Summary:

- Eli Lilly and Company reported strong Q2 2024 earnings with revenues up 36% year-on-year, exceeding expectations.

- Guidance for 2024 was raised by ~$3bn with expectations of $45.4bn — $46.6bn in revenues and EPS of $15.1 — $15.6 on a GAAP basis.

- Tirzepatide, a key revenue contributor, shows enormous potential in the diabetes and weight loss markets, driving Lilly’s share price and market cap valuation.

MCCAIG/iStock via Getty Images

Investment Overview

Eli Lilly and Company (NYSE:LLY), the world’s most valuable pharmaceutical company by market cap, announced its Q2 2024 earnings on Thursday last week. Let’s begin by reviewing the headline figures.

Revenues grew by 36% year-on-year, to $11.3bn. On a GAAP basis, operating expenses grew 14%, to $5.42bn, and operating income was $3.72bn – up 90% year-on-year. Net income was $2.97bn, up 86% year-on-year, while earnings per share (“EPS”) came to $3.28. On a non-GAAP / adjusted basis, net income was $3.54bn, and EPS was $3.92.

Looking ahead, Eli Lilly issues guidance for 2024 for $45.4bn – $46.6bn – which is $3bn more than expectations set after Q1 earnings were reported in May. EPS was raised from $13.05 – $13.55, to $15.1 – $15.6 on a GAAP basis, and from $13.5 – $14, to $16.1 – $16.6 on an adjusted / non-GAAP basis.

Pre-market today, Lilly stock was trading at a value >$900, giving the Pharma a market cap valuation of $847bn. Currently, the dividend is worth $1.3 per quarter, which translates to an annual yield of ~0.6%.

Analysis: Strong Performance Across The Board Delights Wall Street

Lilly smashed analysts’ expectations for the quarter in terms of EPS on a normalized and GAAP actual basis, by $1.15 and $0.56 respectively, and also on revenues, beating by >$1.3bn. Lilly’s share price is up 18% over the past few days, meaning it is now up very nearly 700% on a five-year basis.

Most of these gains are down to the promise of a single drug molecule, tirzepatide, marketed and sold as Mounjaro in diabetes, and Zepbound in obesity. However, before we consider the performance of this “wonder-drug,” and its peak revenue potential, let’s review performance across Lilly’s other divisions.

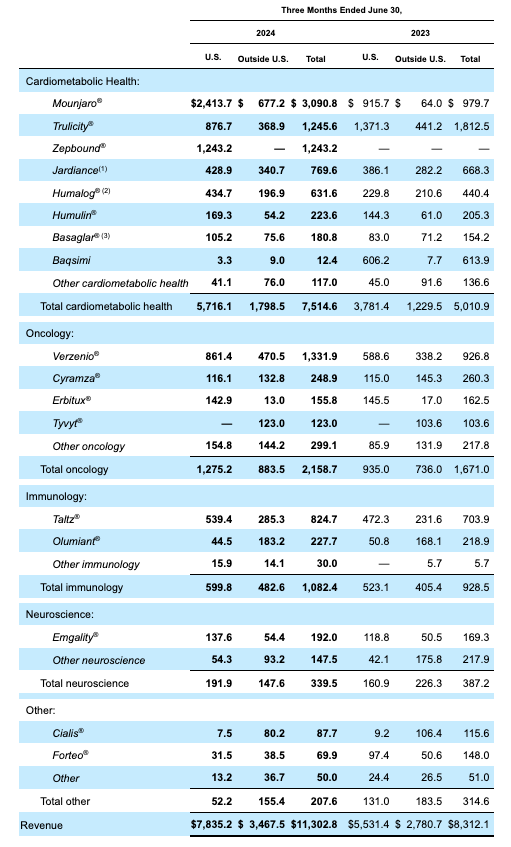

Lilly Product revenues Q2 2024 (Lilly 10Q submission)

As we can see above, performance was impressive across the divisions, with only neuroscience revenues falling year-on-year, from $387.2m in Q2 2023, to $339.5m last quarter. Last year, Lilly sold commercial rights to its >$1.5bn per annum selling schizophrenia drug to Cheplapharma for $1.35bn, so the neuroscience division has shrunk significantly.

In Q2, reported revenues for migraine therapy Emgality were $192m, up from $169m in the prior year quarter, while “other neuroscience” revenues fell from $218m in Q2 2023, to $148m last quarter.

The good news for investors, however, is that this division is likely to perform better than ever before in the coming quarters and years. This is because Lilly’s Alzheimer’s drug, donanemab, has been approved for commercial use, under the brand name Kisunla. Speaking about the approval on the Q2 call with analysts, Lilly’s Chief Scientific Officer Dan Skovronsky told analysts:

the FDA approved Kisunla, including labeling that physicians may consider stopping dosing of Kisunla based on reduction of amyloid plaques. Following the July approval, we launched Kisunla, and we’re delighted to see that patients have already begun receiving this new Lilly medicine as part of clinical practice.

We note that Kisunla is broadly covered for Medicare patients through approved CED registries. Regulatory reviews continue around the world with potential action yet this year in several countries.

Kisunla will cost ~$32k annually, making it slightly pricier than Biogen Inc. (BIIB) / Eisai’s rival therapy Leqembi, which earned $40m of revenues last quarter, although Eisai management has suggested the drug can earn >$2bn by 2026, and nearly $9bn per annum by 2032.

Kisunla has been pegged by analysts for peak revenues of ~$5bn. The dosing strategy discussed by CSO Skovronsky above ought to mitigate the threat of dangerous side effects such as amyloid-related imagining abnormalities (brain swelling). This potentially makes the drug less expensive, and therefore more attractive for health insurers from a reimbursement perspective.

In summary then, while neuroscience revenues were down year-on-year, by the end of the decade this could be a >$10bn per annum business. That is, if Kisunla meets Wall Street’s expectations and a second pipeline asset, another Alzheimer’s therapy, remternetug, focused on patients with earlier stage Alzheimer’s, is approved – phase three studies are ongoing.

Meanwhile, the oncology division grew revenues to $2.16bn, up from $1.67bn in the prior year quarter, mainly buoyed by growing sales of Verzenio, the breast cancer therapy that inhibits the proteins CDK4 and CDK6, which could achieve a >$5bn revenue milestone this year.

The drug faces stiff competition from Swiss Pharma giant Novartis AG’s (NVS) Kisqali and recently failed to meet endpoints in a late-stage study in prostate cancer. However, Lilly’s pipeline drug PNT2002, acquired as part of its $1.4bn acquisition of radiotherapy specialist drug developer Point BioPharma, is expected to challenge for approval in that indication pending late-stage study results. There, it will compete with another Novartis Drug, Pluvicto, another radiotherapy that earned nearly $1bn in revenues in 2023.

Although revenue figures for recently approved Retevmo and Jaypirca, in the indications of thyroid and mantle cell lymphoma cancers, respectively, were not shared in Q2, they may add >$5bn to Lilly’s top line by the end of the decade, it’s speculated. Breast cancer therapy imlunestrant, currently in Phase 3 studies, could also achieve “blockbuster” (>$1bn revenues per annum) status, and Cymraza, Erbitux, and Tyvyt, solid tumor therapies, are likely to deliver >$2bn of revenues in 2024.

Within the immunology division, mainstays Taltz and Olumiant both saw year-on-year revenue increases, to $825m and $228m respectively, and look set to generate close to $4bn revenues in 2024. Meanwhile, mirikizumab was finally approved in October last year, the IL-23 inhibitor joining a competitive field of approved drugs in ulcerative colitis, where it could easily achieve blockbuster status.

Mirikizumab was initially rejected for approval in April 2023, while Lilly is also experiencing problems securing approval for another potential immunology blockbuster, Lebrikizumab, which was rejected for approval in atopic dermatitis after manufacturing issues were detected at a contract manufacturer. Nevertheless, approval is likely to be secured eventually, helping to make the immunology division potentially double in size before the end of the decade.

Tirzepatide Begins To Deliver On Enormous Potential

After reviewing neuroscience, oncology, and immunology, which respectively delivered $340m, $2.26bn, and $1.1bn in Q2 2024, we can turn our attention to Lilly’s most important and celebrated division, diabetes/weight loss, which earned $7.52bn of revenues last quarter, up from $5.5bn in Q1.

Tirzepatide, the “incretin mimetic” (incretin is a hormone that affects receptors in the brain that control how full we feel), or dual agonist of glucagon-like peptide-1 (GLP-1) and glucose-dependent insulinotropic polypeptide (“GIP”) is the main revenue contributor within this division. It is, potentially, the world’s best-selling drug in waiting, thanks primarily to its miraculous weight loss properties – in pivotal studies, patients lost an average of 21% of their body weight at 72 weeks using the drug.

In Q2, tirzepatide earned the bulk of its revenues via its Mounjaro / Type 2 Diabetes (“T2D”) indication – $3.1bn, up from $1.8bn in the prior quarter, and the rest from its Zepbound obesity indication – $1.24bn, up from $517m in Q1. As a reminder, Zepbound was only approved in November last year.

Lilly’s main rival in both markets is Novo Nordisk A/S’s (NVO) semaglutide, as mentioned above. Novo’s Q2 earnings slightly disappointed Wall Street, however, with Wegovy earning $1.7bn of revenues, and Ozempic ~$4.2bn, underperforming expectations.

Estimates for the eventual size of the market for GLP-1 agonist-class drugs vary significantly. However, they are expected to be in the region of $70bn – >$200bn per annum. Hence, signs that Lilly is winning the battle for market share – although Novo remains ahead, its lead is slipping – are driving Lilly’s share price towards the $1,000 mark, and its market cap valuation towards the $1 trillion dollar mark.

As if that weren’t promising enough, Lilly has now submitted for permission to market and sell tirzepatide in the indication of obstructive sleep apnea, in both the US and EU. It delivered positive data readouts from a Phase 3 study of the drug in patients with heart failure with preserved injection fraction and obesity. According to Lilly’s CEO Dave Ricks, speaking on the Q2 earnings call:

We have initiated a broad Phase 3 development program studying the molecule in obesity, OSA, osteoarthritis, cardiovascular and renal outcomes as well as type 2 diabetes. These readouts start in 2026.

One of the problems that has been affecting sales of semaglutide globally is a lack of supply – the drug has been on the FDA’s drug shortage list for more than two years. Novo is investing billions in new manufacturing plants to ramp up supply, but so is Lilly – according to CEO Ricks:

Our top priority remains executing on our ambitious manufacturing expansion agenda. In May, we announced plans to invest an additional $5.3 billion in our Lebanon, Indiana manufacturing sites, bringing our total investment there to $9 billion.

We believe this is the largest single investment in synthetic medicine active pharmaceutical ingredient manufacturing in the history of the United States. Importantly, this expansion will enhance capacity to manufacture active pharmaceutical ingredients for Zepbound and Mounjaro.

Since 2020, we have committed more than $18 billion to build, upgrade, or acquire facilities in the U.S. and Europe, and we began to see the benefit of these investments.

In short, it is beginning to feel as though there is no stopping Lilly and tirzepatide, but even if there were, Lilly is already working on – and indeed close to securing approval for – two further GLP-1 agonist drugs. Orforglipron, an oral therapy (tirzepatide is self-administered via injection) is in Phase 3 studies, and involved in nine clinical studies overall, Lilly says, with readouts beginning next year.

Retatrutide, nicknamed “triple-G” as it targets three different hormones – GLP-1, GIP, and glucagon – has achieved a weight loss of 24% at 48 weeks. Orforglipron has shown nearly 10% weight loss at 36 weeks, meaning arguably, Lilly has the three most powerful members of the GLP-1 agonist class of drugs in its portfolio.

For every other major Pharma company, Lilly is setting the standard in the T2D and obesity markets – forecast to become the largest markets in pharmaceutical history – making it easy to understand why the company’s valuation has climbed so high.

There are of course risks to buying a company’s stock on the basis that a drug that will likely achieve ~$16bn revenues in 2024, will go on to become a >$70bn per annum selling drug. Most pharma companies are working on GLP-1 agonist drugs of their own, arguably the most promising are being developed by Roche Holding AG (OTCQX:RHHBY), Amgen Inc. (AMGN), Pfizer Inc. (PFE), and smaller biotechs Viking Therapeutics, Inc. (VKTX), Altimmune, Inc. (ALT), and Boehringer Ingelheim – but almost every global Pharma has a program in development.

Lilly and Novo have a massive head start that only a drug with an undeniable “best-in-class” profile could undermine. However, there is always that risk in play, plus the risk that longer-term, GLP-1 agonist drug users begin to exhibit negative side effects, or that the health insurance markets buckle under the demand for GLP-1 agonist drugs. That could collapse the current drug reimbursement framework.

Concluding Thoughts: Lilly Deserves Its Valuation & Will Become First $1 Trillion Market Cap Pharma

A couple of years ago, I was writing bearish notes on Lilly when its market cap valuation was <$500bn. I suggested that too much was expected of its new product pipeline, featuring donanemab and tirzepatide. Yet, here we are today with Lilly challenging to become the first trillion dollar market cap Pharma – a milestone I now fully expect the company to achieve.

During the COVID-19 era, when messenger-RNA based vaccines came to the fore, it was tempting to wonder if e.g., Pfizer or Moderna, Inc. (MRNA) would secure domination of the pharmaceutical treatment landscape. This was due to their ability to send instructions to cells to make any protein, using strands of MRNA.

While that approach has stalled and failed to impress outside of COVID vaccination, however, GLP-1 drugs have more or less passed every test and look like the real deal. There are even rumors the drugs may be able to successfully treat cancer.

It is an incredible development for the pharmaceutical industry. Since I began covering the pharma and biotech industries daily in ~2017, the biggest selling drugs were AbbVie Inc.’s (ABBV) Humira (now no longer patent protected) and Merck & Co., Inc.’s (MRK) Keytruda, indicated for immunology and oncology indications respectively, and earning revenues around the $20bn mark. A conservative estimate sees Tirzepatide out-selling both of these drugs combined before the end of the decade.

You might argue that until we see tirzepatide revenues surpass e.g., $50bn per annum – as mentioned, full-year 2024 revenues will likely be ~$16 – $20bn – we should value Eli Lilly stock more conservatively. In that respect, the recent pull-back in the valuation of Novo Nordisk shows how quickly the market can lose faith – but in my view, we are a long way from reaching critical mass with tirzepatide.

The drug has already proven more effective in more indications than even the most blinkered optimist would have believed possible three years ago, and arguably, we are just beginning to understand its full potential.

The risk of another Pharma delivering a better GLP-1 agonist drug in the coming years remains. My companies to watch would be Roche, Pfizer, and Viking. However, given there will likely be no new GLP-1 agonist approvals this year or next, Lilly will remain the horse to back in this market. Having come this far, I suspect there is every chance Lilly’s valuation will exceed $1 trillion by this time next year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, RHHBY, PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.