Summary:

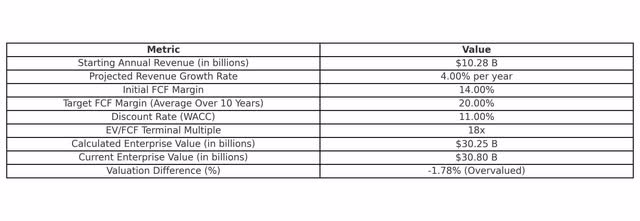

- Based on my 10-year EV-to-FCF-multiple-adjusted DCF model, eBay stock is nearly 2% overvalued at present.

- The company achieved strong Q3 results, but management outlined Q4 and full-year 2024 guidance under the consensus estimates at the time.

- EBAY is unlikely to deliver short-, medium-, or long-term alpha. Unless management focuses more on the dividend yield, investors are likely to divert capital elsewhere over time.

Abstract Aerial Art

I last covered eBay (NASDAQ:EBAY) in August, and I reaffirmed a Hold rating, primarily because the stock was certainly fairly valued (or even moderately overvalued) at the time. I mentioned I expected little upside moving forward, and this has largely proven true—the stock has only given a total return of around 6% since that analysis. Although this beats the S&P 500 (SPY) moderately, it certainly is not the kind of value alpha one would have received if they bought the stock back in November 2023—it has delivered a return of over 40% since then.

Now, the company has reported Q3 earnings, and while there were several positives, management’s Q4 and full-year 2024 guidance is what let investors down. Moreover, taking a 10-year view, the company is currently slightly overvalued based on my analysis. Therefore, I am not a buyer of eBay stock at its current price and given the company’s present market position.

eBay Q3 Earnings Review

eBay had a solid quarter, beating the normalized EPS consensus estimate by $0.01 and surpassing the consensus revenue estimate by $30.59 million. Its year-over-year normalized EPS change was over 3%.

In addition, the company’s gross merchandise volume (‘GMV’) grew by 1% year-over-year, marking two consecutive quarters of GMV growth. Areas that significantly contributed to this growth included motors, collectibles, refurbished goods, and luxury fashion—collectibles particularly shone, experiencing double-digit growth. The company also reported success in high-value auctions, including Shohei Ohtani’s home-run ball, and strengthened initiatives in sports collectibles. All of these elements prove that eBay is still capable of commanding a distinct moat, particularly in high-value second-hand items that are difficult to source on other online retailers like Amazon (AMZN) or Etsy (ETSY). While Amazon is commanding the digital landscape in new products and Etsy in craft and niche items, eBay is continuing to stay relevant as a second-hand marketplace with distinct offerings buyers are unlikely to find elsewhere—I may not have given eBay enough credit for this previously, but this is certainly somewhat of a moat to be acknowledged.

eBay has also been making geo-specific investments, especially in Germany and the UK. For example, in the UK, the company rolled out enhanced tools and processes for consumer-to-consumer (‘C2C’) sales—this led to double-digit growth in pre-owned apparel C2C sales. New UK initiatives also included managed shipping, eBay balance for in-platform transactions, and the elimination of seller fees (except for motor vehicles) to stimulate C2C transactions. In line with these broader growth initiatives, the company is expanding its use of AI through its proprietary LiLiuM language model, enabling features like automatic listing descriptions, title generation, and pricing predictions. As an example of the accretion to eBay from AI, its “Magic Listing” feature has contributed billions in GMV since its launch. Moreover, the addition of “Magic Bulk Listing” for B2C sellers has simplified the bulk listing process and is likely to prove greatly accretive over time in bringing more products to its marketplace and improving sales.

The company’s advertising revenue also rose 11% year-over-year, with many sellers opting to promote listings—a key driver of growth. In addition, the company has been expanding its seller financing options through partnerships and extending cash advances to sellers in the U.S. This is undoubtedly a strong proposition for sustaining eBay’s community of sellers and investing in its core marketplace participants. Moreover, with the company raising $49 million in Q3 for charity and the eBay Foundation being awarded $3 million in grants for entrepreneurial support among historically excluded groups, the company is well-positioned to continue investing effectively in its brand, community, and support network to engender a positive and enduring position in the digital landscape.

Undoubtedly, this was quite a strong quarter for eBay—but it wasn’t enough for investors. With the stock price falling approximately 10% following the results, investors likely wanted more from the long-time online second-hand marketplace. This was most prominently because the company’s guidance fell below analysts’ expectations. For the fourth quarter, management expects revenue between $2.53 billion and $2.59 billion, compared to the consensus estimate of $2.65 billion at the time. Additionally, the company projects full-year revenue in the range of $10.23 billion to $10.29 billion, which was under the consensus estimate of $10.32 billion at the time. Management mentioned that this was largely due to lower consumer confidence in certain regions, like the UK and Germany, due to instability in politics and inflation, among other factors. As the market is consistently forward-looking, it’s no surprise that it was more focused on what’s to come than the positive results in real time.

Moreover, the accretion from its recent C2C initiatives is not expected to really be felt until Q1 2025, when buyer fees will be introduced. In my opinion, management is taking a conservative approach, given the uncertain macroeconomic environment (largely affected by high inflation and interest rates)—but I do expect we will have some positive tailwinds in 2025 and Q4 2024. Therefore, my estimate for the full year 2024 is on the higher end, at $10.28 billion.

EBAY Stock Valuation Analysis

In my opinion, eBay stock is certainly not a Sell. However, it also is not a Buy—it is unlikely to beat the S&P 500 over the short or long term at its current valuation.

eBay has grown its revenues by 9% annually over the past five years on average. However, over the last 12 months, it has only grown its revenues by 2%. Over the next 10 years, I estimate the company will achieve revenue growth of approximately 4% annually.

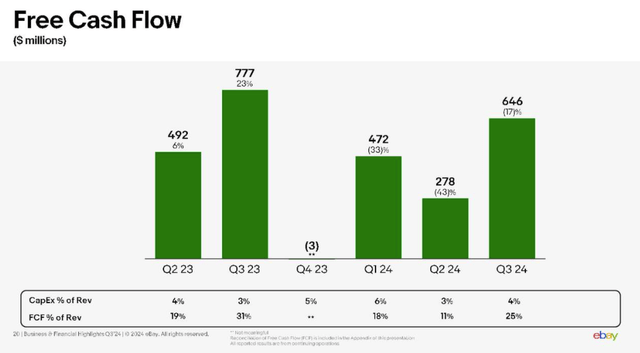

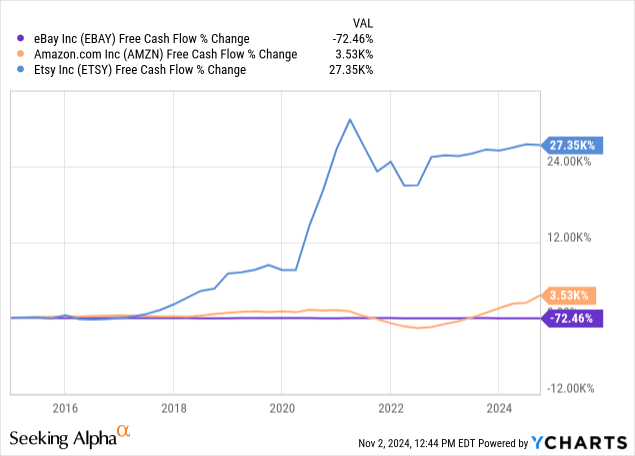

Moreover, given its recent trends in free cash flow, a conservative free cash flow margin as an annual average seems likely to be 17%.

eBay Q3 2024 Earnings Presentation

The company’s weighted average cost of capital is 10.95%, based on a 77.39% weight of equity with a cost of equity at 13.45% and a 22.61% weight of debt with a cost of debt at 3.18%, adjusted for a 24.63% tax rate.

Based on the above EV/FCF-multiple-adjusted 10-year DCF analysis, the stock is slightly overvalued based on my inputs. As a result of this, I consider it to be a poor investment at this time because I expect the company to only grow its FCF at an annual average of 7.8% over the next 10 years.

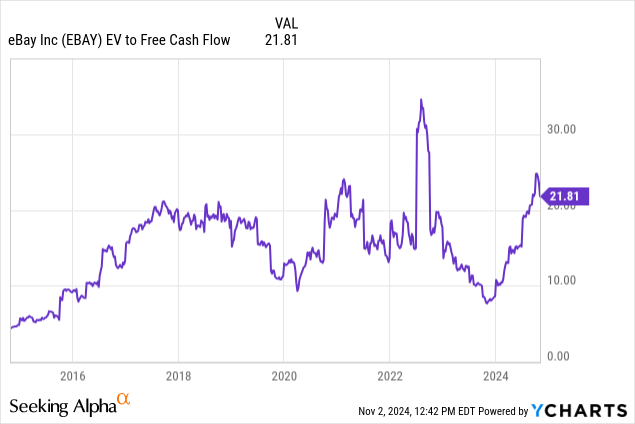

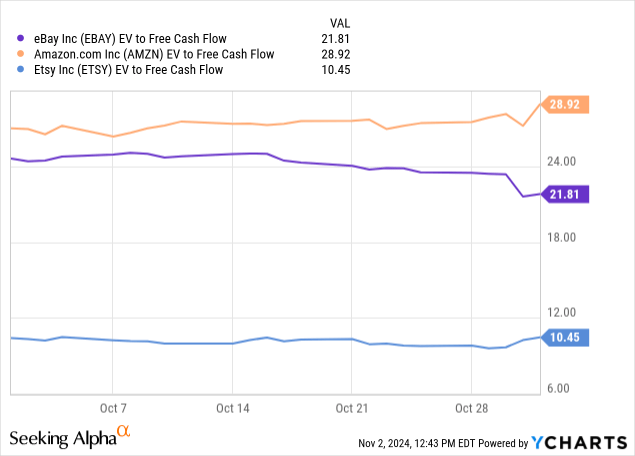

I consider the best companies to compare eBay to for peer analysis to be Etsy and Amazon, but I also believe that peer analysis can only take an investment so far. I consider looking at the sentiment for individual stocks and companies to be the most astute method because, in essence, each company and its valuation is unique.

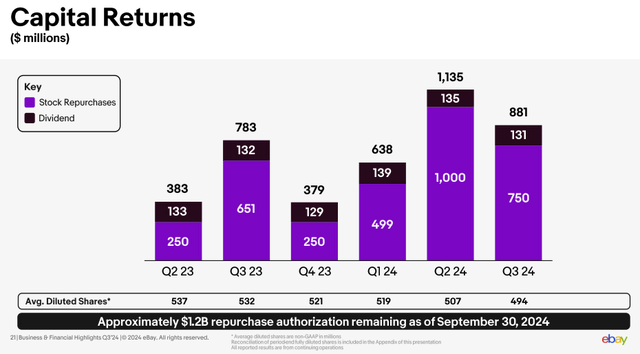

While my 10-year DCF model does show the company is unlikely to grow substantially over the period, this is further supported in the peer analysis charts above. Clearly, Etsy is a much more favorable investment, given its robust free cash flow growth and lower EV-to-FCF ratio. eBay has actually delivered declining FCF over the past 10 years. Based on this outlook, my rating for the company is a Hold (but if one is an eBay shareholder, why not sell? Even if the investment isn’t going to lose money, it’s most likely to grow only moderately over the long term. Moreover, the yield is only 1.8%). That said, management is buying back shares, which should help to improve returns.

eBay Q3 2024 Earnings Presentation

Risk Analysis

Beyond the valuation, there are other operational risks to being a long-term eBay stockholder. For example, there are reports of long-term sellers on eBay expressing dissatisfaction due to increasing fees—increasing fees is a strategy that is vital to the company due to the reduction in its users over recent years. There is growing competition from Meta’s (META) Facebook Marketplace, and if more sellers migrate from eBay to other alternative sites, the quality of eBay’s overall marketplace is likely to decline. This could make the valuation of the company less favorable than in my current 10-year DCF model. I expect that there could be undervalued latent competitors that arise as AI and automation capabilities become more pronounced, making digital marketplace design and production easier and cheaper. Considering eBay is a very mature company, I expect it will take less than a technological forefront conglomerate like Amazon to deplete its market share.

I can’t see a compelling reason to own eBay stock from an operational, financial, or valuation standpoint. There are only two considerations that would realistically make me buy the stock. The first is if the company was significantly undervalued, opening up a near-term or medium-term value opportunity—unfortunately, this opportunity was present approximately 12 months ago, but it certainly isn’t anymore. The second is if management were to decide to offer a higher dividend yield, say 3.5% to 4%. However, unfortunately, the company cannot realistically do this, given the extent of its competitive risk right now—that said, with such a high level of share buybacks in comparison to dividend payments, if I were management, I would prioritize the latter over the former—eBay is not very appealing to growth or value investors right now, but it certainly could be to dividend-oriented capital allocators with a subtle shift in financial strategy from eBay’s management.

Conclusion

I’m not bullish on eBay at the current valuation. I consider it to have very minimal upside in the near future, and while it may grow moderately over the long term, it certainly will not beat the S&P 500 based on my analysis. My rating is currently a Hold, and while I do not think that the stock will decline in price in the medium to long term, I do think it is worth selling right now and replacing it with another high-growth or undervalued stock to achieve alpha. Of course, the caveat to this is that if management focuses more on the dividend yield, eBay stock could still be worth owning—but we have not had indications that the dividend will be heavily emphasized by management in the foreseeable future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.