Summary:

- DraftKings is a rapidly growing and innovative company in the online gambling industry.

- The global online gambling market is expected to experience significant growth, driven by easier access to internet services and the popularity of mobile gambling.

- DraftKings has made strategic acquisitions and partnerships, such as Jackpocket and Barstool Sports, to diversify its services and enhance customer engagement.

- As such, we believe DraftKings can be rated as a buy.

Justin Sullivan/Getty Images News

Introduction

In the rapidly evolving world of online gambling, DraftKings (NASDAQ:DKNG) stands out as one of the most exciting companies. As we dive into the company that is DraftKings, you will find a company that’s rapidly becoming one of the most recognizable names in online gambling with its bold strategies and innovative technologies.

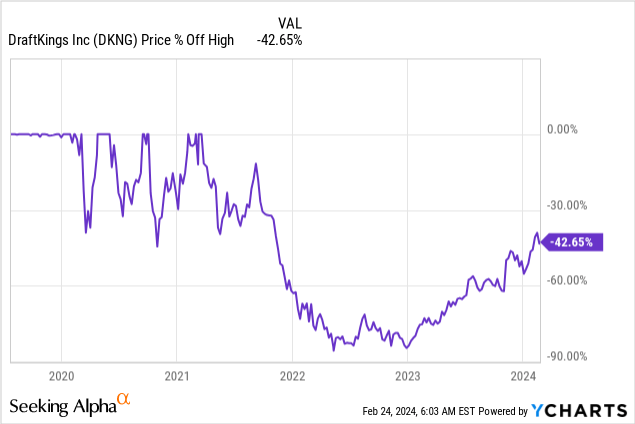

DraftKings experienced an incredible run following its IPO in 2019, reaching an all-time high (ATH) of $74.38 in March 2021. Since then, the stock fell tremendously back to its IPO price and has since then found its second wind. Currently, the stock is trading around 42.65% below its ATH.

YCharts

In this article, we will explore DraftKings’ expansion into new territories, its embracement of cutting-edge technology, and initiatives that have propelled it to the industry’s forefront through acquisitions and partnerships. In addition, we will give an overview of the key revelations in DraftKings’ fourth-quarter earnings presentation.

Industry Overview

Let’s begin by exploring the expected growth of the gambling industry in the coming years, which is crucial for understanding the context of investing in companies like DraftKings.

The global gambling market has seen impressive growth, significantly driven by the rise of online gambling. In 2023, the online gambling market reached $86.6B, a notable jump from the previous year.

Furthermore, the online gambling segment alone is predicted to hit $93.26B in 2024 and is expected to soar to $153.21 billion by 2029, growing at a compound annual growth rate (CAGR) of 10.44%. This surge is mainly due to easier access to internet services worldwide and the increasing popularity of mobile gambling, allowing bets to be placed at any time and from anywhere.

The market is highly diverse, with local and international players such as Bet365, Entain Plc (OTCPK:GMVHF), 888 Holdings Plc (OTCPK:EIHDF), and many more competing in game variety, user experience, and technological innovation.

Industry players have put in strong marketing efforts, advancements in security, encryption, streaming, and the ongoing legalization of online gambling in various regions also drive growth in this sector. In North America, there’s a clear move towards making online gambling legal, with New Jersey leading as the biggest market for it in the United States.

Furthermore, the use of advanced technologies like augmented reality (AR) and virtual reality (VR) is also enhancing the gaming experience and drawing more players. Just imagine playing poker from the comfort of your home, but feeling like you are in a casino – that is the experience companies such as DraftKings are putting resources into. We believe this gives plenty of room for further growth for the gambling industry as a whole.

Regarding new industry technology, DraftKings partnered with Polygon in 2021 to integrate its blockchain technology into its platform. Polygon, an Ethereum-based scaling solution, partnered with DraftKings marketplace to enhance the digital collectibles platform with a scalable blockchain infrastructure. This collaboration aims to democratize access to NFTs, making it easier for mainstream audiences to engage with digital collectibles.

Paul Liberman, DraftKings’ co-founder, highlighted the partnership’s role in addressing blockchain technology’s scalability and sustainability challenges, emphasizing its importance in the evolution of digital collectibles for Web 3.0. This partnership was part of Polygon’s broader initiative to expand its presence in the blockchain gaming and NFT sectors, supporting a vibrant ecosystem of blockchain games and Web 3.0 applications. The partnership was one of the major moves that took a significant step forward in making digital collectibles more accessible and secure for users worldwide.

With this brief overview highlighting the gambling industry’s lively and growing state, marked by rapid expansion and technological innovations, you may see why DraftKings could be a good stock for your portfolio.

Jackpocket and Barstools

Just a few days ago, DraftKings acquired Jackpocket for $750M in a strategic move into the U.S. lottery sector, signaling a significant pivot towards diversifying its services portfolio beyond just sports betting and online gaming. This move seeks to harness the rapidly growing digital lottery vertically within DraftKings’ business.

Jackpocket, a leader in the lottery app space and the largest seller of lottery tickets in New York, is expected to bolster DraftKings’ revenue significantly. Projections suggest an incremental revenue boost of $260 million to $340 million by 2026 – we will explore this later on as well. This acquisition is strategically aligned with DraftKings’ ongoing efforts to innovate and provide its users with a comprehensive array of gambling and entertainment options, enhancing both customer engagement and revenue streams.

Simultaneously, DraftKings has fortified its content and media partnerships, notably through a new collaboration with Barstool Sports. This partnership shows DraftKings’ commitment to leveraging media and content platforms to boost customer acquisition and engagement. The collaboration is expected to capitalize on the synergies between DraftKings’ extensive sports betting infrastructure and Barstool’s robust media presence and loyal fanbase, providing users with a unique blend of entertainment and sports betting experiences.

These strategic moves by DraftKings, including the acquisition of Jackpocket and the partnership with Barstool Sports, reflect a broader strategy to diversify and strengthen its market position. By tapping into the digital lottery space with Jackpocket, DraftKings enters a rapidly expanding market and leverages Jackpocket’s technological capabilities and established user base to enhance its product offerings. Meanwhile, the partnership with Barstool Sports represents a savvy integration of sports media and betting, aiming to drive user engagement and acquisition through innovative content and promotional activities.

DraftKings’ approach underscores a forward-looking vision where collaboration with media entities and expansion into new gambling verticals are pivotal. These initiatives are set to create significant value for DraftKings, offering diversified revenue streams and solidifying its foothold in the competitive online betting landscape.

As the company navigates the regulatory and operational challenges inherent in such large-scale acquisitions and partnerships and the potential for cross-selling and integrated customer experiences between sports betting, online gaming, and lottery offerings, it presents a compelling growth trajectory for DraftKings in the coming years.

Q4 Earnings

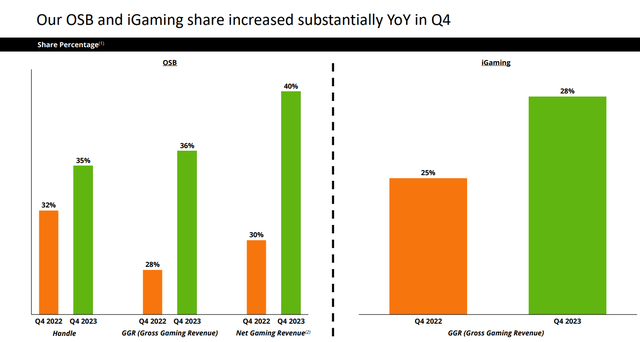

In the latest earnings report, DraftKings displayed impressive year-over-year growth in market share within both the Online Sports Betting (OSB) and iGaming sectors for the fourth quarter. The OSB segment, in particular, saw an uptick in the total number of bets placed, moving from 32% to 35%.

Even more striking was the Gross Gaming Revenue (GGR) for OSB, which soared from 28% to 40%, showcasing a significant increase in revenue before the payout of winnings. The Net Gaming Revenue (NGR) for OSB, which considers the cost of payouts, also experienced growth, rising from 30% to 36%. This growth underlines the segment’s increasing profitability.

In the iGaming sector, there was a slight but positive shift in GGR, advancing from 25% to 28%. Although this growth is modest compared to that of the OSB segment, it still marks a positive direction. The chart below shows these improvements, with the orange color being Q4 2022 and green for Q4 2023. This makes it clear that DraftKings is growing and strengthening its position in the market, suggesting a promising outlook for the company’s future and potentially boosting investor confidence.

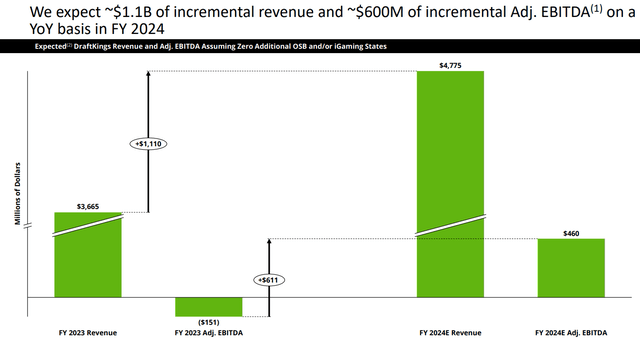

In addition, the chart below from the same presentation shows a significant YoY growth for the fiscal year 2024. The revenue for FY 2023 was reported at approximately $3.665 billion, with the adjusted EBITDA showing a loss of about $151 million, indicating a shortfall in operational earnings after adjustments.

Looking ahead to FY 2024, the company anticipates a significant revenue jump to around $4.775 billion, marking an increase of roughly $1.110 billion over the previous year. This substantial growth shows a positive outlook on the company’s revenue potential.

More strikingly, the adjusted EBITDA is expected to experience a dramatic shift from a negative position in FY 2023 to a positive $460 million in FY 2024. This represents an impressive turnaround of approximately $611 million, suggesting not just a return to profitability but a considerable margin of operational earnings before accounting for interest, taxes, depreciation, and amortization.

It’s critical to highlight that these projections assume no new additions to OSB and iGaming states, implying that the anticipated growth is projected to stem from the company’s current operations and market conditions. This chart conveys a robust expectation of revenue growth and a significant transition from operational losses to profitability in the upcoming fiscal year.

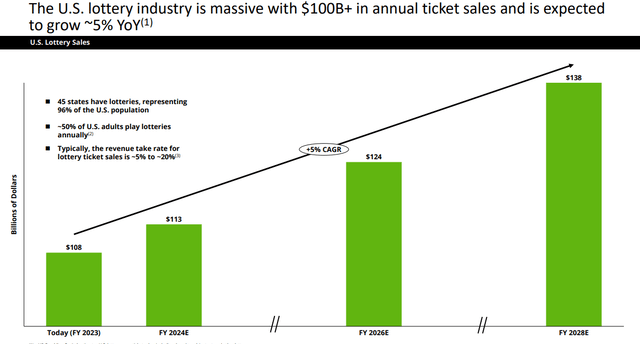

Furthermore, the chart presented below outlines the expected expansion of the U.S. lottery market, showcasing its strength with annual ticket sales surpassing $100 billion and an estimated annual growth rate of around 5%. For the fiscal year 2023, lottery sales reached $108 billion, with forecasts indicating an increase to $113 billion in FY 2024 and $124 billion in FY 2026, and they are expected to hit $138 billion by FY 2028.

This growth is supported by the wide availability of lotteries in 45 states, covering 96% of the U.S. population. The chart also points out that roughly half of U.S. adults annually engage in lottery games, highlighting a solid consumer base. The revenue earned from these sales generally ranges from 5% to 20%, demonstrating a substantial profit margin for the states involved. The anticipated growth path and the current market reach emphasize the lottery’s vital and growing role in generating state revenues, with the data suggesting a promising future for the industry’s expansion and profitability.

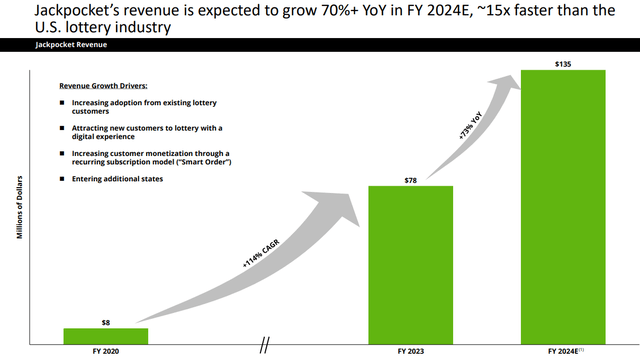

Finally, we shift our focus to Jackpocket’s ambitious revenue forecast, which predicts an impressive year-over-year increase of over 70% in fiscal year 2024. This growth rate is roughly 15 times faster than the average expansion rate seen across the industry. Jackpocket’s revenue, which was at $8 million in FY 2020, is on track to escalate to $78 million in FY 2023, with expectations set for a leap to $135 million in FY 2024.

This remarkable growth can be attributed to a series of strategic moves, including boosting engagement with current lottery enthusiasts, drawing in new users with a digital lottery platform, introducing a recurring revenue stream through a subscription service named “Smart Order,” and broadening its reach into more states. These steps highlight Jackpocket’s aggressive strategy to secure a substantial portion of the digital lottery market, reflecting their confidence in the merging paths of technology adoption and traditional lottery gaming.

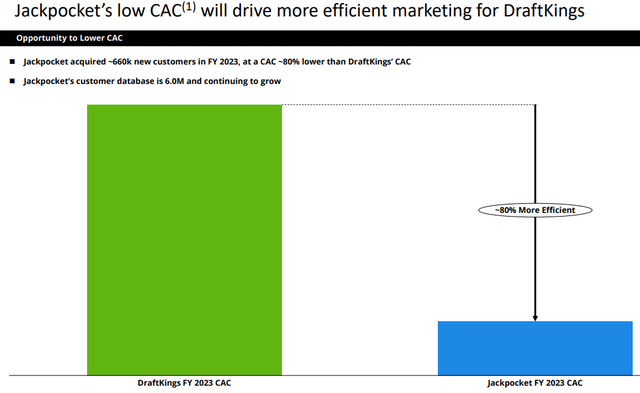

Moreover, DraftKings views the acquisition of Jackpocket as a strategic complement to its business model, notably because the customer acquisition costs (CAC) for Jackpocket were 80% lower than those for DraftKings. This indicates that DraftKings now possesses a more cost-effective method for attracting new customers. This advantage is poised to be highly beneficial for DraftKings as it continues on its growth trajectory, leveraging Jackpocket’s innovative approach to redefine the digital lottery space and enhance customer acquisition strategies efficiently.

Historical Financials

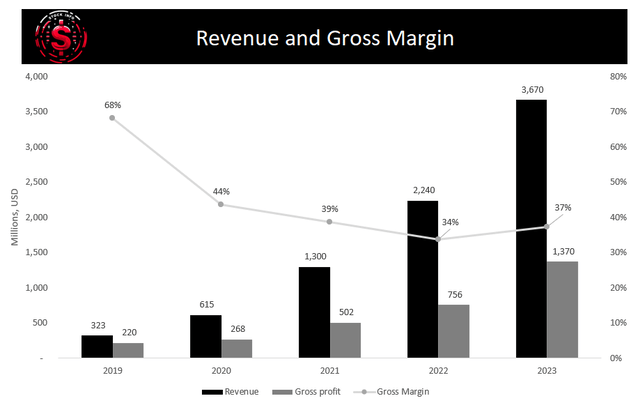

Next, we delve into DraftKings’ historical financial performance, focusing on the evolution of its top-line results, specifically revenue and gross margin. Over a span of five years, there’s been a marked trajectory of strong revenue growth, beginning at $323 million in 2019 and skyrocketing to $3,670 million in 2023. The revenue nearly doubled from $1,300 million in 2021 to $2,240 million in 2022, followed by a significant, though smaller, increase the next year.

Concurrently, gross profit saw a notable increase, from $220 million in 2019 to $1,370 million in 2023. However, despite these positive revenue and gross profit trends, the gross margin percentage has declined. It peaked at 68% in 2019, dropped to 44% in 2020, and decreased to 34% in 2022, slightly improving to 37% in 2023.

This trend suggests that while DraftKings has successfully boosted its revenue, it has also faced higher costs of goods sold or shifted towards lower-margin offerings, affecting its gross margin percentage. Despite this pressure on margins, the overall increase in gross profit demonstrates DraftKings’ ability to improve its profitability concretely.

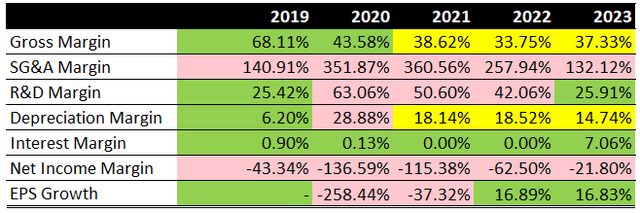

Next, the table below outlines various financial margins and the growth in earnings per share (EPS) for a company from 2019 to 2023, revealing a variable performance across different financial indicators. Beginning with gross margin, there’s a noticeable decline from a robust 68.11% in 2019 to a more modest 37.33% in 2023. This trend points to diminishing profitability in relation to sales.

The Selling, General, and Administrative (SG&A) Margin, which quantifies selling, general, and administrative expenses as a fraction of total revenue, experienced a sharp increase in 2020, reaching 351.87%. However, it has progressively decreased to 132.12% by 2023, suggesting an effective reduction of these costs in proportion to sales over the past few years.

Additionally, the Research and Development (R&D) Margin, reflecting research and development expenses relative to revenue, also saw its highest level in 2020 at 63.06% before declining to 25.91% in 2023, indicating a possible stabilization or decrease in R&D spending.

The depreciation margin saw a notable rise in 2020 and has stayed high, though it fell from its peak to 14.74% in 2023. Interest Margin, minimal in 2020 and 2021, climbed to 7.06% in 2023, indicating rising debt-related costs. The Net Income Margin remained negative throughout the five-year period, with the deepest loss in 2020 at -136.59%; however, there’s an observable improvement in 2023, reducing the loss to -21.80%. This improvement suggests a decrease in net losses as a share of revenue.

After a severe drop of -258.44% in 2019, EPS Growth turned positive in 2022 and 2023, with increases of 16.89% and 16.83%, respectively. This indicates a resurgence in earnings per share in the last two years. The compilation of data indicates the company encountered substantial hurdles in 2020, but exhibited signs of operational enhancement and cost efficiency in the following years.

In summary, DraftKings has navigated through challenging times over the past few years, with its bottom-line showing considerable strain. Nonetheless, with the company projecting a profitable fiscal year in 2024, alongside strategic acquisitions and partnerships, it’s plausible that DraftKings could reverse its fortunes.

Challenges and Risks

DraftKings operates within the intricate realm of online gambling, navigating through a landscape filled with challenges and opportunities for growth. The company is entrenched in a constantly evolving regulatory and legal framework, facing hurdles that require adaptation and opening doors for strategic maneuvering.

DraftKings actively engages in lobbying efforts to shape a regulatory environment conducive to its long-term growth ambitions, a crucial step for thriving in the competitive domain of online gambling. It contends with established industry giants and rising newcomers, a scenario that demands substantial marketing and product innovation investment to sustain its market position and profitability, even if these investments initially strain financial resources.

The company’s dependence on sports leagues introduces a vulnerability to fluctuations in the sports calendar, where unexpected disruptions can affect revenue streams. However, DraftKings’ diverse portfolio, spanning various sports and geographies, safeguards against such volatility. Additionally, while the broader economic landscape and consumer spending habits pose potential risks, DraftKings has demonstrated resilience against economic downturns, indicating a strong consumer base that remains engaged even in tough times.

Despite the challenges of a highly regulated market, DraftKings’ strategic focus on technology adoption, market expansion, and product diversification equips it to seize the extensive opportunities within the ever-evolving online gambling and sports betting landscape.

Conclusion

DraftKings’ journey within the online gambling industry showcases a blend of strategic growth, resilience, and innovation. Despite regulatory hurdles and intense competition, the company has effectively solidified its presence, mainly through significant acquisitions and partnerships, like Jackpocket and Barstool Sports. These moves enhance its product range and user engagement and signal a strong potential for sustainable growth.

Financially, DraftKings is on the cusp of profitability by FY 2024, reflecting a significant turnaround supported by its technology and market expansion investment. Challenges remain, such as dependency on sports schedules and economic fluctuations, yet DraftKings’ diversified approach and technological innovation, including ventures into VR, AR, and blockchain, position it for future success.

DraftKings is navigating the complexities of the gambling sector with strategic and innovative efforts, as it explores new technologies and markets, the company is poised for continued growth, promising an exciting future for stakeholders in the evolving landscape of online betting.

DraftKings has set itself up for an exciting and profitable future, and we, therefore, rate this stock a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DKNG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.