Summary:

- Eli Lilly’s stock has surged 88.5% in the past year, driven by weight loss drugs.

- Approval of tirzepatide for weight management in China and the EU opens up new markets for the company.

- Despite strong growth potential, Eli Lilly’s stock remains pricey, with upcoming earnings report potentially changing the investment outlook.

jetcityimage

One of the most amazing growth stories, especially if you ignore the semiconductor space, over the past couple of years, has been pharmaceutical giant Eli Lilly and Company (NYSE:LLY). In just the past year, shares of the stock are up 88.5%. This comes on the back of tremendous growth driven by its weight loss drugs. As I detailed in a prior article, this has the potential to generate tremendous value for the company and its investors. But up until recently, the conversation has really only been focused on the US market.

The good news is that this is no longer the case. Earlier this month, on July 19th, news broke that the drug regulator in China, the National Medical Products Administration, had approved Eli Lilly’s weight loss therapy, tirzepatide, for the purpose of providing long-term weight management. This follows news in April of this year that the drug would be able to be sold for the same purpose throughout the European Union.

At its core, Eli Lilly is an American company. In 2023, 63.9% of the firm’s revenue came from the US market. And over the past few years now, revenue here in the US has exploded higher. But with a tremendous number of obese and overweight adults in both Europe and China, this approval paves the way for even more upside over the next few years. Given how shares of the company are priced at this point in time, I’m not yet ready to upgrade the stock back to a ‘buy’ from the ‘hold’ I downgraded it to in February. But with earnings just around the corner, with management planning to announce them on August 8th before the market opens, this picture could always change.

A big win for Eli Lilly

As I mentioned, on July 19th, news broke that Eli Lilly’s drug, tirzepatide, had been approved for long-term weight management throughout China. Tirzepatide is the technical name for the dual GIP/GLP-1 receptor agonist that the company has developed. But it’s most commonly known as Mounjaro by those taking it for diabetes and as Zepbound for those who are not diabetic but who have other weight related issues.

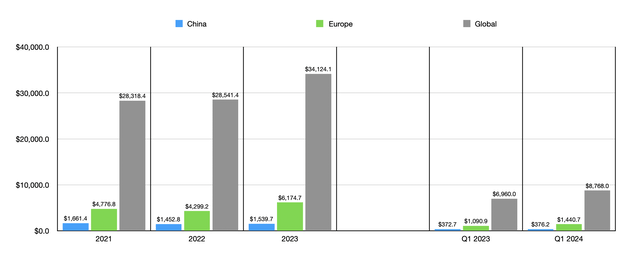

The fact of the matter is that Eli Lilly has a long history of operating in China. But over the last few years, financial performance there has stalled. In fact, even though revenue increased from $1.45 billion in 2022 to $1.54 billion in 2023, the 2023 reading was still lower than the $1.66 billion generated from China in 2021. Even this year, financial performance has been lackluster. For the first quarter of 2023, sales in China totaled only $372.7 million. For the first quarter of this year, that number had ticked up modestly to $376.2 million. Even so, that means that China accounts for only 4.3% of the company’s revenue.

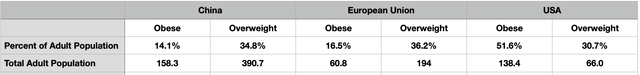

I suspect, with this approval, that this picture will change for the better. The fact of the matter is that China is a massive market, not just in general, but also for those who are overweight or obese. Back in 2018, it was estimated that 8.1% of the country’s population was obese. While this might seem small, that accounted for 85 million people at that point in time. What’s more, the obesity rate was three times higher than it was back in 2004. More recent data shows that about 14.1% of all adults in China are obese. Another 34.8% are overweight.

When you run the numbers, this means that about 158.3 million Chinese are obese. Another 390.7 million are overweight. To put this in perspective, for the US market, about 138.4 million US adults are obese, and another 66 million are overweight. Combined, this works out to 204.4 million. This means that the number of obese and overweight individuals in China is about 2.7 times higher than it is in the US. Though, of course, that picture flips if you focus on just the percentage of the population.

Unfortunately, Eli Lilly is not the first major player to get approval in China. Novo Nordisk (NVO) received approval to sell semaglutide (sold under the name Wegovy) in June of this year. It has had regulatory clearance to do so since 2021. The good news is that studies indicate that tirzepatide is a superior drug, so I don’t think this will hurt Eli Lilly in the long run. It is also worth noting that, back in May of this year, Eli Lilly did receive the right to sell tirzepatide in China under the brand name Mufenda to those with diabetes. But this is a far narrower market than long-term weight management in general.

This is not the only positive development for the company. As I mentioned at the start of this article, in April of this year, Eli Lilly received news that tirzepatide had received approval for two different indications in the European Union. This came courtesy of the European Commission. In this case, this is specifically for those with insufficiently controlled Type 2 diabetes for patients who are unable to take metformin or, according to the press release, need to take it for the treatment of diabetes instead of diet and exercise when combined with other medicinal products. It has also been approved for weight management in obese adults who have at least one weight related comorbidity, in addition to a reduced calorie diet and increased physical activity.

Based on the data that I was able to come across, the obesity rate in European countries varies significantly. For women, Italy has the lowest overweight and obesity rate at 37%. Croatia has the largest at 58%. For men, France is the best at 58%. And Croatia is the worst at 73%. But based on the data available, across the European Union, approximately 52.7% of all adults are either overweight or obese. 16.5% in total are obese, leaving the remaining 36.2% overweight. When you do the math, this works out to roughly 60.8 million individuals that are obese in the European Union. And the number that’s overweight comes in at roughly 194 million. This is actually 24.7% higher, in the aggregate, than the number that are obese or overweight in the US.

Historically speaking, Europe has been a much larger market for Eli Lilly than China has. In addition to this, it has been responsible for a lot more growth. Back in 2021, sales in Europe totaled $4.78 billion. That number grew to $6.17 billion in 2023. And for the first quarter of this year, the $1.44 billion generated from Europe dwarfed the $1.09 billion generated the same time last year. All combined, as of the first quarter of this year, Europe was responsible for 16.4% of the company’s overall sales.

On the whole, I would say that these are great developments for Eli Lilly and its investors. Considering that we are talking about a global market that has the potential to reach $130 billion in annual revenue by 2030, being able to focus on three massive markets will prove to be invaluable for the company. This does not mean that investors should consider buying the stock at this point in time. As I detailed in my most recent article about the company back in early May of this year, shares are incredibly pricey. Seeing as how the stock has moved up 11.7% since then, shares have gotten even more expensive. But instead of rehashing all of those numbers, I would just refer you to that article.

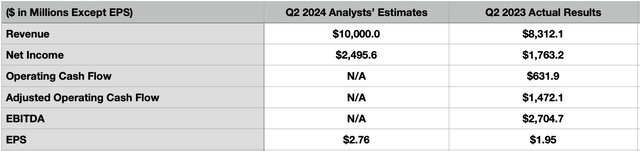

This does not mean that the picture cannot change, either for the better or the worse. The fact of the matter is that, before the market opens on August 8th, management intends to announce financial results covering the second quarter of the company’s 2024 fiscal year. Depending on how those results come in and what guidance looks like, my mindset could change. At present, though, analysts do have some rather aggressive expectations. They currently anticipate revenue of $10 billion. If this comes to fruition, it would translate to a 20.3% increase over the $8.31 billion generated in the second quarter of last year. Earnings per share, meanwhile, are forecasted to come in at $2.76. This would be well above the $1.95 per share reported the same time in 2023, and it would translate to an increase in net income from $1.73 billion to approximately $2.50 billion. Naturally, investors should also be paying attention to other profitability metrics. No estimates have been provided on these. But in the table below, you can see what they looked like in the second quarter of last year. In all likelihood, given the rapid growth that we are seeing for the firm, these will also improve nicely year over year.

Takeaway

The way I see things, Eli Lilly is growing at a rather fast pace. The company has tremendous potential for additional growth. And those growth opportunities continue to open up thanks to regulatory approval in overseas markets. I do not think that it is an ideal time to buy into the stock just yet. Shares do look very pricey. But that picture could change based on new data that is about to come out early next month. Until then, I think that keeping the company rated a ‘hold’ makes the most sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!