Summary:

- Eli Lilly’s new Alzheimer’s drug, Kisunla, shows promise with its unique treatment regimen and potential competitive advantages over Biogen’s Leqembi.

- Despite challenges, Kisunla is priced aggressively at $32,000 per year, offering a potentially more cost-effective solution given its shorter treatment duration.

- Eli Lilly reported a 26% increase in revenue in Q1, driven by strong performances from its diabetes and obesity drugs.

- Eli Lilly is a buy due to its robust product portfolio and growth prospects, particularly from Zepbound.

LightFieldStudios

Introduction

My last article on Eli Lilly (NYSE:LLY) focused on their prospects in the multi-billion dollar obesity market with their GLP-1/GIP agonist, Zepbound (tirzepatide). On the heels of Zepbound, Eli Lilly’s valuation, now $816 billion, has catapulted itself into the top 10 largest global market caps, trumping companies like Tesla (TSLA), Visa (V), and Walmart (WMT). Zepbound, approved in November 2023, brought in $517 million in Q1 and is projected to exceed $16 billion in sales per year by 2029. Moreover, Eli Lilly has a number of obesity-related assets, covering different mechanisms of action, in the pipeline, perhaps ensuring a “duopoly” with Novo Nordisk (NVO) in obesity treatment.

Eli Lilly is in the news again, but this time for their work on Alzheimer’s disease. The following article will look at Eli Lilly’s potential in the Alzheimer’s market.

Eli Lilly Unlocks New Frontiers in Alzheimer’s with Kisunla

The Alzheimer’s disease [AD] market is expanding rapidly as a result of an aging population and advances in diagnostic technology. The global AD market is projected to eclipse $10 billion by 2029. On Tuesday, Eli Lilly announced that the FDA had approved Kisunla (donanemab), an Alzheimer’s disease therapy. Kisunla targets amyloid plaques, a hallmark of AD pathology. Compared to a placebo, after 18 months, Kisunla “slowed cognitive and functional decline by up to 35%.” Compared to other AD treatments, like Biogen’s (BIIB) and Eisai’s Leqembi, Kisunla offers a compelling treatment option with its limited-duration regimen, “treat to clear” (12 months), substantial amyloid plaque reduction (84% versus <75% for Leqembi), and convenient administration schedule (30 minute infusion versus 45-60 minutes for Leqembi).

Biogen is still reporting losses from Leqembi’s marketization due to perceptions of “modest benefits, expensive costs, and potential for serious adverse effects (including death),” as discussed in my recent article on Biogen’s Q1 earnings. Eli Lilly may have more luck than Biogen has had thus far. Leqembi, which was approved just over a year ago, is not an established treatment, and Eli Lilly can learn from Biogen’s mistakes and shortcomings (second-mover advantage).

Although Eli Lilly is pricing Kisunla aggressively ($32,000 per year versus Leqembi’s $26,500), the company notes that:

The total cost of Kisunla will vary by patient based on when they complete treatment. The FDA’s dosing instructions state that prescribers can consider stopping the dosing of Kisunla based on removal of amyloid plaques to minimal levels as observed on amyloid PET imaging. The potential to complete treatment after a limited-duration course of therapy, along with 30-minute infusions once per month, could result in lower patient out-of-pocket treatment costs and fewer infusions compared to other amyloid-targeting therapies.

Kisunla will bear the same safety warning for amyloid-related imaging abnormalities, or ARIA, which can be life-threatening.

Peak annual sales for Kisunla are anywhere between $2 billion and $5 billion. The market estimates have become far more conservative following Leqembi’s commercialization. Immediately following its launch, Eisai’s own estimates for Leqembi’s peak annual sales exceeded $7 billion. Eisai is currently submitting a BLA for a Leqembi subcutaneous autoinjector. A subcutaneous version is also being tested by Eli Lilly. The hope is that it will provide more convenient and cost-effective administration (for example, at home or in a clinic) while also being safer (reduced risk for ARIAs).

While there is still a lot of uncertainty about drugs like Kisunla and Leqembi in the AD market, I believe Eli Lilly’s Kisunla is a better choice. As a result, Eli Lilly has become a market leader in Alzheimer’s, a significant accomplishment. Kisunla likely adds another blockbuster to Eli Lilly’s arsenal and investors should appreciate the diversity in therapeutic indications.

Q1 Earnings

Eli Lilly had an impressive Q1 earnings report despite revenue of $8.77 billion, up 26% year-over-year, missing by $161 million. Net income was $2.24 billion, with earnings per share (EPS) of $2.48, exceeding expectations by $0.04. Eli Lilly increased its full-year guidance by $2 billion to $42.4 billion to $43.6 billion on the strength of Mounjaro and Zepbound.

Eli Lilly’s Mounjaro (diabetes) is their #1 contributor, netting $1.81 billion in Q1 revenue. Trulicity (diabetes) comes in at #2 with $1.46 billion in revenue, despite a 26% year-over-year decrease (“due to supply constraints and competitive dynamics). Verzenio, for the treatment of HR+ and HER2-metastatic breast cancer, saw Q1 revenue rise 40% to $1.05 billion. Jardiance (diabetes and heart failure) rose 19% to $686.5 million. Finally, Taltz (psoriasis) landed $604.1 million, growing 15%.

Peer Comparison

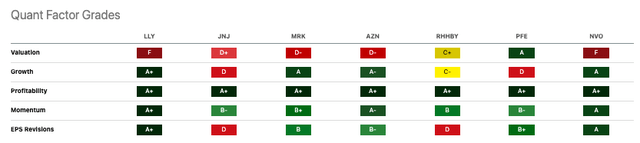

Seeking Alpha

Eli Lilly’s stock returns have significantly outperformed those of its peers, even edging out Novo Nordisk (NVO) by a 1Y return of 96% versus 79%. Both LLY and NVO score “F” on valuation. For example, LLY’s EV/Sales [TTM] of 23.56 is 4.1x that of Merck’s (MRK) 5.74. However, LLY’s revenue growth (YoY) of 29.76% outperforms MRK’s 6.11% (4.8x). To me, statistics like this make LLY’s valuation easier to stomach. LLY’s growth profit margin of 80.16% bests Roche’s (OTCQX:RHHBY) 74.19% but trails AstraZeneca’s (AZN) 82.5%.

Risk/Reward Analysis and Investment Recommendation

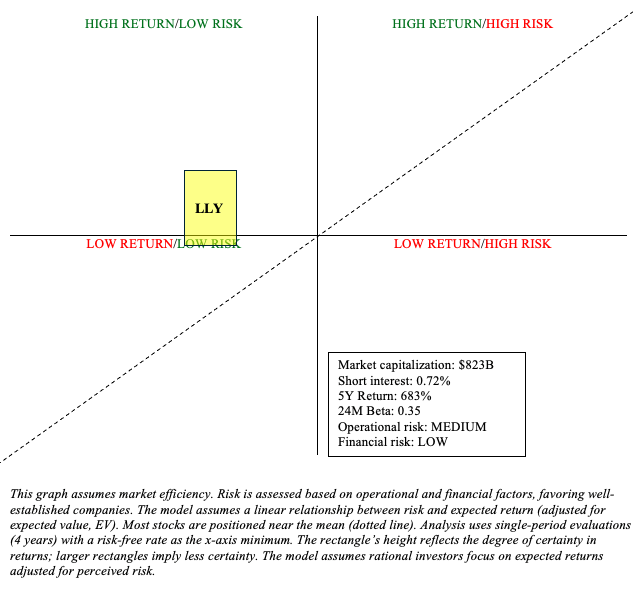

Eli Lilly is experiencing significant growth thanks to its robust diabetes and obesity portfolio. Its 683% stock return over the past five years is a testament to this. Investors often wonder if it’s too late to jump on the bandwagon. Sure, the stock is quite unlikely to see similar returns over the next five years, but one could reasonably see its returns outpacing the risk-free rate (Buy). Expectations are high, but Zepbound could reasonably continue to surprise due to the overwhelming therapeutic potential (including early work in seemingly unrelated conditions like Alzheimer’s and addiction) of GLP-1s.

Author

Kisunla’s approval is welcome news, but the impact on the company’s earnings is unknown. Leqembi’s lackluster performance thus far, owing in part to provider and patient hesitancy, may foreshadow this. However, I believe Eli Lilly’s chances in Alzheimer’s are better due to Kisunla’s unique characteristics.

Eli Lilly’s financial outlook is favorable, despite its $26.35 billion total debt. TTM net income was $6.14 billion, and it is expected to rise further as Zepbound’s capacity catches up with demand. There is a significant operational risk that must be acknowledged. Eli Lilly is heavily reliant on a few drugs, and any changes (e.g., competitive pressures, newfound safety concerns, drug pricing regulation, etc.) could have a significant impact on its earnings potential. Moreover, investors should not be surprised if LLY is subject to considerable volatility in short timeframes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.