Summary:

- Eli Lilly has proved me wrong again, outperforming the S&P 500 since my previous update.

- Lilly is gaining share and achieving breakthroughs in the US commercial market.

- Its pipeline is growing, potentially expanding the treatment areas and bolstering its TAM.

- LLY’s valuation is a critical concern, but its robust execution has improved its ability to actualize its high-growth thesis.

- I explain why it’s timely for me to acknowledge that I’ve gotten LLY’s thesis incorrectly. Read on to find out more.

JHVEPhoto

Eli Lilly: Robust Growth Momentum Overcomes My Bearish Thesis

Eli Lilly and Company (NYSE:LLY) investors have continued to lift its momentum as the leading GLP-1 weight loss drugs maker lifted its guidance at its recent earnings scorecard in August 2024. As a result, LLY has outperformed the S&P 500 (SPX) (SPY) markedly since my previous update in early May 2024. I must concede that I’ve vastly underestimated the secular growth prospects underpinning Lilly’s market leadership. I’ve also understated the company’s ability to gain share against Novo Nordisk A/S (NVO) as Lilly ramps its capacity amid industry-wide shortages.

In my bearish LLY article in May 2024, I assessed Lilly’s potential to capture more market share in its bid to reshape the market dynamics with NVO. However, I was concerned about the apparent valuation bifurcation with NVO, suggesting the market could have been too optimistic about LLY’s growth potential.

Notwithstanding my caution, Lilly’s ability to upgrade its outlook at its Q2 earnings release has taken apart my Sell rating. Accordingly, Wall Street estimates on LLY have also been bolstered, justifying the market’s optimism. The launch of Zepbound has proved to be a success, as it recorded more than $1.2B in sales in Q2. As a result, it has markedly driven its new products portfolio, and the segment notched a 36% YoY increase in sales.

Accordingly, management noted it has made a significant breakthrough in its US commercial business, gaining about “86% access in the commercial segment.” Therefore, Lilly’s ability to rapidly expand coverage with employers has gained significant traction, justifying its growth opportunities. Furthermore, Mounjaro has also continued to perform admirably. Lilly’s GLP-1 success has afforded more clarity into its second-half performance, spurring the upgrade to its full-year revenue outlook.

Eli Lilly Could Expand Access To Other Treatments

Moreover, the company isn’t standing still, as it seeks additional indications in other critical therapeutic areas to expand its TAM. Accordingly, the company has progressed in several programs that could deepen its exposure to weight loss. Notably, LLY highlighted advancements in its Phase 3 pipeline for sleep apnea, osteoarthritis, and cardiovascular issues. In addition, Lilly expects to stretch its competitive advantages against new entrants by investing in “next-gen” portfolios. These are expected to improve the efficacy and delivery mechanisms, representing noteworthy improvements to the current formulation strategies.

However, investors must also not understate the competitive risks, potentially gaining market share at the expense of NVO and LLY. However, Wall Street seems confident that the current leaders have established a robust competitive moat to maintain dominance. Despite that, I assess the competitive landscape of weight loss drugs as continually evolving, requiring investors to scrutinize the developments in the industry. In addition, Lilly’s battle with less expensive compounded versions of the weight loss drugs is expected to continue, given the shortages observed. As Lilly lifts its manufacturing capacity, the company might also need to adjust its pricing strategies, given potentially improved demand/supply dynamics. Hence, it could also raise execution risks over the next two years as the competitive landscape shifts toward NVO seeking to protect its market share.

LLY Stock: Growth-Adjusted Valuation Not Overvalued

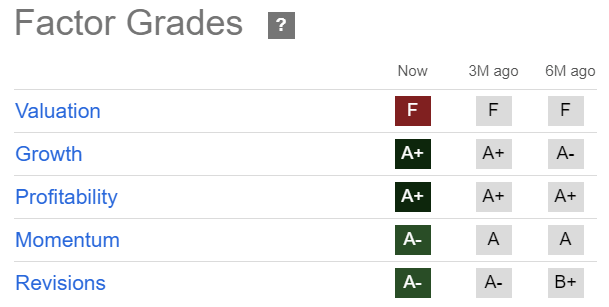

LLY Quant Grades (Seeking Alpha)

LLY’s premium valuation (“F” valuation grade) must be assessed with the secular growth prospects undergirding its bullish thesis. With four “A” range factor grades justifying the market’s optimism, I assess that staying bearish and going against the market seems unjustified.

LLY’s forward-adjusted PEG ratio of 1.3 is more than 30% below its sector median. Therefore, the market seems to have reflected reasonable execution risks, even as the company embarks on the next phase of its expansion to take on market leader Novo Nordisk.

Is LLY Stock A Buy, Sell, Or Hold?

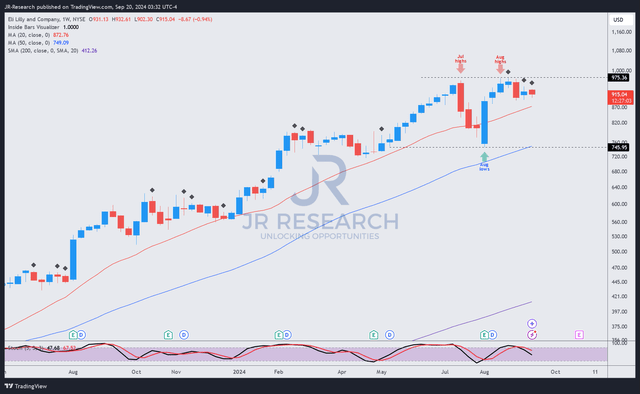

LLY price chart (weekly, adjusted for dividends, medium-term) (TradingView)

LLY’s price action strongly suggests it remains in an uptrend bias, corroborated by the robust “A-” momentum grade. However, a stiff resistance zone under the $1000 level has resisted further buying advances in July and August 2024.

Despite that, dip-buyers aggressively bought into LLY’s collapse in August above the $750 zone. Hence, maintaining a bearish rating on the stock is increasingly justified, although getting past the $1,000 level has proved challenging.

Therefore, a Neutral rating on LLY seems apt for now as we determine how the stock consolidates over the next few months.

Rating: Upgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!