Summary:

- The events of the massive 2021 short squeeze in GameStop have been made into a Hollywood movie.

- The film follows Keith Gill, a cat-loving Boston dad who manages to take Wall Street for nearly $50 million.

- GameStop’s short squeeze is a story of David beating Goliath, but also one of the dark side of crowd psychology and the danger of the mob mentality.

- I take a fresh look at the mania 2.5 years later with lessons for investors today.

Leon Varas /iStock via Getty Images

“Babe, how much did we make today?”

“$5 million…”

“And yesterday?”

“4 million…”

–Dumb Money (2023).

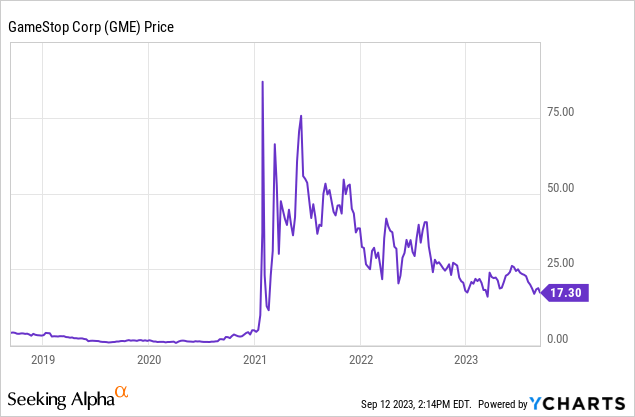

The massive 2021 short squeeze in GameStop (NYSE:GME) has officially been made into a movie. The film opens this week in New York and Los Angeles, and in the rest of the US on September 29. Dumb Money follows Boston-area dad Keith Gill’s all-in bet on GameStop stock options that reportedly profited him close to $50 million and led to the downfall of several well-known hedge funds. Gill frequently shared his investment theses on YouTube as “Roaring Kitty,” and on Reddit as “Deepf***ingvalue,” inspiring millions of other investors to coattail his investment. From December 2020 to January 2021, GME stock soared from a split-adjusted $15 to a peak of $400+. The initial short squeeze will likely go down in history as one of the largest redistributions of wealth from Wall Street to Main Street in history.

While I personally only banked a small profit on GameStop during the squeeze, friends of mine really did make life-changing money from the event. However, for many, a blessing soon became a curse. For reasons that are likely to be litigated for decades, Robinhood (HOOD) and other brokers soon disabled the buy button on GameStop, marking the top. Acquaintances of mine were later shocked to find that stock market gains are taxable income. Others chased the next high, trusting their hard-earned money with charlatans promoting failing companies and SPACs as the next GameStop. Others still stayed long after the party ended in GME, pumping their money into the company at nosebleed valuations long after the short squeeze. Gill’s fans turned on him as well, filing half-baked class action lawsuits for a free shot at his profits. Gill went radio silent in April 2021 and he hasn’t spoken to the media since.

I warned my followers in March 2021 about what would happen to those buying stock after the squeeze and got a huge backlash from conspiracy-minded investors who thought I was on some secret payroll of Wall Street. Random people tracked me down and loaded my inbox with hate mail. At a steakhouse bar, someone launched into me with a drunken tirade that AMC Entertainment (AMC) stock was going to $1000. Someone even stole proprietary keyword research from us and published it misleadingly out of context to fuel conspiracy theorists and as a cheap attempt at gaining some fame. What I’ve learned (and what Roaring Kitty surely has) is that being a public figure has a price. Unfortunately, it’s almost impossible to reach the top level of success in sports, business, arts, or politics without attracting some hate. I’ll forever remember the first time my family got a death threat related to my dad’s work as an insurance executive– I was in second grade.

Rather than firing off hate mail for their own failings, what Reddit traders need to learn is how to read an income statement (GameStop’s is here) and a balance sheet (here). You shouldn’t put internet personalities on a pedestal, but you should do your own research and be objective about your plans for trading. It’s quite easy to look at GME’s operating income and see that the company loses a few hundred million dollars per year, and they’ve got about $1.2 billion in assets. To this point, GME is down about 80% off the bubble highs because the underlying business doesn’t support the valuation, and the big money short sellers are long gone. We can loosely estimate that this gives GameStop 3-5 years of runway left to operate. After that, the future is increasingly shaky, because revenue isn’t even close to keeping pace with inflation. This isn’t rocket science. You don’t even need to be able to read a balance sheet– all you have to do is drive to your local GameStop store and watch traffic coming in and out. GameStop also has some assets like cash and real estate, but much of it is illiquid (book value of $4.16). This suggests a fair value for GME at present of somewhere between $2 and $10.

In the end, maybe the GameStop trade was just a game. Over 100% of the stock’s shares were sold short in January 2021, so by pumping billions of dollars into the stock, retail traders could name their price and the hedge funds would be forced to buy it back. This actually happened in a famous short squeeze in 2008 when Porsche cornered the market in Volkswagen stock and then sold back the shares to the shorts for an enormous profit. That’s the economic logic behind a short squeeze, the price rises until it induces enough sellers to allow the short sellers to cover. This is also why history is littered with failed attempts to corner various markets. Cornering the market makes good plots for James Bond movies, but not a great long-term business plan. There’s nothing wrong with buying stocks on momentum, but you have to know when to let them go. Many people who bought on momentum to squeeze Wall Street hedge funds and sold their shares high made life-changing money. Those who thought they were starting a broader revolution ended up holding the bag.

In truth, the biggest winner from the GameStop bubble is likely the U.S. government, which collects income taxes on the winners and gives measly tax loss carryforwards to losers. In the end, meme stocks are a zero-sum game (actually negative-sum counting transaction costs and taxes), and retail investors are significant losers in most bubbles. If you’re curious about how the money flows in speculative bubbles, I did a breakdown on the cash flow from the Dogecoin (DOGE-USD) craze in 2021.

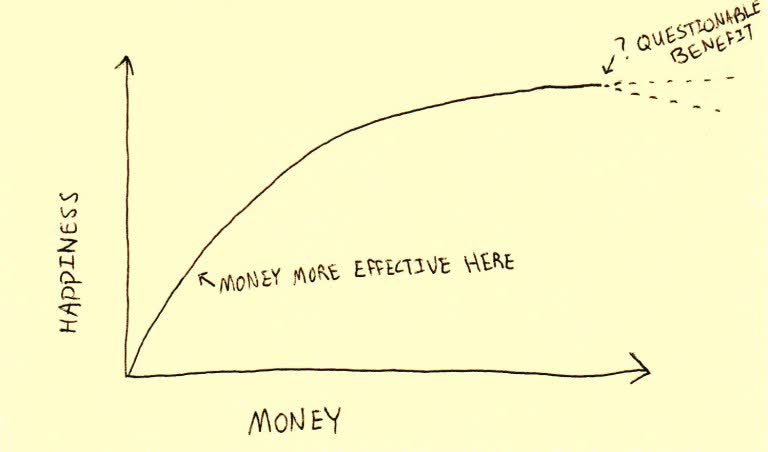

Gill/Roaring Kitty hasn’t publicly said whether he sold his shares or not in 2021, but given that he’s a finance professional and that we haven’t heard from him about still being in the stock, my educated guess is that he sold at some point when the momentum turned. It certainly doesn’t make him a bad guy – I’d do the same myself. I’m speculating as to the amount, but after taxes, that likely leaves a nest egg of somewhere from $20-$30 million for him. Economists often refer to the utility theory of money, which basically means that getting more money is less useful the richer you get. By disappearing from the public eye, Roaring Kitty may be even smarter than he’s given credit for.

Utility Theory of Money (Passive Income MD)

Bottom Line

It’s said that life imitates art and art imitates life. Roughly 2.5 years after the GameStop short squeeze, the story is being brought to life in theaters around the world. Some people made life-changing money trading it, while others lost everything. It’s a story of a guy who took on Wall Street and won big, but also a powerful warning against falling into the mob mentality. Was the GameStop squeeze a brilliant David vs. Goliath story, an example of the dark side of human nature, or both? See the movie and decide for yourself, as it’s likely a better use of $17 than buying a share of GME.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.