Summary:

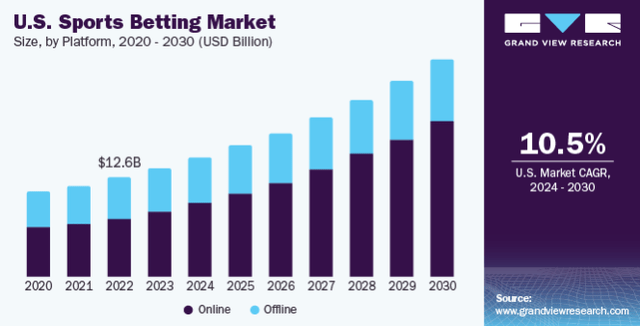

- The US gambling industry generated over $54.9 billion in revenue in 2022 and is projected to grow at a compound annual growth rate of 10.5% through 2030.

- DraftKings is a pioneer in mobile gambling with strong brand recognition and has experienced significant revenue growth, but its valuation is a concern.

- There are risks to investing in DraftKings stock, including potential future legislation impacting the industry and competition from other digital and physical operations.

svetikd

The gambling industry is massive, as it generated more than $54.9 billion in revenue during the 2022 calendar year. I have an indirect investment in casinos through VICI Properties (VICI) and now Realty Income (O), but I want direct exposure to the industry. In 2023, the sports betting market was estimated to generate $13.76 billion and is expected to grow at a compound annual growth rate [CAGR] of 10.5% through 2030. Sports betting is legal in 38 states and territories throughout the U.S., with the potential for California to enter the space in the future. While only certain states have casinos and some of the largest states, including California and Texas, are not participating in sports betting yet, there is no denying that gambling is big business and there is room on the horizon for growth. DraftKings (NASDAQ:DKNG) is a name I have been watching closely, especially as it’s mounted a sizable rebound back into the $40s. DKNG has the brand recognition, and is a pioneer in mobile gambling with a growing user base. My problem is valuation, and while I think they continue to grow the top-line, I am not convinced that its actual business operations can produce the amount of EPS that some analysts are projecting. If DKNG retraces or improves the valuation, I would be more interested in starting a position, but today, DKNG trades at too steep a premium for its potential growth for me to place a buy order.

Seeking Alpha

Risks to investing in DraftKings

There are many risks to investing in DKNG that investors should consider prior to starting a position. While gambling is legal in many states and sports betting is on the rise, there is no way to predict how future legislation will impact the industry. If we see an epidemic of individuals losing their life savings due to gambling, there is the potential that restrictions could be imposed or states even reverse their laws on gambling despite the tax revenue implications. DKNG also faces immense competition, and while some may disagree, they are competing with other digital and physical operations, including Caesars Entertainment (CZR), PENN Entertainment (PENN), Las Vegas Sands (LVS) and Churchill Downs (CHDN). DKNG also hasn’t turned a profit, and if they reduce their bonuses and incentives to use their platform, a decrease in utilization could occur, which could impact revenue. We could also see a shift away from gambling in the coming years as U.S. consumer debt expands and disposable income becomes tighter.

Why I am interested in DraftKings

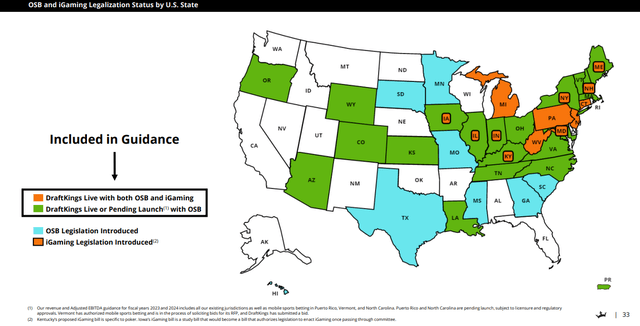

DKNG has been a pioneer in the online sports betting realm. Today, DKNG has generated $4.07 billion in revenue over the trailing twelve months (TTM) and Q1 2024 marked the first time DKNG produced 2 consecutive quarters that exceeded $1 billion in revenue. DKNG has accomplished this with an onslaught of competition and without participation from California or Texas. At DKNG’s 2023 investor day in November, they projected that revenue would grow at a 14% CAGR through their 2028 fiscal year. This would put DKNG on a path to generate $7.1 billion in revenue and $2.1 billion in Adjusted EBITDA. There is currently an inverse trend occurring that is beneficial to DKNG as their customer acquisition cost decreased by 21% in 2022 and by another 20% in 2023 while the number of users grew at a 40% CAGR since 2021. As more states approve legislation for online sports betting and iGaming, DKNG is estimating that there is the potential to generate an additional $6.2 billion of Adjusted EBITDA from additional states approving legislation, including California, Texas, and Florida.

DraftKings

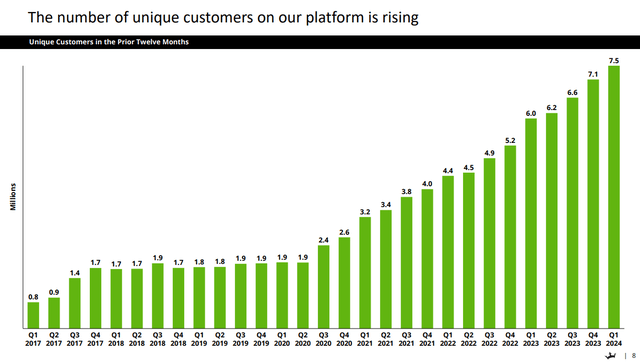

My opinion doesn’t matter, and I can ask 10 different people which sports betting app do they use, and I am likely to get multiple answers with different reasons as to why they made that selection. I would rather look at the hard data to see how relevant a platform is. When I look at the engagement behind DKNG, it’s overwhelming how much growth there is. Since Q2 of 2020, DKNG has delivered 15 consecutive quarters of unique customer growth. Over the past 15 quarters, DKNG has grown its unique customer base by 294.74% as it added 5.6 million unique users. In the last 3 months, DKNG has seen 5.63% QoQ growth as 400,000 unique users were added to the platform. Over the TTM, DKNG has added 1.5 million unique users, with a QoQ average growth rate of 5.75%. If DKNG can grow at 5% QoQ, they will finish 2024 with 6.68 million unique users, adding an additional 1.18 million people to the platform throughout the rest of the year.

DraftKings

Sports betting in the United States continues to grow, as it accounted for 15% of the global sports betting market in 2023. The fact that sports betting alone is expected to increase from $13.76 billion in 2023 to $27.5 billion in 2030 is compelling enough, but when iGaming is also included, the total addressable market for DKNG just gets more exciting. As more legislation has been approved, DKNG has grown is annualized revenue by 1,158.72% since the end of the 2019 fiscal year. DKNG closed 2019 out, generating $323.4 million in revenue and on a TTM basis, has produced $4.07 billion in revenue. Between the amount of user growth DKNG is experiencing and the fact that they just produced their first 2 consecutive quarters of over $1 billion in revenue, I think that there is a lot more top-line growth on the horizon for DKNG, especially as more states get involved in online gambling. From a tax revenue perspective, I just don’t see how states such as California, Texas, or Florida will sit on the sidelines indefinitely, and when those markets come online, it could add a big boost to DKNG’s top and bottom line.

Grand View Research

I want to start a position in DraftKings, but the financials and valuation are holding me back

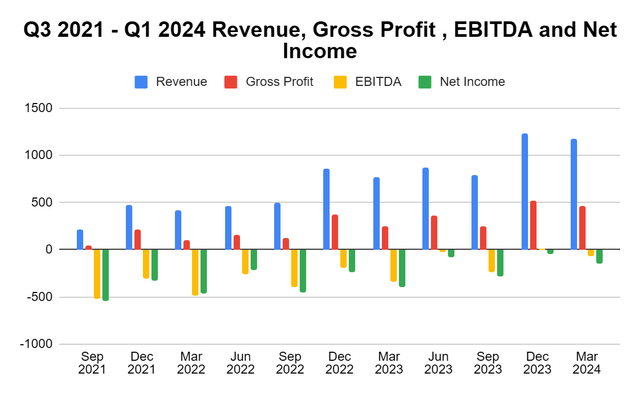

I see the potential for top and bottom-line growth with DKNG, but their current financials are a red flag for me, and I can’t get past the valuation. Even if DKNG doesn’t sell off, and I miss some upside, I want to see the financials improve before starting a position. On the positive side, revenue has exploded to the upside, and over the past 2 years, the revenue and gross profit trend is very strong. The problem I have with the financials is that DKNG is being valued based on its future projections, which have no guarantee of unfolding how they believe it will, when the reality is that DKNG has never turned a profit. On a quarterly basis since Q3 2021, DKNG has generated $7.77 billion in revenue, and while the trend is going in the right direction, DKNG has never turned a profit. To produce its revenue, DKNG has spent $4.91 billion, leaving $2.86 billion in gross profit for its remaining expenses. Between R&D and general administrative costs, it cost DKNG $6.15 billion to operate its business since Q3 2021. DKNG has only generated 1 quarter of positive EBITDA and never turned a profit on the bottom line. While the numbers are getting better, the fact is that DKNG has produced -$2.81 billion in EBITDA and -$3.19 billion in net income over the past 11 quarters.

Steven Fiorillo, Seeking Alpha

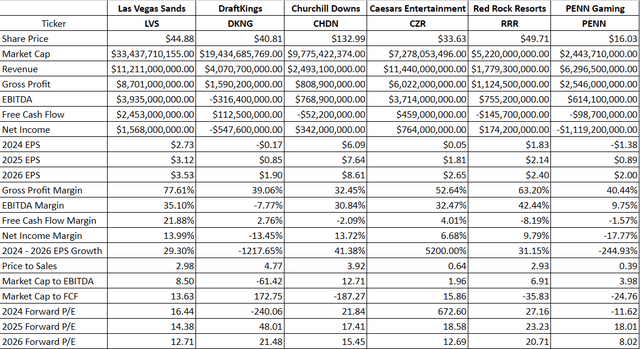

I compared DKNG to Las Vegas Sands (LVS), Churchill Downs (CHDN), Caesars Entertainment (CZR), Red Rock Resorts (RRR), and PENN Entertainment (PENN) to see how the market was valuing them. I was shocked that out of these companies, DKNG has the 2nd largest market cap. I feel as if the market is pricing in so much of DKNG’s future, as they are the only one of these companies that generates negative EBITDA from the revenue produced. DKNG also trades at the largest price-to-sales ratio while having the 2nd lowest gross profit margin. It’s hard for me to get behind a valuation of $19.43 billion for DKNG when CHDN is worth $9.78 billion and generated $768.9 million of EBITDA and $342 million of net income in the TTM. CZR has a $7.28 billion market cap, and has produced $3.71 billion of EBITDA and $764 million in net income in the TTM from $11.44 billion of revenue. CZR has a gross profit margin of 52.64% as 32.47% of every dollar hits its EBITDA, and 6.68% is pure profit after every last expense.

To DKNG’s credit, the markets are forward-looking, and the projections are that DKNG will generate -$0.17 in EPS for 2024, but this will grow to $1.90 of EPS in 2026. This places DKNG at a forward P/E of 21.48 based on the projected EPS for 2026. While this is still the highest multiple in the group, I don’t think paying 21.48 times 2026 earnings is unreasonable at all; in fact, it may be cheap based on the expected growth. The problem that I have is that DKNG isn’t turning a profit, and I would want to see a track record of profitability, so I can feel confident in these projections. There are many unknowns, and DKNG has significant competition in the marketplace. There are catalysts on the horizon, but the wheels of government move slow, and it’s going to take a few more quarters before I can consider justifying paying this type of premium.

Steven Fiorillo, Seeking Alpha

Conclusion

DKNG is at the top of my watch list, and I will be waiting for a better entry point. I believe that at some point, I will become a shareholder as I think DKNG will continue to be a dominant player in the mobile gambling industry. There are many catalysts on the horizon, and as more states pass legislation that allows sports gambling and iGaming, it will greatly benefit DKNG as it is one of the most recognized brands in the sector. DKNG’s numbers are moving in the right direction, and as their unique users increase, their EBITDA and net income get closer and closer to sustained profitability. I am confident that DKNG will continue to establish itself as a leader in the market, and my decision to stay on the sidelines could come back to haunt me, but the current valuation isn’t attractive enough for me to allocate capital toward this investment. For me to establish a position in DKNG, I would need to see a significant sell-off in the share price, or the valuation to become less expensive. I will be watching DKNG closely as I look for a more optimal price to start my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O, VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.