Summary:

- Netflix is up almost $100 per share from the last earnings report in mid-October ’23 when the stock was trading poorly coming into the earnings.

- Sell-side consensus is expecting $2.22 in earnings per share on $9.3 billion in revenue for the 4th quarter of ’23, which amounts to expected YoY growth of 1750% on 20% revenue growth.

- Sell-side consensus is expecting TSLA to print $0.74 in EPS on $25.59 billion in revenue, for an expected YoY decline in EPS of -38% on 20% revenue growth.

deepblue4you

Netflix’s (NASDAQ:NFLX) movie chief Scott Stubler announced Monday night, January 22nd, he was leaving Netflix to start his own movie company, which – from a timing perspective – is probably not fortuitous given that Netflix is scheduled to report their Q4 ’23 financial results after the bell on Tuesday, January 23rd, 2024.

Netflix is up almost $100 per share from the last earnings report in mid-October ’23 when the stock was trading poorly coming into the earnings after growth stocks weakened beginning in late July, ’23.

Sell-side consensus is expecting $2.22 in earnings per share on $9.3 billion in revenue for the 4th quarter of ’23, which amounts to expected YoY growth of 1750% on 20% revenue growth.

Netflix is facing a very easy compare from Q4 ’22: let’s look at the numbers:

Q4 ’23 (est):

- Rev: $9.3 billion

- Op inc: $1.973 billion

- EPS: $2.22

Q4 ’22 – actual:

- Rev: $7.8 billion

- Op inc: $550 million

- EPS: $0.12 (actual) versus the $0.55 estimate

Q4 ’22 was a bit of a dumpster fire for NFLX, but the streaming giant did guide higher for Q1 ’23.

Q3 ’23 or last quarter for NFLX, was pretty solid as revenue grew 8% in Q3 ’23, operating income grew 28%, and EPS grew 20%.

The big “upside surprise” metric for Q3 ’23 was subscriber growth as it came in at 8.76 million versus the 5.8 ml estimated.

Most of the subscriber growth is coming from non-US geographies, like Europe and Asia. US and Canada subscriber growth has been much more subdued.

If Q4 ’23 estimates are met, NFLX will have grown full-year EPS +26% on 6% revenue growth.

As of tonight, expected ’24 estimates are looking for full year ’23 EPS growth of 31% on 14% revenue growth, which would be the strong revenue growth of the last 3 years for NFLX.

Valuation: Trading at 50x and 30x expected ’23 and ’24 EPS of $12.18 and $15.93, the stock never looks cheap. 5.7x sales and 36x and 38x cash flow and free cash flow are also expensive metrics, so buyer beware.

Our own internal valuation metric values NFLX at $600 per share, while Morningstar still has a $350 fair value estimate on the stock.

If readers average the two estimates, it leaves a roughly $500 fair value estimate on the stock, versus the $485 close tonight, hence the stock could be considered fairly valued, i.e. at not enough of a discount to buy new shares.

The strengths of Netflix are that revenue revisions have been positive probably thanks to pricing power, as my own Netflix subscription has been raised in price (again) in the last several months, but free cash flow has dramatically improved as well. Here’s the actual trailing twelve month (TTM) free cash flow dollars in the last 5 quarters:

- Q3 ’23: $5.7 billion

- Q2 ’23: $4.3 billion

- Q1 ’23: $2.8 billion

- Q4 ’22: $1.4 billion

- Q3 ’22: $523 million

Because of free cash flow growth, NFLX now sports a free cash flow yield of between 2-3%.

This blog has modeled NFLX since Q1 ’16, and I’ve never seen NFLX’s free cash flow this healthy.

What I’m not crazy about is that Netflix can’t seem to raise the operating margin over the low 20% area (20-22%) despite their pricing power.

Summary/conclusion: NFLX could easily trade down 10-15% on Tuesday night after the close on weak subscriber numbers (if that should happen) and the salty valuation, but the stock would likely fund support in the $400 area, as it continues to trade between that price level and the late ’21 high of $616 per share.

In late ’21, with the stock over $600, NFLX actually had a multiple of about 30x but negative free cash flow, so as NFLX approaches that all-time-high print just above $600, it’s doing so with much higher free cash flow and a far higher quality of income (i.e. free cash flow to net income) ratio than 2.5 years ago.

I personally have always judged Netflix on the availability of decent shows to watch, and I’m still finding programs to watch, albeit I’m working a little harder to find them. Some are started and never finished. They took Sicario off the menu (ouch) which really hurt.

Netflix is another Covid period victim in the sense that 2020 through late ’21 greatly distorted the financial and subscriber metrics.

The “stay-at-home” mandate may have pulled forward years of US and Canadian subscriber growth that is only now starting to normalize.

Clients own about a 1% position, simply thanks to the gut-wrenching volatility of the stock.

Tesla (NASDAQ:TSLA): Hard to remember sentiment around the stock or industry this bad.

The only other time that general market sentiment has been this bad around TSLA (that I can remember) was when Elon Musk came out with “the $210 bid is secured” (supposedly from the Saudis) and he was being beaten up for his Joe Rogan show appearance and then the subsequent SEC investigation.

When Tesla reports their calendar Q4 ’23 results after the bell Wednesday night, January 24th, 2024, sell-side consensus is expecting the EV giant to print $0.74 in EPS on $25.59 billion in revenue, for an expected YoY decline in EPS of -38% on 20% revenue growth.

Current full year 2024 estimates are looking for 17% EPS on 19% revenue growth and the problem with that is just two quarters ago i.e. July ’23 – the same ’24 estimates for EPS and revenue growth were for 65% EPS growth and 25% revenue growth.

The numbers are coming down rapidly.

Here’s the progression in gross margin since the late ’21 peak:

- Q3 ’23: 22%

- Q2 ’23: 21%

- Q1 ’23: 23%

- Q4 ’22: 27%

- Q3 ’22: 29%

- Q2 ’22: 29%

- Q1 ’22: 32%

- q4 ’21: 30%

Will last quarter’s 1% sequential increase in gross margin, signal the end of the erosion ?

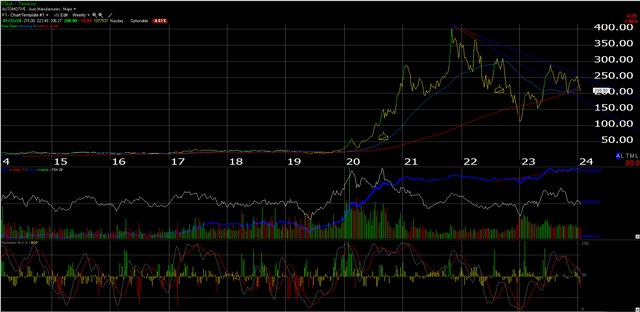

One technician told me that ultimate support for Tesla could be down between $140-150, which is the gap left from the January ’23 earnings call. However, with today’s close, TSLA is sitting right on top of the 50 and 200-week moving averages.

Here’s what that chart looks like:

The volatility around this stock is like trading a future.

This blog has a very small position in the stock, but I’d like to see some basing first. Tesla’s all-time high was $414 per share around November ’10 ’21, so the stock corrected 75% in ’22 and has now retraced a bunch of the latest rally that started in ’23.

If TSLA is added prior to earnings, it will only be in very small quantities.

Valuation: At $200 per share, TSLA is still trading at 63x and 54x ’23 and ’24 EPS estimates of $3.15 and $3.70. Unlike Netflix, which is seeing upward revenue revisions, the revisions to TSLA’s revenue is decidedly negative, and that’s never good for an auto company.

The sentiment is getting so bad both around Tesla and the EV industry in general it’s becoming a positive.

The technical setup might warrant a few small positions being purchased, but the negative EPS and revenue revisions mean the quantities will be small, and the anticipation of another $50 drop in the stock can’t be ruled out.

EVs are still just 4-5% of US automobile ownership, although Tesla still has the lion’s share of market share at around 65% of the segment, the point being there is still likely plenty of growth down the road, albeit the sector is definitely seeing a rough patch today.

None of this is advice or a recommendation. Past performance is no guarantee or suggestion of future results. All EPS and revenue data is sourced from IBES by Refinitiv.

The two stocks discussed today are very volatile given their valuations, and even now might be considered earlier-stage growth companies. Both are the leaders in their respective sectors, or business segments.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.