Summary:

- Eli Lilly and Company has gained approval on yet another prospective blockbuster drug, Donanemab, the second FDA-approved Alzheimer’s treatment on the market.

- It is too soon to know what kind of impact Lilly’s Donanemab will have on future earnings, but I predict it will be fairly positive.

- Eli Lilly has proven its commitment to product depth and innovation, one of the many reasons it’s the largest holding at my firm.

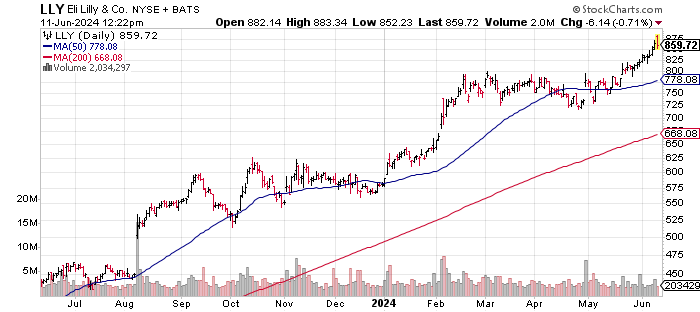

StockCharts.com

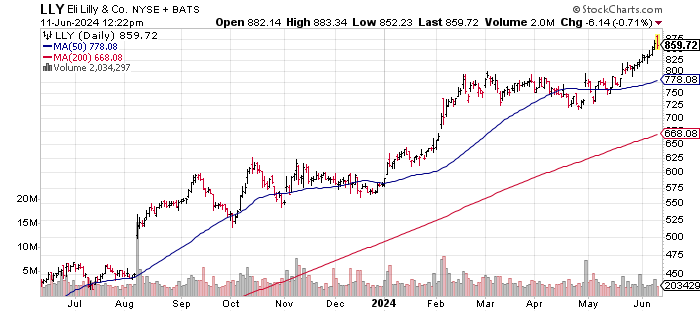

Last week I wrote an update on the largest overall holding at my firm, Eli Lilly and Company (NYSE:LLY), in an article titled, “Is It Possible Eli Lilly Is Breaking Out To New All-Time Highs?” Following strong earnings, approval of its blockbuster diabetes drug Mounjaro for weight loss, and a growing demand for weight loss drug solutions, I raised my 5-year target price to $1,455. This update was based on a very conservative projected growth rate of 19% per year and a multiple that I feel Lilly deserves.

Best Stocks Now App

Within a short few days of my last update, Eli Lilly has gained approval on yet another prospective blockbuster drug, Donanemab, holding the potential to capture half of the Alzheimer’s market. Donanemab is only the second FDA-approved Alzheimer’s treatment on the market, behind Leqembi, developed and manufactured by Biogen Inc. (BIIB) and Japanese pharmaceutical company Eisai Co., Ltd. (OTCPK:ESALF).

While this news celebrates a huge milestone in Alzheimer’s research and development, it comes with a strong safety label, cautious warnings around side effects, and hesitation to prescribe the drug due to extensive and expensive treatment requirements. The new drug appears to be most effective in mild or early cases of Alzheimer’s or dementia.

It is too soon to know what kind of impact Lilly’s Donanemab will have on future earnings, but one would think that it would be fairly positive. Over the next week or so, I’m sure many of the approximately 20 analysts who follow the stock will be putting a pencil to the potential size of the market for this drug and the possible market share that Lilly can garner.

Once we have some better numbers to work with, I will update my 5-year target price for Lilly. I would expect it to go higher. I also suspect the compound annual growth earnings growth rate will also go higher. Furthermore, I could see a potential target price in the $1,600 area, but I’m prepared to wait until we have better data on the possible impact that this new drug will have on Lilly’s future earnings.

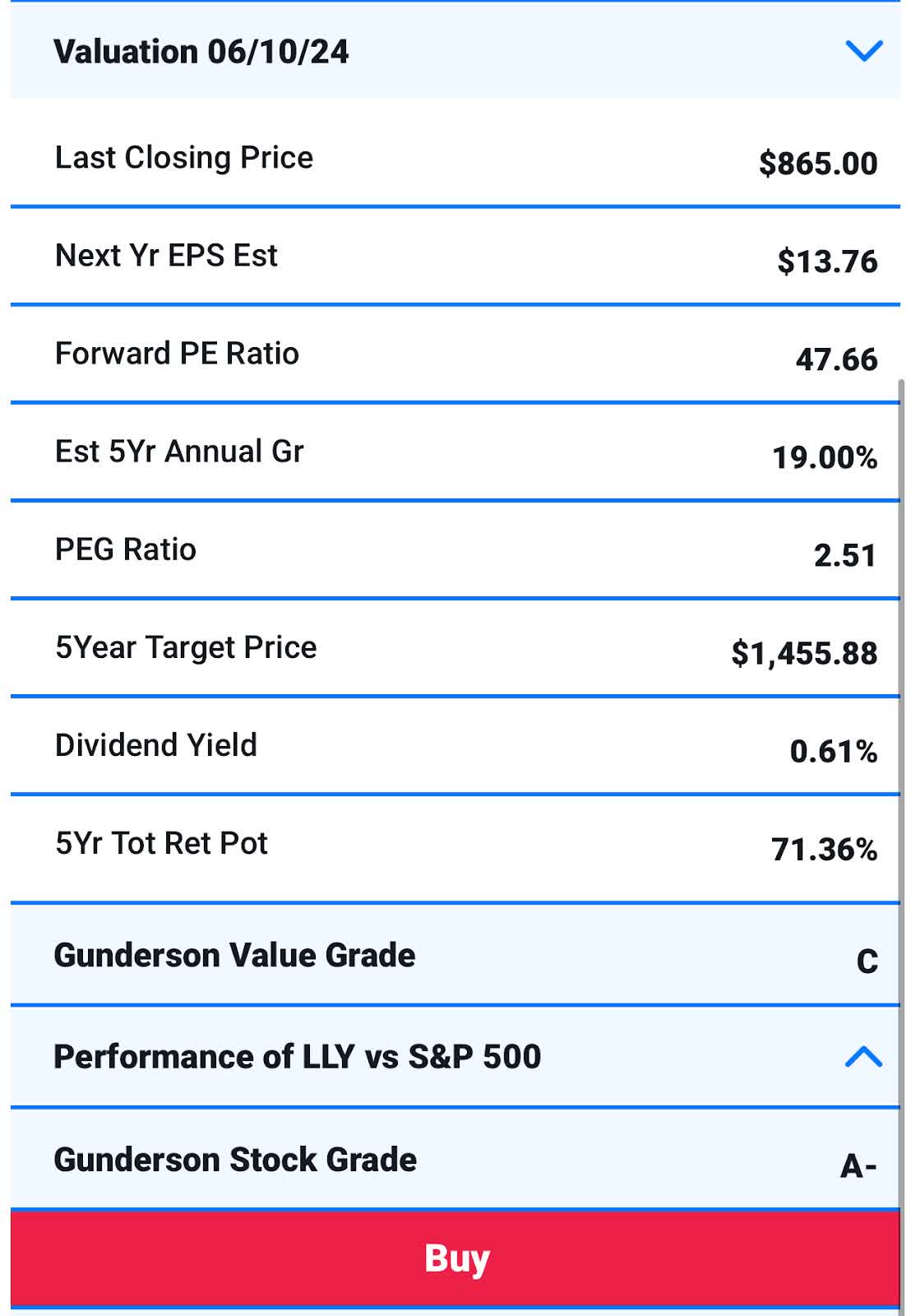

One of the reasons Eli Lilly remains the largest holding at my firm is because I believe Lilly is a great stock with or without the Alzheimer’s drug. Eli Lilly has proven its commitment to product depth and innovation, and I believe it will continue to do so. In the graphic below, you can see that the stock has done very well against the S&P 500 (SP500) over the last one, three, five, and 10 years.

Best Stocks Now App

Lilly continues to have a strong technical chart, and it has been hitting new, all-time highs.

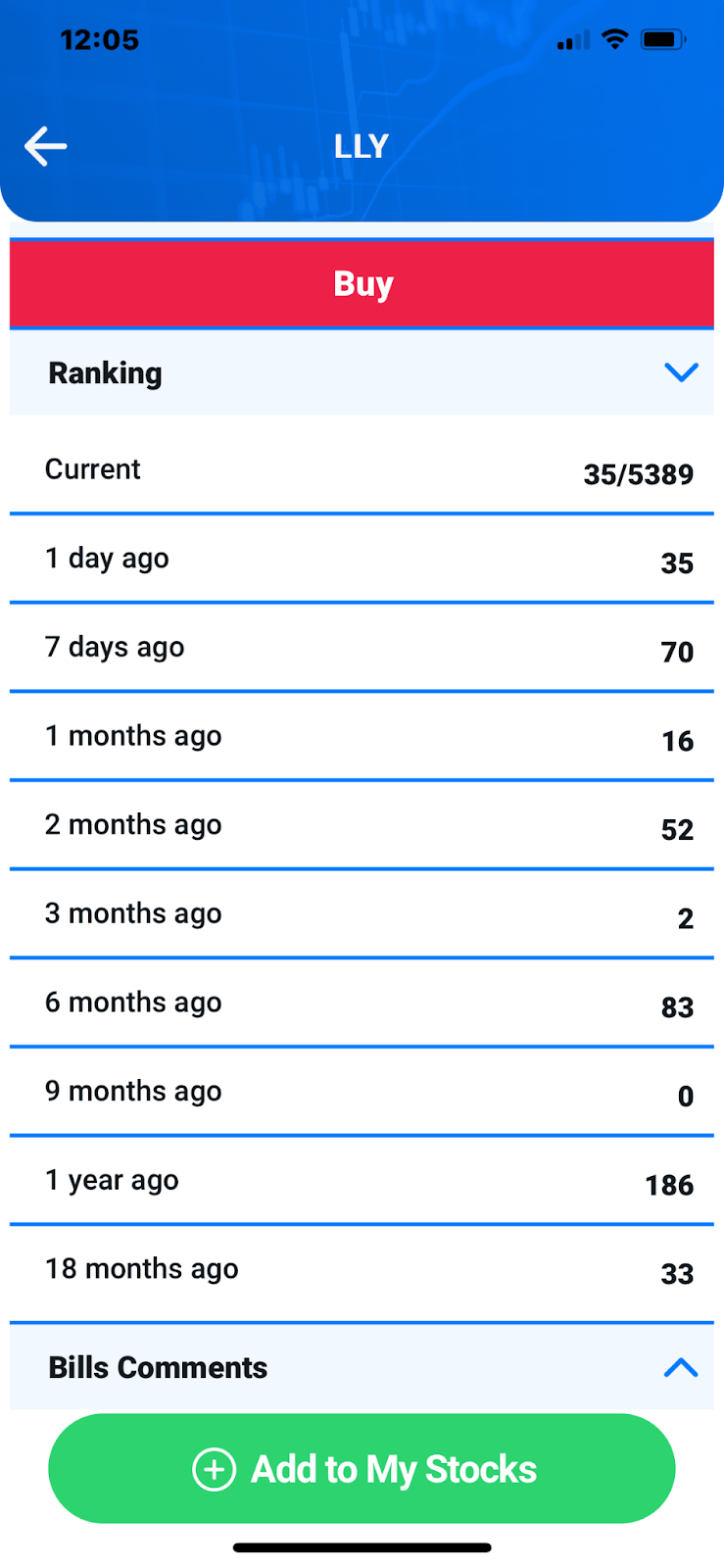

When compared against the 5,389 stocks in my database, LLY is ranked No. 35 and earns a performance grade of A+. Not bad for a Mega-Cap company that has been around since 1876!

Best Stocks Now App

We continue to rank Eli Lilly and Company stock as a BUY, and it continues to be our largest holding.

jetcityimage

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 23 years of experience.

You get Bill’s daily “live” buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, and Dividend & Growth. Our Ultra-Growth portfolio has tripled the returns of the S&P 500 since its 1/1/2019 inception, while our Premier Growth portfolio has doubled the returns of the market during that same time-period.

JOIN NOW to get daily “live” buys and sells, weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on over 5,300 securities, and a daily live radio show!