Summary:

- eBay’s value narrative that I projected around 15 months ago is materializing, as the company delivered stellar commercial performance though 2023.

- eBay reported solid FY 2023 results, with FY 2023 revenues at $10.1 billion, and adjusted operating income margin at 26.7%.

- eBay has raised its Free Cash Flow return expectation to shareholders from 125% to 130%, suggesting a 10% equity yield in 2024.

- I increase my eBay’s target price to $66 per share, reflecting confidence in eBay’s continued profitability and shareholder value delivery.

Justin Sullivan

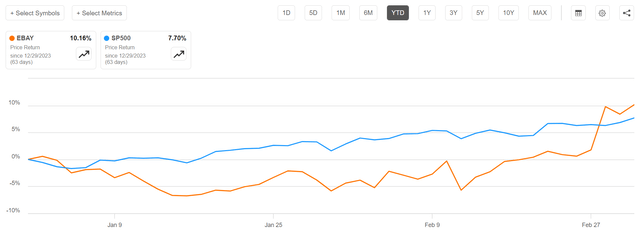

eBay (NASDAQ:EBAY) shares are up almost 10% since the company opened books for the December quarter 2024, and rightly so: eBay’s value thesis, which I initiated about 15 months ago on the backdrop of strong commercial momentum, is taking shape, fueled by an impressive Q4 report and a promising outlook for FY24. The marketplace giant is delivering a solid performance in the core commerce business, while advertising revenues are soaring. Moreover, Strategic cost management and a generous shareholder return policy underscore the bullish thesis. Considering updated valuation metrics, I estimate the intrinsic value of eBay to be around $66 per share, suggesting close to 40% upside.

For context: eBay stock has outperformed the broader U.S. stock market YTD. Since the start of the year, eBay shares are up approximately 10%, compared to a gain of about 8% for the S&P 500 (SP500)

eBay Q4 Beats Expectations …

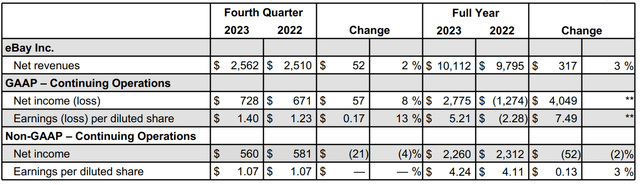

eBay Q4 2023 results outpaced analyst expectations, beating consensus estimates on both topline and earnings. In the period from September through end of December, the e-commerce company reported a 4% FX neutral YoY growth in revenue, reaching $2.56 billion. Notably, analysts had expected revenues at around $2.51 billion, approximately $50 million lower. According to management commentary, the better than expected result is largely attributed solid Gross Merchandise Volume, as well eBay’s success with the dynamic advertising platform, particularly the 1P Promoted Listings, which saw a 30% YoY increase in sales and now accounts for 2% of the total GMV. In context of advertising, the company’s strategic investments in AI and the introduction of new ad units like the Topic Picks Carousel Ad Unit for Search have been pivotal in attracting advertising bids.

On profitability, it is noteworthy to point out that eBay’s adjusted operating income margin for the fourth quarter came in at 26.7%, at the upper border of the company’s guidance, and above the FY 2023 average of 27.4%. In dollar-value terms, after taxes, eBay’s non-GAAP net income from operations was reported at $560 million, and EPS came in at $1.07 (vs. $1.02 estimated by consensus, according to data collected by Refinitiv).

For the FY 2023, eBay’s revenues increased 4% FX neutral YoY to $10.1 billion, while operating profits jumped from negative $1.3 billion in 2022 to positive $2.8 billion in 2023.

… Raising The Bar For Shareholder Returns

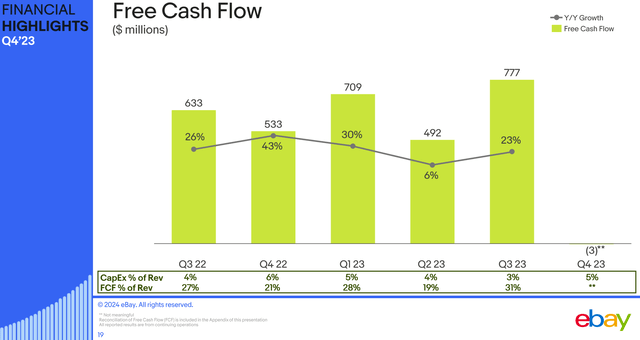

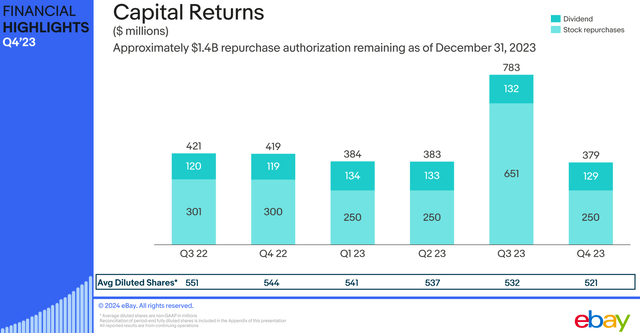

Supported by strong financial results, eBay should be well positioned to return attractive amounts of capital to shareholders in 2024 and beyond. In fact, investors should consider that the company has uplifted its Free Cash Flow return expectation to shareholders from 125% to 130% for the period 2022-2024. This adjustment not only highlights eBay’s solid cash generation capabilities but also reflects the additional financial gains anticipated from the impending Adevinta sale. Moreover, with approximately $5.1 billion in cash reserves and a conservative net leverage of 1.8x, eBay’s balance sheet supports the thesis of returning >100% of FCF to shareholders.

On that note, I point out that for the trailing six quarters, eBay has generated slightly more than $3 billion of FCF …

… of which close to $2.8 billion have been distributed to shareholders in the form of buybacks and dividends. Comparing eBay’s cash return to the company’s market capitalization suggests a 7-8% annualized equity yield.

Pointing to the latest financial highlights from eBay, paired with company’s optimistic outlook for Q1’24, I have little doubt that strong shareholder pay-outs are poised to continue. The projected Gross Merchandise Volume for Q1 ranges between $18.2 to $18.5 billion, while revenue expectations are anchored in the range of $2.50 to $2.54 billion. On profitability, eBay anticipates a solid operational performance with a Non-GAAP Operating Margin between 29.6% to 30.0%. The forecasted Non-GAAP operating margin expansion and an effective tax rate of 16.5% further reflect eBay’s FCF thesis. Overall, eBay management is targeting at least $2 billion of share repurchases in 2024.

Valuation Update: Raise TP To $66

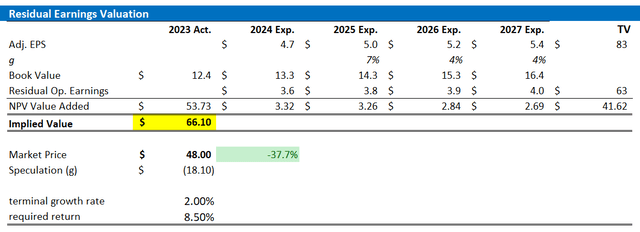

I remain optimistic about eBay’s core business. And aligning my earnings per share forecasts for the company with analyst consensus estimates as collected by Refinitiv, I am updating my valuation model for eBay shares. I now predict eBay’s EPS to be in the range of $4.6 to $4.8 (non-GAAP) for FY 2024. For FY 2025, 2026 and 2027, I set my expectations at $5, $5.2 and $5.4. Moreover, while I maintain a terminal growth rate assumption at 2%, which is approximately in line with nominal GDP growth, I’ve decreased the cost of equity by 50 basis points, to 8.5%, mostly as a reflection of a more accommodating interest rate environment. All these assumptions considered, my valuation model returns a revised fair stock price estimate of approximately $66, up from $60 projected previously.

eBay financials, author’s estimates, and calculation

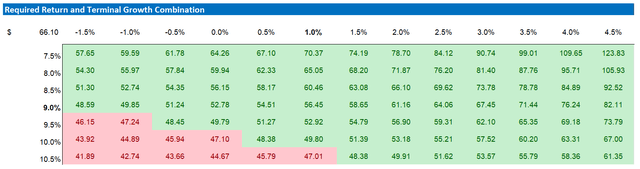

Below is also the updated sensitivity table.

eBay financials, author’s estimates, and calculation

A Note On Risks

Overall, I think eBay stock’s risk-reward proposition is excellent, as the company’s cheap valuation should balance most concerns that investors may have. That said, however, it is important to note that eBay is operating in quite a competitive market, with Amazon (AMZN) as a major direct peer in e-commerce. Moreover, it noteworthy to acknowledge that the e-commerce market is dynamic, with Social Media businesses such as TikTok and Facebook increasingly pushing for e-commerce wallet share. On that note, also Reddit (RDDT) may be growing to take a share of this cake. As a consequence of competitive dynamics, eBay’s business volume (GMV) or take-rate, or both may decline over time.

Investor Takeaway

eBay’s value narrative that I projected around 15 months ago is materializing, as the company delivered stellar commercial performance through 2023. On this note, I point out that eBay is delivering robust results in its primary e-commerce operations, while its advertising momentum is accelerating. Additionally, eBay’s commitment to strategic cost management and its generous policy of returning value to shareholders reinforce the bullish thesis. Based on updated valuation estimates, I project eBay’s fair value at approximately $66 per share, indicating a potential upside of nearly 40%.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EBAY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.