Summary:

- Eli Lilly and Company has seen significant growth and generated strong returns, outperforming the S&P 500.

- The company’s revenue increased by 28.1% in the final quarter of 2023, exceeding analysts’ expectations.

- While some drugs, like Trulicity, have declined, others, such as Mounjaro and Verzenio, have shown promising growth.

- That growth should continue in the near term, but Eli Lilly and Company shares are getting expensive and warrant a downgrade.

jetcityimage/iStock Editorial via Getty Images

Although I do not fancy myself a growth investor, opting instead to focus on the value approach to investing, I cannot deny that there is something alluring about buying rapidly growing firms that go on to achieve robust returns. One company that I uncharacteristically became bullish on late last year was pharmaceutical giant Eli Lilly and Company (NYSE:LLY). The progress that the enterprise had made in the obesity market, first with the success of its Mounjaro brand and later with its launch of the same drug branded as Zepbound but marketed for obesity as opposed to those suffering from diabetes, made me excited about what kind of growth the company could achieve moving forward.

After careful consideration, I ended up rating the company a “buy” because I believed that growth would continue and that shareholders would benefit as a result. Since my most recent article on the company in early November of 2023, shares have seen an upside of 22.9% at a time when the S&P 500 (SP500) has risen by 14.9%. And since I first rated the company a “Buy” in June of last year, shares have generated upside for investors of 56.2% while the S&P 500 has increased by only 12.3%. I would call that a success.

But, of course, one of the dangers of growth investing is that companies can become overvalued. And while it remains to be seen whether that is the case for Eli Lilly and Company, I do think that the stock is priced to such an extent that further upside relative to the broader market is unlikely at this time. Because of this, I have decided to downgrade the firm to a “Hold.”

A great outlook

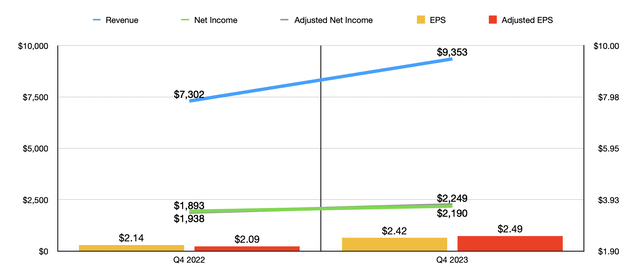

On February 6th, the management team at Eli Lilly and Company announced financial results covering the final quarter of the 2023 fiscal year for the business. In some respects, the quarter was quite positive. In others, it could have been better. For starters, revenue came in at $9.35 billion. That represents an increase of 28.1% over the $7.30 billion the company reported one year earlier. In addition to seeing a massive increase in sales, the revenue reported by management actually came in about $380 million higher than what analysts anticipated.

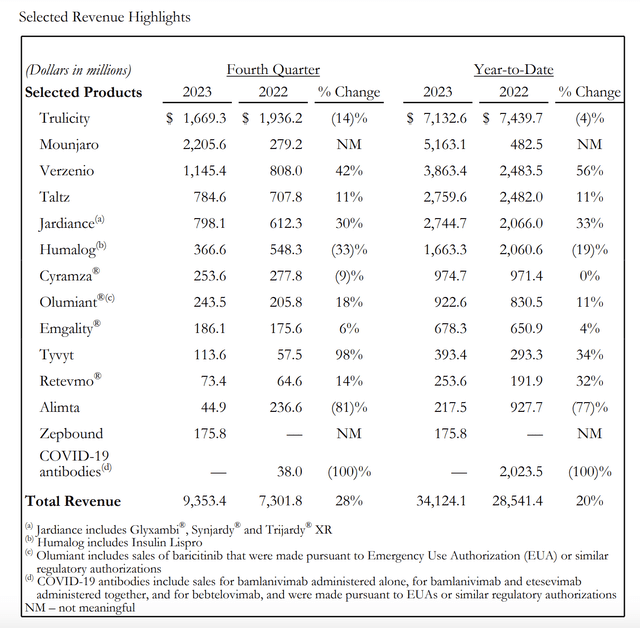

One of the downsides of the pharmaceutical space is that, because much of the research that they conduct falls under a particular category, the success of a new drug can mean the cannibalization of an older drug. While revenue for the company came in strong, what had previously been its most significant drug, Trulicity, has been on the decline because, quite frankly, it pales in comparison to what has come out recently. Although for the 2023 fiscal year in its entirety, Trulicity remained the largest source of revenue for the business, accounting for $7.13 billion, or 20.9% of overall revenue, the final quarter of 2023 was not great for it. Revenue during that time totaled $1.67 billion. That represents a decline of 13.8% from the $1.94 billion generated one year earlier.

Although revenue associated with Trulicity is now slated to fall in the years to come, there have been some truly bright spots for the business. Most notable is the Mounjaro brand, which has been described by many as a miracle for those looking to lose weight. Revenue during the final quarter of the year was $2.21 billion. That’s almost eight times more than the $279.2 million generated the same time one year earlier. Even more exciting is the version of that drug dedicated specifically to those with obesity who have not been diagnosed with diabetes. The drug started selling late last year and still generated revenue of $175.8 million for the quarter. While this might seem small compared to the rest of the revenue the company generated, consider that it was only approved on November 8th of last year and was only available starting on December 5th.

Mounjaro and Zepbound are not the only drugs doing well. The company has seen attractive growth elsewhere. Most notably, there was a 41.8% surge in revenue associated with Verzenio, a drug that is used to treat certain types of breast cancer. Revenue jumped from $808 million to $1.15 billion. Another growth area for the business involved Jardiance, which is used to lower blood sugar for those with type 2 diabetes with the goal of reducing the risk of cardiovascular disease. Its revenue went from $612.3 million to $798.1 million. That is a 30.3% increase year-over-year.

With revenue rising, profits also improved. Although earnings per share fell short of analysts’ expectations by $0.04, they still managed to grow from $2.14 to $2.42. That brought net profits up from $1.94 billion to $2.19 billion. On an adjusted basis, however, profits per share exceeded forecasts by $0.12. That resulted in adjusted net profits of $2.25 billion, compared to the $1.89 billion reported one year prior. Other profitability metrics, unfortunately, have not yet been provided by management. That data will come out when the firm releases its official annual report. But if this year is like last year was, it could be around the end of February before that data comes out.

This does present an issue when it comes to valuing the company. For instance, we don’t know what net debt is, nor do we know what valuable cash flow figures are. For the purpose of valuing the company, the best I could do is assume that the balance sheet looked the same in the final quarter of the year as it did in the third quarter. I also assumed that the year-over-year growth rate for EBITDA for the first nine months of the year relative to the same time of 2022 continued for the final quarter of the year and applied to adjusted operating cash flow as well.

But before we get into how shares are priced, we should talk more about the future. Even ignoring the prospect of additional drugs that are in the company’s pipeline, which is a topic I wrote about in my first article on the company, the future seems to be quite positive. We unfortunately have no idea what kind of growth to expect of Zepbound, but in all likelihood, its prospects fit into the $25 billion revenue opportunity that the company is being exposed to.

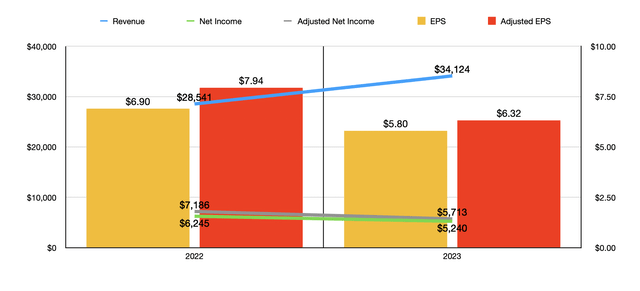

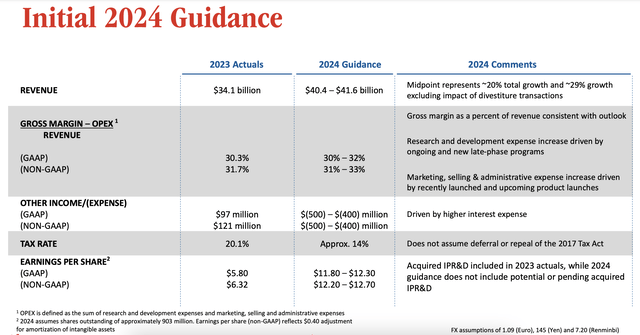

Of course, this will not occur overnight. It will take some time to play out. The good news is that management has provided some guidance for what 2024 will look like. They currently forecast that revenue will come in at between $40.4 billion and $41.6 billion. At the midpoint, that should represent a year-over-year increase of 20.1% compared to the $34.1 billion the company reported for 2023 in its entirety. Earnings per share are forecasted to come in between $11.80 and $12.30. That’s a massive increase over the $5.80 per share reported for 2023.

If this earnings guidance comes true, investors should expect profits of about $10.88 billion. That suggests an adjusted operating cash flow of around $16.96 billion and EBITDA of $24.30 billion. But again, that is without complete data from the 2023 fiscal year.

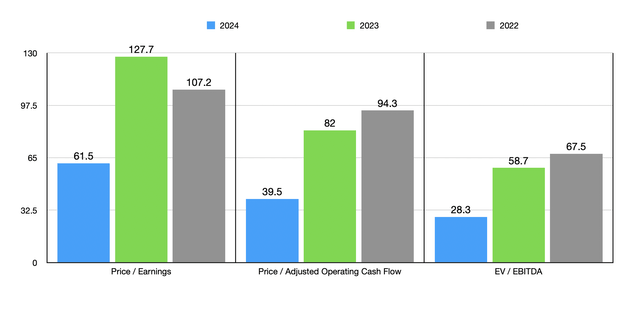

Using those estimates, as well as estimates for 2023 and historical results from 2022, I valued Eli Lilly & Co. as shown in the chart above. Even on a forward basis, the stock does look very expensive. I then, in the table below, compared it to five similar firms. Compared to the 2023 estimates, Eli Lilly & Co. ended up being the most expensive of the group using two of the three valuation metrics, with four of the five companies being cheaper than it when it comes to the price-to-earnings approach. But even if we use the forward estimates for 2024, three of the five companies would be cheaper than it using both the price to earnings approach and the EV to EBITDA approach, while the price to operating cash flow approach would still see it be the most expansive of the group.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Eli Lilly & Co. | 127.7 | 82.0 | 58.7 |

| Johnson & Johnson (JNJ) | 13.1 | 20.2 | 17.4 |

| Merck & Co. (MRK) | 907.8 | 16.2 | 58.0 |

| Pfizer (PFE) | 76.4 | 13.7 | 18.5 |

| AstraZeneca (AZN) | 35.4 | 20.2 | 16.5 |

| Novo Nordisk (NVO) | 43.5 | 33.4 | 31.3 |

Takeaway

Moving forward, I have no doubt that Eli Lilly and Company will continue to do well for itself. The firm should go on to generate significant earnings and cash flow growth. But even if we take management’s assumptions, Eli Lilly and Company stock looks rather expensive. It’s unlikely that we will see further upside from here unless something unexpected comes out of the woodwork. So, because of how shares are currently priced, and because of how much the stock has already risen up to this point, I do believe that downgrading it from a “Buy” to a “Hold” is prudent.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!