Summary:

- The updates from clinical trials of Eli Lilly’s competitors in the obesity market were largely underwhelming this year.

- Tirzepatide’s clinical trial updates were very positive this year, including the results from the head-to-head showing superiority trial to Novo Nordisk’s semaglutide.

- With CagriSema underperforming expectations this week, the risk of a product superior to tirzepatide coming to market in the next few years is greatly reduced.

- However, the valuation differential to Novo Nordisk already reflects these favorable changes and Eli Lilly needs to meet or exceed growth expectations going forward.

- I remain bullish on LLY’s long-term prospects, but cautious about its ability to outperform peers in the next few quarters.

JHVEPhoto

This year’s developments in the obesity market have really gone in Eli Lilly’s (NYSE:LLY) favor. Clinical trial results from competitors were largely underwhelming, including this week’s REDEFINE-1 phase 3 results of Novo Nordisk’s (NVO) CagriSema, and Eli Lilly delivered superior weight loss of tirzepatide (Mounjaro/Zepbound) compared to semaglutide (Ozempic/Wegovy) in a head-to-head clinical trial.

I continue to see Novo Nordisk as a formidable competitor, but the latest updates give Eli Lilly the upper hand in the near and medium term.

However, I also think that the valuation differential to Novo Nordisk already reflects that, and that the company will have to live up to or exceed growth expectations to drive upside for shareholders. I remain bullish on Eli Lilly’s long-term growth prospects, but in the near term, I’m more cautious on the valuation side, especially in relative terms.

Clinical trial updates from competitors have gone largely in Eli Lilly’s favor this year

Eli Lilly delivered several positive clinical trial updates from tirzepatide this year:

- Roche (OTCQX:RHHBY) running into tolerability troubles after reporting strong topline efficacy of its early-stage injectable and oral candidates. I covered these results in my September article on Roche.

- Amgen (AMGN) reporting underwhelming efficacy from the highly anticipated phase 2 MariTide phase 2 trial.

- Novo Nordisk (NVO) reporting underwhelming results of CagriSema in the phase 3 REDEFINE-1 trial this week.

The REDEFINE-1 trial update from Novo Nordisk was, by far, the most important one, as Roche and Amgen are still years away from reaching the market. As I covered previously and today, CagriSema had the potential to (at least temporarily) tilt the scales in Novo Nordisk’s favor with superior efficacy to Eli Lilly’s tirzepatide, but that did not happen and CagriSema seems more of a match to tirzepatide which should still make it a formidable competitor, but the important part here is that the superiority expectations were not met.

Not all the updates from competitors were disappointing, and the honorable mention here is Viking Therapeutics (VKTX) with what I saw as very good phase 1 results of its oral VK2735 candidate. But even this update was met with a negative market reaction, and Viking’s oral candidate is still very far from reaching the market.

Eli Lilly’s clinical trial updates were very positive this year

Eli Lilly had several positive clinical trial updates from tirzepatide this year:

- In April, the company reported impressive phase 3 results in patients with obstructive sleep apnea and obesity.

- In June, positive results in MASH patients were presented.

- In August, Eli Lilly said that tirzepatide reduced the risk of heart failure outcomes by 38% compared to placebo in adults with heart failure with preserved ejection fraction (HFpEF) and obesity.

- In November, the company reported 176-week data from the SURMOUNT-1 trial showing sustained 22.3% weight loss and nearly 99% of patients on tirzepatide remaining diabetes free, a 94% reduction in the risk of progression to type 2 diabetes.

And just two weeks ago, Eli Lilly announced that tirzepatide showed superior weight loss in a head-to-head trial against semaglutide. The results were not surprising considering the known weight loss profiles of the two drugs, but the difference in efficacy was higher than anticipated.

In their respective phase 3 trials, tirzepatide achieved 21-22% weight loss and semaglutide achieved 16-18% weight loss, implying a cross-trial difference of approximately 4.5 percentage points at the mid point, but the difference in this head-to-head trial was 6.5 percentage points with tirzepatide generating 20.2% weight loss and semaglutide only 13.7%.

I do not believe these results change much in terms of perception of the two products, but I expect Eli Lilly to take advantage of the results since previous superiority claims were based on cross-trial comparisons and this is the first proper head-to-head trial.

Novo Nordisk remains the commercial market leader in the U.S. obesity market, but not for long

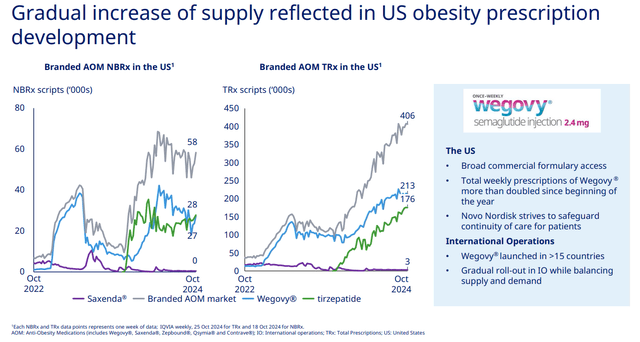

Eli Lilly is still slightly behind Novo Nordisk in terms of market share of the incretin class in obesity in the United States, but this is more a reflection of the inability of both companies to secure adequate supply of tirzepatide and semaglutide rather than the real picture of competitive dynamics.

Novo Nordisk Q3 2024 earnings presentation

And with the CagriSema superiority threat to tirzepatide removed, I see a clear path for Eli Lilly to become the market leader in the following quarters, and to maintain that position at least in the next few years, assuming a complete resolution of supply constraints.

There was also good news this week from the FDA as it said on Thursday that there was no longer a shortage of tirzepatide after a re-evaluation of supply by the agency. This should address the widespread sales of cheap compounded copies that have spread throughout the United States in the last few quarters. This decision comes despite pushback from compounding pharmacies and the Outsourcing Facilities Association which claims that the FDA made the decision based on Lilly’s claims and that the drug remains in short supply.

While this drama may not be over just yet, I do not really see compounded versions as having a negative impact on the growth of tirzepatide as it remains limited by how much Eli Lilly can produce.

Valuation reflects Eli Lilly’s leadership position in the obesity market and it needs to meet or exceed expectations going forward

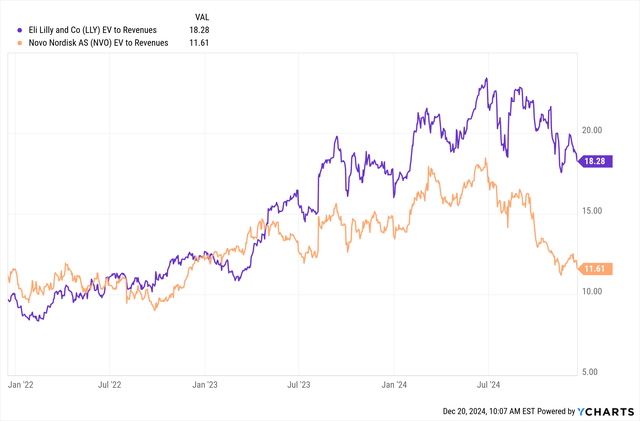

The spread between the valuations of Eli Lilly and Novo Nordisk has widened considerably in the last few months, and the chart below has not yet been updated by Ycharts to show today’s price changes that widen the gap even further.

Ycharts

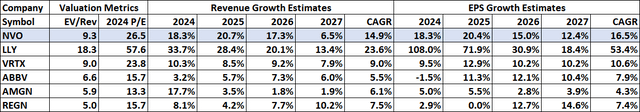

Eli Lilly is now trading at nearly double the EV/revenue ratio and more than double the 2024 P/E ratio of Novo Nordisk. The valuation metrics and growth estimates for the two companies and several biopharma peers are shown below, and they are based on $85 per share for Novo Nordisk and on yesterday’s closing prices for other companies in the table.

Seeking Alpha, YCharts, VRTX 2024 EPS and P/E normalized to exclude the impact of acquisitions

I remain bullish on Eli Lilly’s long-term growth prospects and expect the company will be able to meet or exceed long-term expectations, but relative valuations are now less favorable than they were earlier this year. As such, I’m more cautious about the company’s ability to outperform its peers in the next few quarters.

Conclusion

This year’s updates from Eli Lilly on tirzepatide were very favorable and the updates from competitors were largely underwhelming, and put the company in a stronger position to become the leader in the obesity market rather than share the top spot with Novo Nordisk.

I also expect the non-obesity product portfolio to perform well going forward, led by the recently approved Ebglyss for the treatment of atopic dermatitis.

That said, the valuation differential to Novo Nordisk now reflects these positive changes in the competitive landscape, and the burden on Eli Lilly to perform or even outperform growth expectations going forward is higher than it was earlier this year. As such, while I remain bullish on Eli Lilly’s long-term growth prospects, I’m more cautious about its share price being able to outperform biopharma peers in the next few quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NVO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up to Growth Stock Forum.