Summary:

- An FDA advisory committee voted 11-0 in favor of Eli Lilly and Company’s donanemab for the treatment of early Alzheimer’s disease.

- Donanemab has no effect on non-APOE4 carriers, may slow the decline of APOE4 carriers closer to that of non-carriers, and may cause brain swelling and brain bleeds in APOE4 carriers.

- Alternative treatments like ALZ-801 (for APOE4 carriers) and Anavex’s blarcamesine (for those with functioning sigma-1 receptors) show promise in clinical trials.

- The potentially slow roll out of donanemab, potentially fatal side effects, and more effective and safer treatments may have a modestly negative impact on Eli Lilly’s stock.

pidjoe/E+ via Getty Images

On June 10, 2024, an FDA advisory committee voted unanimously (11-0) that the Eli Lilly and Company (NYSE:LLY) anti-amyloid antibody drug donanemab was effective for the treatment of early Alzheimer’s disease and that the risks of brain bleeds and swelling were outweighed by the benefits of treatment.

All anti-amyloid antibody drugs produce similar results. They slow down the progression of the disease for a short period of time and then only in groups that have large amounts of amyloid to begin with, such as APOE4 carriers. They can cause potential fatal brain bleeds and brain swelling as they pull amyloid out of the brain (Leqembi/lecanemab/Ban2401 and Aduhelm/aducanumab).

While the results may be almost the same, the response to the success and/or failure of these drugs may have a greater impact on Biogen (BIIB) than on Eli Lilly stock because the latter has already established a lucrative market for its anti-diabetes and anti-obesity drug (Mounjaro/Zepbound). But if the roll-out of donanemab is slow as it was for Biogen and Eisai’s (OTCPK:ESALF) Aduhelm and Leqembi, that could potentially bring the stock down by 100 points or so. Biogen’s stock went up over 100 points in anticipation and subsequent approvals of Aduhelm and Leqembi and then down over 100 points after the subsequent stumbles for each (Biogen has now shelved Aduhelm and Leqembi sales are slow) (five year chart).

The Anti-Amyloid Chimera

The shepherd leading his flock is a good analogy/allegory for the current state of Alzheimer’s disease drug development. Some leaders in the field have tried to convince the public that the removal of amyloid is equivalent to the effective treatment of Alzheimer’s disease. Eli Lilly’s own charts show that this is not the case:

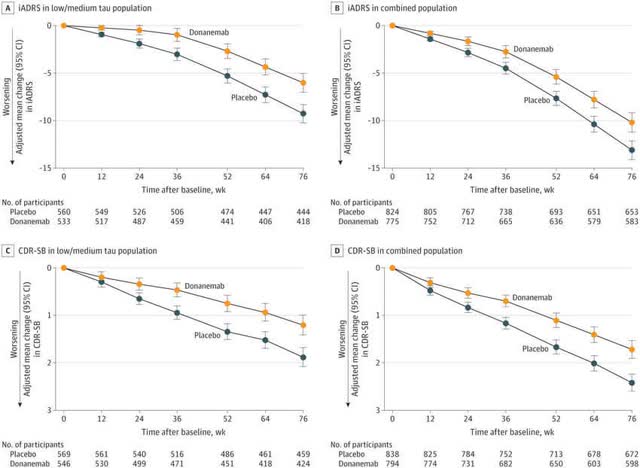

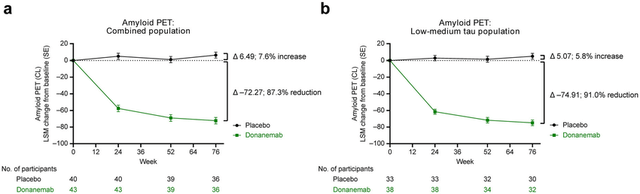

What these charts show is that the maximum separation between donanemab and placebo occurs at 52 weeks, which not incidentally is the point where most of the amyloid has been removed from the brain.

The whole issue then of being able to stop taking donanemab once most of the amyloid has been removed is rather mute. One stops taking the drug not because most of the amyloid has been removed (and will take some time to return), but because the drug is no longer effective at this point. Amyloid is a secondary contributor to Alzheimer’s disease. Once it is removed, the other factors that primarily drove the disease are still there (high glucose levels, exposure to environmental toxins, psychological stress, etc.). Donanemab then has just a minimal time of minimal effectiveness.

Anti-Amyloid Drugs Only Help Certain Subgroups

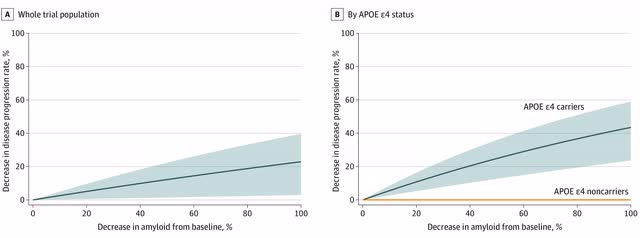

The issue is more complicated than even this, though. Some individuals – such as many non-APOE4 carriers and African Americans – have limited amounts of amyloid to begin with. Removing this amyloid (if anti-amyloid antibody drugs can remove any of it all) makes little difference in these individuals. For APOE4 carriers, there is no relationship between removal of amyloid and iADRS scores [integrated Alzheimer’s Disease Rating Scores – which measure changes in cognition and activities of daily living].

APOE4 carriers decline more rapidly during the early stages of Alzheimer’s disease, in part because they have more amyloid in their brains, but removing that amyloid only slows their progression rate closer to that of non-carriers. In the charts above, tau is a surrogate marker for APOE4 status – the intermediate/moderate group and high tau group (the combined group) are mostly patients who have two copies of the APOE4 gene and one copy of the APOE4 gene, respectively. The low tau group mostly were non-APOE4 carriers. The intermediate/moderate and high tau group on donanemab declined by 5 points at 12 months, whereas the low to moderate group on placebo also declined by 5 points at 12 months (see chart above). Carriers with a single copy of the APOE4 gene on donanemab decline almost the same as non-carriers on placebo.

Donanemab – an invasive intravenous and costly – treatment should not be given to non-APOE4 carriers (and probably not to African Americans) because it has no effect on this group. It does lower the rate of carriers close to that of non-carriers, but with the risk of potentially fatal brain swelling and brain bleeds.

Potential Competitors

There are alternative treatments that may be available soon. Alzheon’s ALZ-801 is being tested only in APOE4 carriers because the company found that an early version of the drug had no effect on non-carriers (clinical trial results). ALZ-801 stops the aggregation of amyloid monomers into amyloid oligomers and plaques, so unlike amyloid removing drugs such as donanemab it does not cause brain swelling and brain bleeds. ALZ-801 may be at least as effective as anti-amyloid antibody drugs in APOE4 carriers, without the potentially deadly side effects. Results for this potential treatment of Alzheimer’s disease may be known in the third quarter of this year.

Anavex’s (AVXL) blarcamesine is a sigma-1 agonist. Sigma-1 agonists such as Aricept/donepezil and blarcamesine slow down the progression of mild cognitive impairment and mild Alzheimer’s disease for about a year (Aricept in mild cognitive impairment – Table Two, Aricept in mild Alzheimer’s disease – Table Three, blarcamesine in mild cognitive impairment to mild Alzheimer’s disease-Table Three). Blarcamesine may also be a direct antioxidant. In a tiny trial, a high concentration of blarcamesine kept those with mild cognitive impairment to mild Alzheimer’s disease close to baseline for 148 weeks (results – Figure 2). Results for Anavex’s 96-week extension trial of its phase 2b/3 clinical trial are due later this summer, and will likely be critical for this struggling company.

Cassava Sciences’ (SAVA) simufilam may also be a sigma-1 receptor agonist (although this is far from proven). It appears to keep those with mild cognitive impairment above baseline for at least a year and those with mild Alzheimer’s disease just below baseline for a year (press release). If these results are replicated in its 12-month phase 3 clinical trial (available near the end of this year) and its 18-month phase 3 clinical trial (available near the middle of next year) it will be interesting to see how the FDA’s reacts to this data.

Coya Therapeutics (COYA) should have results from its phase 2 clinical trial in the third quarter of this year, and INmune Bio, Inc. (INMB) should have results from its phase 2 clinical trial one quarter later. Both (albeit by different means) reduce neuroinflammation in Alzheimer’s disease, but both may be intervening too late in the process to make a major difference (previous article).

The Decline of Anti-Amyloid Antibody Drugs

It is difficult to say exactly where the Achilles heel of anti-amyloid drugs will be: lack of efficacy in certain population groups, deaths due to brain bleeds and brain swelling, competition from more effective and less dangerous drugs, or some combination of all three. Eli Lilly, with a market cap of over $800 billion, probably has more to fear from competitors and emerging side effects from its anti-diabetes and anti-obesity drugs (whose efficacy does not seem to be in doubt) than it does for its Alzheimer’s drug.

Even without timely alternatives, the roll-out of donanemab (assuming the almost certainty of FDA approval now) may well parallel that of Biogen and Eisai’s lecanemab (another anti-amyloid drug). Many physicians will be reluctant to prescribe a drug whose effect may be barely clinically significant (if that). Caregivers may not wish to subject their loved ones to drug infusions that are costly and invasive and may result in potentially deadly side effects. Medicare and private insurers may cover part or all of the cost but will want to closely monitor what impact the drug is having in the real world. For these “stakeholders,” the risks may outweigh the benefits.

If the above happens, Eli Lilly may give back around 100 points in its stock value. The company is fortunate in that the popularity of its anti-diabetes and anti-obesity drugs will offset most of the potentially negative news about donanemab. Competition and emerging side effects, however, may cut somewhat into Eli Lilly’s position in this area as well.

I have felt that Eli Lilly and Company stock has been overvalued for a long time, but it keeps going up (fundamentals and valuation). It may be near its apex now, but even that is not certain. The only thing I can say for certain is that donanemab is not a very good drug for Alzheimer’s disease because amyloid is not the root cause of Alzheimer’s disease.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is a re-working of a previous submission. The last advice that I received was to spend more time on a macro-analysis of Eli Lilly, but I wanted to focus more on the limitations of donanemab and the effect that this may have on Eli Lilly's stock.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.