Summary:

- eBay’s active users dropped from 175M in 2018 to 132M in 2023 due to high fees, slow innovation, and competition; remains strong in second-hand market despite competitors like Etsy.

- eBay’s revenue is steady, but net income and free cash flow declined over 10 years; valuation now fair to slightly overvalued; focus on dividends and buybacks could attract investors.

- Despite user decline, Q2 2024 showed revenue growth, improved earnings, and strong shareholder returns; potential for growth via luxury markets, eBay Motors, and market restructuring led by Jay Lee.

Richard Drury

In my first and only other analysis of eBay (NASDAQ:EBAY) in November 2023, I put out a Hold rating. At the time, I considered the company to be trading at a good valuation, but I raised concerns about slowing growth amid market competition. I believe this analysis is true, and after the 34.5% gain in price since my last analysis, I think the valuation for eBay has now become unfavorable. As a result of this, I am reiterating my Hold rating, as I do not expect price appreciation from here on out to be exceptional as the value opportunity has likely now culminated.

Operational Analysis

There is a growing consolidation from tech giants like Amazon (AMZN), which has over 310 million active users, and Alibaba (BABA), which has extensive reach in Chinese and Asian markets. Furthermore, competition is growing as traditional retailers like Walmart (WMT) seek to further develop their online presence to compete. In addition, smaller platforms like Etsy (ETSY) have gained substantial popularity, offering a user experience and catalog that often undercuts the integrity of eBay for high-quality, niche items.

As a result of these developments, eBay has become more useful as a place to buy in bulk cheaply, and it retains a moat in being the largest provider of online retail for the secondhand market in the West. However, there are newer, fresher companies now competing in the second-hand market, like Depop and Poshmark. Depop was acquired by Etsy in 2021, which shows how fierce a competitor Etsy may become.

In my opinion, what eBay is lacking is a culture of quality. In other words, in my opinion, I do not think eBay’s reputation for standards of goods bought and sold is nearly anywhere as high as Amazon’s, nor as high as Etsy’s, the latter of which should be commended for establishing such a unique moat.

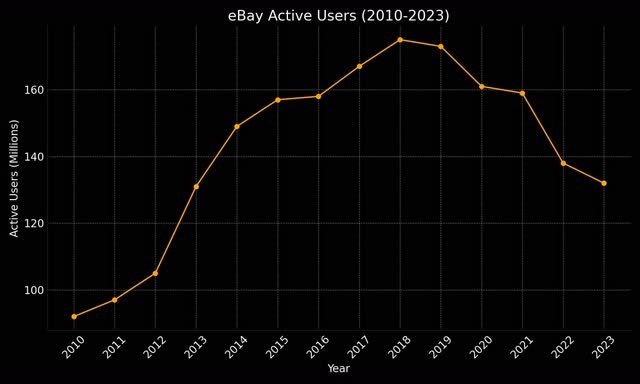

eBay’s active user base peaked in 2018 with 175 million users. Since then, there has been a consistent decline. By 2021, the number of active users dropped to 159 million, further decreasing to 138 million in 2022 and finally reaching 132 million in 2023. The three core areas that have caused this are eBay’s reputation for high fees compared to competitors, slower levels of innovation, and a decline in the auction format, where users are generally preferring the convenience of fixed-price listings available on other platforms.

Analyst’s Chart, Company Data Sourced From Business of Apps

Based on my research and experience, declining active users is never a good sign for the long-term growth outlook; this almost goes without saying. However, surprisingly, eBay has managed to keep revenues high through an increased take rate, a focus on high-value categories such as collectibles, luxury goods, and refurbished items, advertising revenue and managed payments. However, these strategies can arguably only be maintained for so long, and I do not think it is unlikely in the next decade, we start to see declining revenues from eBay.

Financial & Valuation Analysis

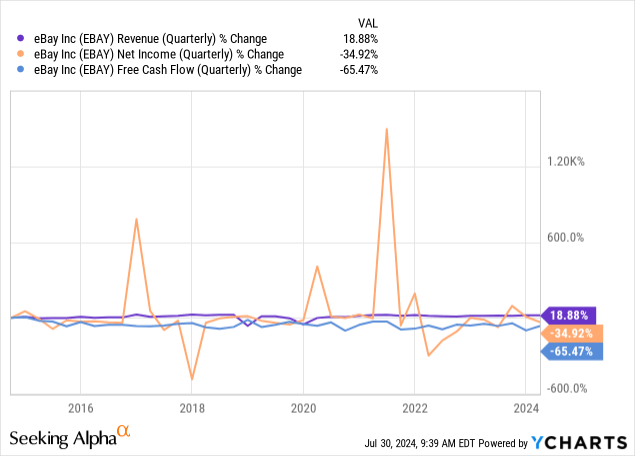

I mentioned positive revenue growth, which can be seen in the chart below, but what is more concerning for investors and potential investors in eBay is that its net income and free cash flow have contracted quite significantly already over the past 10 years.

I believe we have already seen much historical evidence that eBay does not work very well as a growth investment. As such, I think management should be looking to expand the dividend yield significantly. This would help to attract a range of investors who still believe in the business model of eBay, which I think is relatively strong despite its lack of growth prospects. The company has ample free cash flow per share that would allow it to incrementally increase the dividend yield. To me, this seems essential to making eBay attractive over the long term, and if management were to restructure the financial incentives of the business to favor free cash flow and dividends over a heavy emphasis on growth, I think eBay could become very attractive to own.

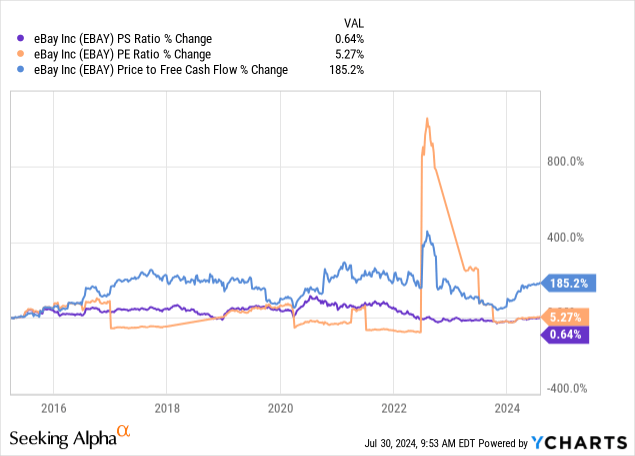

Currently, eBay is not cheap, as some would assume. It was undervalued a year ago, but now, if one is to be optimistic, it is fair to conclude that eBay is fairly valued based on its PS, PE and PFCF ratios compared to its 10Y history. In more real terms, eBay could be considered slightly overvalued when we consider the long-term prospects of fundamental decline and the present recorded user decline. In my opinion, I expect the valuation ratios to contract from here on out unless the company instigates a better dividend strategy, which would bolster investor sentiment significantly if executed effectively.

Suppose eBay delivers 7% EPS growth over the next 5 years, which is what is indicated by Wall Street; in this instance, the non-GAAP PE ratio is likely to contract from the current 12.5 downward, I estimate toward 11. If the Wall Street estimate of $6.20 comes to fruition in December 2029, it is not unlikely the stock would be worth $68.20. This indicates a 5Y price return of just 4.3%.

Counterpoints

In February 2024, eBay’s Board of Directors authorized an additional $2B stock repurchase program, increasing the company’s remaining stock repurchase authorization at the time to $3.4B. This indicates management’s awareness and commitment to strengthening shareholder value. During the same earnings report, management outlined an 8% dividend raise. Both of these areas are the two core aspects I would be looking for from eBay as a potential investor. Without dividend raises and share buybacks moving forward, eBay is unlikely to be a competitive investment option, in my opinion.

Furthermore, management’s efforts in driving growth despite the decline in users are commendable. In Q1 2024, it delivered revenue growth of 30% YoY—this shows the effective monetization strategies underway. I also like the emphasis the company is placing on luxury, and the platform has now extended to vehicles with the development of eBay Motors. In other words, there are multiple areas for growth that management could successfully capitalize on, and they have given evidence that they are capable of delivering fundamental growth through innovative strategies despite a contraction in users. As a result of this, I think there is some potential for long-term growth outside of current consensus estimates.

eBay is also establishing a new regional market structure to enhance alignment across its largest markets. This is led by Jay Lee. I believe the restructuring could significantly bolster the earnings growth of the company by improving margins over the long term. In turn, this could bolster the free cash flow and potentially provide further room for management to continue to raise the dividend and perform share buybacks.

Q2 Earnings

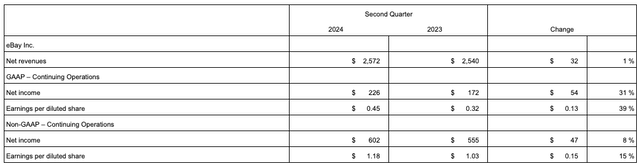

In Q2 2024, eBay achieved revenue of $2.6B, up 1%, and GMV of $18.4B, up 1%. Furthermore, the company returned $1.1B to stockholders in Q2, including $1B of share repurchases and $135M paid in cash dividends. Notably, there was significant growth in Q2 earnings per diluted share and net income, 39% YoY growth and 31% YoY growth, respectively.

Despite the good Q2 results, the shares have failed to react with upward momentum, indicating the stagnation I believe eBay is likely to continue to experience now that it is more fairly valued. That being said, Q2 was definitely a good sign for eBay’s fundamentals. I think it shows strength in management, which could translate to long-term stability for the stock, further outlining the positive future eBay could potentially establish as a dividend stock.

Conclusion

eBay doesn’t offer good value anymore based on my analysis. Furthermore, its long-term growth trajectory is weak due to heightened competition and declining users. Despite this, there is hope for higher earnings through internal measures and the potential for a higher dividend and stock buybacks to bolster shareholder value. However, in my estimation, eBay could be a good dividend play now, but management has yet to establish the competitive dividend required for this to be attractive to investors. As a result of these factors, my rating for eBay is a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.