Summary:

- Eli Lilly has acquired POINT Biopharma Global in a $1.4 billion all-cash deal.

- POINT Biopharma Global generates modest revenue and experiences significant losses, but its focus on radioligand therapy aligns with Eli Lilly’s oncology operations.

- The acquisition allows Eli Lilly to tap into the growing global cancer treatment market, which is expected to reach $366 billion by 2030.

JHVEPhoto

As one of the largest publicly traded companies on the planet, Eli Lilly (NYSE:LLY) has plenty of fuel that it can use in order to grow by means of acquisition. And the company has made sure to let the market know this. In August of this year alone, the firm completed three separate acquisitions. But the latest is of a publicly traded company called POINT Biopharma Global (PNT). This specific acquisition is interesting because, like many other small biotechnology and pharmaceutical companies, it generates only a modest amount of revenue and experiences significant net losses and cash outflows. At first glance, this might make it seem odd as a buyout candidate, especially at the $1.4 billion that Eli Lilly agreed to pay for it. But when you look at all the details and look at the arena in which Eli Lilly plays, this deal actually makes a tremendous amount of sense.

To be clear, this is not the first time that I have written about Eli Lilly, nor is it the first time that I have rated the company a ‘buy’. In late June of this year, I wrote a bullish article about the enterprise wherein I discussed its opportunity in the weight management market. What I called ‘miracle drug progress’ opened up a revenue opportunity that could go on to generate the company 10s of billions of dollars of additional revenue each year. Those reading this article now might think, then, that anything the drug company does in the cancer space is a side quest of sorts. But that would be a bad way of thinking. While it is true that the best opportunities for Eli Lilly are in the weight management market, the cancer market offers plenty of upside for shareholders, especially if acquisitions like this one turn out to be fruitful.

An interesting purchase

On October 3rd of this year, the management team at Eli Lilly announced that the company had reached an agreement to acquire POINT Biopharma Global in an all-cash deal valued at $1.4 billion. This scent shares of POINT Biopharma Global skyrocketing 84.9% to $12.36. This implies a spread of only 1.1% compared to the $12.50 buyout price agreed upon by the two parties. When you first look at the fundamentals behind POINT Biopharma Global, this may seem like a head scratcher of a move. After all, the company only just began generating revenue.

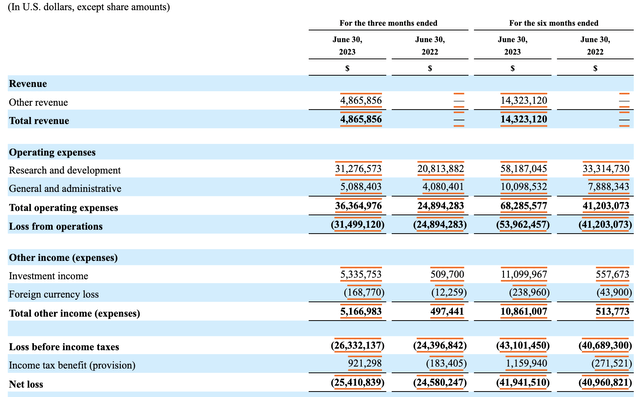

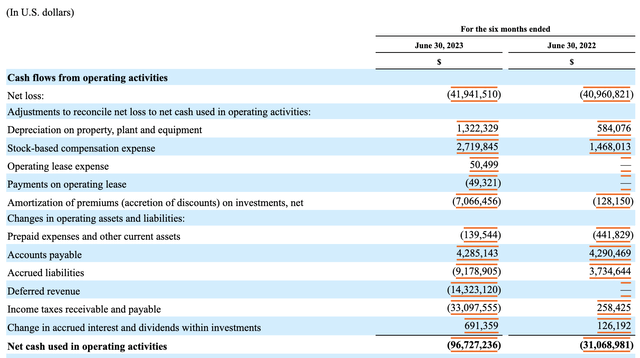

Take data from the first half of 2023 and compare it to the same time last year to get some idea of what we are dealing with. Revenue so far this year has been $14.3 million. That’s up from nothing the same time of 2022. Meanwhile, the enterprise generates significant losses. In the first half of last year, it reported net losses of $41 million. Those losses widened to $41.9 million the same time this year. Meanwhile, operating cash outflows tripled from $31.1 million to $96.7 million.

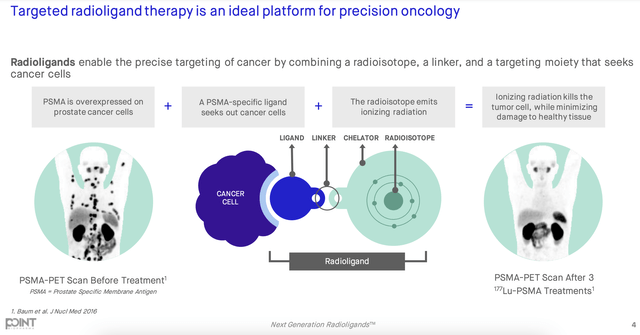

But when it comes to companies in this space, transactions often have far less to do with existing operations and far more to do with long term potential. And in order to understand that picture a bit better, we should come to know POINT Biopharma Global a bit better. According to management, the firm operates as a, ‘next-generation radioligand company’. While an actual doctor could get more into the weeds on this, radioligand therapy basically involves the process of taking a radioligand, which is composed of a ligand, a medical isotope, and a linker that connects the other two parts, and then launching the radioligand toward cancer cells to provide targeted therapy. The benefit of this technology is that, unlike many other radiation-based cancer treatments, radioligands are not widespread across the treatment area and, as such, do not cause damage to anything other than the cancer cells themselves.

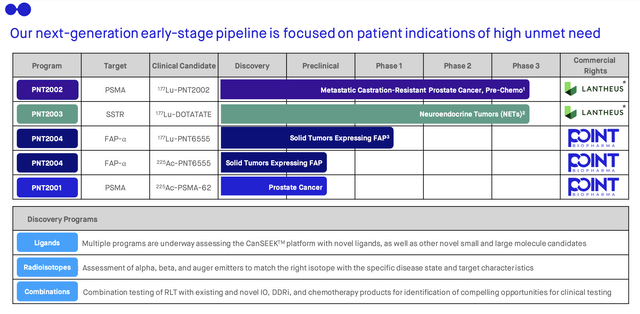

At this time, there are a variety of medical isotopes that have been prioritized for use in this treatment. These include Lutetium, Fluorine, Actinium, and Gallium. The platform developed by POINT Biopharma Global has focused on rare medical isotopes such as actinium-225 and lutetium-177. The company’s product pipeline consists of late-stage programs focused on the treatment of prostate cancer, such as using PNT2002, and neuroendocrine tumors using PNT2003. It also has an early-stage portfolio of programs such as PNT2001 and PNT2004. The late-stage ones happen to be based on lutetium-177, while the company uses both that and actinium-225, not to mention other isotopes, for early-stage development programs.

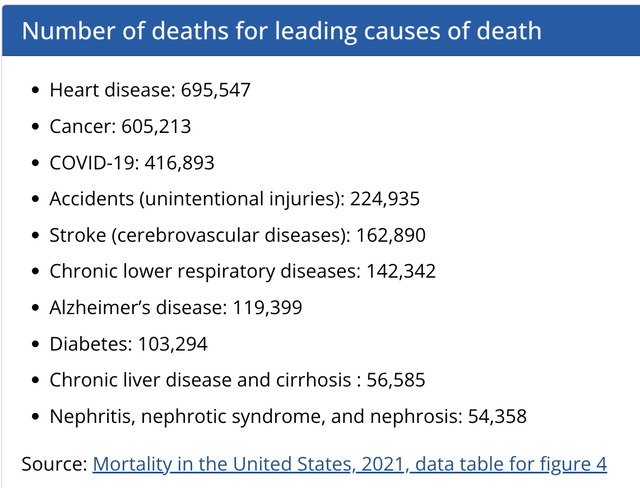

Earlier this year, I wrote an article discussing the opportunity that Eli Lilly has when it comes to weight loss drugs. I want to be very clear in that I still believe that is the most significant opportunity for the company in the near term. But this is not to say that the company cannot or should not look for other ways to grow. And frankly, addressing cancer is probably one of the best ways for a business already as large as Eli Lilly to grow. This is because, in 2021, the global cancer treatment market was estimated to be worth $166.5 billion. By 2030, that’s expected to grow to $366 billion. That’s a 9.1% annualized growth rate. In the US alone, cancer was the second leading cause of death in 2021, accounting for 605,213 individuals. This placed it only behind the 695,547 that died because of heart disease. To put this in perspective, COVID-19 killed 416,893 that year. And in a distant fourth place and fifth place were accidents and strokes with 224,935 and 162,890 deaths, respectively.

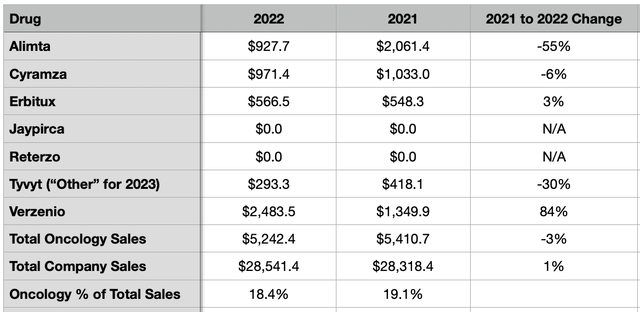

And what’s really great for Eli Lilly and its investors is that the company already has a rather large a portion of its operations dedicated to oncology. In 2022, $5.24 billion of its revenue came from its oncology products. That’s 18.4% of the $28.54 billion in sales the company generated that year. And even though its weight loss operations are growing at a rapid pace, the company’s exposure to cancer therapies only continues to grow.

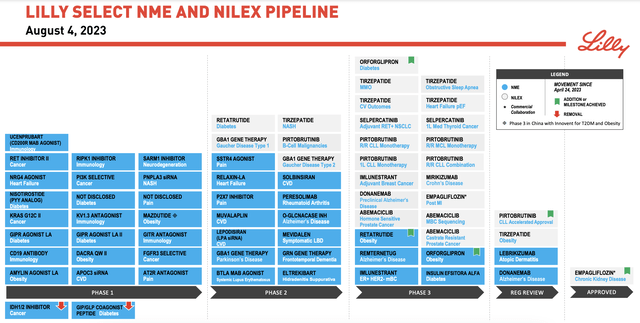

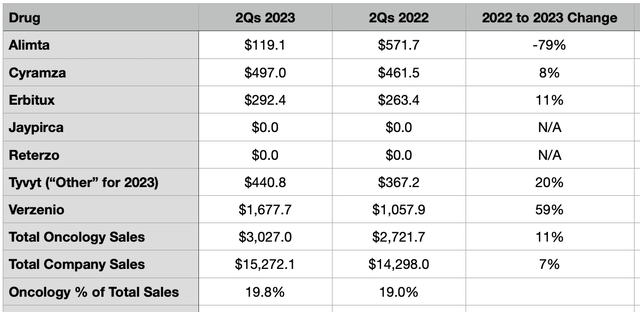

In the first six months of this year, $3.03 billion, or 19.8%, of its revenue involved oncology products. That’s up from the $2.72 billion, or 19%, reported the same time last year. This doesn’t even factor in the potential associated with a wide variety of other drugs that have yet to make it to the market. As of the end of the most recent quarter, the company had five different drugs that were classified as being in phase one that are dedicated to the treatment of cancer. It has another two drugs that are undergoing phase three trials that fit this description as well.

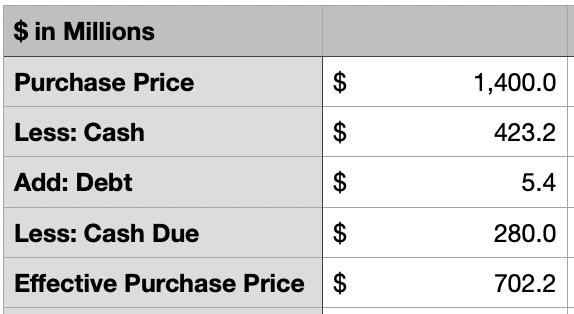

Now, regarding the price, only the market will tell at the end of the day whether or not this deal made sense. If Eli Lilly can capture billions of dollars of revenue in the future, then the transaction will certainly have been worth it. The good news is that the purchase of POINT Biopharma Global is not as expensive as it looks at first glance. You see, the company is paying $1.4 billion for the enterprise. However, the company has net cash totaling $417.8 million. That brings the effective purchase price down to $982.2 million. But the adjustments don’t stop there.

Author – SEC EDGAR Data

In November of 2022, POINT Biopharma Global entered into a strategic collaboration and exclusive license agreement with Lantheus Holdings (LNTH) whereby Lantheus received worldwide rights for both Lu-PNT2002 and Lu-PNT2003, excluding certain territories like Japan, South Korea, Singapore, Indonesia, China, and Taiwan, in exchange for some rather significant payments. Already factored into POINT Biopharma Global’s balance sheet is a $250 million payment associated with Lu-PNT2002 and a $10 million payment associated with Lu-PNT2003. If the US government grants approval for this deal to move forward, POINT Biopharma Global will receive another $280 million in payments. The company will also receive payments based on sales, if they top a certain amount, of up to $1.575 billion. And, they are slated to receive royalties of 10% and 15%, respectively, should sales reach a certain point as well. It is entirely possible that none of these thresholds will be met. But if we factor in the cash payments that will be due once regulatory approval is provided, then this brings the effective purchase price of the enterprise for Eli Lilly down to only $702.2 million. That’s approximately half of what the company is paying for it today.

Takeaway

Based on the data provided, I would argue that this maneuver by Eli Lilly is speculative just like any purchase in this space. However, I would say that it is definitely a deal that investors should be happy with. Shareholders of POINT Biopharma Global get a massive one-time payment, while Eli Lilly receives a good deal of risk and potentially significant additional revenue and cash flows should that bet turn out to be accurate. In all, I see this as a win for both firms, with Eli Lilly likely benefiting the most in the long run.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is a service geared toward investors who are interested in keeping track of oil and gas E&P firms. It offers its subscribers cash flow deep dive analyses into a portfolio of 36 different E&P companies of all sizes, as well as periodic sensitivity analyses. The world of E&P companies is incredibly volatile and understanding how healthy these firms are and how well they can stand up in different environments can result in attractive returns, especially in an environment where oil and/or gas prices are elevated.