Summary:

- Pfizer has underperformed compared to Eli Lilly in recent years, but now appears to be a more attractive investment with fewer risks.

- Pfizer is more diversified, while Eli Lilly is heavily dependent on a single drug, making it riskier.

- Pfizer is priced for disaster and offers a higher dividend yield, making it a better investment option than Eli Lilly.

jetcityimage

Article Thesis

While Eli Lilly and Company (LLY) has had an excellent run in recent years, Pfizer (NYSE:PFE) has been a disappointment. But today, Pfizer seems like the more attractive investment and has, I believe, fewer execution and valuation risks compared to Eli Lilly. I believe that locking in gains in very expensive Eli Lilly and moving into cheap and high-yielding Pfizer could be a good idea.

A Tale Of Two Pharma Companies

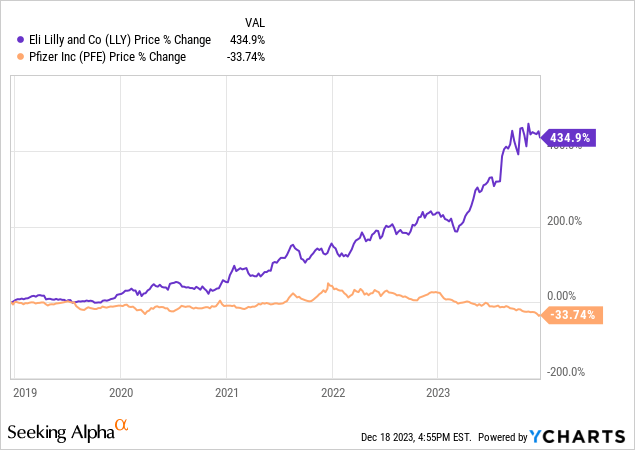

The charts of Eli Lilly and Company and Pfizer Inc. over the last five years couldn’t be much more different than they are now:

Eli Lilly soared by more than 400%, more than quintupling investors’ money, even before dividends. Pfizer, meanwhile, saw its share price drop by around one-third over the last five years, despite a huge bull run in the broad market. Even more surprisingly, Pfizer has massively underperformed despite generating gigantic profits during the pandemic via the sale of its COVID vaccine (“Comirnaty”) and the sale of its COVID treatment (“Paxlovid”). It should be noted that Pfizer spun off some parts of its business over the last couple of years, but nevertheless, the return difference compared to Eli Lilly is dramatic. Those that bought Pfizer five years ago will likely be quite unhappy with their investment, while those who bought Eli Lilly have likely been very happy, seeing their investment soar higher and higher. But that doesn’t mean that things will be the same going forward.

Why Pfizer Could Be Better Than Eli Lilly Going Forward

Of course, no one knows for sure what the future will bring, but we can make estimates and look at probabilities. And I believe that there is a good chance that Pfizer will substantially outperform Eli Lilly over the coming years — although there is no guarantee for that. I believe that this is likely due to the following reasons:

1: (Lack of) Dependence on a single drug

All pharma companies have smaller and larger drugs, and all pharma companies are more dependent on some drugs compared to others. But not all pharma companies are equally dependent on one drug or on one group of drugs.

Pfizer is relatively well diversified across different areas, including heart diseases, oncology, vaccines, inflammation, infectious diseases, and so on. Its biggest drug, or rather group of drugs, is the Prevnar family, which contributes around 14% of Pfizer’s revenues. If those revenues were to vanish overnight, then Pfizer’s profits would take a hit, but the company would likely still be quite profitable, and its growth outlook would not be hurt dramatically.

In contrast, Eli Lilly seems extremely dependent on a single drug: Mounjaro/Zepbound. This drug was first approved for type 2 diabetes but has recently also received approval as an obesity treatment. The vast majority of the expected revenue growth for the company over the coming years is dependent on this single drug (tirzepatide) — actually, even on a single indication for this single drug, as the obesity market is where analysts and investors see Eli Lilly grow its revenues by a lot. Some analysts see Zepbound generating multiple dozens of billions of dollars in annual revenue at some point in the future, which means Eli Lilly is extremely dependent on a single drug.

This means that if the drug is indeed as successful as expected, it will be a hefty growth driver. But if anything goes wrong, then that could be disastrous for the stock, as the growth outlook would take an enormous hit. Eli Lilly is expected to generate sales of $55 billion in 2026, looking at the current consensus estimate. If anything were to go wrong with Zepbound, sales estimates would dwindle. And there are, of course, some potential risks — unknown long-term side effects could materialize over time, a competitor could bring a more efficient drug to the market, and it is also possible (although not likely) for patent issues to arise. All in all, if a pharma company is very dependent on a single drug, especially on a single drug in one indication, then that is highly risky. A more diversified player that benefits from growth in different markets and that can balance out headwinds in one area via its internal diversification seems less risky.

2: Priced for perfection versus priced for disaster

There’s an old and well-known saying about investing when there’s blood in the streets. Buying when sentiment is weak and when valuations are low makes for attractive entry prices while buying when there’s massive euphoria and when valuations are very high makes for unattractive entry prices.

Ideally, buying when valuations are low and locking in gains when valuations are high is what investors should aim for.

Today, Pfizer is priced for disaster and thus very cheap, while Eli Lilly is priced for perfection and thus very expensive.

Looking at the profit estimates for 2024, which will start in less than 2 weeks, Pfizer Inc. is currently valued at just 12x net profits, which makes for an earnings yield of around 8%. Eli Lilly, meanwhile, is valued at 46x next year’s expected net earnings, which makes for a valuation that is around 4x as high as that of Pfizer.

For investors that are bullish on Eli Lilly due to its growth potential over more than one year, we can also take a look at estimates for 2025: We see that Pfizer is expected to see its earnings per share grow by 31% in 2025, to $2.88, which makes for an earnings multiple of 9 based on current prices. Eli Lilly is forecasted to see its profits climb by 41% in 2025, which makes for an earnings multiple of 33. Again, Eli Lilly is trading at a valuation premium of several hundred percentage points. Its expected growth is higher, but the difference between a 31% profit growth rate and a 41% profit growth rate is, I believe, not drastic enough to warrant a valuation that is more than 3 times higher.

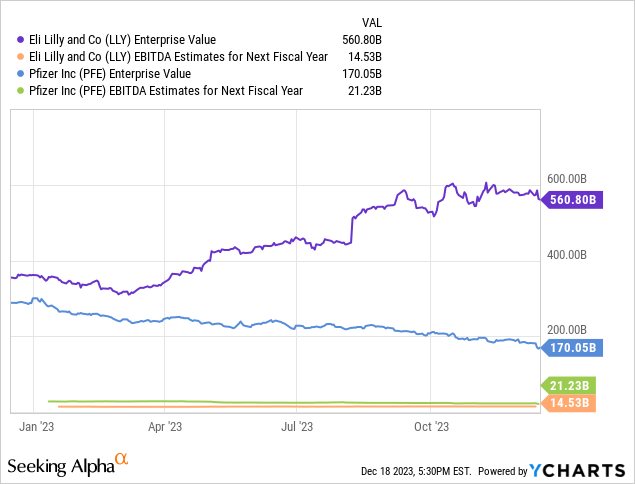

We can also look at different valuation metrics, and we will see the same picture. The following chart shows Eli Lilly’s and Pfizer’s enterprise value and EBITDA estimates for 2024:

Pfizer is currently trading at 11.7x next year’s EBITDA, while Eli Lilly trades at 26.7x next year’s EBITDA. Again, Pfizer is the way cheaper stock, trading at less than half the valuation of Eli Lilly — even when we account for debt on the balance sheets of the two companies. Looking at equity valuations alone, Pfizer is even cheaper, relative to Eli Lilly, as we have seen earlier when using the price-to-earnings multiple.

3: Dividends as a total return booster

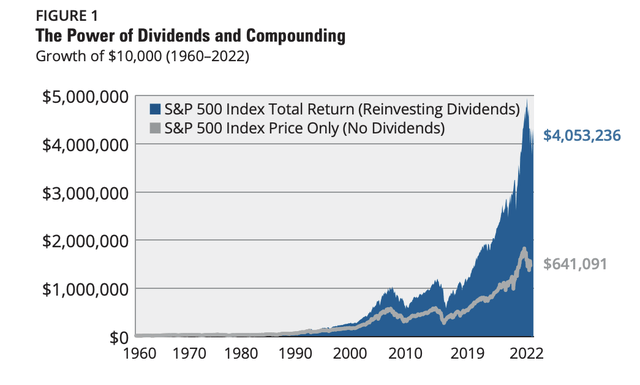

Share price gains are nice, but dividends matter a lot as well when it comes to generating total returns:

Dividend contribution to total returns (hartfordfunds.com)

The above chart from a whitepaper from Hartford Funds shows that the S&P 500’s total returns over the last couple of decades drastically depend on dividends and the reinvestment of these dividends. Without them, total returns would have been just 15% of what they had been with all dividends reinvested.

Today, Pfizer’s dividend yield is very different from that of Eli Lilly: Pfizer just raised its dividend and is now offering a dividend yield of 6.2%, while Eli Lilly’s dividend yield is just 0.9%. In other words, Pfizer provides around 7x the income Eli Lilly provides — one would have to invest $70,000 in Eli Lilly to get the same dividends as one can get from a $10,000 investment in Pfizer. Dividend yield isn’t everything, but with the huge importance of dividends for total returns over a longer-term period and with the dividend yield being so drastically different between Pfizer and Eli Lilly, I believe Pfizer’s way better income generation potential is an important reason to favor Pfizer over Eli Lilly at current prices.

Takeaway

Is Pfizer a better company than Eli Lilly? One can argue that PFE’s way better diversification is a plus and that the recent Seagen acquisition gives it highly appealing oncology assets, but I nevertheless wouldn’t say that Pfizer is a better investment than Eli Lilly. Would I favor Pfizer over Eli Lilly if both were valued at $300 billion? I wouldn’t, to be honest, nor would I favor Pfizer over Eli Lilly if both traded at 20x, 30x, or 40x net earnings.

But with well-diversified Pfizer trading at just 12x next year’s earnings, while Eli Lilly trades at a massively higher valuation, I believe Pfizer is more attractive today. If anything goes wrong at Eli Lilly with Zepbound, that could be dramatic for its share price — Pfizer does not have the same risk due to not being priced for perception and since it is not as dependent on a single growth asset. Add the hefty dividend yield of Pfizer and contrast it to the very low yield one can get from Eli Lilly, and the former looks better at current prices.

With one stock being very cheap and out of favor, and the other having run up massively and being in a state of euphoria, I believe the former is the more opportune investment. At different prices, the verdict could be different, but here it makes sense, I believe, to lock in gains in very expensive LLY and to shift them into Pfizer (or another very inexpensive pharma company).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!