Summary:

- Eli Lilly and Company’s revenue for the first quarter of 2024 fell short of analysts’ expectations, but the company exceeded forecasts on the bottom line.

- Sales of the company’s obesity and diabetes drugs, particularly Mounjaro and Zepbound, saw significant growth.

- Management increased guidance for 2024, expecting further growth in revenue and earnings per share, but the stock is considered expensive.

jetcityimage

Fundamentally speaking, things just appear to keep getting better for pharmaceutical giant Eli Lilly and Company (NYSE:LLY). You see, back in June 2023, I ended up writing a bullish article about the firm. I cited what I referred to as its “miracle” weight loss drugs, most notably Mounjaro, as a reason for investors to be optimistic about the future. Ultimately, I ended up rating the company a “Buy.” And from that time through the present day, shares are up 68% compared to the 14.1% increase seen by the S&P 500 (SP500).

But I have not always been bullish on the firm. In fact, in early February of this year, I felt as though shares had moved up too much. Despite strong fundamental results, the 56.2% surge that prices had seen since my initial bullish article on the company led me to think that further upside would be unlikely. This caused me to downgrade the company to a “Hold.” Since then, however, shares have moved up another 7.3% compared to the paltry 0.8% uptick the broader market achieved. However, most of that increase occurred on April 30th when shares closed up 6% compared to what they were at the day prior.

This sudden move higher was driven by financial results posted covering the first quarter of the company’s 2024 fiscal year. Although revenue fell short of analysts’ expectations, the company exceeded forecasts on the bottom line. Furthermore, management increased guidance for 2024 thanks to continued strength from some key drugs. Moving forward, there are reasons to believe that further growth beyond 2024 will be achieved.

However, we are starting to find ourselves in a rather difficult situation. This is because the stock looks expensive. While I am not yet prepared to downgrade the company to something bearish, I do think that further upside without a corresponding increase in expectations on the bottom line could warrant an eventual downgrade.

Stellar growth remains in play

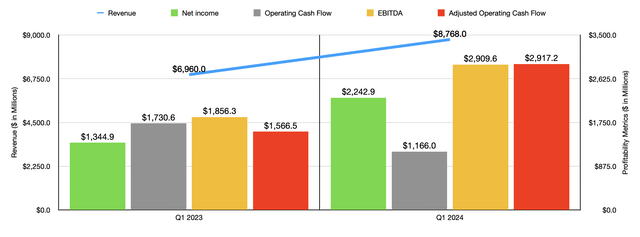

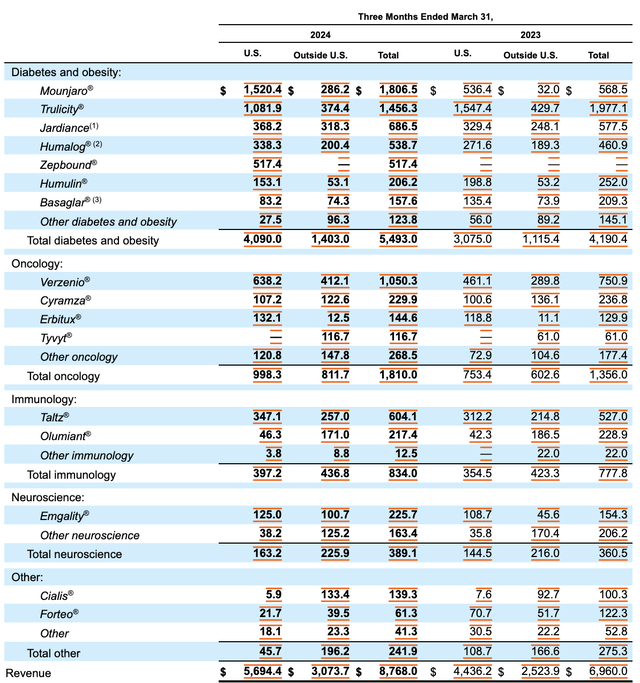

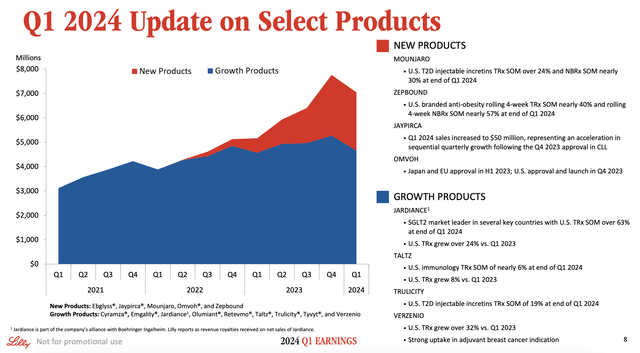

When it comes to the first quarter of the 2024 fiscal year, revenue for the company came in quite strong. Sales ultimately totaled $8.77 billion. That’s an increase of 26% over the $6.96 billion generated one year earlier, but it fell short of analysts’ expectations by $160 million. All the rage as of late has involved the company’s obesity and diabetes drugs. The most notable of these is Mounjaro, which has been described by many, myself included, as a “miracle” weight loss drug. Sales of that particular offering came in at $1.81 billion for the quarter. That’s more than triple the $568.5 million generated at the same time one year earlier.

To date, Mounjaro has seen perhaps the most impressive growth of any drug produced by Eli Lilly. For details on exactly why this drug is such a hot ticket item, I would like to refer you to my initial article on the company from last year. That is the aforementioned article published in June 2023. But the bottom line is that it helps those taking it achieve rapid weight loss while in general improving the overall health of those with diabetes.

But it’s not alone. An even newer offering provided by management is known as Zepbound. However, it would be a mistake to call this a standalone drug. In fact, it’s the same formulation as Mounjaro, only that it has been branded and approved for weight loss as opposed to diabetes like Mounjaro has. This drug generated sales of $517.4 million in the first quarter of 2024. That’s up from nothing the year prior. This is really impressive considering that it was only November 8th of last year that Zepbound received approval from the FDA to launch.

For a long time now, Eli Lilly has focused on diabetes and obesity drug development. Collectively, sales for these products came in at $5.49 billion for the first quarter of 2024. That’s 31.1% above the $4.19 billion generated one year earlier. And unfortunately, however, not every offering under this category has experienced strength as of late. The biggest loser for the company has been Trulicity, which has historically been used to curb one’s appetite. In essence, this drug is being viewed as less relevant today thanks to the introduction of Mounjaro and Zepbound. Overall sales are still significant, totaling $1.46 billion during the quarter. But that’s down mightily from the $1.98 billion generated one year earlier.

It would be a major oversight to ignore some of the other reasons for the company’s growth. While the diabetes and obesity drugs are undoubtedly the star of the show, there has been growth elsewhere within the firm. Oncology related revenue, for instance, spiked 33.5% year over year, shooting up from $1.36 billion to $1.81 billion. The biggest mover on this front was Verzenio, which saw revenue jump 39.9% from $750.9 million to $1.05 billion. Verzenio has been developed and approved for treating different types of breast cancer that traditionally has a high chance of returning. Multiple studies, however, have backed the idea that taking this drug significantly reduces the chance of that occurring. When combined with hormone therapy, Verzenio has been associated with a 35% reduction in the risk of said cancer returning, with 85.5% of people that took it alongside hormone therapy still alive and without their cancer returning compared to 78.6% that used hormone therapy alone over the span of 48 months.

The fact of the matter is that Eli Lilly is a very diverse company in terms of how it generates revenue. And all major parts of it appear to be growing. Under the immunology category, revenue of $834 million beat out the $777.8 million generated one year earlier. This was driven entirely by its Taltz treatment. Meanwhile, revenue generated from neuroscience drugs rose from $360.5 million to $389.1 million. And all of that was thanks to Emgality, which reported an increase from $154.3 million to $225.7 million.

While Eli Lilly did fall short of expectations when it came to revenue, the company exceeded forecasts on the bottom line. Earnings per share came in at $2.48. That compares to the $1.49 per share generated one year earlier, and it was $0.04 per share above what analysts were anticipating. This translated to net profits climbing from $1.34 billion last year to $2.24 billion this year. Most other profitability metrics also improved year over year as well. The big exception to this was operating cash flow. It managed to fall from $1.73 billion to $1.17 billion. But if we adjust for changes in working capital, we would get an increase from $1.57 billion to $2.92 billion. And lastly, EBITDA for the company expanded from $1.86 billion to $2.91 billion.

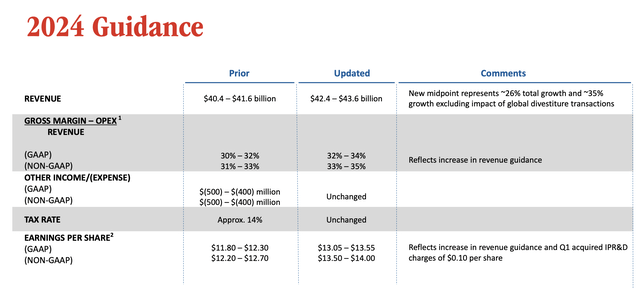

While the bottom line improvement certainly aided in the bullish argument, what was probably more significant was the fact that management increased guidance for 2024. Previously, the company was guiding for revenue of between $40.4 billion and $41.6 billion. That number has now been increased to between $42.4 billion and $43.6 billion. At the midpoint, that would come out to $43 billion, which would be a whopping 26% above the $34.12 billion generated in 2023. On the bottom line, earnings per share were revised higher to between $13.05 and $13.55. That’s a nice uptick from the $11.80 to $12.30 per share previously anticipated.

If we hit the midpoint of guidance, then net profits would be about $12.02 billion. That’s more than double the $5.24 billion generated in 2023. If we annualized the other profitability metrics, we would expect adjusted operating cash flow of $15.21 billion and EBITDA of $19.30 billion.

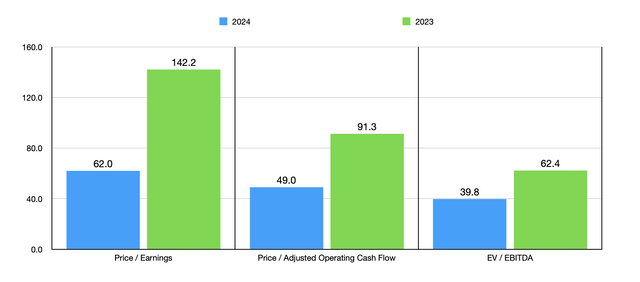

As amazing as these expectations are, there is also no denying that the stock is very expensive. In the chart above, you can see how shares are priced using data from 2023 and using historical results from 2024. Seeing a company trade at 49 times adjusted operating cash flow is borderline insane. But that is a meaningful improvement over the 91.3 multiple that we get using 2023 data.

In the table below, I compared Eli Lilly to five similar firms. However, I even decided to make this comparison based on the forward estimates for our prospect. My thought process is that if shares look expensive on a forward basis when we are using trailing 12-month data for the other companies, then shares must be truly pricey. And sure enough, that’s what we get. On a price to operating cash flow basis, Eli Lilly ended up being the most expensive of the group. And when it comes to the EV to EBITDA approach, four of the five firms ended up being cheaper than it. Only when we look at the price to earnings multiple is the relative valuation not absurd, with three of the five companies cheaper than our candidate.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Eli Lilly and Company | 62.0 | 49.0 | 39.8 |

| Johnson & Johnson (JNJ) | 9.1 | 17.7 | 12.4 |

| Merck & Co. (MRK) | 144.3 | 25.8 | 45.9 |

| Pfizer (PFE) | 71.3 | 16.7 | 21.3 |

| AstraZeneca (AZN) | 37.4 | 24.5 | 18.8 |

| Novo Nordisk (NVO) | 47.5 | 36.5 | 33.7 |

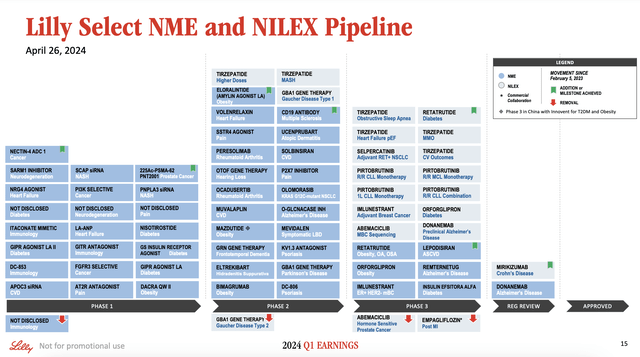

This doesn’t mean that the company can’t eventually grow into its valuation. The fact of the matter is that the firm has a massive pipeline of drugs in the works. In the image below, you can see different drugs and the phase of trials that they are currently in. By my count, we are looking at 14 different drugs across the obesity and diabetes space spread across all three phases. And this doesn’t even factor in potential approval for existing offerings for additional indications. For instance, the company is currently testing Tirzepatide (the technical name for Mounjaro and Zepbound) at higher doses, and it is also testing it for treating other issues like obstructive sleep apnea.

There are other drugs that are noteworthy as well. Late last year, results came out involving a drug called Retatrutide. In a 48-week timeframe, patients who took that lost an average of 24.2% of their body weight. That compares to 18% seen by Zepbound over the span of 72 weeks. Eventually, drugs like this could go on to make a great deal of money for shareholders. According to Goldman Sachs (GS), in early 2023, anti-obesity medications had grown to be worth $6 billion in revenue on an annualized basis. But by 2030, that number is expected to grow to as much as $100 billion. As the undisputed leader in this space, it’s likely that Eli Lilly stands to benefit the most.

Takeaway

If I had to make a guess, I would say that the future will be very bright for Eli Lilly. The company has a lot going for it currently, and I fully expect growth to continue. I wouldn’t even be surprised if we see additional upward revisions later this year. But just because their company is growing rapidly does not mean that it makes for an attractive opportunity. Shares are very expensive, both on an absolute basis and relative to similar enterprises. The stock is so expensive, in fact, that I was very tempted to downgrade it to a “Sell” after researching for this article.

But I’m not there quite yet. The industry does offer a lot of potential, and the ramp up of revenue associated with its new drugs is only just beginning. For that reason, I’m being a bit more lenient than I normally would be. Nonetheless, if we see shares continue to climb like this, a downgrade for Eli Lilly and Company stock could be on the horizon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!