Summary:

- My initial bearish thesis about Eli Lilly stock did not age well, as the stock has performed well since February despite being substantially overvalued.

- However, the market appears to be comfortable with the overvaluation as long as the company continues to capitalize on strong demand momentum for its diabetes and obesity drugs.

- Apart from the strong momentum of its stellar products like Mounjaro and Zepbound, there are several additional developments that contribute to my optimism.

- My valuation analysis suggests LLY stock is around 23% overvalued, with a target price of $619.

wellesenterprises/iStock Editorial via Getty Images

Investment thesis

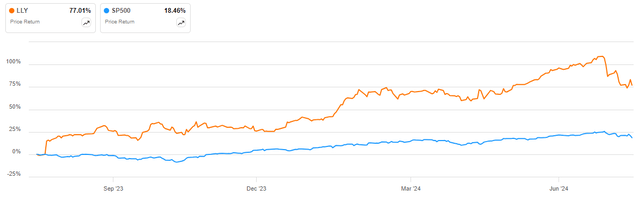

My initial bearish thesis about Eli Lilly (NYSE:LLY) did not age well, as the stock slightly outperformed the broader U.S. market since February.

It appears that I was too pessimistic in my initial coverage. My valuation analysis suggests that the stock is still massively overvalued, but it looks like investors are ready to ignore the generous premium as long as the company continues delivering massive revenue growth and EPS expansion. Since there are several indications that LLY is poised to deliver strong Q2 earnings on August 8, I upgrade it from “Sell” to “Hold”.

Ely Lilly Q2 earnings preview

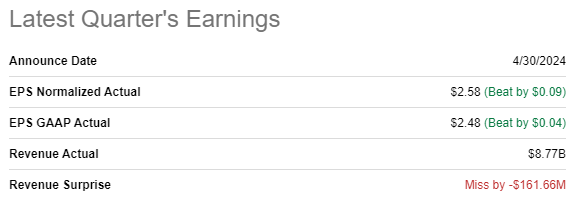

Before I start my Q2 earnings preview, just a short recap of the previous earnings release. The latest quarterly earnings were released on April 30 when LLY missed revenue consensus estimates. On the other hand, the company delivered positive EPS surprises.

Seeking Alpha

Revenue grew by around 26% YoY and the adjusted EPS expanded from $1.62 to $2.58. The EPS growth was of high-quality as it was achieved by the substantial YoY expansion of the operating margin, from 24.6% to 31.2%.

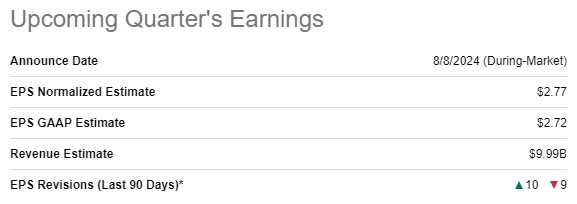

The upcoming earnings release is scheduled for August 8. Wall Street analysts expect LLY to generate $9.99 billion revenue in Q2, which will be 20% higher than the same quarter last year. The adjusted EPS is expected to follow the top line with the notable YoY expansion, from $2.11 to $2.77. Wall Street’s sentiment around the upcoming earnings release looks mixed, as there were approximately equal number of EPS upward and downward revisions over the last 90 days.

Seeking Alpha

LLY’s earning surprise history does not look flawless, with multiple quarterly revenue and EPS misses over the last two years. On the other hand, the market ignored the last quarter’s revenue miss and the stock price grew by around 5% on April 30.

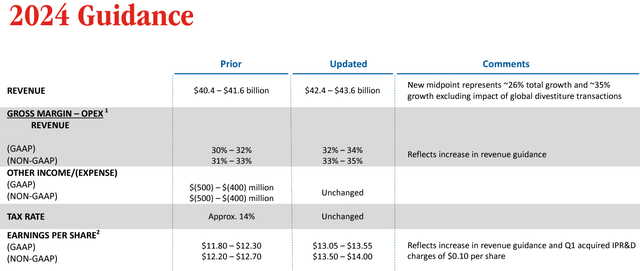

I think that the key factor is that LLY continues demonstrating massive revenue growth as it capitalizes on the high demand for its diabetes [Mounjaro] and obesity [Zepbound] drugs. The management expects this momentum to last for longer, as it raised its full-year 2024 guidance during the previous earnings call.

LLY’s latest earnings presentation

Due to Ely Lilly’s historically strong performance in obesity and diabetes drugs, I expect the company to continue successfully absorbing tailwinds in this niche. The fact that the company decided to invest an additional $5.3 billion in its Indiana facilities to boost production of Zepbound and Mounjaro is the clear indication of the management’s confidence that the demand will continue accelerating. Another strong evidence is that Novo Nordisk (NVO), LLY’s fierce rival in the obesity and diabetes drugs space, also plans to pour billions into expanding its production facilities.

There are a couple more solid reasons to be optimistic about the upcoming earnings release. The company’s Kisunla product was approved by the FDA on July 2. The product is for the treatment of early symptomatic Alzheimer’s disease. I see this as a promising development because the Alzheimer’s disease market is expanding at a notable pace and is expected to deliver a 12% CAGR by 2035.

On July 8, the company also announced that it is to acquire Morphic for $3.2 billion, which will help to expand LLY’s footprint in the immunology drugs niche. This move looks promising as well, as the global immunology market is also thriving and is expected to compound with a 12.1% CAGR by 2032.

LLY stock valuation update

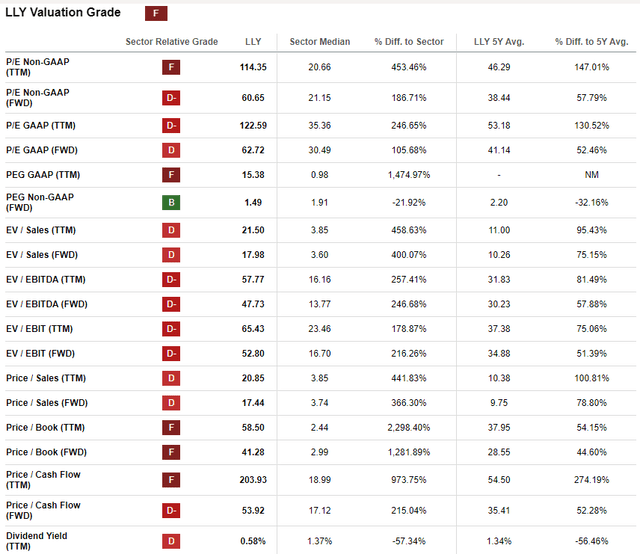

LLY recorded a massive 77% rally over the last 12 months, and the momentum is still strong, with a 38% stock price appreciation since the beginning of 2024. Seeking Alpha Quant assigns LLY the lowest possible “F” valuation grade because its ratios are multiple times higher than the sector median and substantially higher than the company’s historical averages. That said, LLY is overvalued from the perspective of valuation ratios.

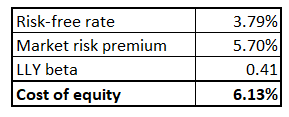

While LLY is a dividend growth superstar, I think that its shallow 0.62% forward yield makes the dividend discount model simulation useless. That said, I will proceed with my valuation analysis with the discounted cash flow [DCF] simulation. Since LLY’s total debt is immaterial compared to its market cap, I use the company’s cost of equity as a discount rate for my DCF. Cost of equity is calculated below using the CAPM approach, and all variables are easily available on the Internet.

Author’s calculations

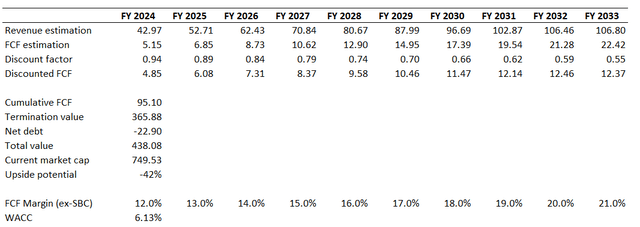

My first scenario will go with consensus revenue estimates, which project an 11% CAGR for the next decade. I use a 12% FCF margin, which is the last decade’s average, and project a 100 basis points yearly expansion.

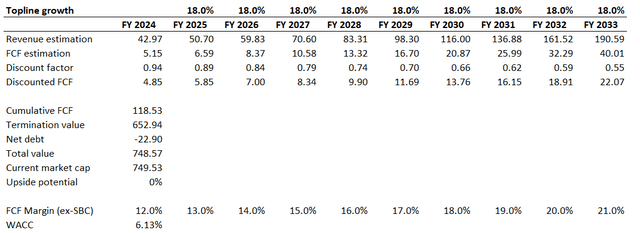

As seen above, the company’s fair market value is around $438 billion, which is significantly lower than the current market cap. That said, massive long-term revenue forecast upward revision is priced in, and I would like to demonstrate below the revenue CAGR that justifies LLY’s current valuation with other assumptions remaining unchanged. According to my calculations, the company’s top line must compound by 18% yearly to justify the current generous valuation.

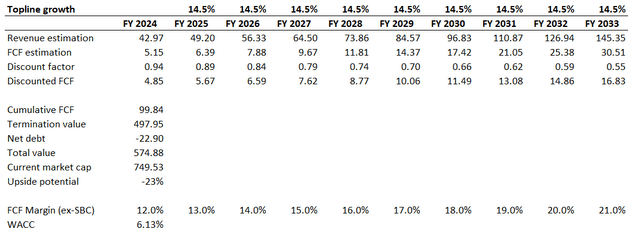

I find it improbable that a long-term revenue CAGR revision from 11% to 18% will occur, considering the significant magnitude of such an upgrade. Conversely, the 10% revenue CAGR might be overly conservative, given LLY’s strategic strength. Therefore, I will simulate a third scenario with a revenue CAGR representing the midpoint between 11% and 18%, i.e., 14.5%. I opt to keep other assumptions unchanged because revenue growth appears to be the most unpredictable factor and has the greatest impact on the outcome.

According to the third scenario, the business’s fair value is around $575 billion, closer to the current market cap than the first scenario. Still, the stock appears to be around 23% overvalued. After implementing a 23% haircut to the current share price, I arrived at a target price of $619.

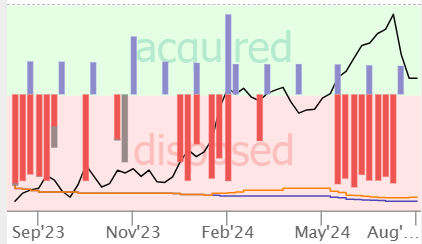

TrendSpider

Another important factor that screams about LLY’s overvaluation is that insiders were only selling over the last 12 months. No insider buying over such a long period likely indicates that insiders do not find the stock’s valuation attractive.

Risks to my cautious thesis

Betting against a company like Eli Lilly, its industry behemoth with strong momentum due to robust secular tailwinds, is inherently risky. The optimism around the stock looks massive, according to the “A” momentum grade from Seeking Alpha Quant. The stock outperforms the broader market, and I believe that there is a substantial portion of a FOMO factor as well.

Another factor that might result in a new wave of optimism around LLY is the better-than-expected new product release. Since the company’s pipeline is extensive, there is a probability of delivering a new sensation to the market. This will lead to a new 2024 guidance upgrade, which will make analysts’ DCF models even more optimistic.

Bottom line

To conclude, LLY is a “Hold”. It appears that I was too pessimistic in my initial coverage, as the market is ready to tolerate substantial overvaluation while the company demonstrates massive revenue growth and operating leverage. LLY is expected to deliver strong Q2 earnings, but the valuation already prices in this optimism.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.