Summary:

- MSFT’s consensus EPS and revenue estimates for ’24 – ’26 (fy ’24 starts July 1) still calling for mid-teens EPS and low teens revenue growth. Expect those estimates to soften.

- GOOGL’s 5% free-cash-flow yield and easier ad spending comps make for a better ’23 story.

- META today is a cost-reduction story, having little to do with the post-Covid hangover. Ultimately, “the metaverse” needs to become viable as a business model opportunity.

- Amazon’s online store will improve in ’23, just as AWS is showing signs of slowing. Amazon’s total revenue closing in on Walmart.

4kodiak/iStock Unreleased via Getty Images

Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) report their respective March ’23 quarters after the closing bell on Tuesday, April 25th, 2023. Meta (NASDAQ:META) reports Wednesday, April 26th, 2023 after the closing bell and Amazon (NASDAQ:AMZN) Reports Thursday, April 27th, 2023, after the closing bell.

Here’s a quick look at the numbers and some thoughts on each company:

Microsoft:

When Microsoft reports their fiscal Q3 ’23 after the closing bell Tuesday night, analyst consensus is expecting $2.23 in earnings per share on $51.018 billion in revenue for expected year-over-year (y.y) growth of 0% and 3% respectively. Operating income is expected at $20.4 billion and also is expected to be flat y.y.

Sometime in mid to late 2022 Satya Nadella said things would likely be slow for a few years (that’s me paraphrasing his comments) which the expected results reflect.

Revenue guidance in Jan ’23 was for $50.5 to $51.5 billion for Q3 ’23 while operating profit guidance was for $20.15 to $20.85 billion.

Expected 2023 revenue growth has slowed from 14% in March ’22 to just 7% today, pre-earnings, while expected ’23 EPS growth has slowed from +16% in March ’22 to +2% today.

There is a lot of bad news baked into expected results today.

Azure growth has slowed from its torrid 50% for most of the last decade, to +36% as of the December ’22 quarter. It will likely slow further given Amazon’s AWS comments, although Azure could be grabbing market share from AWS.

Here’s the key: Looking at Microsoft’s forward estimates for ’24 – ’26, the Street is expecting mid-teens EPS growth and low teens revenue growth. Investors won’t get the fiscal ’24 guidance from MSFT management until July ’23, but that consensus has been coming down for the software giant.

Personally, while ChatGPT is becoming more and more of a thing, and MSFT looks like an early winner, the Intelligent Cloud (most of which is Azure ) is still a big part of MSFT’s business at 41% of revenue and 44% of operating profit as of last quarter.

The point being Intelligent Cloud grew operating profit from the teens through 30% y.y growth, for 20 consecutive quarters, before last quarter’s 9% y.y growth.

We should probably expect MSFT’s numbers to continue to get revised lower, at least for another quarter.

Valuation: With MSFT trading at 27x and 31x the expected ’23 and ’24 EPS growth of 5% and 11%, along with the 8x sales value, the stock’s valuation looks expensive, but MSFT has a history of trading that way.

Morningstar fair value: $310

Microsoft YTD return as of 4/21/23: +19.44%

Alphabet:

When Alphabet reports Tuesday night after the bell, consensus is expecting $1.07 in EPS on $68.9 billion in revenue for expected y.y growth of -12% and +1% respectively.

Clients are only long GOOGL, so that’s the ticker that will be used, but with the Q1 ’23 financial results, GOOGL will lap it’s last tough quarter from Covid. In March ’22, GOOGL grew revenue and operating income +22% y.y, (which is pretty good growth) and now the compares get easier moving through ’23.

The big issue circulating around GOOGL is the potential loss of search engine dominance due to ChatGPT AI, and while it’s a threat, Morningstar’s analyst Ali Mogharabi detailed in his latest note that Google search market share has yet to be impacted.

Ad spending and advertising got a lot of press in the back half of ’22, which has seemed to have evaporated in 2023, as ChatGPT concerns have arisen. Google Cloud has put up good numbers, with revenue growing at a 30% – 40% rate the last 10 quarters although it’s currently just 10% of GOOGL’s total revenue, and last quarter’s +32% y.y growth rate was the slowest of the last 10 quarters.

Google Advertising, which is 78% of GOOGL’s revenue, saw y.y revenue growth of +60% – 70% in ’21 (during Covid) unfortunately that revenue growth slowed to -4% in Q4 ’22.

My own opinion is that GOOGL’s ad spending is simply “normalizing”: it grew mid teens in 2019 for the search giant.

Valuation: With a 4% – 5% free-cash-flow yield and trading at a high teen’s PE for expected 10% average EPS growth in 2023 and 2024, GOOGL has a lot of bad news baked into its share price, but the impact of ChatGPT has really yet to be seen.

Morningstar fair value: $154

GOOGL YTD return as of 4//21/23: +19.47%

Meta Platforms:

META’s stock has rallied from below $100 in late ’22 to $220 per share pre-earnings this week, even though revenue growth has been negative for 4 consecutive quarters, operating income growth has been negative for 5 consecutive quarters and EPS growth has been negative for 6 consecutive quarters.

The stock has definitely gotten a lift from headcount reductions at META, while the Metaverse still seems to lack any kind of broad traction yet from the consumer.

Barry Diller has pointed out or questioned (a few times) in the business media, why Mark Zuckerberg more or less torpedoed the original Facebook business, and did a 180 and started pursuing the so-called Metaverse (AR, VR, AI and even crypto was thrown in there for a brief period) without seeing if the consumer was going to embrace this new technology.

Because of the headcount reductions, forward EPS estimates have been revised positively for META, even though forward revenue estimates continue to be revised lower.

Valuation: Trading at an “average” 18x multiple for a stock that is expected to average 15% EPS growth (9% revenue growth) over the next 3 years (’23 to ’25), with a 4% free-cash-flow yield is cheaper than most of the mega-cap tech you’ll fund, but META is a cost-cutting game and that doesn’t fare too well with higher-multiple tech over the long run.

Annual EPS estimates have been cut in half on META in the last 2 years, and the company now has been forced to rebuild its business model. The vast majority of META or the old Facebook was sold from client accounts in 2017 when the Cambridge Analytica scandal broke and only a smaller percentage is still held today. Some progress on “the metaverse” would be good to see.

Morningstar fair value: $260

META YTD return as of 4/21/23: +76.91%

Amazon:

Amazon will report their Q1 ’23 financial results after the closing bell on Thursday, April 27th, with analyst consensus expecting $0.21 in earnings per share on $124.5 billion in revenue for expected y.y growth of a lot in EPS (against a loss of $0.38 a year ago) on 7% revenue growth.

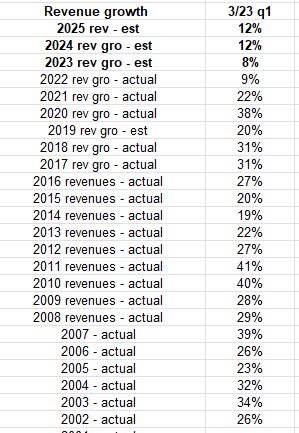

There is a lot going on with Amazon. Here’s an amazing table (I think):

Amazon historical / expected rev gro (historical earnings )

Prior to 2022, Amazon’s lowest year of revenue growth was 19% in 2014 – even 2008 was a 28% growth – and yet 2022, with a fairly decent economy, saw 9% y.y revenue growth, the lowest on my valuation spreadsheet.

That’s one reason for the lethargic stock price, but there are other interesting metrics as well.

Amazon inventory-to-sales history (Historical financials )

(Click on above inventory-to-sales history to make for easier reading).

Like this Walmart earnings preview written for Seeking Alpha, the online stores and 3rd party selling aspect of Amazon is similar to Walmart, and for Amazon the “online store” is close to half of total revenue, and grew in the 40% range during the pandemic, but “averaged” -1% y.y revenue growth in 2022.

Part of that – like Walmart – was the surge in inventory in during 2021 to meet the heightened growth rates (not to mention the capacity expansion) only to see late 2021 and 2022 drop like a rock.

However Amazon is now coming out of this (as readers can see from the improvement in the inventory to sales ratio) and this should improve and contribute to results going forward.

However Amazon Web Services (AWS) is a different story: like MSFT’s Azure, AWS has seen slowing revenue growth and operating margin fell 2% y.y in Q4 ’22, in addition AWS’s operating margin dollars face another tough comp in Q1 ’23.

What’s more important, because of the severely curtailed profitability at online stores, AWS was essentially accounting for all of Amazon’s operating margin, thus with AWS slowing, and the operating margin contribution slowing, it’s imperative on AMZN to remedy the margin at “online stores” and not rely on AWS to “carry the water” so to speak.

The positives in AMZN’s Q4 ’22:

- After declining sequentially for 8 straight quarters, AMZN’s operating income improved 8% in q4 ’22;

- AMZN’s inventory-to-sales ratio improved for the first time in 6 quarters, possibly due to it being the Christmas quarter;

- Free-cash-flow jumped to $12.5 bl in Q4 ’22, almost doubling from Q4 ’21;

- Gross and contribution margins continued to improve y.y in Q4 ’22, however the operating margin has declined y.y for 7 straight quarters;

One final point: Amazon’s operating margin in Q4 ’22 was 1.8%, Walmart’s operating margin Q4 ’23 was 3.70%. Amazon still has room to boost that margin once they get past the excess capacity of Covid.

Morningstar fair value: $137

AMZN YTD return as of 4/21/23: +27.33%

Summary / conclusion:

It’s hard to believe there is this much bad news within the tech sector, but this is not 2001 – 2002, when – post the technology and dotcom boom of the late 1990’s – the SP 500 fell 50% and the Nasdaq corrected 80% peak-to-trough.

The 1990’s were all about the secular buildout of corporate technology ( PC’s, laptops, servers, and ultimately the internet itself) or the “pipeline” but the decade starting with 2010 (whose origins date back to the early 2000’s with Apple and Amazon) is all or a lot of it is about consumer technology.

It took Microsoft 16 years to make a new all-time-high after it peaked at $53.81 in January, 2000. It took the QQQ 17 years to make a new all-time-high even with Apple as its largest component.

Discounts to Morningstar fair value:

- MSFT -10%

- GOOGL: -32%

- META: -19%

- AMZN: -23%

Despite the apocalyptic messages repeatedly heard, one aspect to the US economy that is almost unanimously thought to be in good shape is the consumer.

Amazon is a great opportunity to play the US consumer and more importantly a potential doubling of their operating margin to get it closer to Walmart’s operating margin.

It might not happen this quarter, but by the end of calendar ’23 we should see better performance metrics from Amazon.

Microsoft and Alphabet worry me the most – more GOOGL than MSFT – given ChatGPT, but Alphabet faces easier comp’s as we move through 2023.

META I’m not sure what to make of although not a lot of the stock is owned by clients. The metaverse headsets are supposedly already seeing price cuts and it’s rare to see anyone on the tech websites or social media bragging about what they are doing in the metaverse.

Cost-cutting and headcount reductions only take you so far in any sector, but especially tech (and retail tech). You better start growing revenue or you eventually encounter problems.

The one fundamental aspect to “pre-megacap” earnings this week is the generally bearish sentiment and the “hold-your-nose” aspect to being long mega-cap growth, which typically bodes well after the fact.

All 4 stocks listed above are trading above their 200-day moving average (with the exception of AMZN, which is sitting just below its 200-day), so investors have the usually good combination of decent technical’s and poor sentiment around the stocks.

Let’s see if the fundamentals cooperate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.