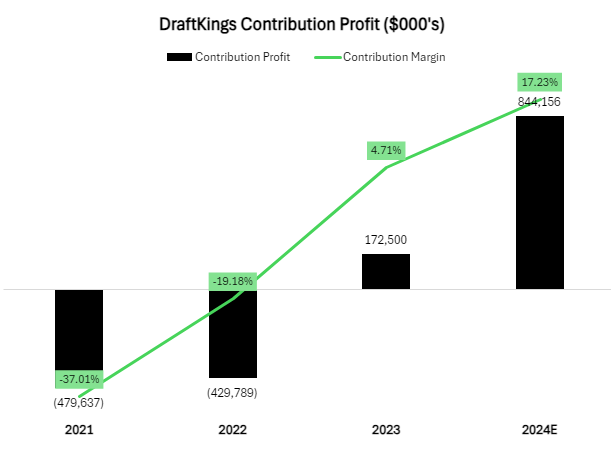

Gross margins improved by 730 bps Y/Y but declined sequentially. The contribution margin (gross profit minus sales & marketing) was 10.6%, a 28-point improvement Y/Y, and a 760 bps decline Q/Q.

Operating loss was $139 million, and EBITDA was a negative $86 million.

Created and calculated by the author using data from DraftKings financial reports.

The company is still very far from being profitable, which I don’t expect it to reach before 2025.

In the metrics they rely on, which are Adj. EBITDA and Free Cash Flow, it may seem like the business is extremely profitable. In my view, their adjustments, which include stock-based compensation to the amount of $93 million, make these metrics essentially meaningless.

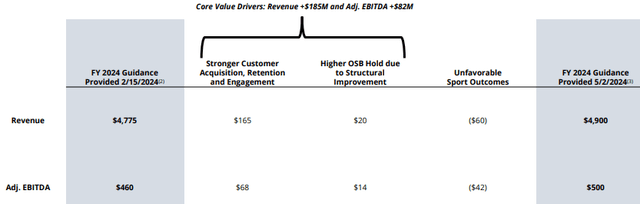

Still, the company raised its guidance by $125 million in revenues, and by $40 million for Adj. EBITDA.

DraftKings Q1’24 Presentation

In my view, when and if they change their thinking from these adjusted metrics to actual GAAP numbers, that will be a big sign we’re approaching true profitability.

Valuation

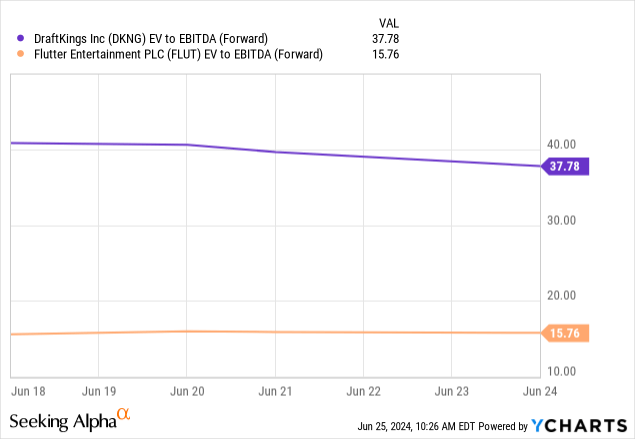

At an enterprise value of $19.5 billion, DraftKings is trading at 39 times adjusted EBITDA.

The company is projected to have stock-based comp. expenses of around $400 million this year. Subtracting that from the Adj. EBITDA guidance gets us to $100 million in EBITDA and puts us at 195x EV/EBITDA. Lord have mercy.

As we can see, DraftKings is trading at more than three times the valuation of FanDuel owner Flutter, although the latter does have international businesses that aren’t growing as rapidly.

Still, this is a huge gap in my view, which adds to my valuation worries.

Conclusion

DraftKings is riding multiple secular tailwinds forming a long runway for elevated growth prospects.

However, the company plays in a highly competitive landscape, with essentially zero competitive advantages regarding customer retention, and is still very far away from real profitability.

The tension between these two trends can be solved with the right valuation, but that is not the case, as DraftKings trades at a jaw-dropping 39 times adjusted EBITDA (emphasis on the adjusted).

Ignoring any reasonable level of commonsense valuation led to DraftKings’ 2022 collapse, but investors didn’t learn the lesson.

I reiterate a Hold and strongly advise investors not to initiate new positions at this level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.