Summary:

- This week Lilly surpassed Johnson & Johnson to become the world’s largest Pharma by market cap.

- That is quite astonishing given JNJ drove $95bn of revenues last year, compared to Lilly’s $28bn.

- Pharma valuations are based on “jam tomorrow”, however, and in Tirzepatide Lilly may have the world’s first $100bn per annum selling drug.

- Tirzepatide has shown in studies that it could be superior to Novo Nordisk’s semaglutide, marketed as Ozempic in Type 2 diabetes and Wegovy in obesity.

- Tirzepatide is approved as Mounjaro in T2D but not yet in weight loss, although that looks a formality. The drug is seemingly of generational importance and as high as Lilly’s stock has risen, there is probably room for 20% more upside.

Tatiana Dvoretskaya/iStock via Getty Images

Investment Overview

There are so many reasons why it should not be possible that Eli Lilly (NYSE:LLY), the Indianapolis based Pharma founded in 1876, became the world’s largest listed Pharmaceutical company by market cap this week – and one major reason why it is very much possible.

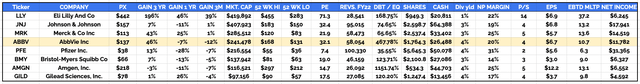

In several previous notes for Seeking Alpha I have shared the following table, comparing what I refer to as the “Big 8” US Pharmaceutical companies – by order of market cap valuation, that is Eli Lilly, Johnson & Johnson (JNJ), Merck & Co (MRK), AbbVie (ABBV), Pfizer (PFE), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD).

“Big 8” US Pharmas compared (TradingView, Google Finance)

Looking at the table, it is not easy to find justification for Lilly’s market cap valuation of $420bn and share price of $442 – which has admittedly slipped slightly in trading this week, to $437 per share at the time of writing.

In terms of revenue generation, Lilly comes in sixth out of eight, generating $28bn, compared to the >$50bn generated by Merck and AbbVie, $95bn by Johnson & Johnson, and >$100bn by Pfizer.

Of all the Pharmas, only Gilead reports a lower cash position. In terms of price to sales ratio, Lilly’s ratio is nearly 3x higher than the next highest – the company trades at 14x sales, almost unheard of for a major Pharma. In terms of price to earnings, Lilly’s ratio of 71x is more than twice as high as any other. Lilly’s profit margin of 22% is only the 4th highest, and its dividend yield of 1% is the lowest by a long way, the sector average being ~3%.

Bearing all of this in mind, why does investors’ money keep pouring into Lilly? It all comes down to a single drug – Tirzepatide.

Tirzepatide – The Trillion Dollar Diabetes / Weight Loss Phenomenon

Tirzepatide is a part of Eli Lilly’s “incretin” franchise. According to Wikipedia:

Incretins are a group of metabolic hormones that stimulate a decrease in blood glucose levels. Incretins are released after eating and augment the secretion of insulin released from pancreatic beta cells of the islets of Langerhans by a blood-glucose–dependent mechanism.

Some incretins (GLP-1) also inhibit glucagon release from the alpha cells of the islets of Langerhans. In addition, they slow the rate of absorption of nutrients into the blood stream by reducing gastric emptying and may directly reduce food intake.

The two main candidate molecules that fulfill criteria for an incretin are the intestinal peptides glucagon-like peptide-1 (GLP-1) and gastric inhibitory peptide (GIP, also known as: glucose-dependent insulinotropic polypeptide).

The part of this definition I would draw reader’s attention to here is “may directly reduce food intake”. Several GLP-1 receptor agonists have been approved in the past, primarily to treat diabetes, such as Novo Nordisk’s (NVO) Victoza and Ozempic, and Lilly’s Trulicity, and now Tirzepatide, which secured FDA approval to treat Type 2 diabetics in May last year, and is marketed and sold as Mounjaro in that indication.

Interestingly, the second bullet point in Lilly’s press releases announcing the T2D approval news opted to focus on the drug’s weight reduction capabilities:

While not indicated for weight loss, Mounjaro led to significantly greater weight reductions versus comparators in a key secondary endpoint.

Type 2 diabetes is a giant market – according to the Centers for Disease Control (“CDC”), >37m people in the US have diabetes, and 90-95% of those have Type 2 diabetes. Lilly’s Trulicity (dulagutide) was approved to treat Type 2 diabetes in 2014, earning >$7bn of revenues in 2022. Novo Nordisk’s Ozempic (semagultide), a drug with a very similar mechanism to Tirzepatide, was approved in 2017, with a higher dose formulation also approved last year. In 2022, Ozempic drove ~$8.6bn in revenues.

Peak sales estimates for Ozempic and Mounjaro in Type 2 diabetes are astoundingly high – both drugs are expected to easily drive sales in the double-digit billions, and in fact, many analyst believe both drugs could become all-time best-sellers in this indication alone.

Lilly has apparently set a list price of $974.33 for four weekly doses, which translates to $12,666 per annum. Of course, patients will pay different amounts – usually much less – depending on their insurance status and means, but for a ballpark estimate of the market opportunity, 90% of 37m potential patients is 33.3m, multiplied by the annual list price is $422bn.

That is a big number – enough to set Lilly shareholder’s pulses racing – but now let’s consider the weight loss / obesity market.

Obesity is one of the most feared potential epidemics of the future – arguably, it is already here. According to the World Health Organisation (“WHO”), in 2016, 1.9 billion adults aged 18 years or overweight, and 650m adults were obese, or ~13% of the world’s adult population. Let’s do the math – 650m multiplied by $12,666 equates to a market opportunity of >$8 trillion!

Key Question – Does Tirzepatide Work, & Is It Safe?

You might ask, if there have been approved GLP-1 receptor agonists on the market since 2014, why the sudden enthusiasm over the emergence of Tirzepatide?

Researching this, I came across a transcript of an interview with Dr. Juliana Simonetti, the medical co-director of the Comprehensive Weight Management Program at the University of Utah. Here are the doctor’s opening remarks:

I’ll start by just telling a short story. I was at an endocrine meeting in California two weeks ago when this drug got approved by the FDA for the treatment of diabetes. And we were doing a lecture, and all of a sudden, everyone started clapping and announced that this drug had been approved by the FDA for the treatment of diabetes. So that’s the kind of excitement we’re getting with this drug.

If the medical community are as excited about the potential of Tirzepatide as the public, that would seem to be a resounding positive for the drug, for the public, and of course, for Eli Lilly. But how is Tirzepatide different from formerly approved GLP-1 receptor agonists – let me quote from Dr Simonetti again:

Tirzepatide is unique in the sense that is a dual incretin medication. It attaches to two different receptors….

…the GLP-1 receptor agonists work in your brain and in the appetite centers of the brain. It works in the brain to tell you that you’re full, so you don’t have those cravings and then sensation that you wanted to keep on eating. It really leads to the feeling of feeling fuller.

With tirzepatide, why this is so exciting and different is that this not only works with the GLP-1 receptors, but also works in another receptor called GIP, which is a glucose-dependent insulinotropic peptide. It’s a mouthful, but it’s really another hormone in our body.

The issue with our natural hormones in our body is that they get taken down, they get broken down very quickly. They only last a few seconds. And these new drugs bind now to those two different kinds of hormones and lead to this really much heightened sensation of fullness and to a much more significant response lasting much longer than what our own body would produce.

This is the theory, and in practice, Eli Lilly’s clinical study results have been nothing short of spectacular. Announcing results from the latest Phase 3, 938-patient SURMOUNT-2 study, Lilly’s Chief Scientific and Medical Officer Daniel Skovronsky told analysts on the late April Q123 earnings call:

Tirzepatide met the co-primary study endpoints and also hit on all prespecified key secondary endpoints. Participants with obesity or overweight and with type 2 diabetes achieved up to 16% weight loss at 72 weeks, which translates to a mean weight loss of 34 pounds.

Additionally, 86% of people taking 15-milligram tirzepatide achieved at least 5% body rate reduction. This was in line with our expectations based on our SURPASS-3 data in a similar population.

It’s Lilly’s second successful readout for Tirzepatide in weight loss, confirming the positive data witnessed in the Type 2 diabetes studies. The SURMOUNT-1 study demonstrated a 22.5% weight reduction in people without Type 2 Diabetes.

For context, the FDA approval benchmark for a weight loss drug is ~5%. For good measure, Lilly is running SURMOUNT studies 3, 4 and 5, and SURMOUNT-MMO, “investigating the effect of tirzepatide on the reduction of mortality and morbidity in adults with obesity, which will read out data in 2027.

From a safety perspective, the most commonly reported adverse events were diarrhea and nausea, which was experienced by 20-22% of patients, Lilly says, versus 6-9% of patients on placebo. Treatment discontinuation due to adverse events was 3.8% in the 10mg arm, and 7.4% in the 15mg arm versus 3.8% for placebo. So far, so good.

Tirzpeatide versus Semaglutide – Lilly Set To Come Out On Top?

Novo Nordisk is Lilly’s chief rival in the diabetes space going back many years, and given the Danish Pharma was first to market with its semaglutide formulation in Type 2 Diabetes – where it is marketed and sold as Ozempic – and has already won approval to treat weight loss – under the alternative brand name Wegovy, surely there should be as much hype surrounding Novo Nordisk as there is Lilly?

First of all, Novo Nordisk’s share price and valuation has indeed been climbing – shares are +240% over the past 5 years, and Novo’s market cap valuation $347bn – is larger than all of the “Big 8” US Pharmas bar Johnson & Johnson and Lilly itself. Demand for Wegovy has been so strong that Novo has been unable to meet it, and analysts have forecast that Ozempic alone will realise $17bn in sales in 2029. The company, which turned over >$25bn in 2022, is forecasting for a 24-30% uplift in 2023, primarily based on growing sales of Wegovy and Ozempic.

Lilly’s approval for Tirzepatide in weight loss looks a foregone conclusion, however, and the company has a spare Priority Review Voucher (“PRV”) – awarded to companies that advance drugs in rare diseases and guaranteeing an FDA review period of less than 6 months – that it purchased last year for ~$110m and use to accelerate approval. That PRV could be worth some $6bn to Lilly in earlier sales, it’s been speculated.

Lilly’s SURMOUNT-5 clinical study of Tirzepatide will directly compare the drug to Novo’s Semaglutide – emphasising Lilly’s confidence that its drug will prove to be the superior of the two, and therefore dominate market share.

In diabetes, thanks to its dual action, which has led to its being dubbed “twincretin”, tirzepatide has already apparently established its superiority over semaglutide. According to data published in the New England Journal of Medicine (“NEJM”):

In an open-label, 40-week, phase 3 trial, we randomly assigned 1879 patients, in a 1:1:1:1 ratio, to receive tirzepatide at a dose of 5 mg, 10 mg, or 15 mg or semaglutide at a dose of 1 mg. At baseline, the mean glycated hemoglobin level was 8.28%, the mean age 56.6 years, and the mean weight 93.7 kg. The primary end point was the change in the glycated hemoglobin level from baseline to 40 weeks.

The estimated mean change from baseline in the glycated hemoglobin level was −2.01 percentage points, −2.24 percentage points, and −2.30 percentage points with 5 mg, 10 mg, and 15 mg of tirzepatide, respectively, and −1.86 percentage points with semaglutide…

…Reductions in body weight were greater with tirzepatide than with semaglutide (least-squares mean estimated treatment difference, −1.9 kg, −3.6 kg, and −5.5 kg, respectively; P<0.001 for all comparisons).

Although a single study – particularly one part-funded by Lilly – may not tell the whole story, it persuaded analysts at UBS to tentatively declare Tirzepatide the better drug, and set a peak sales expectation of $25bn per annum – nearly $5bn more than Humira, the world’s all-time best-selling drug, has ever achieved in a single year.

Frankly, the more research that is done into the commercial opportunity, the bigger the figures get – current thinking is that $50bn per annum may not be excessive. For good measure, Lilly is also working on a new drug – orforglipron, an oral GLP-1 non-peptide agonist – which could easily bring in another $10bn of revenues per annum – and likely substantially more than that.

Will Tirzepatide Distort Global Health Markets?

One of the questions asked when Biogen’s Alzheimer’s drug was controversially approved in 2020, before the drug was sunk by safety concerns – was whether, with nearly 6m AD patients in the US, and a mooted list price of ~$50k per annum – representing a market opportunity of >$300bn – making the drug available to all patients would bankrupt the healthcare industry?

How does Lilly respond to similar questions around Tirzepatide? Mike Mason, President of Lilly’s Diabetes division pointed out to analysts on the Q123 earnings call that:

it’s easy to look at the number of people who live with obesity both in the U.S. and globally, and look at, boy, this could have a big impact on health care costs. But I think if you look more at the real true potential that we focus so much on weight loss, but when you look at not only the — what does weight loss really provide, there’s over 200 complications associated with living with obesity.

Lilly’s CEO and Chairman David Ricks also discussed the matter:

I think the latest data from the Medicare Trust is that we’re spending about $1 trillion a year as a country on obesity-related complications and comorbidities. I don’t think we always do a very good job of thinking about buying pharmaceuticals as an investment and future savings in our health. Maybe we do better when it’s acute like COVID. I think we spent tens of billions on COVID therapies and didn’t question it as much.

But here’s — I think even in the most rosy forecast, we’re not going to sell $1 trillion of obesity drugs. So the question is more like, over time, can we demonstrate that treatment today reduces cost downstream? We’re highly confident that, that will be a multiple of 5x, 10x savings for whatever people invest in the medicines.

These are valid points. Although it is hard to envisage a future in which hundreds of millions of people are self-injecting tirzepatide after meals, ff that were to happen, and in some ways logically it should do, who would rule out Lilly driving $1 trillion dollars of revenue!

How Do We Think About Lilly’s Valuation & Share Price In The Short, Medium and Long Term?

In the first half of last year I posted on Seeking Alpha about Lilly several times, querying whether the company’s sky-high, and constantly rising valuation could be justified by a pipeline drug?

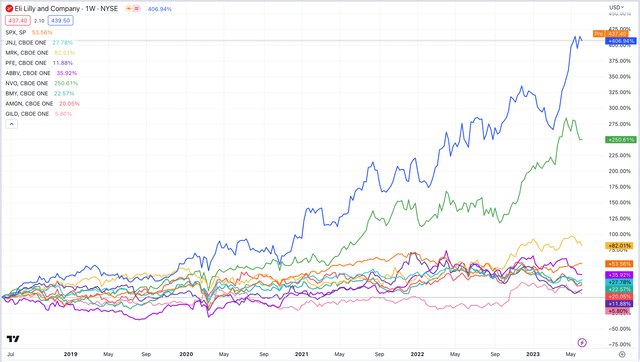

After all, Pfizer had just posted the Pharma industry’s first ever $100bn dollar revenue year thanks to its COVID drugs – earning nearly 4x more than Lilly – and just look at the performance of Lilly, and Novo Nordisk’s valuation across the past 5 years compared to the rest of the “Big 8” and the S&P 500.

LLY and NVO outperformance vs Pharma industry sector, SPX (TradingView)

Surprising as it may seem, however, if the hyperbole surrounding both companies – but especially Lilly’s – incretin franchises is anything like realistic – and there is a growing body of clinical evidence, and real world market data that it is – then who knows how high Lilly’s valuation could climb?

If we take the average price to sales ratio of the “Big 8” US Pharmas, minus Lilly, of ~4x, then based on current market cap, the market is clearly expecting Lilly to drive >$100bn in annual revenues in the foreseeable future.

Is this realistic? In the past I have shared forward revenue forecasts for the company that map out such a scenario – the Diabetes division earning $75.7bn by 2030, whilst the oncology division contributes $10bn, and Immunology $8bn. Almost incredibly, within its neuroscience division Lilly boasts 2 Alzheimer’s drugs boasting best in class potential – likely soon to be approved donanemab, and next generation remternetug. I “Guesstimate” the contribution from this division could be $16bn by 2030 (if safety concerns can be overcome it could be much higher, if not, much lower).

That gives me a FY30 total revenue figure of $111bn, and a compound annual growth rate of 19% per annum – very impressive. Interestingly, even with such a high revenue figure, and reducing Lilly’s total operating costs from 78% of sales in 2022 (albeit on a GAAP basis), to 52% in 2030, my discounted cash flow analysis – using a weighted average cost of capital of ~7.8% – only gets me to a target share price of $440 per share – within 1% of today’s share price.

As such, even with the excellent clinical results that Tirzepatide has shown to date, the unparallelled market opportunity, and with the Alzheimer’s opportunity thrown in, it is hard to match the market’s current enthusiasm for Lilly stock using normal valuation metrics, and surely, the risks associated with drug development dictate that an opportunity that looks too good be true, probably is.

The fact that Lilly is now the world’s most valuable pharmaceutical company based on the promise of a drug that is not even approved yet in its key target market might seem presumptious, but frankly, given what we know about Tirzpeatide to date, would it be outlandish to suggest peak sales could top $100bn, rather than $50bn?

I am not sure it would be, and I think Lilly could ultimately end up with a >$500 – $600bn valuation if Tirzpeatide proves to be the real deal, as hard as that is to believe given what needs to happen revenues wise in the coming years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GILD, BMY, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.