Summary:

- Eli Lilly’s well-diversified portfolio and pipeline have been rewarded by the market, with its scale efficiencies and large-scale production processes contributing to its success.

- However, its valuation is now at nose-bleed levels, reflecting significant optimism over the next four years, leaving little margin for error.

- While LLY remains in a long-term uptrend, I assessed that investors should remain patient if they have yet to add positions after its significant run-up this year.

JHVEPhoto

Investors in Eli Lilly and Company (NYSE:LLY) have benefited from its solid execution in its well-diversified portfolio and pipeline as the market rewarded LLY for its ability to drive potentially significant upside.

Keen investors should know that Lilly is a leading big pharma with a leading portfolio in tackling diabetes, obesity, Alzheimer’s disease, and autoimmune disorders.

The market has rewarded the company’s potential breakthroughs in its new and growth products, which bolstered its performance in Q1. In addition, Lilly’s competitive advantage in its core diabetes products helps to undergird its wide economic moat, creating significant barriers to entry for generics in attempting to replicate its scale.

The company’s ability to drive scale efficiencies through large-scale production processes cannot be further overstated. Management updated in a recent June conference that “manufacturing and supply decisions are strategic and made well in advance of product launches.”

As such, Lilly’s $1.7B investment in its new North Carolina facility was prepared before the company had “full data on tirzepatide and understanding market demand.”

Mounjaro (Tirzepatide) and Trulicity are important growth drivers for Lilly. Mounjaro is “currently in Phase 3 clinical trials for obesity,” with the recent positive data highlighting the potential to combat obesity effectively.

In addition, Lilly stressed that the “actual data exceeded expectations.” As such, it undergirded stronger adoption and underlying demand for Tirzepatide, providing the impetus for healthcare investors in a difficult year so far.

Accordingly, Health Care Select Sector SPDR ETF (XLV) has significantly underperformed the S&P 500 (SPY) (SPX) in 2023, with a total return of -4.3% compared to SPY’s 15.6% uptick. As such, I assessed the broad healthcare sector remains undervalued, as several leading stocks were battered in the first half of 2023.

However, LLY bucked the sector’s trend in 2023, delivering a YTD total return of 24.3%. Notably, LLY has significantly outperformed XLV over the past five to ten years in total return terms, indicating the market’s confidence in Lilly’s execution and portfolio potential.

Wall Street analysts are also optimistic about the company’s ability to drive topline growth and operating leverage over the next three to four years. Lilly is projected to achieve a 5Y revenue CAGR of 15.5% from 2022-27. In addition, it’s expected to deliver an adjusted operating profit growth of 24.3% over the same period. I assessed that these are spectacular growth metrics for a big pharma player, with revenue expected to reach $31.4B in 2023.

Seeking Alpha Quant also rated LLY’s growth profile with a “B+” grade, suggesting that LLY is priced for growth. Undergirded by solid profitability (rated “A+” by Quant), Lilly is well-positioned to capitalize on its portfolio and pipeline as it continues to make R&D a core focus of its spending profile.

However, the critical question facing investors is whether the current levels are still reasonable for them to add further?

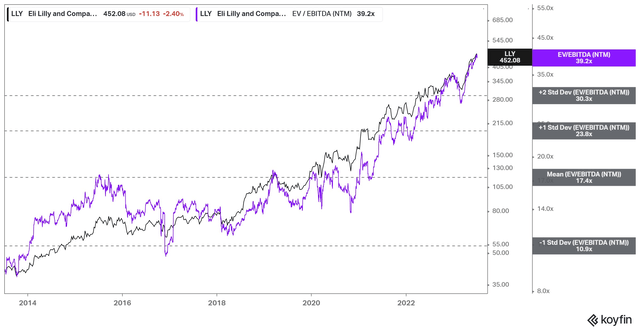

LLY forward EBITDA multiples trend (Koyfin)

As seen above, LLY last traded at a forward EBITDA multiple of more than 39x, well above its 10Y average of 17.4x. Considering its potentially significant operating profit growth, I gleaned that the market has likely priced in a relatively successful outcome of its current portfolio and pipeline over the next four years.

Based on its FY27 projections, LLY is assessed to trade at an FY27 EBITDA multiple of 17x. Therefore, the market seems to have reflected its growth profile over the next four years, leaving little room for execution or market definition challenges.

Despite its overvaluation, LLY’s price action remains well-anchored in a long-term uptrend, with no strong sell signals. While I gleaned that a pullback is increasingly likely to help digest some of its recent optimism, I have yet to see a reason for investors to cut significant exposure in LLY.

As such, investors should consider holding through potential near-term volatility and adding on sharp pullbacks to improve the risk/reward profile. For now, stay on the sidelines.

Rating: Hold.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!