Summary:

- eBay’s stock has jumped nearly 20% year to date, but the company is struggling to maintain its relevance despite its growth in “focus categories.”

- The company has raised its sales and marketing spend as a percentage of revenue just to achieve roughly flat GMV (and mid-single digit growth in focus categories).

- eBay’s TTM free cash flow falls short of its total shareholder returns, with little hopes for meaningful FCF growth.

- The stock’s only saving grace is its cheap valuation at 11x P/E, but its lack of growth warrants a discounted multiple.

Prykhodov

If there’s one thing that’s constant in the tech industry, it’s that the market darlings that stay on top usually don’t stay for very long, and that legacy companies swiftly get shifted out of the mainstream narrative. It’s difficult to remember that eBay (NASDAQ:EBAY) once used to be the toast of Silicon Valley, and now the company is struggling to maintain its relevance.

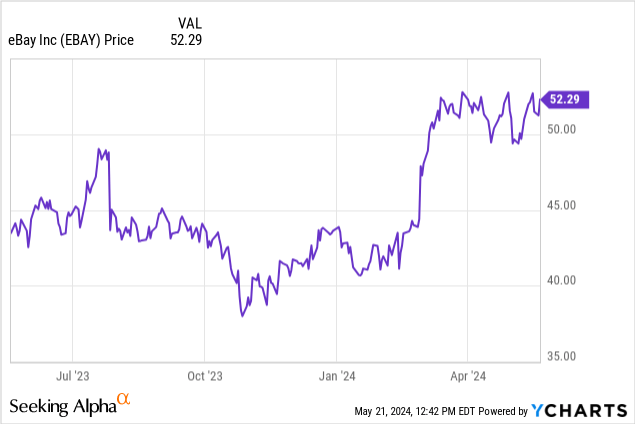

Now, year to date, shares of eBay have jumped nearly 20%, a reflection of the broader market’s advance as well. Still, from a fundamental business perspective, the company has continued to limp along:

I last wrote a neutral opinion on eBay in April, when the stock was also trading in the low $50s but prior to the company’s Q1 earnings release, which showcased flattish performance but beat expectations. With the latest trends considered, I remain neutral on eBay going forward.

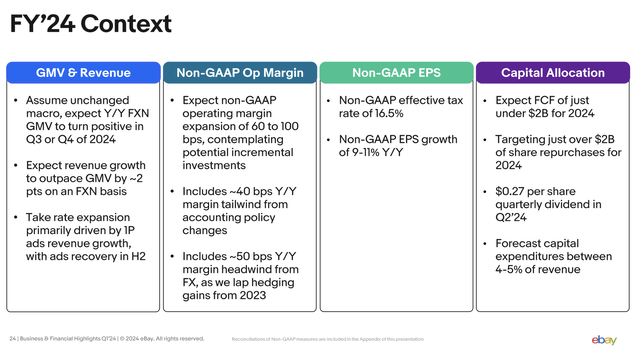

There is a mixed bag here to consider. One of the top things to note is that after a largely disappointing 2023, eBay expects to return to slight GMV growth and revenue growth at a pace above GMV growth, driven by both easier prior-year comps as well as performance of focus categories like auto parts and trading cards.

On the one hand: eBay is achieving slightly better marketplace performance this year. Its “FY’24 Context” walkthrough, showcased below from the Q1 earnings deck, notes that the company is expecting GMV growth to turn positive in the second half of FY24.

eBay 2024 context (eBay Q1 shareholder deck)

It’s further expecting revenue growth to outpace GMV growth, as the company continues to pump focus into advertising in order to boost take rates.

The other cherry to note for eBay: nominally, the stock looks cheap. Consensus is expecting $4.69 in pro forma EPS this year (+12% y/y), which puts the stock at a ~11x P/E ratio – several turns below the broader S&P 500.

It is worth noting, however, that eBay is investing a bit more in marketing in order to achieve these slightly better 2024 expectations, and for its focus categories in particular. For example, in Q1, the company put a lot of marketing focus around a “Pokemon Catch 151” auction event day to boost visibility for Pokemon card listings, which is a staple fixture of its trading card and collectibles business.

The second thing to note: as of today, eBay spends notably more on shareholder returns (buybacks plus dividends) than it generates in cash flow. And with meager cash flow growth, the company may find it will need to either cut down on its capital returns or add to its existing load of debt.

All in all, I find few compelling reasons to be a long-term holder of eBay stock, especially with longer-terms risks to the relevancy of its auction platform and the sustainability of its dividend and buyback program. This may be a good stock to short-term trade on daily dips, but I’m not comfortable banking on this name in the long run.

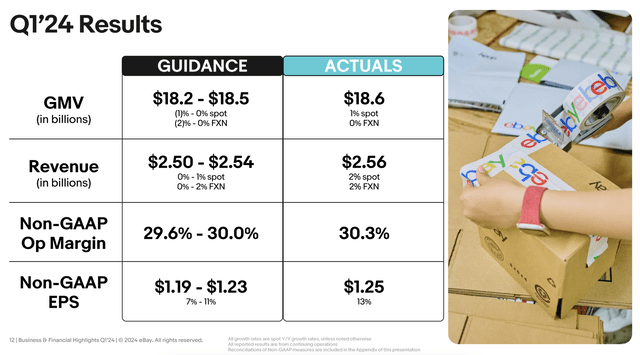

Q1 download

Let’s now go through eBay’s latest quarterly results in greater detail, starting with the earnings highlights in the snapshot below:

eBay Q1 results snapshot (eBay Q1 shareholder deck)

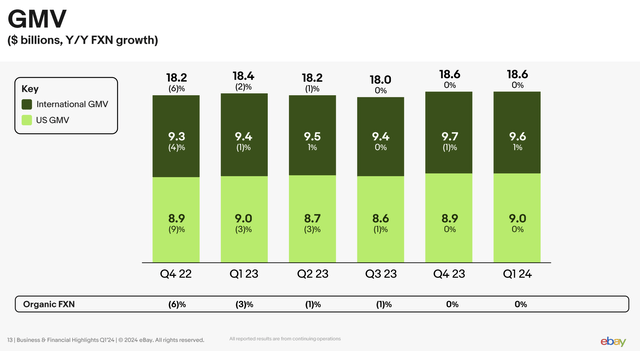

eBay’s GMV grew 1% y/y to $18.6 billion, with one point of benefit from currency rates (on a constant currency basis, GMV was flat). Constant-currency growth, as shown in the chart below, matched Q4’s growth pace. International GMV accelerated two points to 1% y/y growth, helped in large part by favorable currency movements:

eBay GMV (eBay Q1 shareholder deck)

eBay’s “focus categories” continue to be the lynchpin of the company’s survival strategy, and the company continues to roll out new features to keep engaging buyers. In motor parts, the company has added new fitment tools to help customers understand which parts are applicable to their vehicles. In the trading card space, meanwhile, the company has added new pre-filled text features to speed up the process of listing sports trading cards. Per CEO Jamie Iannone’s remarks on the Q1 earnings call highlighting these product advancements:

Motors Parts & Accessories or P&A was once again the largest contributor to growth among focus categories despite facing headwinds in January due to extreme weather patterns in the U.S. […] Fitment is a central component of trust within the P&A category, helping customers understand exactly which of our more than 600 million live listings in this category fit their vehicle. We continue to work closely with large P&A sellers to augment their inventory using the myFitment toolkit […]

In Q1, we continued to innovate by launching a simplified listing flow for sports trading cards to all U.S. sellers. This experience leverages our proprietary technology to prefill the listing with relevant item aspects, provide simpler shipping options, and offer smarter pricing recommendations based on the value and the condition of the card. This rollout has resulted in a double-digit percentage reduction in listing time and measurable increases in completed listings and sold items per customer.

We are also seeing a more than 20% increase in CSAT for U.S. Sports trading card sellers versus our baseline prior to this rollout.”

Overall focus category GMV grew 5% y/y, while everything else on eBay declined -1% y/y (netting out to the ~1% GMV growth for Q1). Revenue growth of 2% y/y to $2.56 billion, meanwhile, essentially met Wall Street’s expectations of $2.54 billion (+1% y/y) with 10bps of additional take rate from a 20% y/y jump in advertising revenue to $384 million.

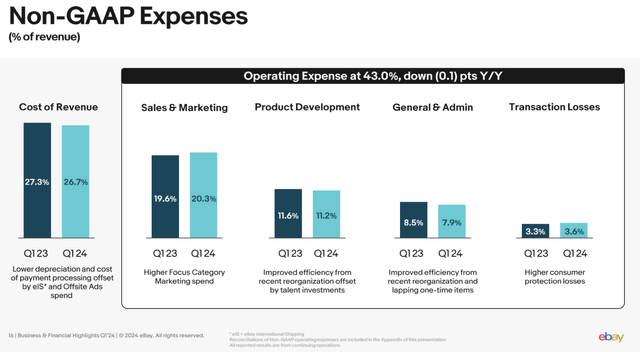

We do start to see some weakness on the expense side, however. eBay’s total opex remained roughly flat at 43.0% of revenue. While the company brought down most categories of opex, sales and marketing costs jumped 70bps as a percentage of revenue to 20.3%, suggesting that higher levels of marketing investment are needed to sustain the growth that eBay is enjoying in its focus categories.

eBay opex trends (eBay Q1 shareholder deck)

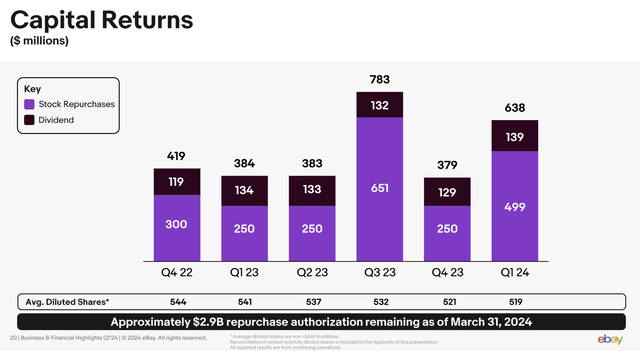

The profitability conundrum is further accentuated when we consider the level of capital returns that investors are used to. Over the trailing twelve months, eBay has returned $2.18 billion in capital to investors, with ~$0.13 billion spent quarterly on dividends and the remainder on buybacks. There are $2.9 billion in buybacks remaining on the current authorization.

eBay capital returns (eBay Q1 shareholder deck)

Yet over the same TTM period, eBay generated only $1.74 billion in free cash flow, covering only ~80% of its capital returns program. With low GMV/revenue growth and no margin expansion driven by increased sales and marketing investments, eBay is unlikely to generate meaningful FCF growth.

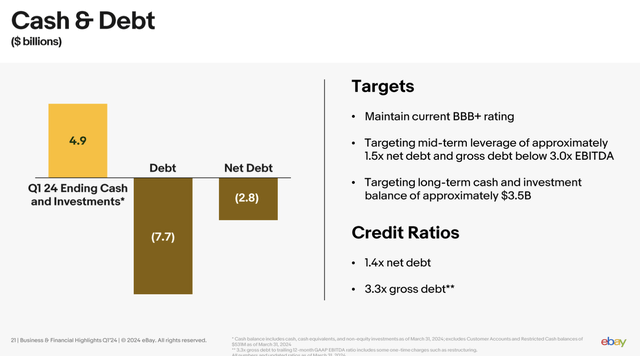

What this means is that the company will likely have to slow down the pace of its buybacks (which has been the backbone of EPS growth since the pandemic) or increase its debt levels. Unfortunately, as shown in the chart below, eBay’s debt levels are already hovering near the company’s target thresholds:

eBay debt (eBay Q1 shareholder deck)

eBay’s $4.9 billion in net debt represents a 1.4x multiple against EBITDA (in line with a 1.5x leverage threshold), and its $7.7 billion in gross debt at 3.3x EBITDA exceeds its 3.0x threshold. The company’s FY24 outlook calls for “just under $2 billion” of FCF, which is still ~10% shy of its TTM capital returns. In other words, investors have been accustomed to generous buybacks propping up EPS growth: but there’s not enough firepower in the tank to keep running this program forever.

Key takeaways

In my view, eBay’s 11x P/E multiple will continue to protect it from serious downside, but I also see little incentive in staying invested in this stock over the long haul, especially as eBay’s auction buying format continues to lose its niche appeal. There may be short-term trading appeal here on recent volatility, but I’d stay on the sidelines for the long haul.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.