Summary:

- Eli Lilly stock has underperformed the market since my previous caution, raising questions about whether significant optimism has been priced in.

- At an adjusted forward P/E of more than 50x, LLY investors looking to add at the current levels need to be wary about falling prey to FOMO.

- I gleaned that market rotation has likely occurred, with dip buyers likely taking the opportunity to reduce their exposure. Investors should seize the opportunity to cut early.

- With LLY priced for perfection, the risk/reward is highly unattractive at the current levels. I argue why it makes sense to cut before the southbound train leaves.

patpitchaya

My caution on Eli Lilly and Company (NYSE:LLY) has played out since my last update in September. Accordingly, LLY posted a total return of just 0.6%, relative to the S&P 500’s (SPX) (SPY) 7.6% gain over the same period. My analysis suggests that LLY is at a critical juncture, with dip buyers needed to sustain its upward bias. However, with LLY’s forward adjusted P/E above 51x (well above its 10Y average of 25.6x), questions must be asked whether it’s appropriate for investors sitting on significant gains to cut exposure.

LLY investors who added over the past year gained nearly 57% in total return terms. However, it should also be noted that it’s much higher than its 5Y and 10Y total return CAGR of 41% and 30%, respectively. In other words, investors looking to add exposure now need to seriously consider how much optimism has been priced into its weight loss drugs thesis, notwithstanding its market leadership with Novo Nordisk (NVO).

Wall Street expects Eli Lilly to continue dominating the space, even as its biopharma peers look to close the gap. As a result, Lilly is expected to further its dependence on its blockbuster GLP-1 therapies, with “close to two-thirds of the firm’s sales projected to come from this drug class by 2032.” Therefore, investors must continue monitoring the competition from Lilly’s peers, as the potential upside in LLY has likely reflected significant optimism.

Accordingly, competitors are also “developing weight loss drugs,” including oral therapies. It also caught the attention of an analyst on Lilly’s third-quarter earnings call, concerned about the impact of oral diabetes drugs against Lilly’s pricing levers. Management clarified that it doesn’t expect “a significant impact on the pricing of injectable diabetes drugs.” The company stressed that “new diabetes drug classes do not typically affect the pricing of existing drug classes.” As a result, Lilly remains focused on the success of its current portfolio and pipeline as it looks to square off against Novo Nordisk in the crucial diabetes/weight loss drugs market.

Lilly highlighted the critical differences in the efficacy of tirzepatide based on a “combination GLP-1 and GIP agonist.” Its research has shown that tirzepatide “appeared to boost efficacy while reducing side effects that limit tolerability, suggesting a positive outcome for GLP-1 agonism.” Observant investors should be aware of recent studies showing how Lilly’s therapy “demonstrates a significant advantage over Novo Nordisk’s rival therapy, semaglutide, in a real-world study.” Accordingly, tirzepatide was noted “to be three times more likely to lead to a 15% weight reduction compared to semaglutide.” Coupled with Zepbound‘s (targeted primarily at employers instead of PBMs) more aggressive price competition against Novo Nordisk’s Wegovy, Lilly anticipates continuing to gain share with its recent FDA approval.

Notwithstanding the excellent news over the past three months, as discussed above, LLY’s relative underperformance against the market could suggest underlying rotation. As a result, investors who bought into LLY earlier and were sitting on significant gains likely saw the opportunity to take profits. I assessed that such caution is justified, with LLY looking increasingly frothy.

With its 1Y performance way above its long-term average, investors adding at the current levels likely need the company to perform with perfection over the next three to five years. However, more intense competition from its peers could set back Lilly’s execution, worsened by the increasing concentration risks baked into its current weight loss drugs portfolio.

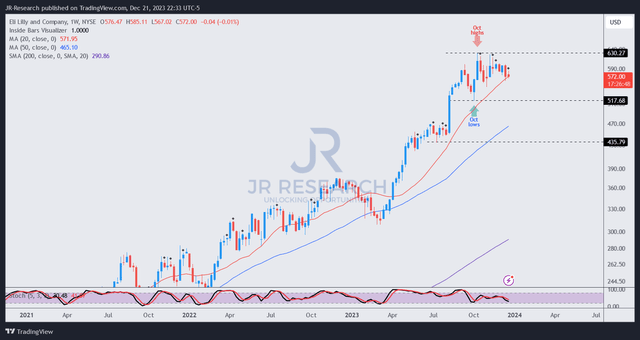

LLY price chart (weekly) (TradingView)

LLY’s price action suggests it could have topped out in October 2023 and could precede a steep decline before finding a sustained bottom, attracting dip buyers to return.

While I didn’t assess a bull trap or false upside breakout, LLY buyers have been unable to muster sufficient momentum to push higher, notwithstanding the significant broad market recovery since early November.

Therefore, I believe astute investors could be distributing from LLY, taking profits in a controlled cadence before eventually unloading at a faster pace. With that in mind, LLY investors should consider cutting exposure before that happens, as it could trigger much higher downside volatility, forcing a steeper selloff to dissipate the recent optimism.

I assessed two key levels to watch on LLY, with the $515 and $435 levels as its two critical support zones to underpin its medium-term uptrend. I might consider buying aggressively if LLY does get to the $435 level and is supported by aggressive dip-buying.

I urge investors to consider cutting exposure (you can still keep a core position if you want to hedge against upside potential) and rotate before the rest of the market does so.

Rating: Downgraded to Sell/Cut exposure.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!