Summary:

- Alzheimer’s drug is expected to receive full approval.

- Mounjaro formulary placement may fuel sales growth.

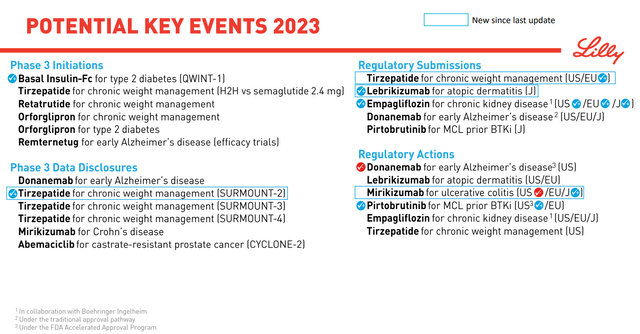

- Several major pipeline clinical readouts and approvals are lined up in H2.

jetcityimage

In previous coverage, Eli Lilly and Company (NYSE:LLY) investors were cautioned to hold and wait for regulatory decisions, the uncertain ones such as Omvoh (mirikizumab, which was rejected by the FDA for ulcerative colitis but approved in Japan and soon could be in Europe), and the more likely label expansion for Verzenio, which now could double its market in breast cancer. Longs were rewarded when topline results of the TRAILBLAZER-ALZ 2 Phase 3 study demonstrated that donanemab significantly slowed cognitive and functional decline in people with early symptomatic Alzheimer’s disease (‘AD’). Investors should expect full approval for this medicine. Longs should be further encouraged by the latest formulary review findings on Mounjaro (tirzepatide) and the new launch of Jaypirca.

Donanemab for AD

TRAILBLAZER-ALZ 2’s primary endpoint (‘PEP’) measured changes from baseline on the integrated AD Rating Scale (iADRS; scores range from 0 to 144, with lower scores indicating a greater cognitive deficit and greater impairment of the ability to perform activities of daily living). As discussed previously, the iADRS was made up by Lilly scientists in 2015. combining the AD Assessment Scale-Cognitive 13-item subscale (ADAS-Cog13; score range 0 to 85) and the Alzheimer’s Disease Cooperative Study-instrumental Activities of Daily Living (ADCS-iADL items 6a and 7-23; score range 0 to 59) scales. Because higher scores on the ADAS-Cog reflect worse performance, the ADAS-Cog score is multiplied by (−1) to calculate the integrated scale. As discussed in my Biogen (BIIB) article, accelerated approvals of Aduhelm and Leqembi, which showed 22% and 27% reduced declines on the Clinical Dementia Rating-Sum of Boxes (CDR-SB) scale, indicated the FDA’s willingness to accept that a modest treatment effect difference of 20%-30% is clinically meaningful. Indeed, the FDA granted full approval to Leqembi on July 6.

On May 3, Lilly’s chief scientific and medical officer, Daniel Skovronsky, declared, “This is the first Phase 3 trial of any investigational medicine for Alzheimer’s disease to deliver 35% slowing of clinical and functional decline.” By employing the different scale, donanemab achieved that threshold, so to speak. In TRAILBLAZER-ALZ 2’s primary analysis population (n=1182) comprised of people with an intermediate level of tau and clinical symptoms of AD with a baseline Mini-Mental State Examination (‘MMSE’) score of 22.9, the placebo arm decline on PEP iADRS and the key secondary endpoint CDR-SB by 9.3 and 1.9 points respectively over 18 months. Donanemab slowed decline by 35% (p<0.0001) on the iADRS, and by 36 or 37% (p<0.0001) on CDR-SB. However, in all participants (n=1736), which Lilly called an additional primary analysis that included high tau patients, iADRS and CDR-SB decline slowed by only 22% and 29%, respectively, compared to placebo. It doesn’t seem like the lower average will affect the FDA’s final label.

Safety-wise, the 3 monoclonal antibodies (‘mAbs’) directed against aggregated forms of beta amyloid are notorious for amyloid-related imaging abnormalities (‘ARIA’) with edema (ARIA-E) or hemosiderin deposition (ARIA-H), that are detected by MRI. ARIA-E occurred in 24.0% of the overall donanemab treatment group, and 6.1% were symptomatic. ARIA-H occurred in 31.4% in the donanemab group and 13.6% in the placebo group. Serious and life-threatening events occurred in 1.6% of patients, including 3 deaths. Note that Leqembi’s label lists lower incidences of ARIA-E (13%) and ARIA-H (14%) but more infusion-related reactions (26% vs donanemab’s 8.7%).

Financials

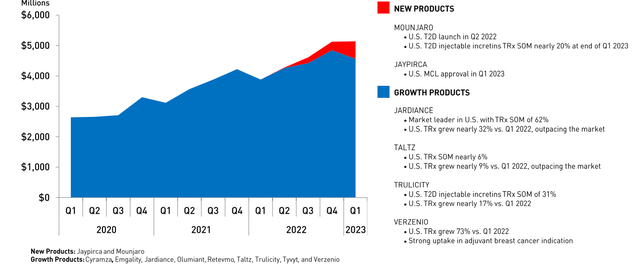

On April 27, mixed earnings for the first quarter of 2023, including a revenue beat, was well received. Lilly featured their Growth Products (defined as Cyramza, Emgality, Jardiance, Olumiant, Retevmo, Taltz, Trulicity, Tyvyt and Verzenio), which generated $4.56 billion and 65.5% of the company’s $6.96 billion in total Q1 revenues (Figure 1) and did grow 18% over the past year. The most vulnerable of the lot to loss of exclusivity this decade are #1 earner Trulicity ($1.98 billion in Q1, +14% YOY), latest patent expiry in 2027) and #4 Jardiance ($0.58 billion, +38%, 2028). Both are still going impressively strong.

Figure 1. Q1 2023 Update on select Lilly Products

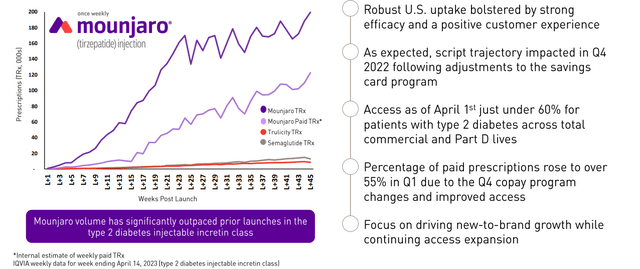

Lilly now highlights a separate New Products group (launched since 2022), which currently consists of Jaypirca and Mounjaro. The pair contributed $573.6 million, mostly Mounjaro’s $568.5 million (+104% over Q4 2022’s $279.2 Million). Its launch is great compared to glucagon-like peptide 1 (GLP-1) agonists Trulicity and Novo Nordisk’s (NVO) semaglutide products (Figure 2), but is starting to plateau in the U.S. It remains to be seen whether greater access in Q2 stimulated more sales.

Figure 2. Mounjaro (tirzepatide) Launch Progress

Formulary Review

The following update for Q2 examined coverage of Lilly’s products launched in the U.S. since 2018. Data was compiled directly from official websites of the 15 largest health insurance companies in the U.S. overall, to see if access would more closely match management’s claims (climbing from 50% to 60% this quarter). It is the first to include Jaypirca.

How to read Table 1:

Tier # Higher Tiers have higher cost share. Drugs in Tier 4 or higher (in 5+-Tier plans) are non-preferred brands and may also include drugs recently approved by the FDA or specialty drugs and may need special handling.

Sp Specialty drugs are used to treat difficult, long-term conditions and may need to get filled through a specialty pharmacy.

PA Prior authorization is the process of obtaining approval of benefits before certain prescriptions may be filled.

NF A non-formulary drug is not included on a plan’s Drug List. Exception processes such as PA or Step Therapy could be available to request coverage for an NF drug.

X Not Covered drugs are specifically excluded from coverage by the terms of the plan. Patients likely won’t get any reimbursement will have to pay out-of-pocket for these drugs.

Table 1. 2023 Coverage of Eli Lilly’s Recent Products at the 15 Largest Health Insurance Companies in the U.S.

|

Rank |

Commercial health insurance plans |

Mounjaro |

Retevmo |

Emgality |

Olumiant |

Verzenio |

Jaypirca |

|

1 |

Kaiser Permanente [Southern CA Commercial HMO 3-Tier] |

x |

x |

x |

x |

x |

x |

|

2 |

Elevance Health (Anthem) National Drug List 5-Tier |

NF ST |

NF PA |

3 PA |

NF PA |

5 PA |

NF PA |

|

3 |

Health Care Service Corporation |

||||||

|

BCBS Illinois Basic Drug List |

3 PA |

5 PA |

3 PA |

x |

5 PA |

x |

|

|

BCBS Montana Basic Drug List |

3 PA |

5 PA |

3 PA |

x |

5 PA |

x |

|

|

BCBS New Mexico Basic Drug List |

3 PA |

5 PA |

3 PA |

x |

5 PA |

x |

|

|

BCBS Oklahoma Basic Drug List |

3 PA |

5 PA |

3 PA |

x |

5 PA |

x |

|

|

BCBS Texas Basic Drug List |

3 PA |

5 PA |

3 PA |

x |

5 PA |

x |

|

|

4 |

UnitedHealth [CA Traditional 4-Tier] |

2 PA |

4 PA |

2 PA |

2 PA |

2 PA |

3 PA |

|

5 |

Centene [Health Net Essential Rx Drug List] |

x |

4 PA |

2 PA |

x |

4 PA |

x |

|

6 |

CVS Health (Aetna Standard Opt Out) |

3 |

4 |

2 |

5 |

5 |

x |

|

7 |

GuideWell (Florida Blue) ValueScriptRx |

4 PA |

5 PA |

5 PA |

6 PA |

5 PA |

5 PA |

|

8 |

Blue Cross Blue Shield of Michigan [BCN HMO] |

2 |

4 PA |

3 PA |

5 PA |

4 PA |

4 PA |

|

9 |

Highmark Healthcare Reform Comprehensive 3-Tier Incentive |

2 |

3 PA |

2 PA |

3 PA |

2 PA |

3 PA |

|

10 |

Blue Cross of North Carolina Enhanced 5 Tier |

3 PA |

4 PA |

2 PA |

4 PA |

4 PA |

5 PA |

|

11 |

Humana Rx5 |

3 |

5 PA |

x |

x |

5 PA |

5 PA |

|

12 |

Blue Cross and Blue Shield of Alabama |

2 |

4 PA |

2 PA |

6 |

4 PA |

x |

|

13 |

Blue Cross Blue Shield of Massachusetts |

2 |

4 PA |

5 PA |

x |

4 PA |

4 PA |

|

15 |

Independence Health Group [Value formulary 5-tier] |

3 |

5 PA |

3 PA |

5 PA |

5 PA |

5 PA |

|

Rank |

Health Insurance Marketplace plans |

Mounjaro |

Retevmo |

Emgality |

Olumiant |

Verzenio |

Jaypirca |

|

1 |

Kaiser Permanente [CA Marketplace] |

x |

x |

x |

x |

x |

x |

|

2 |

Elevance Health (Anthem) CA Select Drug List |

NF ST |

NF PA |

2 PA |

NF PA |

NF PA |

NF PA |

|

3 |

Health Care Service Corporation |

||||||

|

BCBSIL 6 Tier HIM Drug List |

3 PA |

5 PA |

3 PA |

6 PA |

5 PA |

x |

|

|

BCBSMT 6 Tier HIM Drug List |

3 PA |

5 PA |

3 PA |

6 PA |

5 PA |

x |

|

|

BCBSNM 6 Tier HIE Drug List |

3 PA |

5 PA |

3 PA |

6 PA |

5 PA |

x |

|

|

BCBSOK 6 Tier HIM Drug List |

3 PA |

5 PA |

3 PA |

6 PA |

5 PA |

x |

|

|

BCBSTX STAR & STAR Kids |

2 PA |

2 PA |

2 |

2 PA |

2 PA |

x |

|

|

4 |

UnitedHealth Group [TX QHP Standard] |

2 PA |

NF |

NF |

4 PA |

NF |

NF |

|

5 |

Centene [Health Net CA Essential Rx Drug List] |

x |

4 PA |

2 PA |

x |

4 PA |

x |

|

6 |

CVS Health (Aetna Health Exchange Plan: CA) |

x |

x |

x |

x |

x |

x |

|

7 |

GuideWell (Florida Blue) ValueScriptRx |

4 PA |

5 PA |

5 PA |

6 PA |

5 PA |

5 PA |

|

8 |

Blue Cross Blue Shield of Michigan [BCN HMO] |

2 |

4 PA |

3 PA |

5 PA |

4 PA |

4 PA |

|

10 |

BCBS North Carolina Essential Q |

3 PA |

5 PA |

3 PA |

5 PA |

5 PA |

x |

|

11 |

Humana [FL Medicaid Preferred Drug List] |

x |

x |

2 |

x |

2 |

x |

|

12 |

Blue Cross and Blue Shield of Alabama Blue Saver Bronze |

3 PA |

5 PA |

3 PA |

6 PA |

5 PA |

x |

|

14 |

Molina Healthcare [CA Marketplace] |

x |

x |

3 PA |

x |

x |

x |

|

Rank |

Medicare Prescription Drug Plans |

Mounjaro |

Retevmo |

Emgality |

Olumiant |

Verzenio |

Jaypirca |

|

1 |

Kaiser Permanente |

5 |

5 |

x |

5 |

5 |

5 |

|

2 |

Anthem Blue Cross MedicareRx [B5] |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

3 |

Health Care Service Corporation |

||||||

|

BCBS Illinois Blue Cross MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

|

BCBS Montana Medicare Advantage Classic PPO |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

|

BCBS New Mexico MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

|

BCBS Oklahoma MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

|

BCBS Texas MedicareRx Basic |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

|

4 |

UnitedHealth [AARP MedicareRx Walgreens PDP] |

x |

5 PA |

x |

x |

5 PA |

5 PA |

|

5 |

Centene [Wellcare Value Script PDP] |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

6 |

CVS (Aetna) [SilverScript Choice PDP] |

x |

5 PA |

x |

x |

5 PA |

x |

|

7 |

GuideWell (Florida BlueMedicare Premier Rx) |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

8 |

BCBS of Michigan Prescription Blue PDP Select |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

9 |

Highmark Performance Formulary |

3 PA |

5 PA |

3 PA |

5 PA |

5 PA |

5 PA |

|

10 |

BCBS North Carolina Blue Medicare Rx Standard |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

11 |

Humana Basic Rx Plan PDP |

3 |

5 PA |

4 PA |

x |

5 PA |

5 PA |

|

12 |

BCBS Alabama BlueRx Essential |

x |

5 PA |

3 PA |

x |

5 PA |

5 PA |

|

13 |

Blue Cross Blue Shield of Massachusetts |

x |

5 PA |

x |

x |

5 PA |

5 PA |

|

14 |

Molina Medicare Choice Care (HMO) |

x |

5 PA |

x |

x |

5 PA |

5 PA |

|

15 |

Independence Keystone 65 Basic Rx HMO |

NF |

5 PA |

5 PA |

5 PA |

5 PA |

5 PA |

In short, Mounjaro’s coverage greatly improved (changes in bold). It’s now available to members insured by #2 Elevance Health (ELV), #3 Health Care Service Corporation, #7 GuideWell (Florida Blue) and #10 Blue Cross of North Carolina. Starting this month for those who are insured but don’t have coverage for Mounjaro, the new Mounjaro Savings Card gives a patient benefit of $575, so patients can choose to pay approximately $450 out of pocket per month or switch to another drug. The lymphoma treatment Jaypirca immediately gained broad coverage.

Takeaways

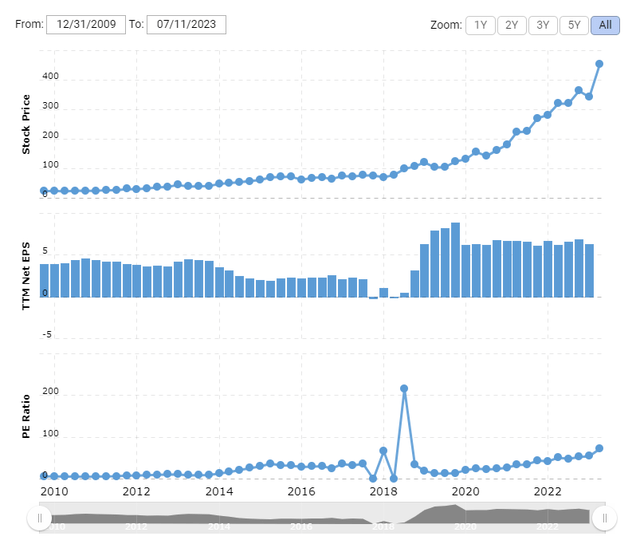

Seeking Alpha’s Quant System is looking green across the board, including very healthy margins for A+ in Profitability. The exception is the ever-depressing F for Valuation. The price/earnings ratio (Non-GAAP) calculated by dividing the current price of $453.16 by trailing 12-month EPS is a frothy 65.14 (Figure 3). Of course, the market is baking in future donanemab sales. The Centers for Medicare & Medicaid Services (‘CMS’) will only cover traditionally approved mAbs for patients enrolled in a registry. There is still debate about which mAb is better, so stay tuned for full results of the TRAILBLAZER-ALZ 2 study to be presented at the Alzheimer’s Association International Conference on July 16-20.

Figure 3. LLY Historical P/E Ratio (Non-GAAP TTM) as of July 7

Turning to the rest of the pipeline, regulatory actions await lebrikizumab (atopic dermatitis) and tirzepatide (obesity) in large markets (Figure 4). For mirikizumab, the FDA cited issues related to its proposed manufacturing, with no concerns about the clinical data package, safety, or label for the med. There is no timeline on when this will get resolved.

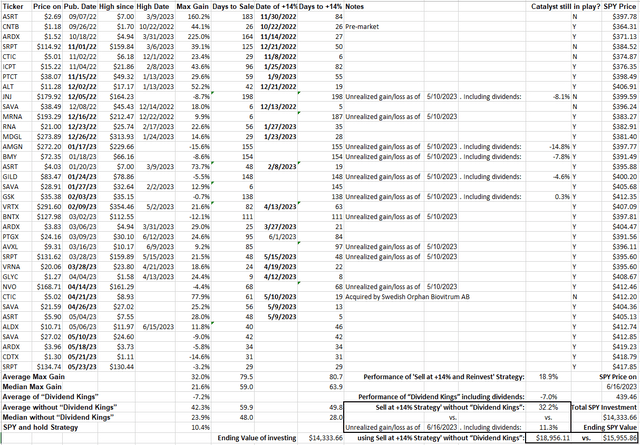

To conclude, Eli Lilly and Company has a lot going for it, including 6 blockbusters, but the recent rally drove down the dividend to 1.0%. On the other hand, Big Pharma stocks promoted for their better yields have all underperformed among personal recommendations since last year (Figure 5). The BP group has gotten even worse the past couple of months relative to the reference SPDR S&P 500 Trust ETF (SPY). To qualify as a success, LLY would have to hit 13% over publication price, or around $512/share, in a relatively short time frame. Unfortunately, catalysts of such magnitude are probably limited to signs of certainty that Mounjaro and Verzenio would have breakout sales in Q2, or of a potential donanemab monster launch; the latter will have to wait for Leqembi to navigate the way through the CMS headwinds.

Figure 4. 2023 Lilly Catalysts

Figure 5. Performance of CSI’s Buys and Strong Buys from September 2022 compared to SPY

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.