Summary:

- As the wider market turns pessimistic, Eli Lilly continues to trade sideways at these inflated levels with the stock still boasting overly premium valuations, triggering a minimal margin of safety.

- While LLY’s capacity expansions and M&A activities will likely be top/ bottom line accretive as demand for GLP-1 remains robust, these have also caused the deterioration of its balance sheet.

- While LLY continues to demonstrate promising long-term prospects, as observed in the raised FY2024 guidance, we believe that the stock is likely to trade sideways in the near term.

- It may be more prudent to maintain our previous Hold (Neutral) rating here, with readers better off looking for other more reasonably priced stocks.

Aslan Alphan/iStock via Getty Images

We previously covered Eli Lilly and Company (NYSE:LLY) in February 2024, discussing its overly premium valuations and inflated prices, with the stock’s exponential momentum nearing its peak optimism levels, as the market exuberance surrounding GLP-1 therapies peaked.

Despite the robust pipeline and promising diabetes/ obesity prospects, we had believed that there might be moderate volatility ahead, resulting in our reiterated Hold rating, while also advising investors to take some of their gains then.

Since then, LLY has only charted an +1.5% return as the wider market trades sideways with an +1% return, with the market also turning pessimistic and the Fed likely to hold interest rates higher for longer.

While LLY’s capacity expansions and M&A activities will likely be top/ bottom line accretive as demand for GLP-1 remains robust, we believe that the stock is overly expensive compared to its direct peer, Novo Nordisk A/S (NVO).

This is especially worsened by LLY’s moderately deteriorating balance sheet and higher debt leverage, resulting in our reiterated Hold rating.

LLY’s Investment Thesis Remains Overly Inflated Here – No Margin Of Safety

For now, LLY has reported bottom-line beat in the FQ1’24 earnings call, with revenues of $8.76B (-6.3% QoQ/ +25.8% YoY) and adj EPS of $2.58 (+3.6% QoQ/ +59.2% YoY).

Part of the top-line headwinds is attributed to the two GLP-1 based therapies: Mounjaro at net sales of $1.8B (-54.5% QoQ/ +221.4% YoY) and Zepbound at $517.4M (+194.3% QoQ/ NA YoY), along with Verzenio at $1.05B (-7.8% QoQ/ +40% YoY).

Two-Horse Obesity Race

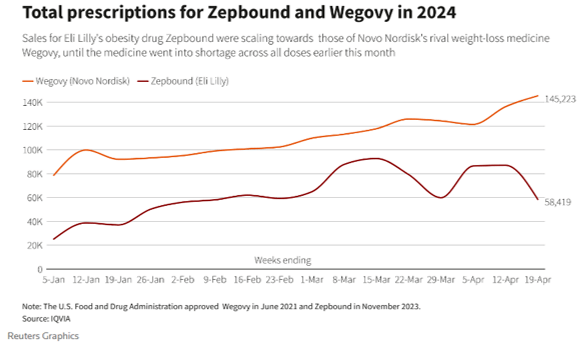

Reuters

It is apparent that the QoQ decline for LLY’s revenues are attributed to the shortage in supply for its GLP-1 based therapies, as opposed to NVO’s ability to meet demand thus far, according to IQVIA data seen by Reuters.

Despite so, it is apparent that patient demand remains robust, explaining why LLY has been able to report that its overall revenues are “driven by increases of +16% in volume and +10% due to higher realized prices.”

With 2024 also bringing forth more hikes in prescription prices and expansion in manufacturing capacity from H2’24 onwards, we expect to see LLY execute brilliantly, as similarly observed in the raised FY2024 revenue midpoint guidance to $43B (+26% YoY) and adj EPS to $13.75 (+117.5% YoY).

This is up from the previous midpoint guidance of $41B (+20.1% YoY) and $12.45 (+96.9% YoY) offered in the FQ4’23 earnings call, respectively.

At the same time, LLY is already looking to aggressively expand its existing manufacturing capabilities over the next few years, through:

- An acquisition of an FDA-approved manufacturing facility in Wisconsin (price unspecified) – production to commence from the end of 2025 onwards.

- A new $1B manufacturing site in Limerick, Ireland – production from 2025/ 2026 onwards.

- A total of $3.7B in two new manufacturing sites in Indiana, US – production from 2026 onwards.

- A new $2.5B manufacturing site in Germany – production from 2027 onwards.

- A total of $4B in multi-year/ multi-phase investments for the manufacturing plants in North Carolina, US, with initial production already occurring in 2023 and expanding in stages through 2027, amongst others.

This is on top of LLY’s M&A activities to expand its existing pipeline:

- POINT Biopharma Global Inc for $1.4B – for the “pipeline of clinical and preclinical-stage radioligand therapies in development for the treatment of cancer.”

- Versanis Bio for $1.92B – for the “bimagrumab, currently being assessed in a Phase 2b study alone and in combination with semaglutide in adults living with overweight or obesity.”

- Sigilon Therapeutics for $309.6M – for the treatment of type 1 diabetes.

- DICE Therapeutics for $2.4B – for the “novel oral therapeutic candidates, including oral IL-17 inhibitors currently in clinical development, to treat chronic diseases in immunology.”

However, the combination of these two concurrent developments also explain why LLY’s balance sheet has moderately deteriorated to a net debt of -$21.97B in FQ1’24, compared to -$15.41B in FQ1’23, and -$11.47B in FY2019.

The same deterioration has been observed in its estimated net-debt-to-EBITDA ratio of 1.89x in FQ1’24, 1.94x in FQ1’23, and 1.57x in FY2019, compared to NVO at 0.77x in FQ4’23, the General Drug Manufacturers average leverage ratio of 2.32x, and the Biotechnology sector of 0.46x.

For reference, LLY already reports a growing annualized interest expenses of $716M in FQ1’24 (+29.5% QoQ/ +74.7% YoY), compared to $400.6M in FY2019 (+65.1% YoY).

Therefore, while the pharmaceutical company’s recent acquisitions may eventually be top/ bottom line accretive, readers may still want to monitor its execution and balance sheet over the next few quarters, since the growing debt levels may potentially trigger moderate bottom-line headwinds as the elevated interest rate environment remains.

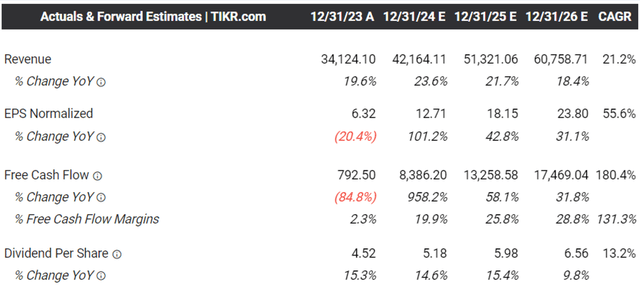

The Consensus Forward Estimates

For now, the raised FY2024 guidance has directly contributed to LLY’s raised consensus forward estimates, with a top/ bottom line CAGR of +21.2%/ +55.6% through FY2026. This is on top of the projected expansion in its net income margins from 16.7% in 2023 to 35.1% in 2026.

This is compared to the previous article’s consensus forward estimates of +20.6%/ +55.2% through FY2026 and the historical growth of +7%/ +8.7% between FY2016 and FY2023, respectively.

So, Is LLY Stock A Buy, Sell, or Hold?

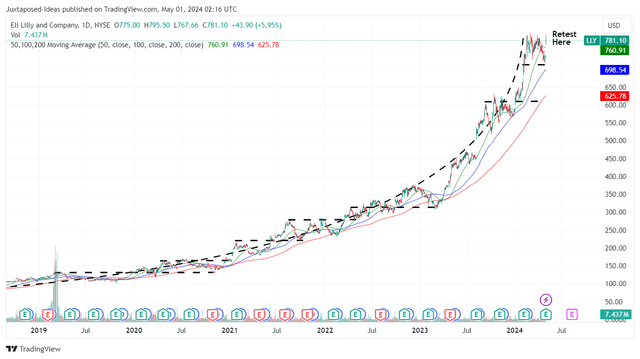

LLY 5Y Stock Price

Nonetheless, it is also painfully apparent that LLY has been trading sideways since early February 2024, with the recently raised FY2024 guidance triggering the timely recovery of +7.7% from the 2024 bottom of $720s.

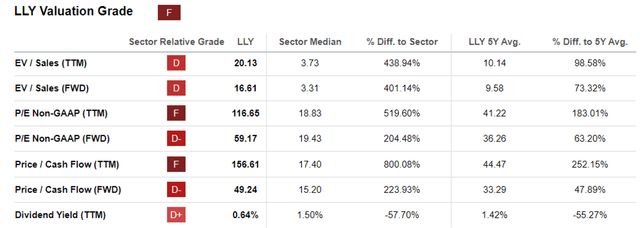

LLY Valuations

Despite so, we are not certain if it is wise for the market to continue awarding LLY with the overly premium FWD P/E valuations of 59.17x and FWD Price/ Cash Flow valuations of 49.24x.

This is compared to our previous article at 49.88x/ 84.20x, 5Y mean of 36.26x/ 33.29x, NVO at 37.70x/ 86.73x, and the sector median at 19.43x/ 15.20x, respectively.

This is especially since NVO is expected to generate a similarly impressive top/ bottom line growth at a CAGR of +19.8%/ +24.2% through FY2026, while generating richer net income margins of 36% in 2023 and 37.2% in 2026.

As a result of these developments, we believe that it may be more prudent to revise our previous fair value estimates using LLY’s more reasonable 5Y P/E mean of 36.26x, especially since it is nearer to NVO’s FWD P/E of 37.70x.

Despite so, it is painfully apparent that LLY is trading at a notable premium of +127.9% to our fair value estimates of $342.60, based on the normalized P/E of 36.26x and the LTM adj EPS of $9.45 (after including a $2.17 impact from the sale of olanzapine rights and acquired IPR&D charges).

Based on the consensus FY2026 adj EPS estimates of $23.80, there seems to be a minimal margin of safety to our long-term price target of $862.90 well.

While LLY continues to demonstrate promising long-term prospects, we maintain our belief that the stock appears to be overly inflated here, with it uncertain if it may be able to sustain the eye-watering growth premium embedded in its valuations, one rarely seen before in the Pharmaceutical industry.

At the same time, while LLY may offer a rather tempting 5Y Dividend Growth Rate of +14.99%, further aided by the recent hike by +15%, the massive rally has also triggered an underwhelming forward dividend yields of 0.67%.

This is compared to the sector median of +6.59% and 1.59%, respectively, and the US Treasury Yields of between 4.69% and 5.35%.

As a result, it may be more prudent to maintain our previous Hold (Neutral) rating for the LLY stock here, with readers better off looking for other more reasonably priced stocks.

Do not chase this rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.