Summary:

- Eli Lilly and Company’s stock has seen an unexpected drop recently following disappointing developments in its Q3 results and more recently a lawsuit against the HRSA.

- While slowing sales growth for key drugs like Mounjaro and Zepbound might be a blip, it’s worth watching out for developments going forward.

- The company also continues to be in the crosshairs with the government, having sued the HRSA recently for rejecting its payment method under the 304B program.

- As a result, despite a more attractive forward P/E ratio than even a couple of months ago, it’s best to err on the side of caution right now.

Michael Vi

Pharmaceuticals stock Eli Lilly and Company (NYSE:LLY) is down by 23% since I last wrote about it in September. At the time, it appeared that the company could come out on top despite challenges related to its weight management drug Zepbound. Even though it had cut prices, margins were expected to remain unaffected and the company’s guidance was robust as well.

LLY may still well be a rewarding stock in the long term, but recent developments do indicate a need for caution for now. Here are three of them.

#1. Legal wrangles

The company recently sued the Health Resources and Services Administration [HRSA] of the U.S. Health and Human Services Department after its planned change in method to offer lower prices through the government’s 340B program was rejected.

The challenge

The 340B program has already been under criticism for some time now, with questions on whether its benefits are reaching the target patients. In its allegations, Eili Lilly further says that the present model used under the program “was designed to exploit arbitrage opportunities, is deliberately opaque, and allows these entities to freely circumvent the law.” “These entities” refer to the likes of pharmacies and hospitals. Instead, the company wants to pay cash directly, such that it isn’t paying higher than the ceiling price under the program.

Why it’s a negative for the stock

Eli Lilly isn’t alone in its opposition to the HRSA’s decision, either. Johnson & Johnson (JNJ), which faces the same situation, has also sued the administration. That’s small comfort, though. It’s still a problematic situation for two specific reasons.

First, it adds to the company’s issues with the government. The Biden administration has been critical of the company’s high prices for weight-loss drugs, but was somewhat assuaged after a price reduction for Zepbound a few months ago. With the latest lawsuit, however, it’s clear that differences persist between Eli Lilly and the government. It remains to be seen whether things would be any different under the incoming Trump government.

Next, legal entanglements aren’t good for pharmaceutical companies’ stock prices. A good recent example is AstraZeneca (AZN) which has run into trouble in China on allegations of fake prescription sales for insurance. Its price fell by 7% on the day the news broke and hasn’t recovered since. Another one is GSK (GSK), which suffered for years due to litigation against Zantac, its heartburn medication that is allegedly cancer causing.

While Eli Lilly’s case is of course entirely unique, and it’s the one doing the suing instead of being sued, the development has already impacted the price. The stock continued to lose value in the three days following the news, and by the end of the third day, it had lost over 10% of its value. While it has recovered somewhat since, I wouldn’t take this factor lightly.

#2. Slowing sales

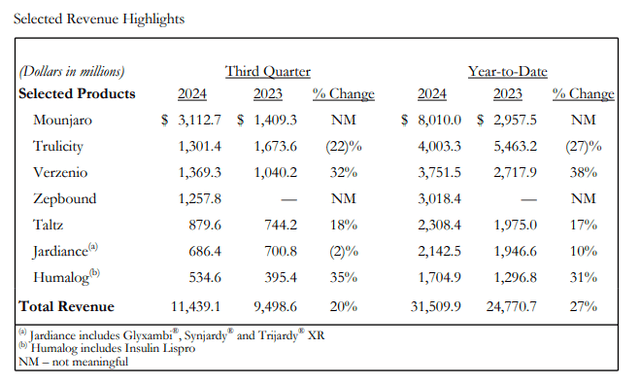

The company also saw a relative slowing down in revenue growth to 20% YoY in Q3 2024 compared with 27% YoY in the first nine months of the year ($9m 2024). It reduced the top end of its revenue guidance range by USD 600 million to USD 46 billion as well.

The big disappointment in the latest revenue figures comes from the drastic slowing down in sequential sales of the company’s otherwise high growing treatments Mounjaro and Zepbound. Type-2 diabetes treatment, Mounjaro’s revenue growth was just 0.7% quarter-on-quarter (QoQ), a sharp plunge from the 71% QoQ increase seen in Q2 2024. Zepbound saw a rise of just 1.2% QoQ as against a 140% QoQ increase last quarter.

While this could be explained simply as wholesalers refraining from restocking inventories, as suggested by a JPMorgan analyst. The sharp decline is, however, still one to look out for in the coming quarters. If it continues, it can have implications for Eli Lilly’s long-term growth.

#3. Reduced outlook

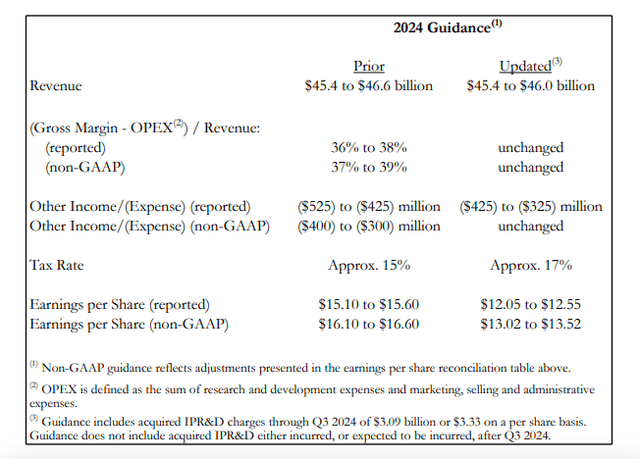

The company also reduced its earnings guidance for 2024 (see table below). The non-GAAP earnings per share [EPS] projections have been cut by ~19% at the midpoint. This is due to the IPR&D expenses incurred during the past quarter with its acquisition of inflammatory bowel disease therapies developer Morphic Holding for USD 3.2 billion.

The market multiples

However, LLY’s price drop has been proportionally higher, resulting in a more attractive forward non-GAAP P/E ratio at 55x, assuming that the EPS comes in at the midpoint of the guidance range, compared with the 60x, when I last checked.

It is higher than the stock’s five-year average of 40.8x, but considering that we are nearing the end of 2024, it’s essential to look at next year’s numbers as well. And analysts estimates on Seeking Alpha put these forward P/E for 2025 at 32.3x, which falls below the average, indicating an over 25% upside to price.

What next?

Currently, however, the assessment of LLY can’t be based on just the forward P/E. The recent developments could well cast a long-term shadow on it if things go south from here. Going by the price reaction to the company’s litigation and the experience of other pharmaceutical companies with lawsuits, some uncertainty at the very least can be expected.

But even more concerning is the sharp drop in Mounjaro’s and Zepbound’s sequential revenue growth in the past quarter. While there’s little denying the potential of the weight loss market and Eli Lilly’s leading position in treatments for it, it would be good to look out for developments in the coming quarters to see if they bounce back.

Presently, the reduction in EPS projections for 2024 is also a bit of a downer. Even though it’s quite possible that LLY bounces back like nothing ever happened, there’s no harm in erring on the side of caution, given the latest developments either. I’m downgrading it to a Hold rating for now. This can change if its Q4 and full year 2024 results due for release in January next year show a turnaround in revenue growth for the above-mentioned key treatments and if its projections for 2025 are positive too.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—