Summary:

- eBay’s financials show some potential for recovery, but a few more quarters of turnaround are needed for success.

- Revenues have been trending upward, but active buyers and gross merchandise volume have been declining.

- Margins have been declining, and customer service needs significant improvement for the company’s longevity.

Justin Sullivan

Investment Thesis

I wanted to take a look at how eBay (NASDAQ:EBAY) progressed over the last three quarters since I covered the company first time. The company is showing some potential for recovery; however, I need to see a few quarters of a turnaround in the vital metrics before I consider this turnaround to be a success. The low PE ratio is still, in my opinion, low for a reason, and I don’t see any catalysts that would change my opinion on that, therefore, I am keeping my hold rating for now.

Update on Financials

Since my last coverage of the company, the stock price declined a little over 4%, against an increase of almost 17% of the S&P 500 (SPY), so you could have found a better place to park your money during the period. I wanted to take a look at some of the company’s updated financials to see if there is any substantial progress.

As of Q3 ’23, the company had around $4.7B in cash and short-term investments, against slightly reduced long-term debt of $7B. That is not a bad position to be in, considering interest expense on that debt is virtually non-existent, and the company has been paying it down also. So, no insolvency risks here.

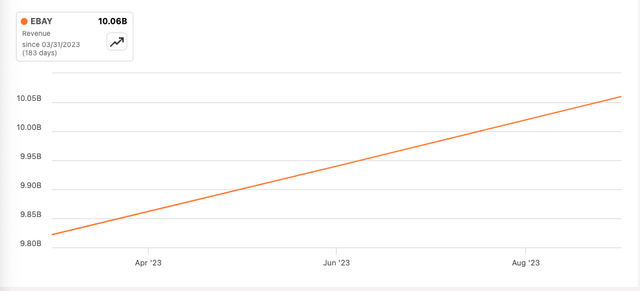

In terms of revenues, it’s been trending upward over the last three quarters, so it looks like the company is not struggling there. Every quarter, the company managed to grow over the same quarter the previous year. For the upcoming quarter, the company estimates to make around $2.51B, which is flat y/y, but it is better than a decrease.

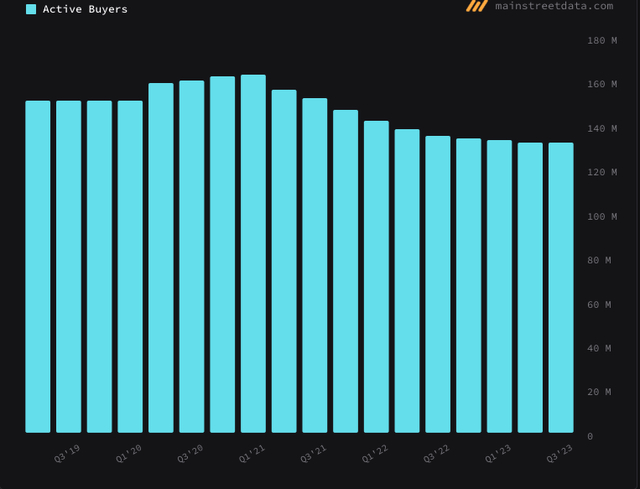

In terms of active buyers, the company managed to hold on to its 132m for the last couple of quarters, but overall, it has been trending down, and I don’t think it is going to be the end of the declines.

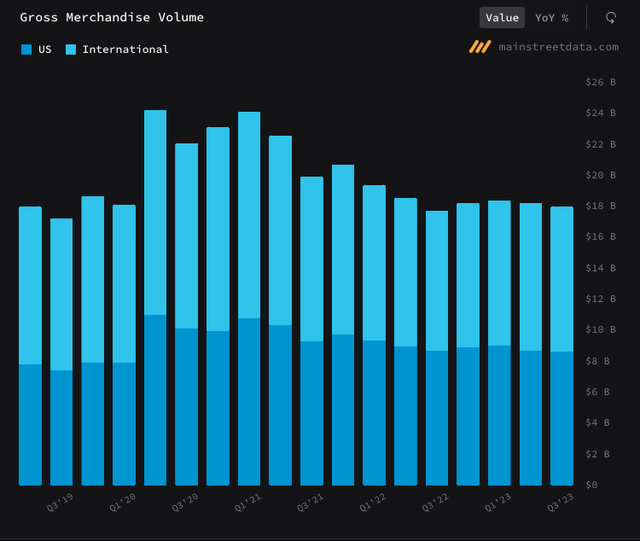

The company’s gross merchandise volume, or GMV, has been trending down since Q1 ’23. For the next quarter, the company expects a slight headwind to the GMV because of FX, so I expect a very similar number and would be surprised if it is higher than that.

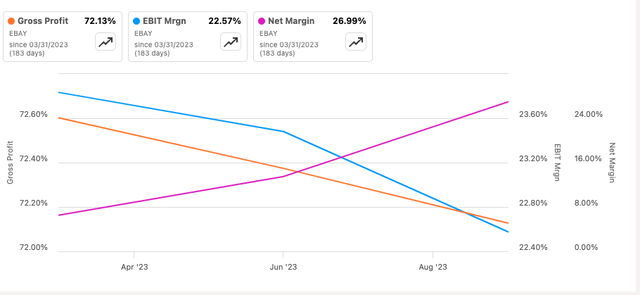

I am not a fan of how the company’s margins have been developing over the last three quarters. Gross and EBIT margins have been declining, while net margins, look like they skyrocketed, however, if we look at the 10-Q, we can see that the company recorded a non-cash gain on equity investments, primarily on their investment on Adyen (OTCPK:ADYEY), compare that same item last year, where it saw a 4.1B decline in value. As I said, this is a non-cash item and it wouldn’t be right to look at it from a GAAP perspective. The adjusted net margin is at around 11%.

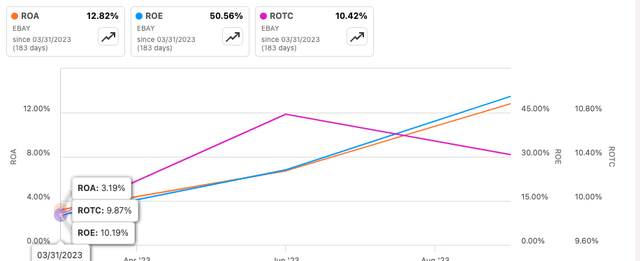

Unsurprisingly, the company’s ROA and ROE have shot up because of the valuation of the increase of their equity investment, which in GAAP terms improved the company’s bottom line tremendously. Furthermore, the company’s ROTC has somewhat remained stable at around a respectable 10%.

Efficiency and Profitability (SA)

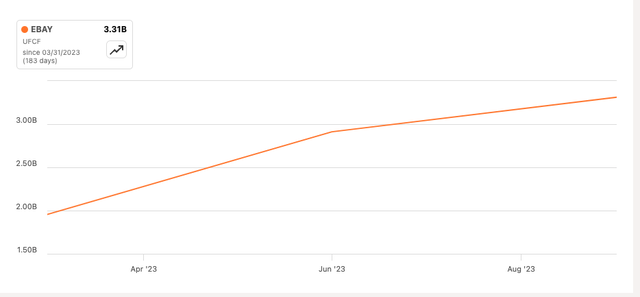

Looking at the company’s unlevered free cash flow, or UFCF, we can see that the EBAY is making quite a lot every quarter, and that is a very good sign.

Overall, I think it is a little too early to tell whether the company will be seeing a turnaround in the most important metrics, but I was pleasantly surprised that the company was outperforming this year compared to last year’s quarters. I would expect a lot more volatility in the bottom line because of the company’s heavy investment in Adyen.

Comments on the Outlook

As I mentioned earlier, the most important metrics need to start improving going forward, if investors were to start believing in the company’s longevity. 132m active buyers is by no means a small number, however, if it continues to dwindle over the next couple of years, I don’t see how the share price is going to ever recover and not continue to decline. The management said that the company has shifted its marketing strategy so that the focus is not on the active buyers only, but also on enthusiast buyers, which stood at around 16m. I don’t know how much this shift in strategy is going to help, as partnerships with influencers and social media may not come cheap. But if it is successful, social media and influencers do tend to move the needle when it counts. A prime example I can think of is the Stanley Durable thermos cup, which was marketed for men at work, and caught the attention of a couple of influencers, which led to Stanley expanding to the women demographic with many different colors. This led to Stanley 10x its revenues in a span of 4 years. If the company can land some sort of success with this type of marketing, we could see some amazing GMV and active/enthusiast buyer growth, but it’s a high risk/high reward in my opinion.

As we saw in the previous section, the company’s efficiency and profitability in terms of margins have not been particularly great. I would like to see this changing in the very near term, and just today as of writing this article, eBay announced its plans to cut 9% of the workforce. This time it was more than double what the company laid off at the beginning of last year, however, as we saw from the above margins development, it did not do a lot. In the long run, this should show improvements in margins, however, it will take quite some time to see any results, especially with all the severance packages coming through in the beginning. This type of cost-cutting measure is probably one of the most effective out there and has the most direct impact on labor costs and improving efficiencies, however, there are negatives to it, like a reduction in employee morale and productivity, which may backfire in the end. I don’t like this type of cost-cutting measure, but companies have to take these drastic measures and reset.

I think one of the main issues remains to be fixed. That is customer service. Many sellers hate the lack of service at the company, and it could do a lot more to resolve issues all across the board. During the latest quarter call, the management said they are looking for ways to innovate in the space, and are seeing some positive feedback, however, I think it is still very early days and there is a lot to be done. And if we compare it to Amazon’s customer service, it’s like night and day difference.

Closing Comments

It may entice a lot of people to jump in because of the company’s perceived low PE valuation, which hasn’t changed since my first article on the company back in May. I am still sticking to my hold recommendation because I would need to see the most important metrics to improve. The GMV and buyers need to start trending upward for a couple of quarters before I start to believe in the company’s turnaround. The company’s margins need to start improving also, and with almost 10% workforce being laid off this year, I would like to see this turn into efficiencies and streamlined operations. Customer service needs to see a vast improvement or sellers will continue to leave the platform, which is not the best for the longevity of the company.

The company is generating impressive free cash flow, and if it can finally turn itself around, I would consider starting a position, however, I don’t think that is going to happen within the next couple of quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.