Summary:

- LLY’s recent sell-off has been unwarranted indeed, since the lowered FY2024 guidance is attributed to the complexities of inventory management and non-cash/ one-time IPR&D charges.

- Even so, the pullback has been a gift for opportunistic investors, with the stock now trading nearer to our recommended buy zones.

- If anything, LLY is even cheaper at FWD PEG non-GAAP ratio of 0.85x, well below historical trends and its direct peer.

- This is especially since GLP-1 competition is only set to enter by the end of the decade, with the compounding dispute likely to be resolved soon.

- With Morgan Stanley already raising their 2030 obesity drug market size projections from $77B to $144B instead, we believe in LLY’s two horse GLP-1 dominance ahead.

DNY59

Buy Eli Lilly’s Steep Pullback – Still Compelling Here

We previously covered Eli Lilly and Company (NYSE:NYSE:LLY) in September 2024, discussing why we had upgraded the stock as a Buy then, attributed to its secure long-term growth prospects from the improved supply in H2’24 and the incoming capacity additions from H1’25 onwards.

Combined with the introduction of its D2C channel for self-pay patients, with it offering the company a new growth opportunity through the uninsured patients, we had believed that the stock was trading cheaply at FWD PEG non-GAAP ratio of 1.30x then, well below its historical levels and sector peers.

Even then, the Buy rating came with the caveat of waiting for a moderate pullback to the stock’s previous trading ranges of between $780s and $845s for an improved margin of safety.

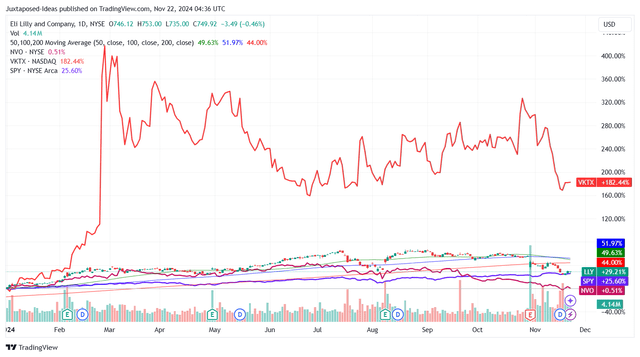

LLY YTD Stock Price

Since then, LLY has effectively lost -18.4% of its value, compared to the wider market at +4.1%, with much of the steep correction attributed to the growth premium embedded in its stock valuations and stock price rally thus far.

This is on top of the competitive headwinds posed by a clinical stage biotech company, Viking Therapeutics (NASDAQ:VKTX), with the recent positive clinical trial data triggering moderate stock price volatility.

On the one hand, we believe that the recent correction has been long time coming indeed, since it finally brings the stock back to earth after the immense rally over the past few years.

On the other hand, we can understand why the market has been concerned about LLY’s growth prospects, attributed to the decelerating sales growth observed in Mounjaro at $3.11B (+0.6% QoQ/ +122.1% YoY) and Zepbound at $1.25B (+0.8% QoQ/ NA YoY) in FQ3’24.

This is compared to the Mounjaro’s sales growth by +43.8% QoQ/ +652.4% YoY in FQ3’23, with it naturally bringing forth great questions of the durability of GLP-1 therapy demand, worsened by the potential sales erosion from compounded GLP-1s.

Despite the supposed resolution of the GLP-1 shortage, the US FDA’s delay in the compounding dispute resolution has triggered moderate uncertainties to LLY’s near-term prospects indeed, since we may see FQ4’24 bring forth another sequentially underwhelming sales performance.

The resolution delay is surprising indeed, despite the numerous safety risks associated with compounded GLP-1s.

These developments have also been worsened by LLY’s lowered FY2024 sales guidance to $45.7B at the midpoint (+33.9% YoY) and adj EPS guidance to $13.27 (+109.9% YoY), compared to the previous guidance of $46B (+34.8% YoY) and $16.35 (+158.7% YoY), respectively.

Even so, one only need to tune in to the pharmaceutical company’s recent earnings call to understand that the headwind is partly attributed to the increases in its manufacturing capacity and supply prowess in FQ2’24, which have directly led to its ability to “fulfill the majority of wholesalers back orders.”

This has also naturally led to the sequential sales headwinds in FQ3’24, as “wholesalers continued to navigate the complexities of high-volume cold-chain products across a dozen different dose and brand combinations,” with it likely contributing to the perceived shortage till now.

At the same time, readers must note that LLY recently acquired Morphic Therapeutics, with it triggering an FY2024 adj EPS impact of -$3.33 in non-cash/ one-time IPR&D charges, barring which we may have been looking at an even higher estimated FY2024 adj EPS guidance of $16.60 (+162.6% YoY).

As a result of these factors, we believe that the stock’s recent sell-off has been overly done indeed.

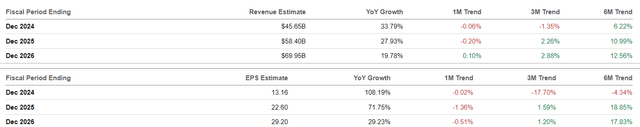

The Consensus Forward Estimates

If anything, the consensus forward estimates remain promising, with LLY still expected to chart an accelerated top/ bottom-line growth at a CAGR of +27%/ +66.6% through FY2026.

This is compared to the original estimates of +11.6%/ +42% and historical growth of +7%/ +8.7% between FY2016 and FY2023, respectively, with the GLP-1 pipelines naturally being the pharmaceutical company’s new growth drivers.

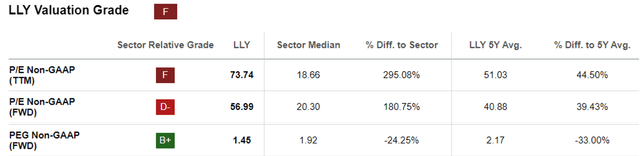

LLY Valuations

And this is also why we believe that LLY remains attractive at FWD P/E non-GAAP valuations of 56.99x, despite the notable upgrade from its 5Y mean of 40.88x, 10Y mean of 28.71x, and the sector median of 20.30x.

Our optimism is attributed to the reasonable FWD PEG non-GAAP ratio of 1.45x, against the 5Y mean of 2.17x, 10Y mean of 6.67x, and the sector median of 1.92x.

The same conclusion may also be derived against its direct competitor, Novo Nordisk A/S (NVO) at FWD PEG non-GAAP ratio of 2.18x, with it underscoring LLY’s compelling high growth investment thesis.

Risk Warning

It goes without saying that with premium (FWD P/E) valuations come with great expectations, one that has triggered LLY’s recent stock price corrections after the supposedly lowered FY2024 adj EPS guidance.

This is on top of the massive GLP-1 competition (likely) launched by numerous players by the end of the decade, with it potentially taking the shine out of LLY’s two race horse cadence along with NVO.

On the one hand, we continue to believe in LLY’s great head start thus far, especially given the secure manufacturing capability along with Mounjaro’s accelerating international sales.

This is on top of the upcoming international launch of Zepbound from Q4’24 onwards, with it likely to be a great growth tailwind in FY2025 despite the tougher YoY comparisons.

These developments imply that LLY’s >$20B efforts in building, upgrading, and acquiring additional manufacturing capacities are likely pay off handsomely by the second half of the decade, as observed in the promising top/ bottom-line growth at a CAGR of +17.5%/ +34.6% through FY2030, respectively.

These numbers do not appear to be overly aggressive indeed, with Morgan Stanley already raising their 2030 obesity drug market size projections from $77B to $144B instead, naturally benefiting the two first movers, LLY included.

On the other hand, we maintain our belief that LLY’s future growth profile are likely to moderate from the triple digits recorded in FY2024, with things eventually normalizing over the next few years.

The same volatility in LLY’s FWD P/E valuations have also been observed over the past one year, moderating from the July 2024 peak of 73.74x to 56.99x by the time of writing, partly attributed to the July/ August 2024 market rotation and recent sell-off.

As a result of the massive fluctuation in its P/E valuations, we will be sticking with the (previous) 5Y P/E mean of 39.41x as the crucial metric for our fair value estimate and long-term price target calculation in our next segment for an improved margin of safety.

So, Is LLY Stock A Buy, Sell, or Hold?

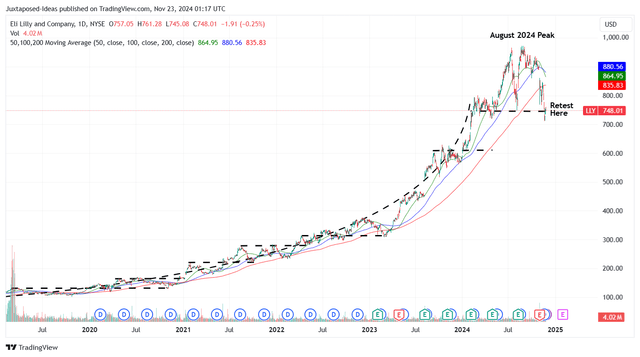

LLY 5Y Stock Price

For now, LLY has charted new peaks of $970s in August 2024, before painfully losing much of its 2024 gains (the equivalent -$189.18B of its market capitalization) after the management lowered their FY2024 adj EPS guidance, triggering the stock’s recent retest of its $720s support levels.

For context, we had offered a fair value estimate of $644.30 in our last article, based on the (previous) 5Y P/E mean of 39.41x and the management’s FY2024 adj EPS guidance of $16.35 at the midpoint (+158.7% YoY).

While LLY may have suddenly lowered their FY2024 adj EPS guidance to $13.27 at the midpoint (+109.9% YoY), with it implying a -18.8% downgrade from previous numbers, we believe that the sell-off has been unwarranted, as discussed above.

If anything, given that the consensus FY2026 adj EPS estimates remain largely stable at $29.20 (previously at $29.28), the recent pullback has already triggered an excellent upside potential of +53.4% to our reiterated long-term price target of $1.15K.

As a result of the still robust capital appreciation prospect and the cheap FWD PEG non GAAP ratio, we are reiterating our Buy rating for the LLY stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.