Summary:

- Eli Lilly’s robust product portfolio, strategic acquisitions, and innovation-led initiatives drive its strong growth, positioning it well in the weight-loss, immunology, and oncology markets.

- LLY’s key products, Mounjaro and Zepbound, dominate the U.S. weight-loss market, contributing significantly to revenue and long-term strategic advantages.

- My fair share price estimate of $1,164 indicates a 49% upside potential.

jetcityimage

Introduction

The international pharmaceutical giant Eli Lilly (NYSE:LLY) has shown tremendous growth in the last few years. The growth happened thanks to its robust product portfolio, strategic acquisitions, and innovation-led initiatives. The company, which specializes in solving the world’s most severe healthcare issues, is well-positioned to ride secular trends in weight-loss, immunology and oncology. I like the management’s strong focus on innovation, which has historically been the core pillar of LLY’s success. The company’s strong financial health positions LLY well to continue to aggressively invest in growth. LLY looks like a rare buying opportunity at the moment as the stock has a 49% upside potential. My recommendation here is ‘Strong buy’.

Fundamental analysis

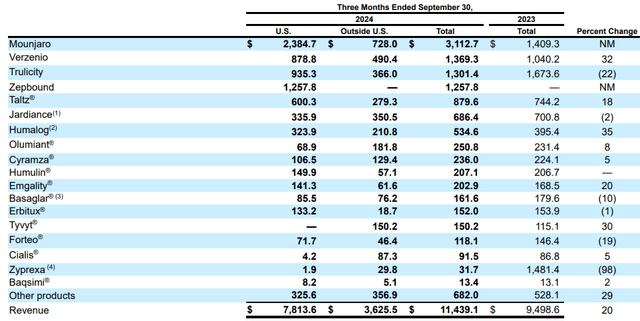

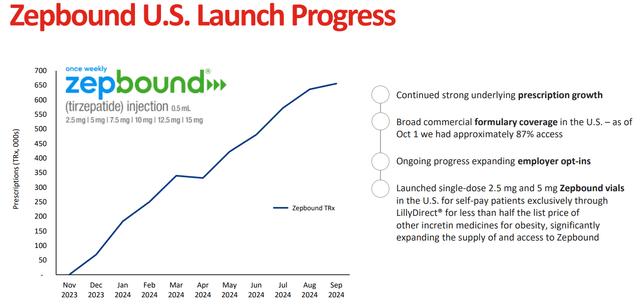

LLY’s business mix is focused on high-growth therapeutics such as diabetes, obesity, oncology and immunology. Its two biggest products – Mounjaro and Zepbound – have been major revenue drivers. In Q3 2024 alone, these medicines sold for more than $4.4 billion, which was driven by strong demand in the U.S. and abroad.

Mounjaro and Zepbound allow LLY to command a significant 40% market share in the U.S. weight-loss drugs market. This is a big fundamental strength of LLY because this industry is thriving and is expected to compound with a staggering 50% CAGR over the next five years. It is crucial to mention that LLY highly likely has a long-lasting strategic advantage in this thriving industry, as the estimated generic launch date is June 14, 2039.

Other areas of LLY’s expansion focus are also promising. For example, the Alzheimer therapeutics market is projected to deliver a 20% industry CAGR by 2030. The global immunology market is expected to observe a 10% CAGR over the next decade. The oncology drugs industry is also expected to maintain double-digit CAGR over the next several years. That said, LLY has exposure to a wide array of thriving niches in the global pharmaceutical industry.

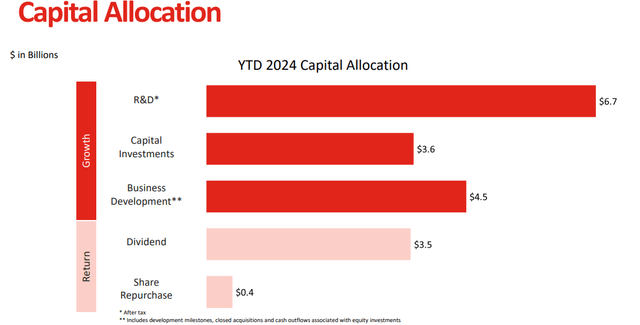

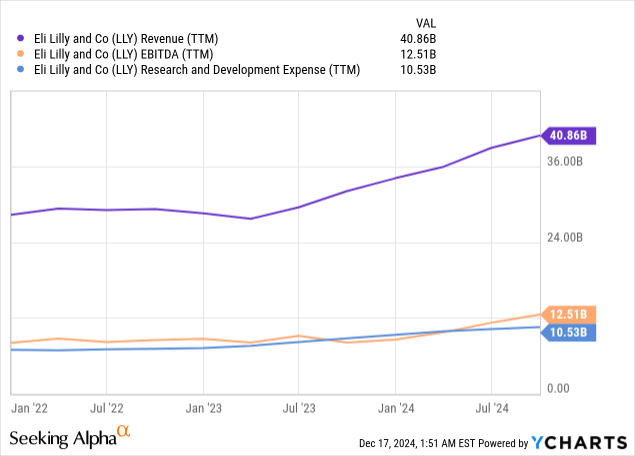

The ability to successfully navigate thriving niches helps LLY in pursuing aggressive revenue growth. As a result, the company gains more resources to boost innovation and still maintain EBITDA growth. Eli Lilly’s growth strategy is multi-layered, a mix of in-house innovation and acquisitions and collaborations. It has continually invested in R&D to continue building its pipeline of new therapies. Its innovation leadership was reflected in the fact that its R&D expenses grew 13% to $2.73 billion in Q3 2024. Recent deals such as Morphic Holding have further expanded its scope of operations in gastroenterology and opened up opportunities for combination therapies.

Along with organic expansion and M&A, Eli Lilly has also forged strategic alliances to expand its market. The first is the ‘Lilly Gateway Labs’ innovation accelerator it launched in partnership with the UK government. The plan will support early-stage life sciences companies and create revolutionary medicines for obesity, the global health crisis. This kind of collaboration not only feeds into Eli Lilly’s pipeline but also enhances its reputation as an industry leader.

The company differentiates itself by manufacturing excellence and supply chain expansion. Investments like the $4.5 billion Lilly Medicine Foundry in Indiana are designed to scale production to address increasing demand for incretin drugs. Combining creativity with productivity, Eli Lilly creates a competitive moat that protects it from rivals.

The company’s capital allocation looks sound with growth initiatives prioritized, which leads to increasing shareholder value via stock price appreciation. The dividend yield is low (below 1%), but payouts are rapidly growing. Eli Lilly is well-equipped to continue investing aggressively in growth and innovation because its balance sheet is strong. The company’s total debt of $30+ billion looks quite insignificant compared to a $700+ billion market cap. Additionally, the company maintains solid cash flows and a comfortable net debt position, enabling continued investments in R&D and manufacturing capacity.

Valuation analysis

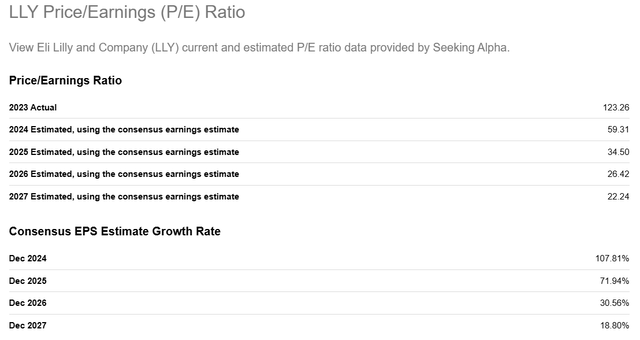

LLY is the largest healthcare company in the world by market capitalization. The valuation is heavily growth-oriented, which we see from the 2023 actual 120+ P/E ratio. However, due to the company’s robust exposure to thriving niches, the metric is expected to shrink significantly over the next few years. The forward 2027 estimated P/E ratio is 22, which looks like a gift for a stock like LLY.

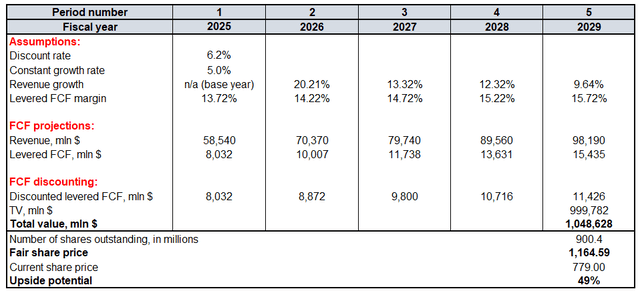

Now, the DCF model. The WACC of LLY is 6.2%. The revenue trajectory projected by consensus incorporates notable revenue growth deceleration every year, which I consider sound for my DCF. The last five years’ FCF margin is 13.72%, my base year’s assumption. LLY’s operating leverage has been historically solid, meaning that I am safe enough to incorporate a 50 basis point yearly expansion of the FCF margin.

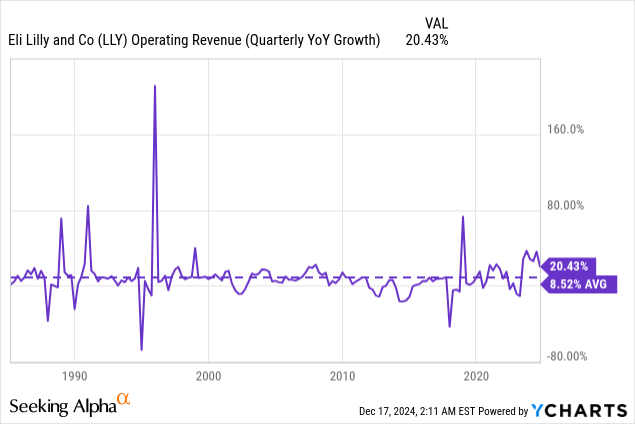

Now, the constant growth rate to calculate the terminal value (‘TV’), which is never easy to estimate. I think that LLY deserves a 5% constant growth rate due to two solid reasons. First, it maintained a much higher 8.5% revenue CAGR over the last four decades. Second, LLY’s ability to outpace the GDP trajectory over the long term is backed by the fact that the company does not only rely on organic growth but also invests in M&A. According to Seeking Alpha, there are 900.4 million LLY shares outstanding.

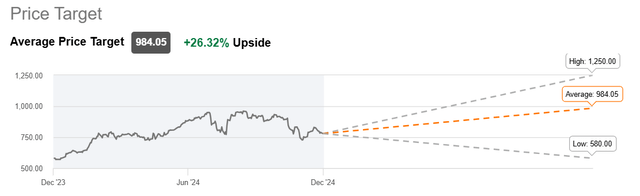

LLY is a trillion-dollar company, according to the fair value calculation above. My fair share price estimate is $1,164 and there is a 49% upside potential. Wall Street analysts also view LLY as a substantially undervalued stock, with an average price target of $984.

Mitigating factors

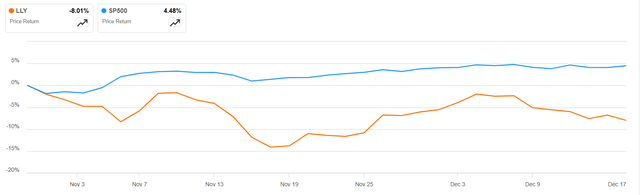

The growth-oriented valuation means that the stock is highly vulnerable to earnings disappointments. As a result, the stock significantly underperforms the S&P 500 since October 30 when the latest earnings release fell short of consensus forecasts on both revenue and earnings.

Despite LLY boasting significant market share in weight-loss drugs and solid patent protection in the U.S., there is a significant competition risk. There is another prominent player in the space, the European giant Novo Nordisk (NVO). This is a strong competitor, which is also highly profitable and demonstrates massive revenue growth. Any decline in LLY’s market share could undermine its long-term growth prospects.

Conclusion

LLY’s 49% upside potential makes it a ‘Strong buy’ investment opportunity, as there are numerous reasons to be confident that the stock will close the gap between its market and fair values. The company is exposed to several rapidly growing niches, has a strong track record of success, and pursues aggressive growth through a mix of organic initiatives and M&A.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.