Summary:

- eBay’s stock has risen 25% year to date, but a sustained rally relies on a multiples re-rating, not substantial expansion in revenue or profits.

- eBay’s Q2 results showed acceleration in GMV and revenue, but Q3 guidance suggests that the company may decelerate further.

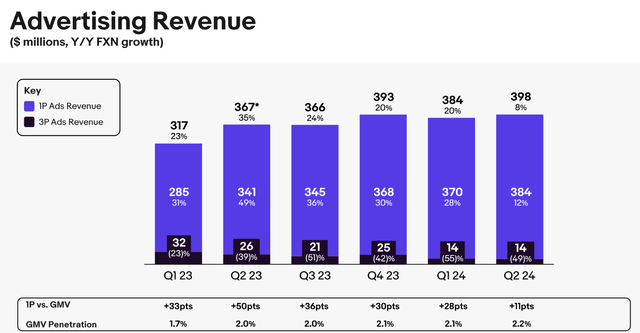

- Ad revenue, meanwhile, showed sharp deceleration in Q2, which was a meaningful lever for growth over the past few quarters.

- The stock trades at an ~11x forward P/E, which is cheap but more likely to be a value trap amid persistent growth stagnation.

bennymarty/iStock Editorial via Getty Images

Among legacy technology companies, one of the most recognizable former tech giants that has continued to drag its feet on seeking relevance in the modern world is eBay (NASDAQ:EBAY). The one-time auction powerhouse has attempted a number of initiatives to bolster its recovery, including focusing on several “focus categories” like collectibles and auto parts while also building up an advertising business to squeeze more revenue from its sellers who wished to more prominently feature their items.

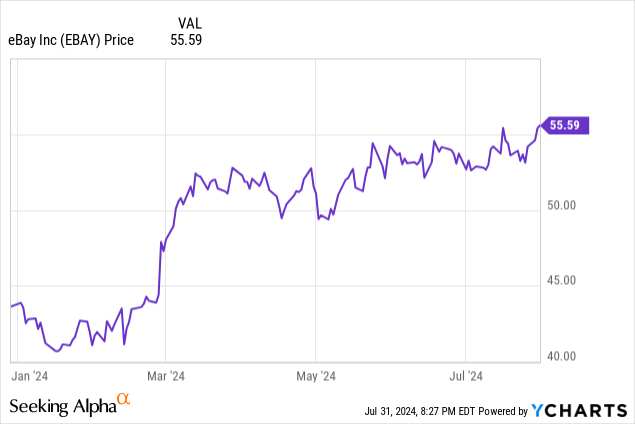

Year to date, investors have responded moderately well to eBay’s turnaround plans, sending the stock up more than 25%. The stock rose modestly after recently reporting Q2 results, which featured a much-needed acceleration in gross merchandise value, or GMV.

But the question that investors have to ask ourselves now is: does eBay have a true path to expand much further from here? Nothing is impossible, of course, but eBay’s future as a successful stock investment relies on a multiples re-rating, not from substantial growth of either its revenue or profit. And for the market to dramatically re-rate eBay, investors’ perception of eBay’s growth trajectory must change – which is difficult when both GMV and revenue have been roughly flat over the past few quarters.

I last wrote a neutral opinion on eBay in May, when the stock was trading slightly lower at ~$52 per share. Now, with eBay nearly 10% higher, I’m largely unimpressed by the company’s Q2 results (especially when its outlook for Q3 points to GMV potentially decelerating again), and I’m retaining my neutral opinion on this stock.

To me, eBay is largely a mixed bag of positives and negatives. On the bright side for this company:

- Appealing valuation. At current share prices near $55, the stock trades at a ~11x forward P/E based on Wall Street’s current $5.04 consensus pro forma EPS target for FY25. That being said, I’ll re-emphasize that without a meaningful change in investors’ growth perceptions for this stock (or a surge of enthusiasm for rate hikes that lifts all stocks’ valuations higher), a re-rating is unlikely.

- Consistent profit growth. The company’s focus on streamlining costs, divesting underperforming divisions, and boosting tertiary revenue sources like advertising have helped eBay expand its operating margins and grow its bottom line faster than its GMV and revenue.

At the same time, however, a number of risks are ever-present on the horizon:

- eBay’s utility beyond its focus categories is limited, and GMV growth is likely to remain tepid in perpetuity. We don’t really buy items via auction when Amazon (AMZN) is omnipresent nowadays. eBay’s survival rests on its ability to maintain interest in its specialized categories of auto parts and collectibles: which makes it more of a niche retailer with a more capped TAM.

- Net debt position. Unlike many large-cap tech stocks, eBay is in a net debt position, which in the long run may rein in its ability to run large capital returns programs.

All in all, I’m not willing to buy into eBay even at an ~11x forward P/E ratio, knowing that the stock has had a history of hovering at P/E multiples in the high single digits. Steer clear here and invest elsewhere.

Q2 download

In a vacuum, Q2 results looked favorable for one main reason: a much better than expected showing on GMV, which has for several quarters been only just about flat.

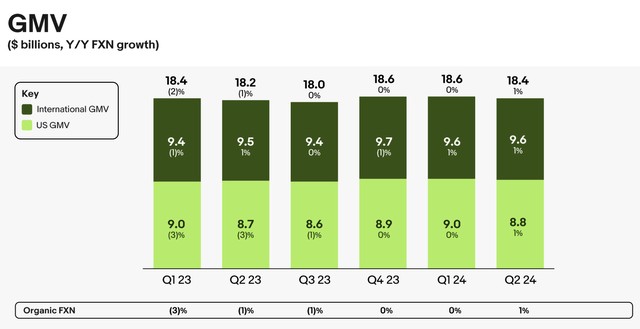

eBay GMV (eBay Q2 earnings deck)

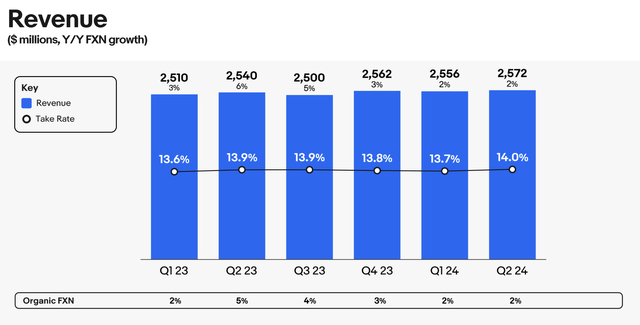

GMV in Q2 accelerated to 1% y/y growth, up from 0% in the prior three quarters. And as shown in the chart below, revenue advanced slightly faster than GMV, up 2% y/y to $2.57 billion, ahead of Wall Street’s $2.53 (flat y/y) expectations.

eBay revenue (eBay Q2 earnings deck)

The company called out a number of individual drivers as helping to extend eBay’s reach and sales, broadening its expertise on focus items to drive incremental buyers. It expanded its eBay Refurbished program to include golf clubs, which is a large market for resale. And in the U.S. and the U.K., it introduced a feature called “Shop The Look,” which deploys generative AI to help fashion buyers pick out items.

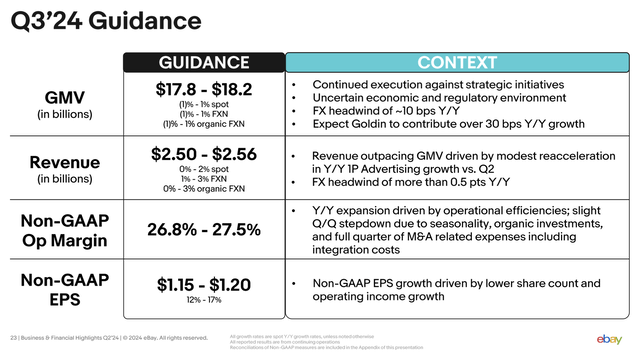

Still: we do have to wonder if any of these small growth catalysts can be sustained. Despite the re-acceleration to GMV growth in Q2, the company is guiding to -1% to +1% GMV growth in Q3, or flat at the midpoint. Now, eBay does have a recent track record of guiding more conservatively (its guidance for Q2 had called for -2% to 0% GMV growth), but we do have to wonder if the path to consistent GMV growth is a reality and not just a fluke in Q2.

eBay outlook (eBay Q2 earnings deck)

Another item to watch out for advertising revenue growth is slowing down, as a victim of its own scale. Today, advertising represents roughly 15% of eBay’s revenue, and it has been a major double-digit revenue growth driver for the company as it pushed more promoted listings.

eBay ad revenue (eBay Q2 earnings deck)

In Q2, however, ad revenue growth slowed to just 8% y/y, down from 20% y/y in Q1. We also note as well that eBay’s active buyer count remained flat at 132 million. To me, these are rather telling signals that eBay continues to stagnate.

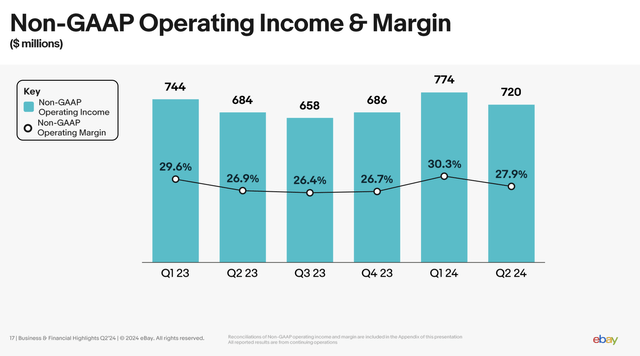

On a profitability basis, we do appreciate the fact that eBay’s pro forma operating margins jumped 100bps y/y to 27.9%, helped by lower product development and G&A costs as a percentage of revenue.

eBay operating margins (eBay Q2 earnings deck)

This helped boost pro forma EPS to $1.18, representing 15% y/y growth. Still, in the long run, eBay has already done plenty to trim cost and the biggest lever for further EPS growth will be top-line expansion: which seems more unlikely after several years of flattish GMV growth and a more niche market positioning.

Key takeaways

“Cheap for a reason” remains my overarching take on eBay, which has struggled to manage anything beyond low single digit growth over the past several years. In the long run, I expect eBay will lose further steam (after all, you can also buy used car parts and refurbished golf clubs on Amazon) and fail to drive any meaningful multiples re-rating upward.

Continue to remain on the sidelines here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.