Summary:

- Eli Lilly stock has outperformed my previous expectations due to its solid execution and growth in the weight management market.

- Analysts anticipate a $100B weight-loss drugs market by 2030, with Lilly accounting for about $50B in sales.

- Questions must be asked whether the market has reflected significant optimism. Its “F” valuation grade cannot be ignored.

- Throwing caution to the wind at this juncture is perilous. At some point, greedy buyers who chased its recent highs could face the harsh reality of a significantly overvalued stock.

- I argue why investors must remain patient and not fall prey to chasing LLY now.

jetcityimage

Eli Lilly and Company (NYSE:LLY) stock has continued to stun the market as it significantly outperformed my Neutral rating in my initial coverage of the leading biopharma company. The significant optimism is predicated on its solid execution and massive growth in the weight management market, attributed to its Mounjaro (Tirzepatide) product.

As such, I assessed that investors have likely reflected robust execution over the next few years. JPMorgan (JPM) analysts also suggested that the market is expected to remain a duopoly dominated by Lilly and Novo Nordisk (NVO). Notably, JPMorgan anticipates a $100B weight-loss drugs market by 2030, with Lilly accounting for about $50B in sales. As such, I’m not surprised that analysts’ estimates on Lilly have been upgraded to account for its market leadership, as investors anticipate future insurance coverage on its weight management product, broadening market access substantially.

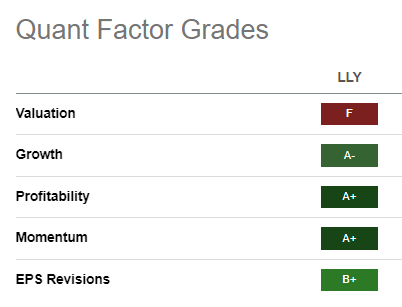

LLY quant grades (Seeking Alpha)

However, investors must temper their optimism now, as LLY seems significantly overvalued as the market bakes in its forward growth prospects. Accordingly, Seeking Alpha Quant assigns LLY an “F” valuation grade (the worst possible), corroborating my analysis.

Lilly Bulls could argue that a premium valuation is justified, given its stellar grades on other factors, as seen above. However, assessing risk/reward is even more crucial now, given its recent surge since my previous update, lifting it into even higher valuation zones.

Of course, Lilly isn’t just a one-product company. Mounjaro accounted for just 12% of its total revenue for the second quarter or FQ2. Its new and growth product categories were instrumental in furthering its wide-moat business model and defending its market leadership.

As such, it doesn’t make sense to bet against Lilly’s ability to innovate, bolstered by best-in-class profitability and free cash flow or FCF. As such, I believe LLY should be a solid core holding for healthcare investors looking to buy and hold. However, if you are new to LLY and missed buying it earlier this year before the sharp surges, you should consider waiting patiently.

Analysts’ estimates suggest Lilly is expected to deliver an adjusted EBITDA CAGR of about 21.8% from FY22-27. Based on its current EBITDA multiple of 40.8x, it’s clear much of it has likely been reflected, given its 10Y average of 18x. If we consider LLY’s FY27 EBITDA multiple of 21x, investors buying at the current levels expect five years of solid execution with little margin of safety. While LLY could continue to move higher, given over-optimism and robust interest from momentum investors, I wouldn’t be next in line to try and snag the possible “greater fool” throne.

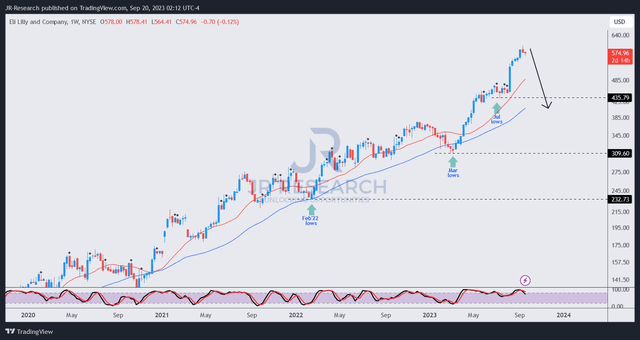

LLY price chart (weekly) (TradingView)

I have not gleaned clear sell signals or red flags on LLY’s medium-term price chart. Given its industry-leading fundamentals and profitability, it remains well-supported and is a solid buy-and-hold proposition.

Technically, it’s also a solid stock, with dip-buyers willing to defend steep pullbacks close to the 50-week moving average (blue line), undergirding its uptrend bias.

Despite that, I assessed that LLY’s near-term momentum has stalled over the past three weeks after its surge toward its September highs ($600 level). Investors looking to buy more should remain patient, as profit-taking could see it fall toward the low to mid-$400 zone before dip-buyers are assessed to return. Don’t chase. Let it come to you. It’s significantly overvalued.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!