Summary:

- eBay is trading just above November’s lowest valuation in a decade, using enterprise value calculations.

- A liquid balance sheet with $10 billion in cash and investments vs. $15 billion in total liabilities provides plenty of flexibility to achieve future business growth.

- Some of the highest online retail business margins/returns are available on the cheap for smart investors.

Kenneth Cheung

One of the early technology-boom Dotcom (online) favorites in the late 1990s, eBay (NASDAQ:EBAY) has witnessed declining valuation metrics since 1999. Over the last decade, several management teams have spun off the PayPal (PYPL) online money handling unit (2015), while outright selling various divisions and asset investments globally to repay debt and buy back shares. These efforts to refocus on its bread-and-butter eBay online website have helped “per share” results to grow rapidly over this span (roughly +200% from 2015 for sales and income), but the stock quote has only risen marginally in response (around +150% for share price gains since 2014).

The consequence of faster business gains not being reflected in the ownership price is today’s business valuation is approaching 2015’s low point, which also figures as one of the cheapest setups in the global online retail industry currently.

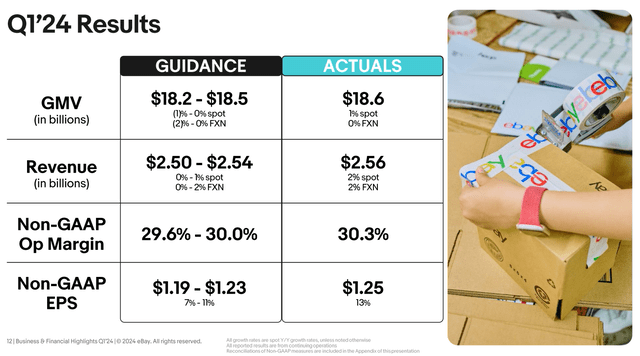

For good news, the share price has popped higher by almost +30% off its November bottom, largely on the back of improved operating performance. Q1 2024 numbers were actually much better than forecast by management or Wall Street analysts. What this could be telegraphing to shareholders is eBay’s business outlook is far from dead, it might even be a shining light in online retail going forward.

eBay – Q1 2024 Earnings Presentation

So, with plenty of valuation room to run higher, continued strong margins/results from the eBay business could support solid investor “outperformance” vs. retail sector gains and even S&P 500 total returns the rest of the year. Another +30% to +50% price advance for the stock is possible over the next 12-18 months to get closer to 10-year “average” valuations on better-than-expected sales, income and cash flow generation. Let me break down the bullish arguments.

Liquid Balance Sheet

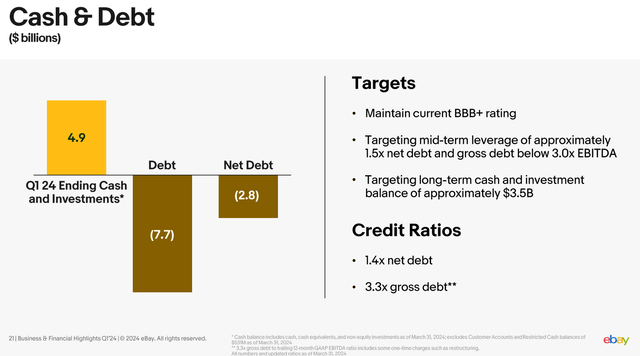

For starters, eBay runs a very conservative and liquid balance sheet. Net interest expense (interest on debt offset by interest on cash investments) of $266 million in 2020 has declined all the way to just $38 million over the trailing 12 months. After asset-liquidation residuals and continued share buybacks are considered, extensive cash levels of $4.9 billion at the end of March are now earning 5%+ for yield, while total debt of $7.7 billion has been financed at rates closer to 4%.

eBay – Q1 2024 Earnings Presentation

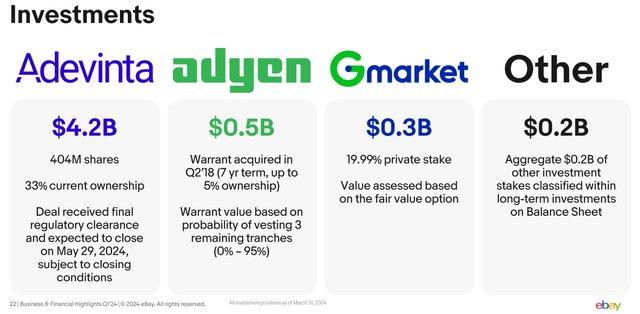

Additionally, the company still holds about $5.2 billion in investments (listed as both short and long-term assets on the balance sheet) in various companies and former business divisions. What this means is cash and investments combined stand at a much higher number than total debt. To boot, cash and investments of roughly $10 billion can almost cover all liabilities near $15 billion.

eBay – Q1 2024 Earnings Presentation

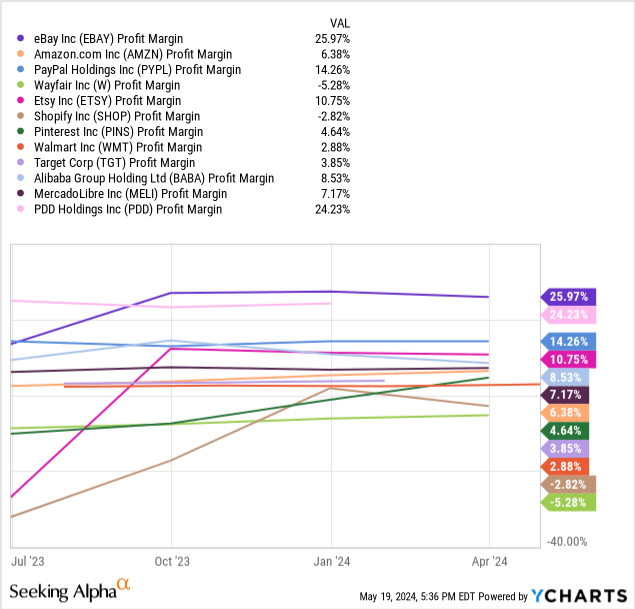

Growth Through Share Buybacks

With a focus on reducing the number of shareholders and rationalizing the cost structure of its core online web store operations, eBay is reaching for some of the highest profit margins in the retailing sector. You can review a graph of final after-tax margins of 26% today, compared to peers and rivals like Amazon (AMZN), PayPal, Wayfair (W), Etsy (ETSY), Shopify (SHOP), Pinterest (PINS), Walmart (WMT), Target (TGT), Alibaba (BABA), MercadoLibre (MELI), and PDD Holdings (PDD) owner of the popular Temu site.

YCharts – eBay vs. Major Online Retailers, Profit Margins, 1 Year

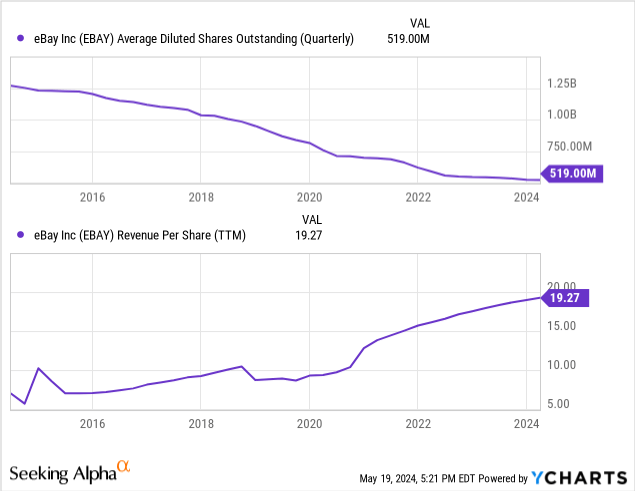

Below you can really see how the 60% reduction in diluted outstanding shares, cost-cutting, asset liquidations, and general inflation have benefited eBay’s “per share” metrics for revenue (200% growth total since late 2014). While total sales have been relatively stagnant on a reduction in business units owned, the asset-liquidation money received has been aggressively funneled into lowering total shares outstanding. It’s a different way of expanding the underlying sales, income and cash flow results per ownership unit.

YCharts – eBay, Outstanding Share Count, Per Share Sales, 10 Years

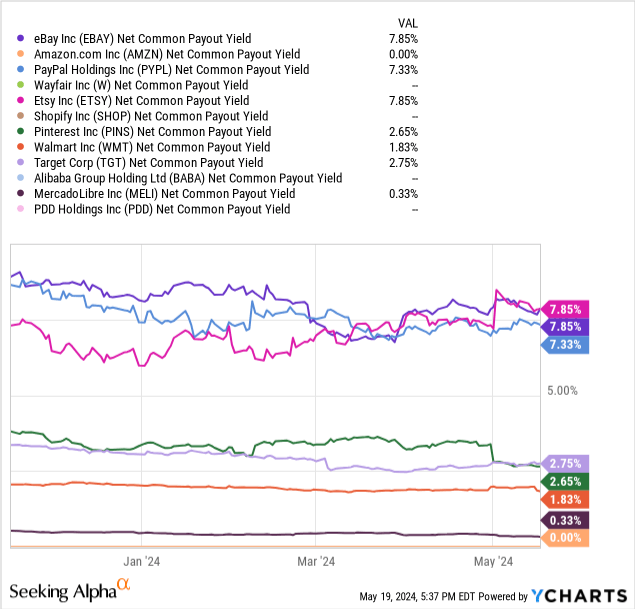

With its current 2.1% cash dividend yield and aggressive buybacks continuing (the equivalent of another 11% of float was authorized going into Q2), the combined return of capital shareholders is one of the highest numbers of the online retail giants. The Net Common Payout Yield of 7.85% on a trailing basis is actually down from 15% to 20% numbers several years ago, yet fully sustainable with huge cash reserves and high free cash flow generation.

YCharts – eBay vs. Major Online Retailers, Net Common Payout Yield, 6 Months

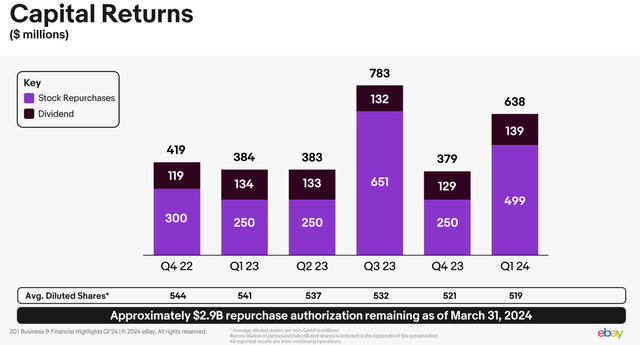

The company’s latest Q1 Earnings Presentation has a slide for the quarterly breakdown of total capital returned to shareholders.

eBay – Q1 2024 Earnings Presentation

Undervaluation Stats

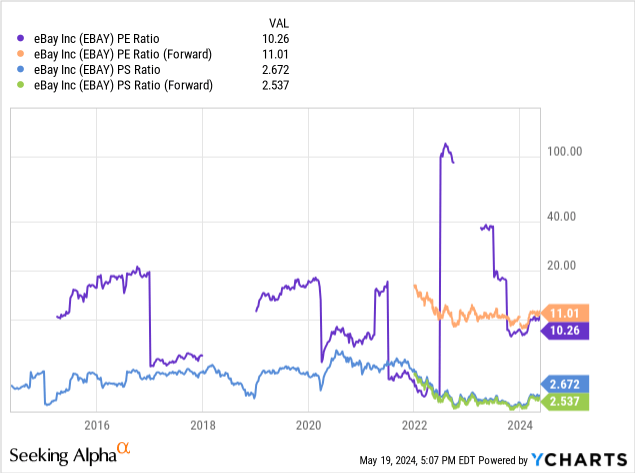

The bullish valuation story begins with a trailing P/E around 10x, with a forward 2024 forecast of 11x. While not a spectacular nominal rate or historical bargain vs. eBay’s past trading, one-time asset disposal gains have skewed this ratio. A better tool for evaluating regular/sustainable operating results comes with the price to sales ratio of 2.6x, which is only slightly above the November 10-year low, and on a par with the cheapest valuation of 2015.

YCharts – eBay, Price to Earnings and Sales, 10 Years

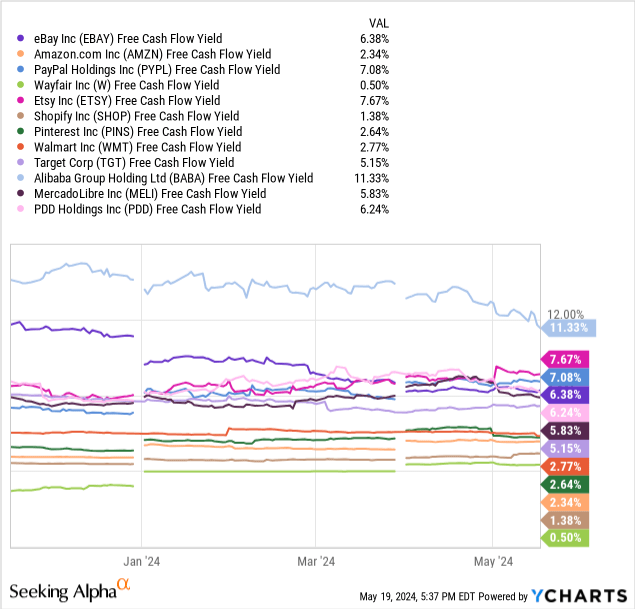

Exceptional free cash flow yields are another reason to like eBay. This number has fluctuated with asset sales, as an 11.8% yield six months ago has dropped to 6.4% on a trailing 12-month basis as of the latest quarter. Outside of the depressed, recessionary, hard-to-repatriate cash setup in China (Alibaba), eBay jumps out as a top free cash flow investment idea in retail.

YCharts – eBay vs. Major Online Retailers, Free Cash Flow Yield, 6 Months

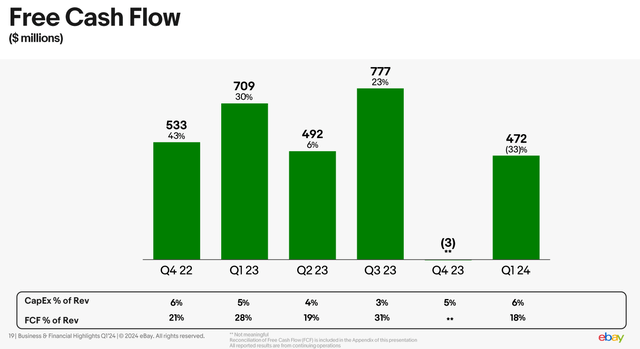

Absent the abnormally weak Q4 showing (from the effects of an accounting write-down on the value of short-term investments), free cash flow yield would be much stronger. So, I fully expect the sub-7% rate of today to rebound going forward.

eBay – Q1 2024 Earnings Presentation

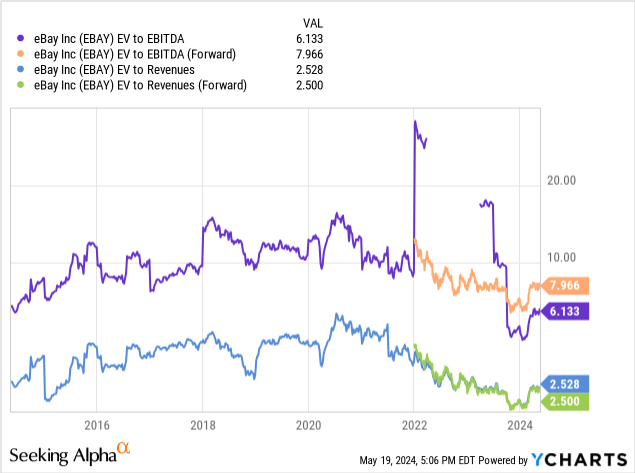

Lastly and most importantly, we can review the business valuation as a function of its total equity, plus manageable debt, minus large cash holdings. The “enterprise valuation” on EBITDA and Revenues is a much cleaner readout of company worth, in my view. With a trailing EBITDA multiple of 6.1x and forward 2024 estimate a little under 8x, the stock has basically reverted back to its ultra-cheap 2015 valuation backdrop. Plus, EV measured against sales is trading close to the depressed 2014-15 level. The question is, does this valuation make any sense?

YCharts – eBay, Enterprise Valuations, 10 Years

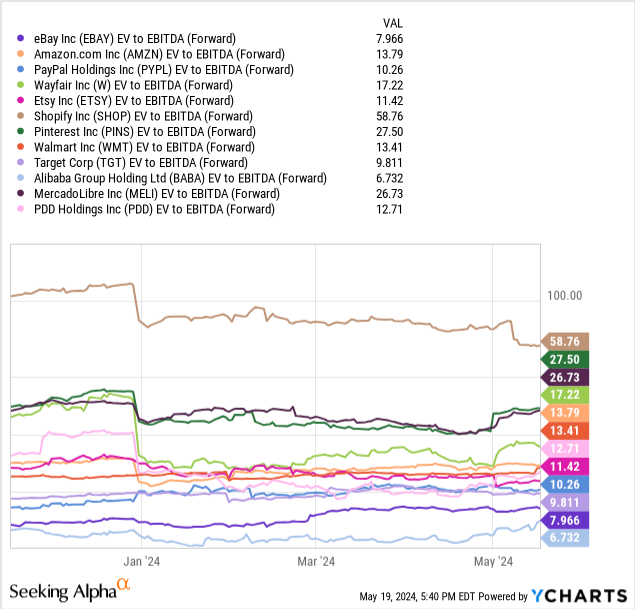

On EV to forward estimates of EBITDA, eBay is now a clear bargain setup in the online retail industry. Only the Chinese-market companies of Alibaba and several others not pictured offer better value on core cash generation.

YCharts – eBay vs. Major Online Retailers, EV to Forward EBITDA Estimates, 6 Months

Final Thoughts

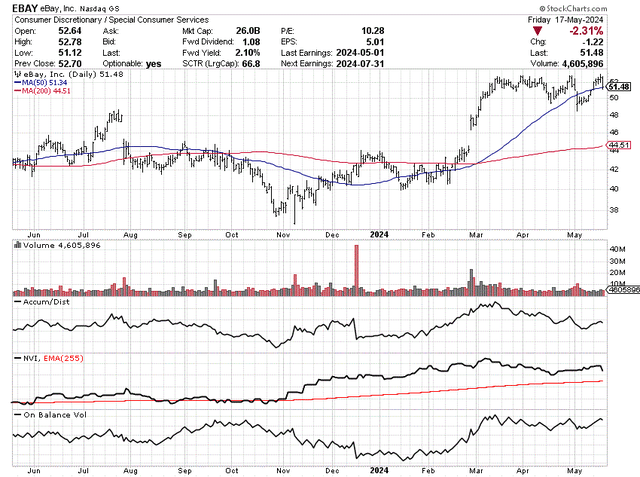

More bullish news: the technical trading picture has absolutely shown signs of improvement since November-January. Not only has the share quote risen, but underlying momentum indicators have been healthy and positive. Below, you can see eBay is trying to hold above its 50-day moving average for price, and has delivered a +20% total return over the last 52-weeks of trading. In addition, the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume calculations are all acting well over the intermediate term. My analysis is any move lower to retest its price gap experienced during late February and/or the 200-day moving average in the $45-46 area may open an excellent entry point for new investment.

StockCharts.com – eBay, 12 Months of Daily Price & Volume Changes

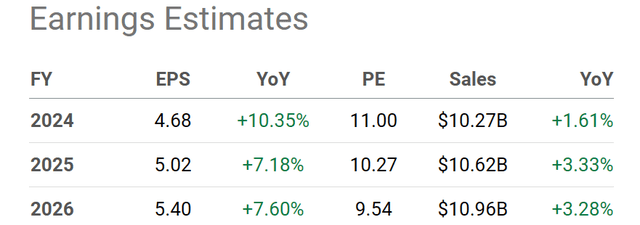

Only minimal expansion in EPS and total sales are projected by Wall Street analysts for 2024-26. (Remember, per share sales will likely rise closer to 10% annually, as ongoing earnings and cash flow generation are used to lower the share count.) My view is the below estimates will not be hard to beat, if the U.S. and global economic backdrop remains stable, while inflation remains a problem. To me, eBay is one of the smartest ways to hedge inflation, with its regular listing fees tacked onto rising product prices generally.

Seeking Alpha Table – eBay, Analyst Estimates for 2024-26, Made May 17th, 2024

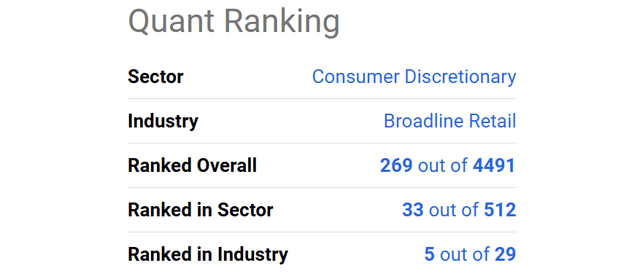

Seeking Alpha computers actually rank eBay quite highly today for investment attractiveness. The cross between a low valuation, rising price since January, and much stronger-than-expected Q1 earnings have put a Top 6% SA Quant score on shares for timeliness, out of a universe of 4,491 equities.

Seeking Alpha Table – eBay Quant Rank, May 19th, 2024

What are the downside risks buying eBay around $50 per share? That’s a great question. The company has a niche position in the online retail world, with its resale focus on collectibles and unique items. The eBay brand name is strong with consumers, and operating margins are extremely high. Online competitors do exist, but management has branched out into generating advertising revenue from others on its site with product placements, while marketing new goods to users to compete with the likes of Amazon and Walmart. So, I don’t really worry about its competitive position or long-term operating trends.

Perhaps the biggest investment headwind could come with another oversized bear market on Wall Street (like 2022). Either from a liquidity crunch in the capital markets or a deep recession showing up, macroeconomic risks could prove the immediate issues holding the stock quote in check. Given a mild recession and -20% to -30% drop in the S&P 500 the remainder of 2024, a drop in eBay’s price back to $40 cannot be ruled out (-20% investment total return, including dividends, from $51).

Nevertheless, 12-month upside targets of $65 to $75 are completely supported by a simple rerating move back to 10-year “average” valuations (particularly on EV to EBITDA and Revenue). Such would outline total return gains of +30% to +50%. The catalyst for this bullish advance would be slightly better operating results than now projected might encourage renewed investor interest, just like the March quarter showing.

I rate eBay shares a Buy, and I am looking to re-enter a position in coming weeks. Essentially, I view this name as an intelligent growth-at-a-reasonable-price [GARP] pick.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in EBAY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.