Summary:

- In recent months, Eli Lilly has continued to delight investors with growth in its share price.

- Strong sales of the company’s diabetes franchise, coupled with progress in the development of tirzepatide, have helped its market capitalization double over the past year.

- However, many of its competitors are developing more effective drugs to combat obesity and type 2 diabetes.

- Furthermore, I believe Wall Street is overestimating the commercial prospects of donanemab in treating Alzheimer’s disease.

- Consequently, I’m initiating coverage of Eli Lilly with a “hold” rating.

PM Images

Eli Lilly and Company (NYSE:LLY) is one of the largest pharmaceutical companies globally, with leading positions in the global obesity and type 2 diabetes treatment markets.

Thesis

Eli Lilly’s share price has nearly doubled over the past 12 months, reflecting euphoria among investors and traders about the expected Fed interest-rate cuts in the second half of 2024, significant progress in developing its experimental drugs aimed at combating autoimmune diseases, and raised its 2024 full-year revenue guidance due to higher demand for Zepbound and Mounjaro than previously expected.

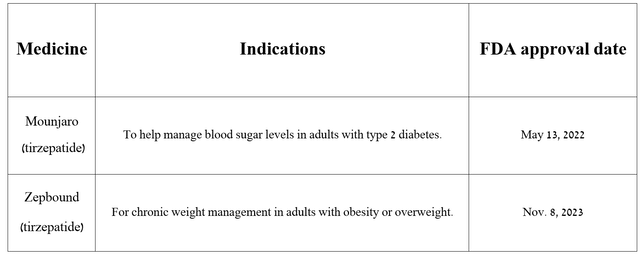

So, Mounjaro and Zepbound are medications that contain the same active substance called tirzepatide. The key difference between the two is that Mounjaro is approved by regulators to treat patients with type 2 diabetes, while Zepbound is used to help obese people lose a dramatic amount of weight.

Source: The table was made by Author based on Eli Lilly press releases

How does tirzepatide work in simple terms?

First of all, I would like to point out that understanding the mechanism of action of medication allows me to determine for which diseases it will be effective, as well as to assess the chances of its success in ongoing clinical trials.

Tirzepatide is a dual GIP/GLP-1 receptor agonist. Glucagon-like peptide-1 receptors are expressed not only in muscle and adipose tissue but also in the pancreas, heart, and GI tract. On the other hand, glucose-dependent insulinotropic polypeptide (GIP) stimulates pancreatic β-cells to secrete insulin in response to elevated blood glucose levels.

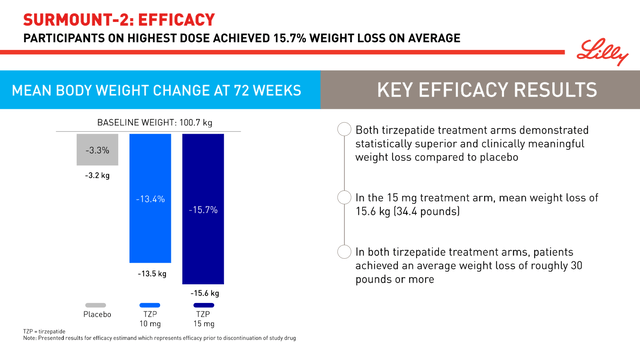

Tirzepatide activates the GIP and GLP-1 receptors, which increases insulin secretion and also reduces appetite by slowing down gastrointestinal motility. In several clinical trials, Mounjaro and Zepbound have demonstrated extremely high efficiency in reducing HbA1c, serum glucose levels, and body weight in patients with type 2 diabetes, as well as those diagnosed with obesity.

Currently, Eli Lilly is conducting numerous clinical studies to determine the efficacy of tirzepatide in reducing the risk of cardiovascular disease, as well as for the treatment of common conditions such as sleep apnea and metabolic dysfunction-associated steatohepatitis.

In my assessment, based on the analysis of scientific articles published in the New England Journal of Medicine and Nature and other journals demonstrating the potential efficacy of GLP-1 and GIP receptor agonists in the treatment of the above-described diseases, I believe in high chances that the company will achieve significant success in developing this mega-blockbuster.

These prerequisites are already resulting in positive results that have pleasantly surprised me.

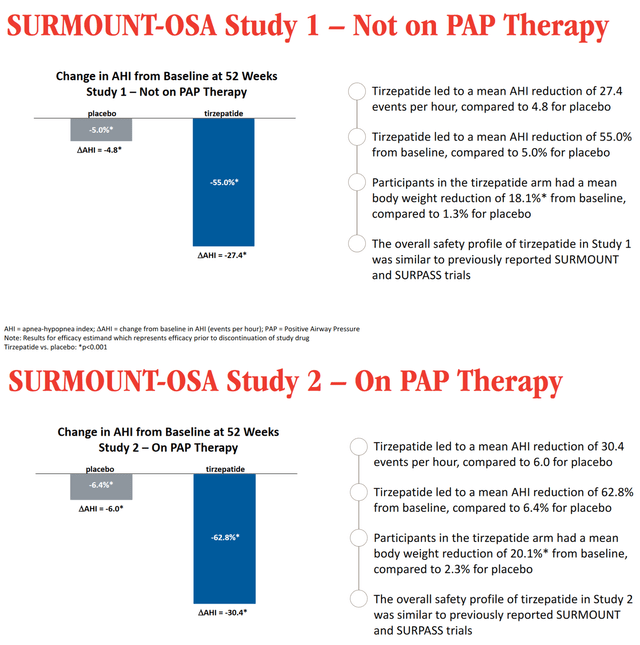

So, on April 17, 2024, Eli Lilly published data from two Phase 3 clinical trials showing that the group of patients taking tirzepatide experienced a significant reduction in the apnea-hypopnea index relative to the placebo group. The company’s product also contributed to a statistically significant improvement in sleep apnea symptoms.

If approved by the FDA and EMA, tirzepatide would be the first pharmaceutical treatment for tens of millions of adults with obstructive sleep apnea.

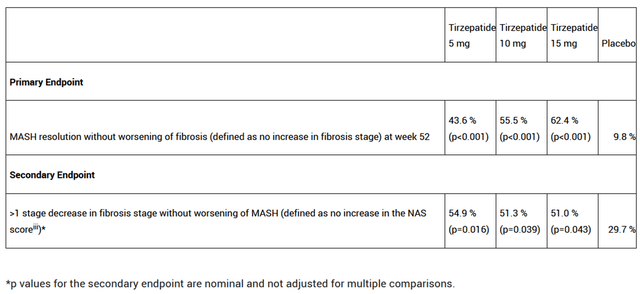

Additionally, on June 8 of this year, the company released highly promising results from a Phase 2 study involving 190 patients with metabolic dysfunction-associated steatohepatitis [MASH]. This condition is one of the most common liver diseases, which is estimated to affect about 19 million Americans by 2039, an 83% increase from 2020.

Eli Lilly’s medicine had a favorable safety profile and improved various biomarkers of MASH, fibrosis, and metabolic parameters. More importantly, when compared to Madrigal Pharmaceuticals, Inc.’s Rezdiffra (MDGL) or other product candidates being developed by pharmaceutical companies such as Novo Nordisk A/S (NVO), Novartis AG (NVS), and Gilead Sciences, Inc. (GILD), I believe tirzepatide has one of the highest efficacies in the fight against MASH to date.

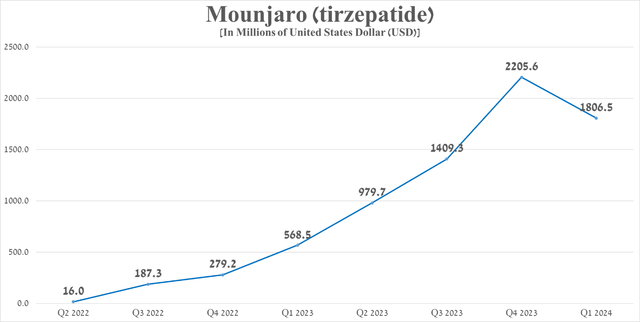

It is equally important to discuss sales of the tirzepatide franchise.

Mounjaro’s total sales were approximately $1.81 billion in the first quarter of 2024, up 217.8% year-over-year, driven in part by higher realized prices and increased demand in the U.S. and Europe due to its competitive advantages over Novo Nordisk A/S’s Ozempic (NVO), Trulicity, Tresiba, Victoza and many other diabetes medications.

Source: graph was made by Author based on 10-Qs and 10-Ks

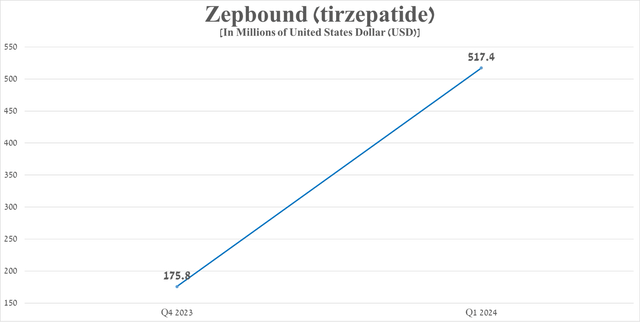

On the other hand, Zepbound sales amounted to $517.4 million in the first three months of 2024, which is approximately 3 times more than the previous quarter thanks to an avalanche-like growth in demand for it due to its highest efficacy in the global obesity treatment market at the moment.

Source: graph was made by Author based on 10-Qs and 10-Ks

However, I believe that despite the company’s most effective FDA-approved medications for the treatment of type 2 diabetes and obesity at the moment, Eli Lilly has run out of “aces up its sleeve.”

First, as mentioned in my previous article about Novo Nordisk, the Danish company, as well as Roche Holding, have demonstrated higher efficacy of their experimental drugs in reducing body weight and HbA1c levels than Zepbound and Mounjaro.

In my assessment, based on ClinicalTrials.gov, it is expected that the potential launch of Novo Nordisk’s CagriSema will begin in 2026, which will slow down the growth rate of sales of Eli Lilly’s diabetes franchise.

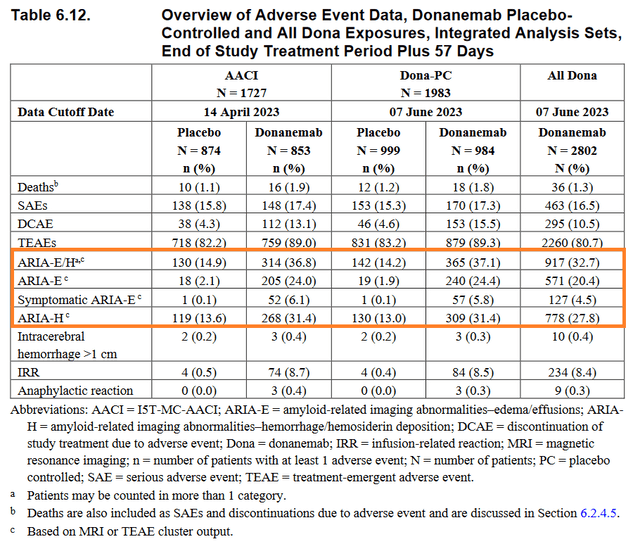

In addition, among the risks to the investment attractiveness of the company, I highlight the overly inflated expectations of Wall Street regarding the commercial prospects of donanemab, which is being developed to combat Alzheimer’s disease.

Donanemab is a monoclonal antibody whose mechanism of action is based on its ability to clear toxic amyloid plaques from the brain, which, according to scientists, are responsible, among other things, for the progression of this disease.

On June 10, 2024, the advisory committee issued a positive decision, concluding that the use of Eli Lilly’s experimental drug is capable of slowing the progression of Alzheimer’s disease, which also significantly increases its chances of being approved by the FDA in the coming months.

However, like Biogen’s Leqembi (lecanemab-irmb), donanemab has been associated with a variety of dangerous side effects, including swelling sulcal effusion/edema [ARIA-E] and small hemorrhages [ARIA-H].

I believe that the side effects will create barriers to the introduction of donanemab into medical practice for the treatment of Alzheimer’s, just as it is happening with Leqembi.

So, sales of Eisai and Biogen Inc.’s medicine (BIIB) amounted to $19 million in the first three months of 2024, which is only $12 million higher than the previous quarter. The pace of its sales growth continues to cause pain among investors even a year after its FDA approval, as well as a huge global Alzheimer’s disease therapeutics market estimated at more than $8 billion in 2032.

Consequently, I’m initiating coverage of Eli Lilly with a “hold” rating.

Eli Lilly’s financial position and the prospects for its portfolio of medications

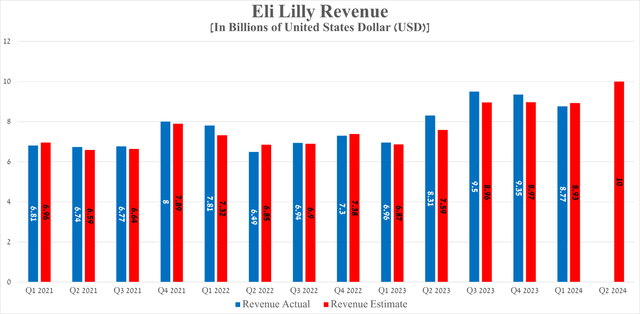

Eli Lilly’s revenue for the first three months of 2024 was $8.77 billion, up 26% year over year, but it missed analysts’ consensus estimates for the first time since 2023.

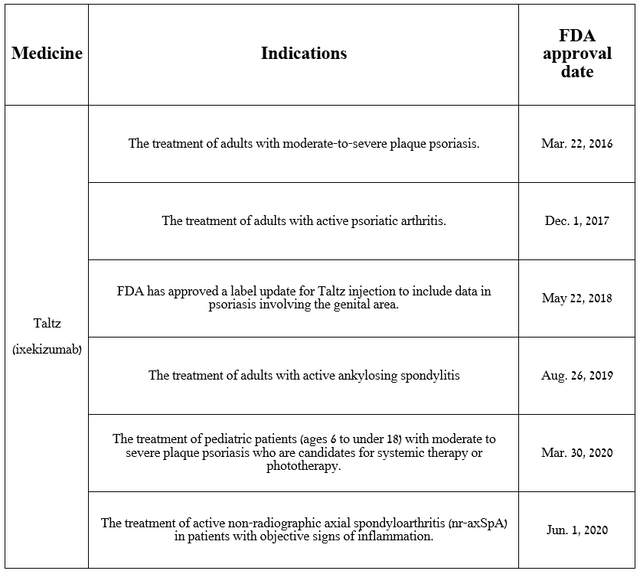

In my estimation, the main culprit for the company’s revenue falling short of Wall Street analysts’ expectations is the modest year-over-year growth rate of Taltz sales. Taltz (ixekizumab) is an anti-interleukin-17A monoclonal antibody, which is approved by the FDA for the following indications.

Source: The table was made by Author based on Eli Lilly press releases

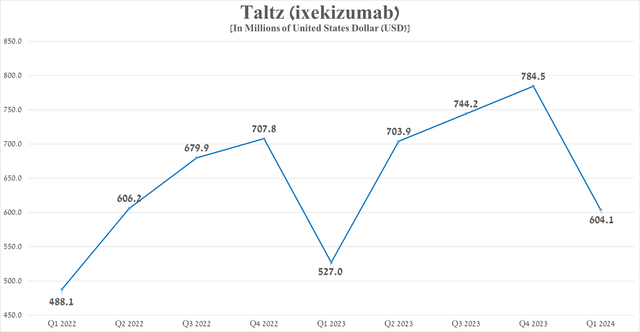

So, its sales amounted to $604.1 million in the first three months of 2024, down 23% quarter-on-quarter, including due to increased competition in the anti-inflammatory therapeutics market from Johnson & Johnson’s (JNJ) Stelara/Tremfya, Bristol Myers Squibb Company’s (BMY) Sotyktu, AbbVie Inc.’s (ABBV) Rinvoq/Skyrizi, Novartis AG’s (NVS) Cosentyx, UCB SA’s (OTCPK:UCBJF) Bimzelx and Humira biosimilars.

Source: graph was made by Author based on 10-Qs and 10-Ks

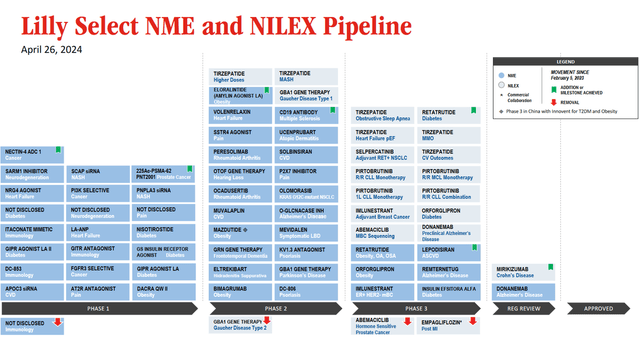

Let’s move on to discuss Eli Lilly’s portfolio of experimental drugs.

In addition to the growth in sales of Mounjaro, Verzenio, and Zepbound, which I analyzed earlier in the article, I believe that an extra factor that has driven Eli Lilly’s share price to new historical highs is its rich pipeline of product candidates.

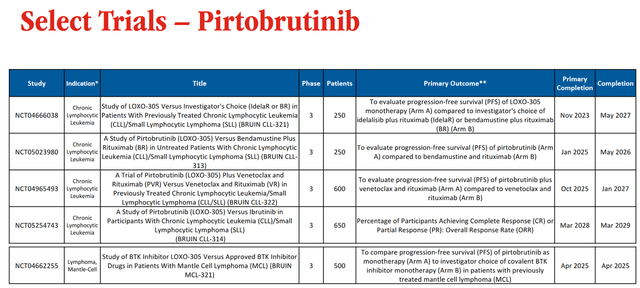

So, in my assessment, one of the most promising drugs in Eli Lilly’s oncology pipeline is Jaypirca (pirtobrutinib), the first FDA-approved non-covalent BTK inhibitor. Its mechanism of action is based on the inhibition of a protein called Bruton’s tyrosine kinase [BTK], which in turn plays a key role in the transmission of oncogenic signaling in B-cell non-Hodgkin lymphomas.

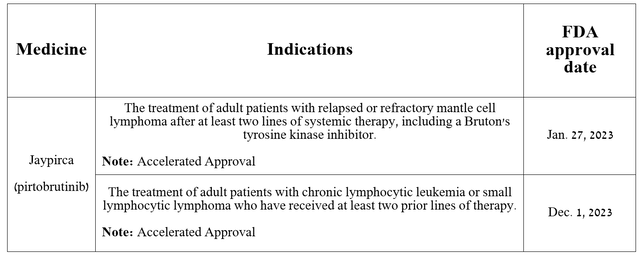

This medication is approved by regulatory authorities for the treatment of patients with the following types of cancer.

Source: The table was made by Author based on Eli Lilly press releases

Currently, Eli Lilly is conducting several clinical studies to determine the efficacy of Jaypirca as monotherapy or in combination with other medications for treating people with relapsed/refractory mantle cell lymphoma [MCL] and chronic lymphocytic leukemia [CLL].

But more importantly, I analyzed the mechanisms of action and clinical data of other BTK inhibitors and came to the conclusion that Eli Lilly’s drug has a more favorable safety profile compared to AstraZeneca PLC’s Calquence (AZN) and BeiGene, Ltd.’s (BGNE) Brukinsa, as well as higher efficacy than AbbVie/J&J’s Imbruvica.

The key factors that contributed to this are that Jaypirca is significantly more selective for BTK, it retains inhibitory activity even with mutations of Cys481, and it also binds non-covalent to the active site of Bruton’s tyrosine kinase.

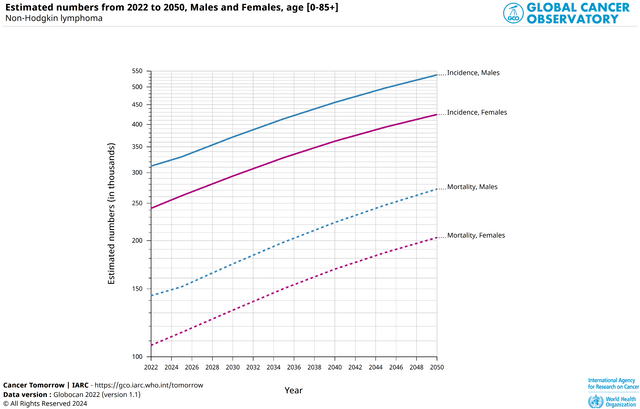

As a result, I believe that the demand for Jaypirca to treat patients with certain types of non-Hodgkin lymphoma will only continue to accelerate, given, among other things, the increase in the number of new cases predicted by the Global Cancer Observatory.

Source: Global Cancer Observatory

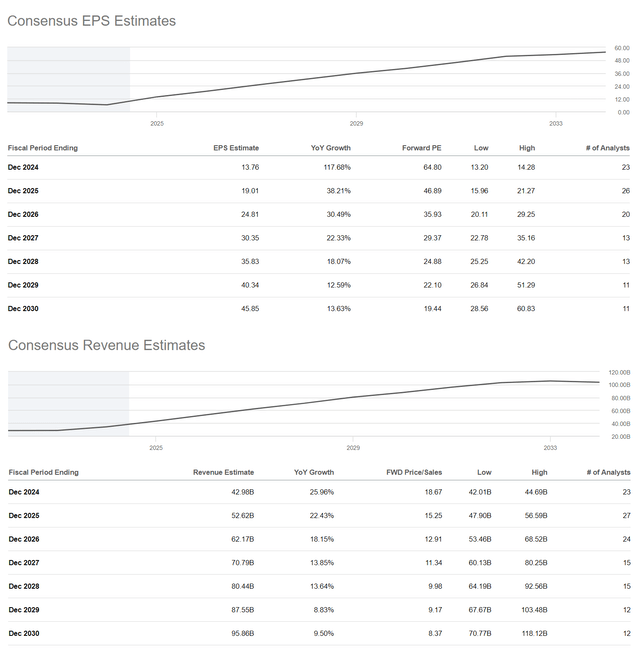

Simultaneously, the Seeking Alpha platform offers financial data as well as Wall Street analysts’ forecasts for Eli Lilly’s earnings per share and revenue for the coming years.

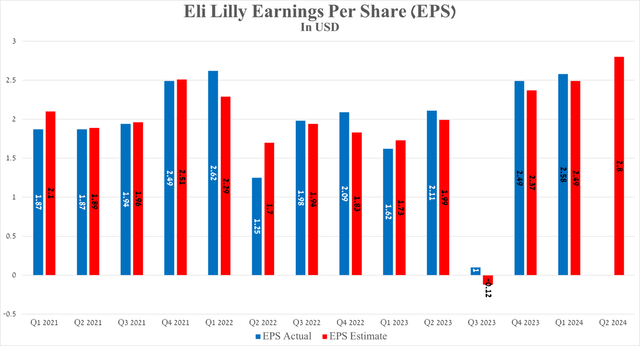

Eli Lilly’s earnings per share for the first quarter of 2024 were about $2.58, up 59.3% year-on-year and beating analysts’ consensus by 9 cents, partly due to continued strong demand for its diabetes franchise. On the other hand, its EPS is anticipated to be in the range of $2.28 to $3.25 in the second quarter, representing a 33% increase from the second quarter of 2023.

Risks

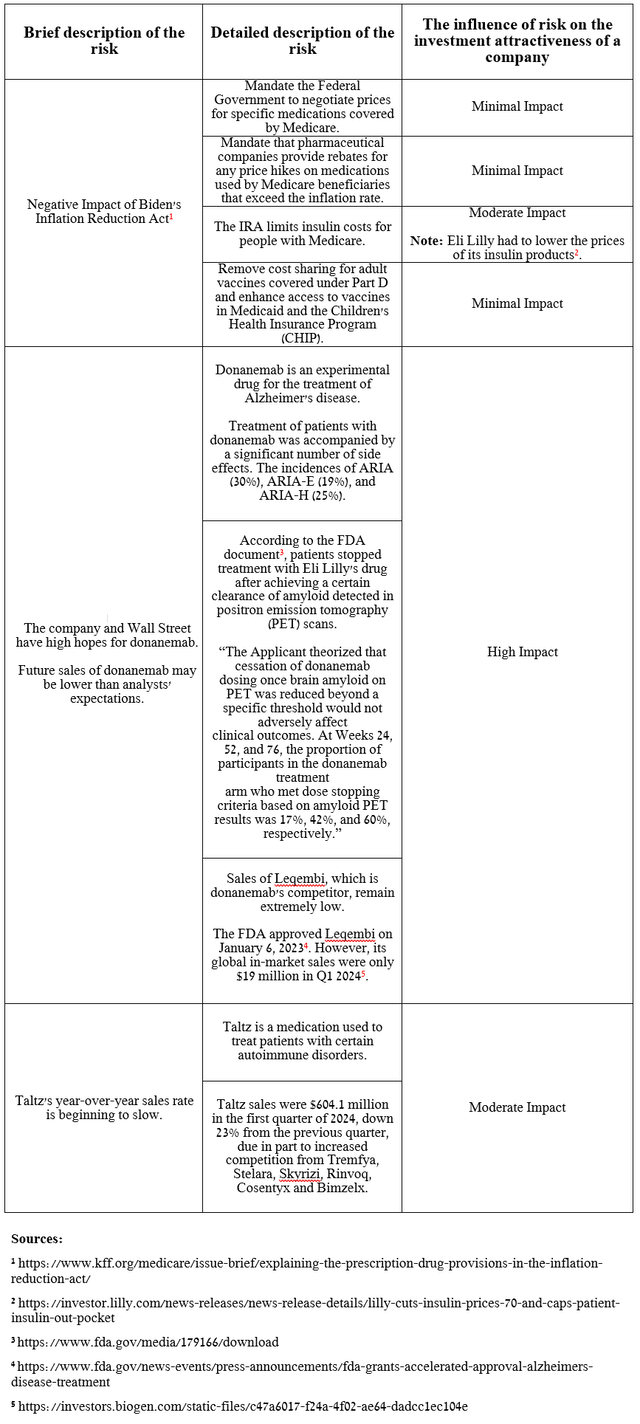

Before moving on to the conclusion, I would like to note the following risks that may negatively affect Eli Lilly’s investment attractiveness in the medium and long term.

Source: The table was made by Author

Takeaway

Eli Lilly’s market capitalization has reached an astronomical value of about $850 billion, thanks to Wall Street’s overly optimistic expectations for its diabetes franchise and donanemab, which is expected to get the “green light” from the FDA.

However, in my opinion, given that many of its competitors are developing more effective medications aimed at treating endocrine diseases, the modest growth rate of Taltz sales, which is its flagship product in the immunology portfolio, the lack of strong catalysts in the near horizon, and given that its shares are overbought according to the RSI and MACD indicators, I believe that Eli Lilly does not offer an attractive reward/risk profile to long-term investors at the moment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.