Summary:

- Lilly stock has been derided as exceptionally overvalued by most measures, e.g. price to sales, price to earnings, and revenues.

- The >$350bn valuation hinges on Lilly’s potential wonder drug Tirzepatide – a drug that is producing some astounding data readouts in diabetes and obesity.

- These markets are simply vast – nearly half of all Americans could be diagnosed as obese and gain access to Lilly’s weight loss drug.

- Lilly believes it can create a diabetes / weight loss franchise with orally available drugs, serving a market of billions globally. Alzheimer’s drug Donanemab is another mega-blockbuster in the making.

- It’s easy to be skeptical, especially on Donanemab, but my bearish sentiment is beginning to change – Lilly could be set for a momentous decade and its share price another 15% upside at least in 2023.

Viktoria Ruban/iStock via Getty Images

Investment Overview

2022 was a poor year for the stock market – with the S&P 500 sinking in value by ~19% – its first year of decline since 2018, and only the second time it has suffered a down year since the financial crisis in 2008.

It was a far more torrid year for the biotech sector – the flagship SPDR S&P Biotech ETF (XBI) fell by 26%, after falling >20% in 2020 – a devastating blow for an index that had delivered >30% gains in 6 of the past 10 years.

Within the large Pharmaceutical sector, stock prices were generally buoyant, with the “Big 8” US Pharmas – by order of market cap Johnson & Johnson (JNJ), Eli Lilly (NYSE:LLY), AbbVie (ABBV), Pfizer (PFE), Merck & Co (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN), and Gilead Sciences (NASDAQ:GILD) – realizing average share price gains of >15%.

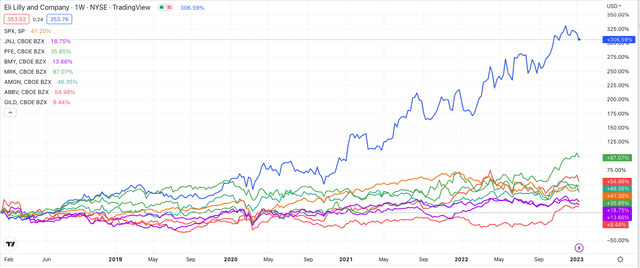

Of these 8 giants the best performing stock price belonged to Eli Lilly – the subject of this post. Lilly shares returned 35%, just a shade higher than Merck & Co. In fact, Eli Lilly’s 5-year returns have been nothing short of spectacular, as shown below.

Share price performance of “Big 8” US Pharmas – past 5 years (TradingView)

Lilly’s share price is up >300% since 2018, whilst the next best performance – Merck & Co again – is +97%, and the S&P 500 is +41% across the same period.

Perhaps even more surprising is that when you take a closer look at Eli Lilly’s performance as a company over the past 5 years, there is little to suggest the Indianapolis-based Pharma deserves such a high valuation.

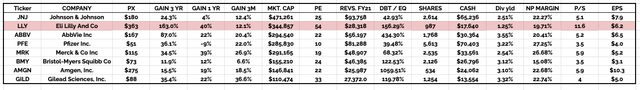

investment fundamental of “Big 8” US Pharmas compared (data collected from TradingView, Google Finance)

If we look at the above table, we can see that Lilly earned revenues of $28.3bn in FY21. That is the lowest amongst the “Big 8” except for Gilead – $27bn – and Amgen – $26bn. Despite the equality in terms of revenues generated, Lilly is >3x more valuable than Gilead, and nearly 2.5x more valuable than Amgen.

In fact, Lilly’s market cap valuation of $344bn is >$50bn higher than Pfizer, despite the fact that Pfizer posted revenues of $81bn in 2021, and will post revenues >$100bn in 2022 – up 23%, whilst Lilly is forecasting for revenues of $28.5 – $29bn – scarcely an improvement on 2021.

I will not labour the point in this post since I have made the same points in previous posts – it is fairly common knowledge that Lilly enjoys a market cap valuation that is out of all proportion to its revenue generation, profit margins, price to sales and price to earnings ratios – as impressive as they are, in keeping with the Big Pharma sector as a whole.

The general consensus – shared by myself in several posts for Seeking Alpha over the past year – is that Lilly stock was overvalued and was due a substantial downward correction, but that correction has not materialized, and I must admit that after studying the company’s pipeline in more depth, I am beginning to see the light.

Lilly’s 2-In-1 Wonder Drug Tirzepatide Could Be An All-Time Bestseller

It’s clear that Lilly must be in possession of an intangible strength that analysts and the market regard as being worth more than, say, the $100bn of extra revenues generated by Pfizer in 2021 and 2022 from its COVID vaccine Comirnaty, and antiviral Paxlovid, or worth 2.5x more than the $46bn of revenues generated by BMY in 2021, and the succession of new blockbuster drug products BMY has launched since its $77bn takeover of rival Pharma Celgene in 2019.

Primarily, Lilly’s skyrocketing valuation has been driven by 2 key fields of research – or 3 if you are splitting hairs – Alzheimer’s, and Obesity / Diabetes.

in May last year, Lilly secured approval for its dual GIP and GLP-1 (glucagon-like peptide-1) receptor agonist Tirzepatide as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes. According to the CDC there are 37m people in the US with Type 2 diabetes, and the list price for Mounjaro – the brand name for Tirzepatide in diabetes, is (according to Medscape) ~$975 for a four weekly dose regime, or ~$12,666 per annum.

We can therefore calculate the total addressable market for Lilly’s new drug – theoretically at least – to be ~$470bn – in the US alone! Of course, there are >150 drugs approved to treat Type 2 diabetes already, but Tirzepatide/Mounjaro’s performance in clinical trials sent it straight to the top of the class. Announcing Mounjaro’s approval in a press release, the FDA commented:

In trials comparing Mounjaro to other diabetes medications, patients who received the maximum recommended dose of Mounjaro had lowering of their HbA1c by 0.5% more than semaglutide, 0.9% more than insulin degludec and 1.0% more than insulin glargine.

Semaglutide refers to the Danish Pharma Novo Nordisk’s (NVO) G1P receptor agonist Ozempic – formerly considered best-in-class – which was approved in 2018, and earned $4.9bn of revenues in 2021, and >$6bn across the first 3 quarters of 2022.

In short, sales of Ozempic are growing by nearly 100% per annum, so we can only imagine what kind of sales Mounjaro – with superior access to the most lucrative US market and a better efficacy profile – can achieve. Analysts have set peak sales targets as high as $25bn per annum – which would make Mounjaro one of the all-time best-selling drugs.

The astonishing thing about Tirzepatide, however, is that it may achieve even higher sales in a separate indication – obesity.

According to the online publication diaTribe Learn:

Tirzepatide is known as a “dual agonist” or a “dual GIP and GLP-1 receptor agonist.” It is similar to GLP-1 receptor agonists, which have been shown to lower glucose levels, lead to weight loss, and lower the risk of heart disease, but then adds a GIP agonist.

The effect of Tirzepatide in its pivotal, >2,500 patient Surmount-1 study in patients with obesity is described by diaTribe as follows:

Those taking Tirzepatide at the lowest dose (5 mg) had an average of 15.0% loss in body weight over the course of the trial.

For groups taking higher doses of 10 mg and 15 mg, weight loss went up to 19.5% and 20.9%, respectively.

In this final group taking 15 mg, 63% of people achieved weight loss of over 20% of their body weight.

This data confirms the already highly promising results from Lilly’s 5 pivotal, Phase 3 SURPASS studies, and establishes Tirzepatide as not only a best-in-class therapy for obesity, but a potentially revolutionary one.

According to the Centers For Disease Control (“CDC”) 42% of the US population can be considered obese, and the estimated annual cost of obesity is ~$173bn. To summarize, Tirzepatide aced its pivotal study in weight loss, looks likely to be approved this year, and has an addressable market that is ~5x larger than Mounjaro’s. Perhaps it is no wonder that analysts and the market are so excited about Lilly’s future.

Could it possibly get any better for Lilly? Yes, apparently it can! During a fireside chat at the J.P. Morgan Healthcare conference yesterday Lilly’s Chief Scientific and Medical Officer discussed an oral, as opposed to injectable form of Tirzepatide:

I think there’ll be some patients who are new to the class and prefer to start with an oral perhaps or even stay on an oral. I think we also just see the magnitude of the challenge in obesity.

And I was saying the numbers, 100 million Americans, this is a once a week injectable is tirzepatide. So multiply that by 52, that’s 5 billion devices to make. And around the world, we’re going to have 1 billion people with obesity.

So it’s not a market that can — I think, ever be addressed purely by injectable. So it’s really important to have an oral there and super excited to have that go to Phase II

To provide some context, Pfizer has earned somewhere in the region of $70bn from its Comirnaty COVID vaccine, supplying ~3bn doses at ~$25 per dose. Lilly is forecasting that it will make 5bn devices per annum, for a disease that, unlike COVID, will not subside within a couple of years, and for the billion or so people around the world suffering with obesity, it will also produce a more convenient, oral version of the drug!

In other words, Tirzepatide can potentially match or exceed sales of Comirnaty – probably the biggest selling drug of all time over a 2-year period – every year for perhaps the next 2/3 decades.

Let’s temper the enthusiasm somewhat and consider the fact that Lilly will not have the market to itself for long – other Pharma’s will clearly be desperate to bring their own GIP / GLP-1 receptor agonists to market. But then again, Lilly will likely have some patent protection, for perhaps as long as a decade – AbbVie’s all-time best selling autoimmune drug Humira, for example, fought off generic market entrants for well over a decade.

Tirzepatide is not side-effect free, with patients reporting instances of nausea, constipation, and diarrhea, although these were generally mild-to-moderate in nature. Prescribing physicians have also expressed a historical distaste for patients taking medication to cure obesity, when healthier lifestyle choices can have as great, if not a greater effect. Similarly, in the present day, it is hard to imagine 100m Americans self-injecting themselves with Tirzepatide before sitting down to dinner.

Despite these concerns, however, I am becoming increasingly persuaded that Lilly’s Tirzepatide is a once-in-a-generation drug that could have as profound an effect on healthcare, and society in general, as the likes of say Lyrica, Viagra, or Prozac.

As huge as the markets are for fields such as autoimmune, oncology, and central nervous system disorders are – and they are likely all worth >$100bn, diabetes and obesity could in grow to be an order of magnitude larger. By 2030, according to some sources, the market for these 2 illnesses could already exceed >$100bn.

Looking Ahead – How Will Lilly Grow Between Today & 2030, & What Ought The Share Price Be Worth Today?

In an article I posted on Lilly at the end of September, I warned that the Pharma’s “Valuation Feels Impossibly High – Don’t Board This Hype Train”.

Fast forward 3 and a half months and “Choo Choo, tickets please!” after taking a deep dive into the Tirzepatide data and researching the full scope of the drug’s potential use cases, I feel I am almost ready to board.

In my September post I shared detailed financial forecasting for all of Lilly’s existing marketed products and several of its pipeline assets, assuming that they will win approval. My conclusion then was that even if Lilly doubled sales between 2022 and 2023, driving top line revenues >$60bn, modelling that scenario and applying discounted cash flow analysis, the highest share price I could generate was ~$250 per share.

That was based on looking at historical drug sales performance, pricing trends, and – because I was using CAGR to generate forward forecasting – backweighting the majority of sales much more towards the end of the decade than the beginning or middle. Thanks to the time value of money, that potentially impacted the valuations I was generating.

When forecasting drug sales, it is usually a good idea to take a more conservative outlook, since analysts can often get carried away, and it is easy to set a double-digit billion sales target, but much harder to create such a scenario in a real life setting.

With Lilly and Tirzepatide, however, I am starting to think I may not have been optimistic enough, and the really frightening thing – for Lilly’s rivals at least – is that the Pharma is confident it can win approval for at least 2 more Obesity / Diabetes drugs, plus an additional Alzheimer’s drug, and a new breast cancer drug.

In my last post I included forecasting for the as yet-unapproved Lebrikizumab, a pivotal trial stage drug targeting Atopic Dermatitis, Mirikizumab, at the same stage and targeting ulcerative colitis, Pirtobrutinib, a Bruton’s tyrosine kinase (“BTK”) inhibitor challenging for approval in mantle cell lymphoma, and Chronic Lymphocytic Leukemia, and Alzheimer’s therapy Donanemab.

In my revised forecasts, I have added into the forecasting 4 of the 5 late stage assets discussed by CSO and CMO Skovronsky in yesterday’s JPM conference fireside chat as follows:

So the next five are once weekly insulin, which I think is a really important innovation for patients with diabetes. The next generation Alzheimer’s disease drug called Remternetug. We have an oral SERD for breast cancer. I think it’s in a Phase III trial in adjuvant breast cancer setting.

And then just last month, we announced two more molecules moving into Phase III for diabetes and obesity. That’s our oral GLP-1 Orforglipron, and our triple agonist to GGG Retatrutide for obesity. So pretty exciting time to have so many new launches and then also a full pipeline of next gen molecules.

I have opted against including once-weekly insulin – instead, however, I have slightly raised sales of existing diabetes portfolio drugs such as Humulin, Jardiance, and Trulicity, all of which very much have a future, despite the emergence of Tirzepatide.

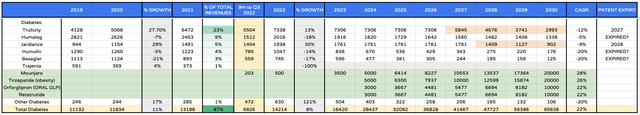

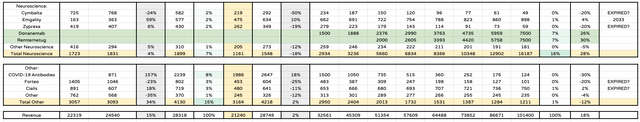

Lilly revenues forecasts – Diabetes / Obesity (my table and assumptions)

In my updated forecasting for Diabetes / Obesity as we can see above, I am throwing caution to the wind and projecting that the diabetes / obesity franchise, consisting of existing drugs plus newly approved Mounjaro, Tirzepatide in obesity, plus the oral GLP and second obesity drug Retatrutude, will generate >$65bn by 2030 on its own.

I have included patent expiries (highlighted orange) and reduced sales by 20% per annum post loss of exclusivity (“LOE”), and included CAGR growth figures and a column showing each drugs contribution to overall revenues, so readers can see how the company changes over time.

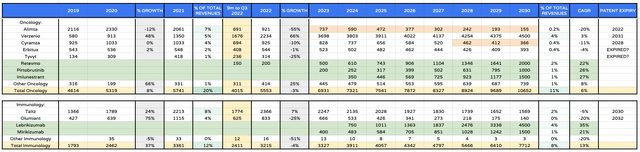

Eli Lilly product revenue forecasts to 2030 – oncology and immunology (my tables and assumptions)

Within oncology and immunology, I make only minor adjustments to my previous forecasts, and see the division capitalising on 3 major new approvals to double revenues between 2022 and 2030.

Eli Lilly product sales forecasts to 2030 – neuroscience, other and Totals (my tables and assumptions)

Finally, my only change within neuroscience is to increase revenues from Alzheimer’s drugs from $10bn, to $15bn, but I am splitting these revenues between 2 drugs as opposed to just Donanemab. I have not discussed donanemab much in this post – please see my last post for more detail – but the approval of Biogen (BIIB) / Eisai’s Lecanemab opens the door for an accelerated approval of a potential double digit billion selling asset this year.

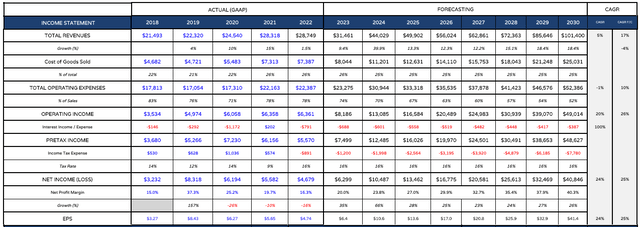

Eli Lilly projected income statement (my tables and assumptions)

Having completed my sales projections, I am now ready to provide a projected income statement. I would draw readers attention to the total operating expenses, which I reduce from 78% of revenues in 2022, to 52% by 2030.

This is to reflect the fact that Lilly will have a hugely significant first mover advantage in the diabetes and obesity markets which ought to drive higher profits – the only realistic challenger being Novo Nordisk’s Semaglutide, marketed as Ozempic in Diabetes, and Wegovy in Obesity. The profit margins generated by the likes of Moderna (MRNA) and Pfizer for their COVID vaccines were similarly wide.

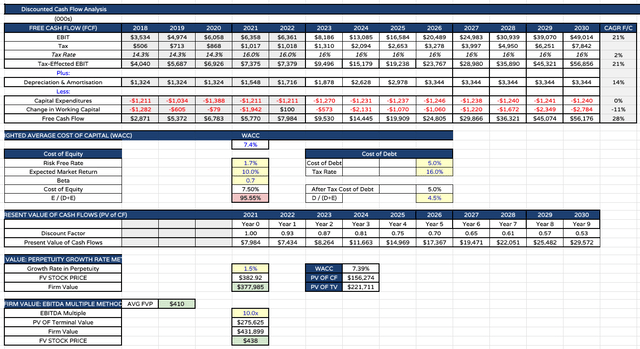

Lilly DCF analysis with EBITDA Multiple (my table and assumptions)

Finally, I can present my updated price target using the average of present day firm valuation divided by total shares for both my perpetuity growth rate and EBITDA multiple methods – which works out at $410, with the perpetuity calculated share price $383, and EBITDA multiple $438.

Conclusion – Hard To Believe But Lilly Shares Could Be Undervalued Relative To A Generational Opportunity

It certainly takes a leap of faith to believe that Lilly, a company that has never produced a double digit billion selling drug, could see no fewer than 5 drugs with that potential approved before 2025, with at least 2 drugs having peak sales potential >$25bn.

With that said, however, the evidence – certainly with Tirzepatide (safety concerns around Donanemab continue to concern me) is that Lilly has a best in class drug addressing 2 markets that are simply vast. Not only that, Lilly may even be capable of creating a franchise of double digit billion sellers in both Diabetes / Obesity and Alzheimer’s.

Where Pharma is concerned, perhaps investors need to more open to possibilities such as these, and ready to expect the unexpected – after all, would anybody have predicted in early 2020 that Pfizer would be driving revenues >$100bn in 2022 – if you had suggested such a scenario back then, you would likely have been laughed out of the room.

I have still had to massage down OPEX and be very ambitious with my peak sales targets to find a way to value Lilly that matches its current real-life valuation using forward sales and DCF analysis, so I will stop short of making Lilly a BUY – things could still unravel very quickly for a company that is trading at an incredible premium to its peers.

Nevertheless, the research that led to this article has at least partially convinced me that Lilly stock may not be overvalued, and may even be undervalued.

It would take a brave investor to buy Lilly stock at a price >$350 – but if you are prepared to follow your head and your heart, it could be the right call. Lilly’s drugs may be about to usher in an incredible, generational change to the way that we treat our bodies over the next couple of decades.

Disclosure: I/we have a beneficial long position in the shares of GILD, BMY, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.