Summary:

- eBay Inc.’s Q1 2024 guidance and increased dividend led to a premarket jump in shares, but I don’t believe it’s worth chasing.

- Not enough positive elements to be bullish on eBay stock.

- eBay’s near-term prospects include enhancing the customer experience, expanding offerings, and positive growth in advertising, but challenges persist.

JHVEPhoto

Investment Thesis

eBay Inc. (NASDAQ:EBAY) delivered Q1 2024 guidance that saw its shares jump premarket. Investors welcome the increased dividend together with its FX-adjusted mid-single digits y/y increase in revenue guidance.

However, I declare that these shares are not worthwhile chasing, and that what investors are looking at right now, is the best eBay is going to guide for a while.

Hence, I remain firmly on the sidelines. I’m not bearish, and I’m not bullish. I recognize some positive elements, but there’s not enough here for me to get bullish on this name.

Rapid Recap

In my previous neutral analysis, back in December, I said:

As we inch closer to 2024, I lay out my assumptions for eBay’s 2024 financial prospects. On the surface, the business remains very cheaply priced at 9x forward EPS.

But with less than tepid topline growth expected, I believe that this stock is likely a value trap and recommend that investors don’t average further into their position.

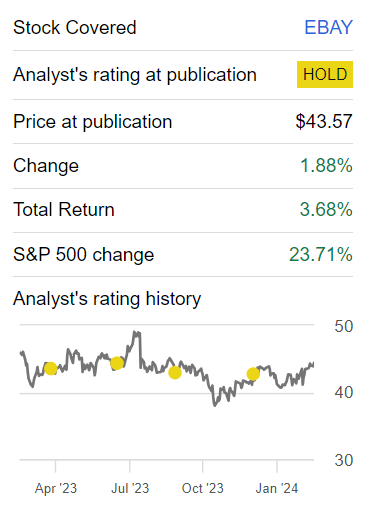

Author’s work on EBAY

I’ve been neutral on eBay for the past year. And for the past year, as the market is on a path to deliver one of its strong returns, with the S&P 500 (SP500) soaring 24% in the past year, eBay stock has barely delivered high single digits – even including this premarket jump. As you’ll soon see, there are more than enough reasons to remain neutral on this stock.

eBay’s Near-Term Prospects

In the near term, eBay is focused on enhancing the customer experience and expanding its offerings in key categories, particularly in Motors Parts & Accessories. The implementation of eBay’s Guaranteed Fit programs has not only improved buyer trust but has also contributed to incremental GMV within the focused category.

The global expansion of the Authenticity Guarantee Program, with a notable presence in Tokyo, Japan, reflects eBay’s commitment to building trust and providing a secure platform for cross-border trade in the high-demand luxury market.

Other positive shoots include eBay’s advertising business, which witnessed fair growth, with total advertising revenue reaching $1.4 billion, a notable increase of roughly 25% for the year. The consistent expansion of first-party advertising and the introduction of innovative features like rule-based campaigns and top-pick carousels contribute to a positive outlook for eBay’s advertising segment.

Meanwhile, eBay also faces challenges. One significant hurdle is the persistently challenging macroeconomic environment, particularly in key markets like the U.K. and Germany. Negative growth in e-commerce in these regions presents headwinds for eBay.

The impact of these adverse conditions is further reflected in the relatively flat gross merchandise volume (GMV) growth of 1% for the full year, underscoring the need for proactive measures to counteract these pressures.

Revenue Growth Rates Will Struggle in 2024

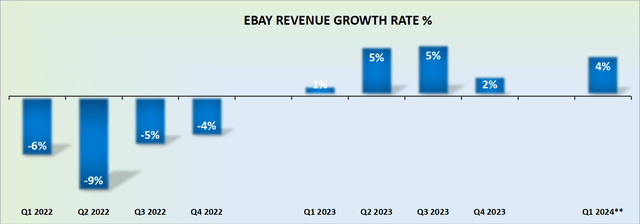

EBAY revenue growth rates; GAAP revenues

Above, I show Q1 2024 as a non-GAAP FX-adjusted revenue growth rate, while the prior quarters are shown as GAAP figures. This doesn’t meaningfully change this what you see above, but I wanted to highlight its guidance as an FX-adjusted figure to best guide our discussion.

What you see above is that Q1 2024 points to approximately 4% top line revenue growth rates. What’s more, recall that this is against the easiest comparable figure with the prior year.

And as the quarters move forward beyond Q1 2024, the comparables will only get more challenging. Meaning that eBay’s Q1 guidance is as good as it’s going to get before its quarterly revenue growth rates once more take a turn to become less enticing.

Given this backdrop, let’s now consider eBay Inc.’s valuation.

EBAY Stock Valuation — 8x Forward EPS

First things first. eBay has increased its annualized dividend to $10.8 per share, which delivers a 2.4% yield, including the premarket jump on its stock.

Not only is this the highest yield its stock has offered this year (aside from a fleeting moment in October), but it’s also the highest yield in 5 years. Simply put, this dividend increase will work to put a floor on its stock from sliding further. But is this alone enough to make me want to buy its stock?

This is where the plot takes an abrupt turn. eBay holds $2.5 billion of net debt. Yes, eBay has a large holding in Adevinta valued at $4.5 billion, but unless eBay monetizes that holding by selling it, eBay will only succeed so far in continuing to raise its dividend higher.

What’s more, even though eBay is likely to make around $5.50 of EPS this year, and its stock looks tremendously cheap at somewhere close to 8x EPS, this does not appear to be an endurable franchise.

This is a business that’s getting disrupted in every direction. And what starts off as a cheaply valued stock today, will only get cheaper with time.

The Bottom Line

In conclusion, I remain on the sidelines regarding eBay’s stocks.

Despite the recent market enthusiasm over increased dividends and positive guidance, I find it challenging to muster bullish sentiments.

While there are positive aspects, such as efforts to enhance customer experience and growth in advertising, there are hurdles too.

The projected 4% Q1 2024 revenue growth, against easy comparables, doesn’t inspire confidence in eBay Inc.’s near-term trajectory.

Furthermore, despite the attractive 2.4% yield from increased dividends, concerns about net debt contribute to my cautious stance.

In a landscape of increasing disruption, eBay’s seemingly cheap valuation isn’t enough to make me bullish on this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.