Summary:

- LLY may have found the next blockbuster drug, potentially exceeding ABBV’s Humira with FY2022 global revenues of $21.23B and MRK’s Keytruda worth $20.93B.

- However, we also believe that most of its upside potential has been fully baked in, with the stock’s exponential momentum nearing its peak optimism levels.

- While we concur with the market analysts’ bullish top and bottom line projections over the next few years, it remains to be seen when the Mounjaro shortage may end.

- This is on top of the ongoing lawsuit in the US, attributed to the “severity of stomach problems/ side effects,” potentially triggering volatility in LLY’s stock prices.

- We do not advise investors to chase this stock over the cliff.

Rowan Jordan/iStock via Getty Images

LLY’s Weight Loss Investment Thesis May Have Been Fully Baked In Here

We previously covered Eli Lilly and Company (NYSE:LLY) in July 2023, discussing the stock’s overly lofty valuations, attributed to Mounjaro as an alternative weight loss therapy to Novo Nordisk’s (NVO) Wegovy.

Despite the expensive list price of over $1K per fill, consumer demand had been insatiable, with the pharmaceutical company unable to supply fast enough and the shortage expected to last through 2023, if not 2024.

We had ended the article with a Hold rating then, since we believed that the stock’s valuations had been over-stretched, with a minimal margin of safety.

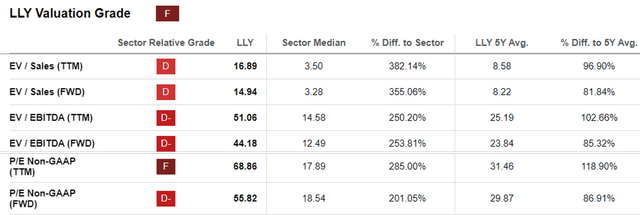

LLY Valuations

Since then, LLY’s valuations have been somewhat moderated compared to its 1Y means, though still elevated at FWD EV/ Sales of 14.94x, FWD EV/ EBITDA of 44.18x, and FWD P/E of 55.82x, compared to its 5Y averages and the sector median.

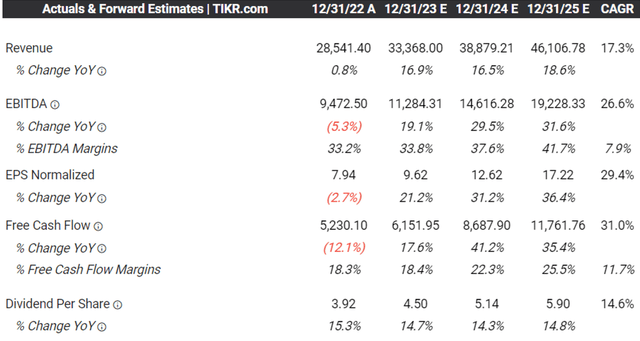

LLY’s Consensus Forward Estimates

Perhaps Mr. Market’s optimism is attributed to the promising consensus forward estimates for LLY, with an impressive top and bottom line expansion at CAGRs of +17.3% and +29.4% through FY2025, compared to its normalized growth of +5.1% and +14.5% between FY2016 and FY2022, respectively.

This is on top of the projected expansion in its profit margins from FY2019’s EBITDA and FCF margins of 33.8% and 17%, respectively, significantly aided by Mounjaro’s compound patents through 2036 in the US, 2037 in the EU, and 2040 in Japan, with no generics obtaining FDA approval yet.

LLY’s opportunities appear to be excellent as well, assuming a full FDA approval as a weight loss therapy, with Mounjaro currently approved as a type-2 Diabetes therapy.

Mark Purcell, a Morgan Stanley European Biopharmaceuticals analyst, now projects a drastic expansion in the global weight loss drug market size from $2.4B in 2022 to $77B in 2030, increasing at a CAGR of +54.27%.

Assuming a two horse race between NVO’s Wegovy/ Ozempic and LLY’s Mounjaro, we may see the latter obtain a bullish market share of up to 50%.

Based on Mounjaro’s FQ2’23 annualized top-line contribution of $3.91B (+72.3% QoQ/ 6,123.1% YoY), we may see the therapy deliver an impressive projected CAGR of +33.09% to our projected sales of ~$38.50B by 2030. Our projections remain modest as well, compared to some other analysts’ projections in annual sales of up to $50B.

It seems that LLY may have found the next blockbuster drug indeed, potentially exceeding AbbVie’s (ABBV) Humira with FY2022 global revenues of $21.23B and Merck’s (MRK) Keytruda worth $20.93B over the next few years.

There Are Risks To This Weight Loss Investment Thesis

However, we are uncertain if these growth levels warrant a near doubling from LLY’s 5Y valuations and near triple from the sector medians, putting its status near to that of Nvidia’s (NVDA) in the semiconductor sector, thanks to the generative AI boom.

We maintain our conviction that this optimism may not be sustainable.

It also remains to be seen when LLY may successfully ramp up its production cadence, potentially impacting its top-line over the next few quarters, based on the management’s recent commentary in the FQ2’23 earnings call:

As we go forward, we’ll — our manufacturing team is working on bringing on new capacity at North Carolina and then a few more areas. And as that production comes on and ramps up, we will see some benefit from that supply.

In the short term, because we’re seeing really unprecedented demand, we do still expect to see tight supply and some spot outages on Mounjaro… in the next couple of months and quarters. (Seeking Alpha)

In addition, many other pharmaceutical companies have been developing similar weight loss therapies, including Pfizer (PFE), Amgen (AMGN), Zealand Pharma (OTCPK:ZLDPF), and OPKO Health (OPK), potentially eroding LLY’s future market share in the long-term.

Lastly, we maintain our conviction that LLY’s 5Y normalized P/E valuation of 29.87x is already rich compared to the sector median of 18.54x.

Combined with the consensus FY2025 adj EPS estimate of $17.22, we believe the stock is also expensive at current levels, with all of its upside potential to our long-term price target of $514.36 already pulled forward.

Furthermore, investors must note that any whisper of pessimism may potentially trigger a steep sell-off moving forward, with LLY already engaged in lawsuit in the US, attributed to the “severity of stomach problems/ side effects” from Mounjaro.

So, Is LLY Stock A Buy, Sell, or Hold?

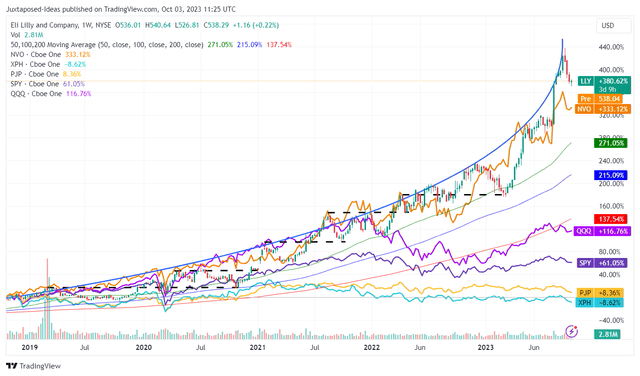

LLY 5Y Stock Price

For now, the same optimism has been observed in the NVO and LLY stocks, naturally outperforming the wider market, the tech rally, and the wider pharmaceutical market.

Nonetheless, based on the exponential momentum observed thus far, we believe LLY may be nearing its peak optimism, with the rally likely to meet its ceiling soon. Combined with its pulled forward upside potential, we do not recommend anyone to chase the rally here.

As a result, we maintain our Hold (Neutral) rating on the LLY stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.