Summary:

- Eli Lilly investors have suffered an unexpected bear market as recent headwinds buffeted the stock.

- Notwithstanding near-term execution challenges, Lilly’s weight loss drugs are gaining more share.

- Potential policy changes under the Biden administration could benefit Lilly, but they are unlikely to be resolved before Trump takes office.

- LLY stock’s PEG ratio suggests the market’s pessimism may have been overcooked as profit-taking occurred.

- I argue why it’s timely for healthcare investors to consider a core position in the GLP-1 leader even as others flee.

JHVEPhoto

Eli Lilly: Too Much Pessimism Recently

Eli Lilly and Company (NYSE:LLY) investors who chased the stock toward its July/August 2024 highs have likely been stunned into submission as LLY has dropped into a bear market. As a result, the stock is down more than 25% toward its recent November 2024 lows as the market reassesses its bullish proposition on the leading GLP-1 weight loss drugs company. Although more intense competition isn’t anticipated until toward the second half of the decade, execution risks on some healthcare stocks have been elevated, given the recent scare triggered by the appointments of President-elect Donald Trump’s healthcare-related appointees.

However, outgoing President Joe Biden’s recent decision to expand Medicare and Medicaid coverage could usher in a new lease on life for the Lilly and Novo Nordisk (NVO) investors. Accordingly, the proposal by the Biden administration could alter the landscape and improve demand dynamics for Lilly as it seeks to continue gaining market share against NVO. However, it’s highly uncertain that the proposal could be implemented before Trump takes over the presidency in January 2025. Hence, I assess it’s still early to ascertain the beneficial impact on Lilly, as the Trump administration could be wary about taking on significant costs to implement the proposals. Therefore, investors are urged to remain cautious about placing too much emphasis on the proposals in the near term.

In my previous Eli Lilly article, I highlighted the breakthroughs that the company achieved, attributed to its growing pipeline and commercial gains. The opportunities into other treatment areas (sleep apnea, heart failure, and kidney disease) could extend the product life cycle, lifting its total TAM growth prospects before peaking.

Lilly Is Making Gains In Weight Loss Drugs

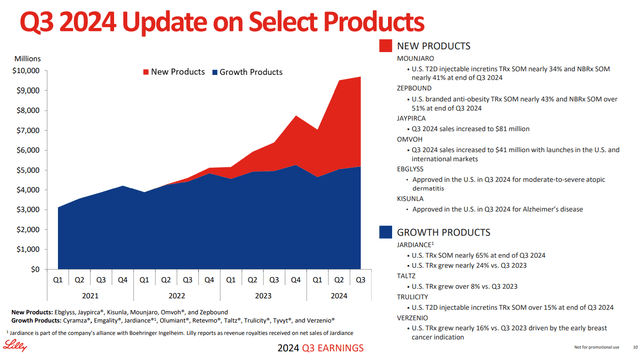

Updates on select products (Eli Lilly filings)

In Eli Lilly’s Q3 earnings release, the surge in revenue contribution from the company’s new products has validated its market share gains. In particular, Zepbound’s sales reached $1.3B in Q3, bolstering Mounjaro’s $3.1B metrics achieved in the same quarter. Hence, it has contributed markedly to Lilly’s diabetes franchise in Q3, as sales surpassed $7.4B. Management also reported that Zepbound had attained 87% in commercial formulary coverage in the US, corroborating the strength of its underlying prescriptions growth since its official launch.

Lilly seems well-poised to continue its gains as it focuses on building up its production capacity to take on Novo Nordisk. Management highlighted that the $2B in additional investments to bolster its manufacturing is on top of its commitment to develop its Lilly Medicine Foundry worth $4.5B. While the company highlighted supply chain and inventory snags in Q3 that affected its sales momentum, it isn’t expected to be a structural headwind. However, it has likely impacted the company’s outlook, as it lowered the top-end of its revenue guidance range and also reduced its non-GAAP EPS outlook for Q4.

As a reminder, Lilly’s adjusted revenue outlook range still suggests a 50% growth rate in Q4. Hence, the company’s ability to meet underlying demand is still assessed to be robust, notwithstanding the reduction in its outlook. Moreover, the growth prospects in global markets are still nascent, affording the biopharma leader a potentially lucrative growth optionality as it expands beyond the US.

Notwithstanding my optimism, the inventory management challenges observed in its supply chain could persist, given the “lumpiness in channel stocking.” Hence, it could complicate the company’s production and marketing activities through early next year, affecting the company’s ability to clarify its revenue outlook through 2025.

Coupled with the challenges besetting the GLP-1 leaders as compounded (lower-priced) versions are still available in the market, Lilly investors also need to consider the Trump administration’s response in assessing the shortages. It remains to be seen whether there could be a push to potentially broaden consumers’ access to the GLP-1 products as part of the “Make America Healthy Again” initiative. Hence, Trump could view an expanded role of the compounded versions as a critical underpinning in his administration’s strategy. These could complicate the demand dynamics for Lilly, notwithstanding its intense focus on R&D innovations and its healthy pipeline.

Lilly’s Ability To Expand Capacity Is Critical

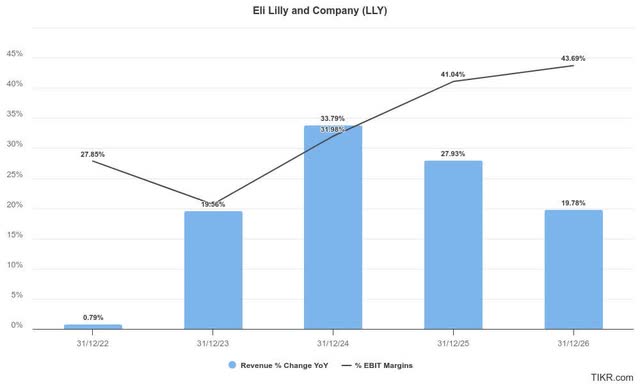

Eli Lilly estimates (TIKR)

Wall Street’s estimates on Lilly have been revised downward, given the company’s revised outlook. Despite that, the pricing levers have been assessed to be constructive. Realized prices were observed to be higher in Q3, while global pricing dynamics have also been lifted. Hence, I assess that as Lilly scales its manufacturing footprint while resolving near-term inventory mismatch headwinds, it should help the company meet more optimistic adjusted operating margins over the next two years.

However, intensified challenges from its biopharma competitors could worsen from FY2028, requiring a reassessment of Lilly’s pipeline developments toward oral GLP-1 products as compared to its current injectable format.

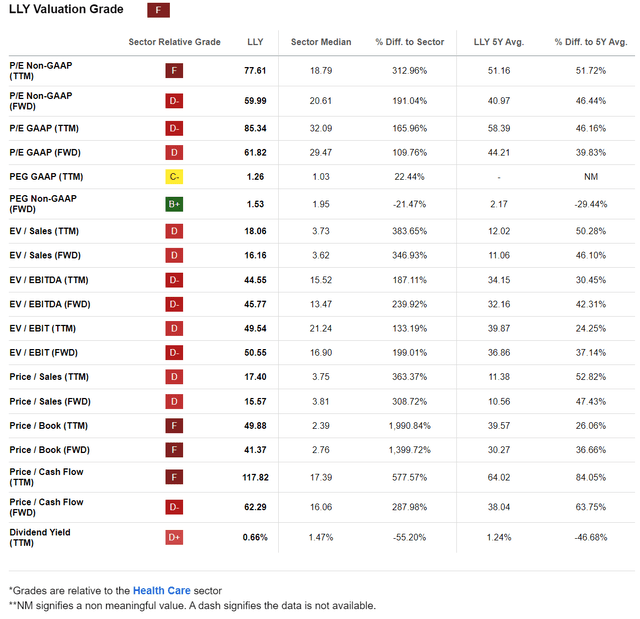

LLY valuation grades (Seeking Alpha)

LLY’s forward adjusted PEG ratio remains relatively attractive. Accordingly, it’s more than 20% below its healthcare sector (XLV) median. It’s also markedly below NVO’s metric of 2.29, suggesting the market seems to have priced in a more pessimistic ramp profile for Lilly. Despite that, LLY’s superior 34% total return over the past year easily eclipsed NVO’s total return of 3.3% over the same period. Hence, it’s increasingly clear that the market has already reallocated to Lilly stock, bolstering buying sentiments.

Is LLY Stock A Buy, Sell, Or Hold?

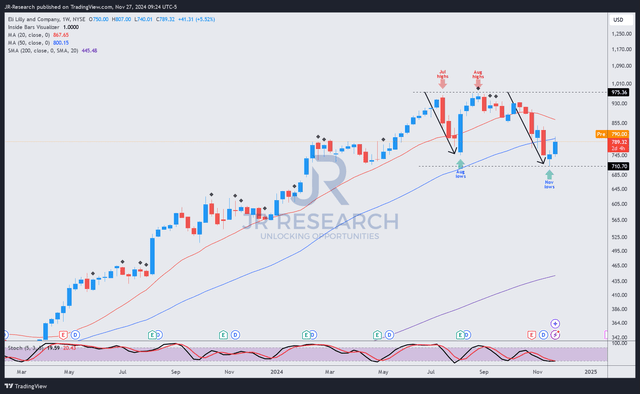

LLY price chart (weekly, medium-term, adjusted for dividends) (TradingView)

LLY has suffered from two notable pullbacks since July 2024, suggesting profit-taking has set in after a stellar run over the past five years. The recent bear market has also likely shaken out dip-buyers who bought into its previous August 2024 lows.

However, I’ve observed a potential bullish reversal opportunity as buyers attempt to regain control of the bullish narrative, potentially helping LLY manage a decisive bottom. If the bulls can muster enough strength to help the stock regain its upward momentum, LLY’s long-term uptrend bias is anticipated to remain intact.

LLY’s “B-” momentum grade corroborates my observation of a possible bottom, lifting the risk/reward profile for investors considering buying the dips in the stock. Consequently, I assess it apt for me to turn bullish on Lilly’s recent opportunity, bolstered by its solid fundamental thesis and relatively attractive valuation.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!