Summary:

- Eli Lilly has received FDA approval for ‘Zepbound’ as a GLP-1 weight loss drug seen as a significant growth driver over the next decade.

- The company benefits from a strong outlook, although we believe many of the positives have already been priced in.

- A lofty valuation and risks to current sales estimates should add volatility to LLY stock going forward.

Liudmila Chernetska/iStock via Getty Images

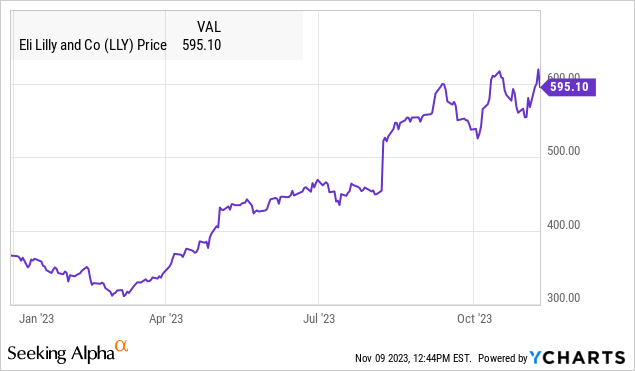

Eli Lilly and Company (NYSE:LLY) is one of the biggest stock market stories this year with shares nearly doubling from its Q1 low. The current market cap of around $550 billion makes LLY the most valuable healthcare company in the world.

A large part of that recent momentum has been in anticipation of the recent FDA approval of “Zepbound”, found safe and effective for weight loss. Lilly now joins Nordisk A/S (NVO) with their “Wegovy” and “Ozempic” as the main players in this market for GLP-1 receptor agonists that help regulate appetite.

These drugs are seen as a game changer in dealing with obesity at the clinical level and have already become immensely popular. Recent forecasts suggest the market may reach $72 billion in annual sales over the next decade, split between Lilly and Novo, highlighting the growth potential.

That being said we see room to turn a bit more cautious on the stock following what has already been a spectacular rally likely pricing in much of these positive tailwinds. Ultimately, valuation is a question mark and we expect shares to face volatility with room for a deeper correction going forward.

Strong Growth But Lofty Expectations

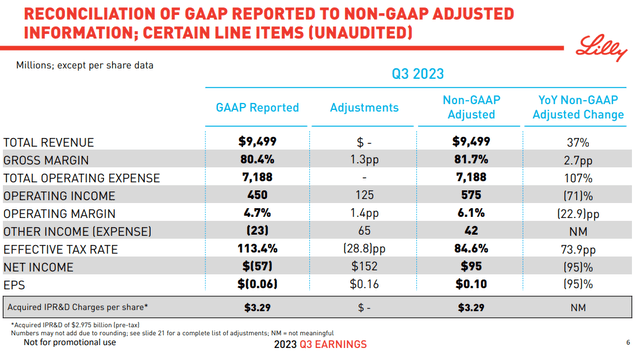

Eli Lilly is benefiting from a broader blockbuster drug portfolio. The company reported Q3 results with revenue of $9.5 billion, up 37% y/y, and beating estimates by $500 million.

The market-leading breast cancer treatment “Verzenio” reached $1 billion in Q3 sales, up 68% y/y. “Jardice” as an SGLT2 inhibitor used to treat type 2 diabetes, also approved for heart failure has performed well with sales accelerating internationally. The new “Mounjaro”, the previously approved version of Zepbound, in a separate class of treatment against diabetes, has also captured a strong market response.

Investors can also look forward to a possible approval of “Donanemab”, for the treatment of early symptomatic Alzheimer’s, with an expected FDA decision by Q1 2024. Overall, it’s clear there are several growth drivers.

The understanding is that even as earnings are pressured in the near term given the higher R&D spending and the ramp-up of production ahead of the commercialization push, profitability is expected to accelerate going forward.

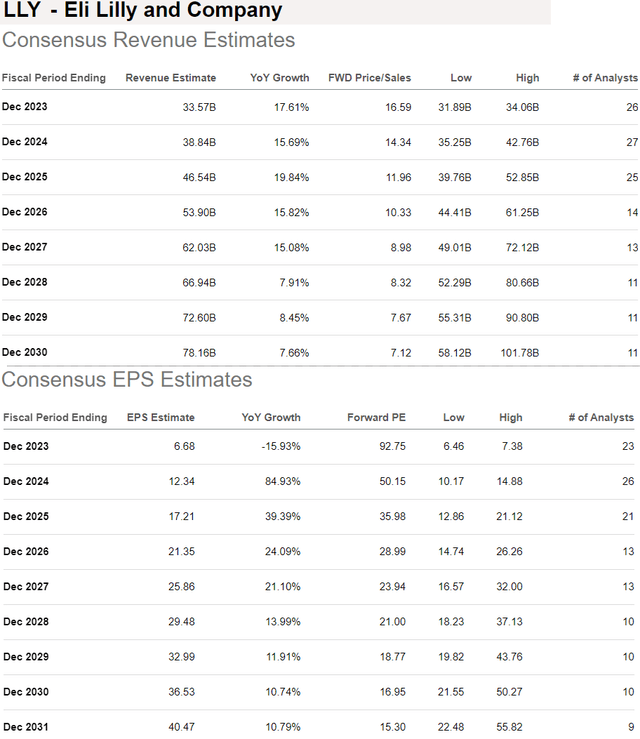

According to consensus, compared to a forecast for LLY to reach $33.6 billion in revenues this year, up 18% y/y in line with management guidance. The market sees annual revenue growth averaging 17% annual growth through 2027.

The path is even stronger for earnings, with the forecast for EPS to rebound from a -16% decline and $6.68 this year towards $12.34 in 2024. That figure is seen as nearly tripling to $36.53 by 2030.

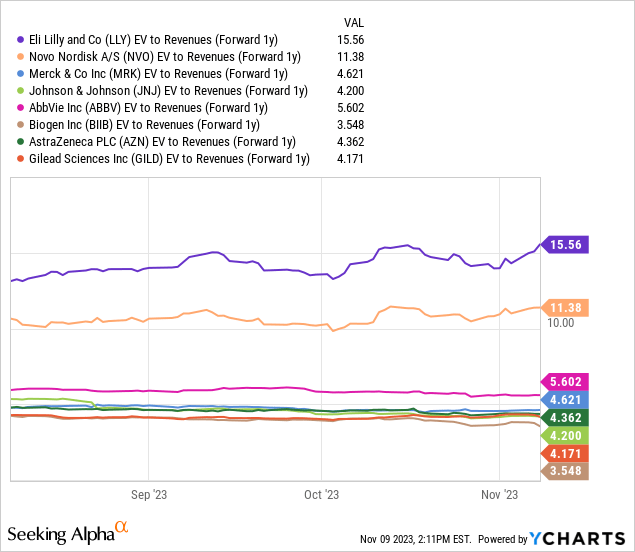

Naturally, there is a lot that can happen in the next 10 years between both positive surprises and the risk of weaker-than-expected results. What we do know is that LLY is trading at a significant premium, considering at nearly 15x consensus 2024 sales and even 50x the EPS for next year.

Not only are these levels unprecedented for a mega-cap drug company, but even at a large spread to NVO which is the first-to-market leader of the GLP-1 drugs on the weight loss side.

On its own, we can tolerate these types of multiples in high-growth stocks and can cite examples like Tesla (TSLA) or NVIDIA (NVDA) which have traded at these levels and were able to grow into those implied valuations over time by delivering on the results. In this case, we’re just not convinced the weight loss opportunity warrants this type of enthusiasm.

Why We’re Skeptical Of the GLP-1 Market

The first point here is that even assuming the addressable market opportunity for Zepbound has been correctly estimated at $72 billion or even $90 billion by other measures by 2030, there isn’t much in terms of a competitive moat long term or brand differentiation, for what could become a commoditized treatment.

Companies like Pfizer (PFE) and Amgen (AMGN) are moving forward with their own experimental GLP-1 weight loss candidate drugs which we interpret as evolving into an intensively contested market. It’s possible another competitor version could perform better clinically for various reasons.

Furthermore, we can push back on the idea that the addressable market for these drugs will capture “all” clinically obese people. Just like the experience with the COVID-19 vaccine, even people who may benefit from Zepbound may simply not want to go through with the treatment.

Some people are comfortable being overweight meaning the intake level of the drug following this early popularity could start to wane. Our point here is to say there is some downside risk to the estimates in the table above, as a key risk for investors to consider.

LLY Stock Price Forecast

Our call here is that the latest headlines of the Zepbound FDA could mark a near-term top for the stock where gains from the past year can at least consolidate. For investors and traders who got in early, this may be a good opportunity to take profits and reduce risk.

So while we won’t claim LLY is a “great short” idea, we expect any upside to be limited over the next several months with risks tilted to the downside as the bullish catalysts have already played out. A break lower in the stock under $550 could open the door for a deeper correction down to $450 as the next area of apparent technical support.

Monitoring points over the next few quarters include not only sales updates but we believe the market will begin to focus more on operating margins and cash flow trends. On the upside, it will be important for eventual fiscal 2024 guidance to supersede current consensus estimates, with indications that sales of new products are stronger than expected.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in LLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.