Summary:

- Eli Lilly’s stock price has increased by 129% in a year, with a Forward Price-To-Earnings Ratio of 60.4.

- Lilly’s valuation in a base case scenario at $171/share, considering traditional drug revenues.

- New growth markets, such as obesity, Alzheimer’s, psoriasis, and diabetes Type I markets, could add up to $1,093/share to Lilly’s total market value.

Scott Olson/Getty Images News

Context

The world of software is being revolutionized by AI technology. The same thing happens in the pharmaceutical world, where new drugs to fight obesity are the driver of its transformation. It is a revolutionary medicine not only to get people thinner but also because obesity is the cause of a lot of diseases, from cardiovascular health problems to diabetes and cancer… Two companies are leading this space: Novo Nordisk (NVO) and Eli Lilly (NYSE:LLY). I am interested in Lilly because it is getting the capacity to approach more new markets I am interested in. For instance, it seeks approval for a drug to fight against Alzheimer’s.

The price of Lilly has gone up by 129% in a year, and its Forward Price-To-Earnings Ratio has gone up to 60.4. So, my main question is: Is it still time to invest in this stock?

To check if it is feasible to invest in Lilly now, I will value a base case in which no blockbuster new drugs will be considered. Those blockbuster drugs are diabetes type II and obesity drugs, Alzheimer’s drugs, Psoriasis drugs, and Diabetes Type I drugs. I will value them independently and add the individual valuations over the base case. That way, I will have a complete valuation.

I do not value the market of radioligand therapies, which utilize radioactive atoms to target cancers with precision. Lilly is entering this market by acquiring POINT Biopharma for $1.4 billion. It is too uncertain for me to value this new technology.

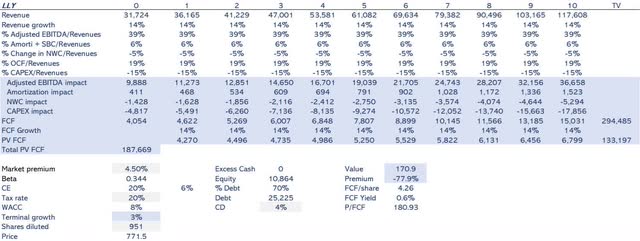

Base case

In this base case scenario, I consider only traditional drug revenues, not considering drugs from what I call new revenue products. I start at $31 billion at a growth rate of 14% until year 10 and 3% later. Cash flows are discounted at a WACC of 8% due to its low beta and relative leverage. As you can see in Figure 1, in this base case, I value it at $171/share.

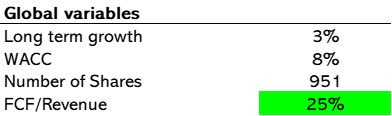

For the rest of the valuations, we will make some common assumptions, as you can see in Figure 2:

Fig. 2: Author

WACC is the same as the base case, so the long-term growth is the same, but the free cash flow over revenue margin is greater (25% vs 13%) because the new business doesn’t need so many general and administrative costs.

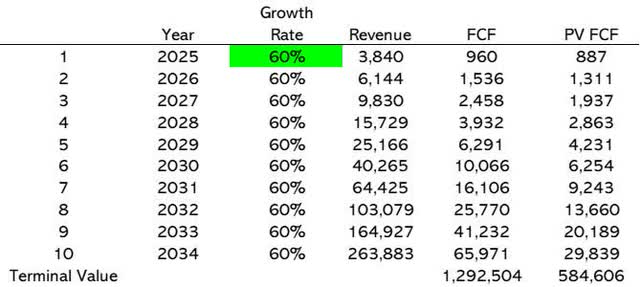

The obesity market opportunity

The obesity market in 2024 is worth $6 billion and is expected to grow to $100 billion in 2030, a 60% growth rate until 2030. Lilly is in the market with the brand Zepbound, and its prescriptions have surpassed Novo’s Wegovy for the first time in the U.S.

Lilly is working on an oral pill, orforglipron, that led to a 15% weight loss in 36 weeks in a Phase 2 study last year. They also have a weekly injectable, retatrutide, known as “triple-G” because it targets three hormones: GLP-1, GIP, and glucagon. This resulted in a 24% weight loss at 48 weeks.

I am not considering the NASH market, which can also be targeted with similar drugs. The NASH drug market is anticipated to exceed $48 billion by 2035, with an annual growth rate of 18% between 2023 and 2035. In 2022, the NASH treatment landscape generated $5.2 billion in revenue.

As opposed to Novo Nordisk, the current Lilly market share is 52%, but I assign a structural share of 30%. After obtaining the cash flows and discounting at WACC (Fig. 3), I value Lilly’s obesity market at $710/share in addition to the base case.

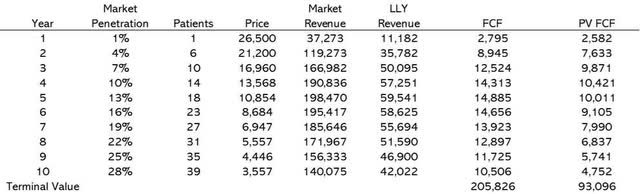

Alzheimer’s market opportunity

Six million Americans are living with Alzheimer’s now, about 1.8% of the total US population. So, that means there must be about 141 million people worldwide with the disease. The disease is expected to grow at 3% annually. The price for an equivalent drug in competitor Biogen (BIIB) is $26,500. That is the actual price in my model, and I will reduce this price as there is expansion in the market (Figure 4).

US FDA delays Lilly Alzheimer’s drug decision because regulator calls for advisory panel. For me, there is a 90% chance that the drug is approved; the uncertainty is when it will be approved. This won’t be a perfect product but is a first step toward fighting this disease.

Alzheimer’s market will add up to $177/share to the total market value of Lilly.

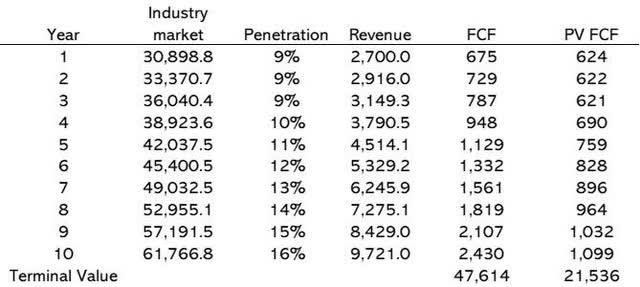

Psoriasis market opportunity

Lilly wants to get a push into the immunology market, specifically in psoriasis, by acquiring DICE Therapeutics. Lilly’s sales reached $2.5 billion last year, significantly trailing behind AbbVie’s (ABBV) mega blockbuster Humira, which achieved $21.2 billion in sales. The global psoriasis treatment market size is projected to expand from $28.61 billion in 2023 to $51.48 billion by 2030, experiencing a compound annual growth rate (CAGR) of 8.8%.

LLY’s penetration in the space is 9%, and I expect it to grow to 16% in 10 years (Figure 5). This immunology market will add up to $31/share.

Diabetes Type I market opportunity

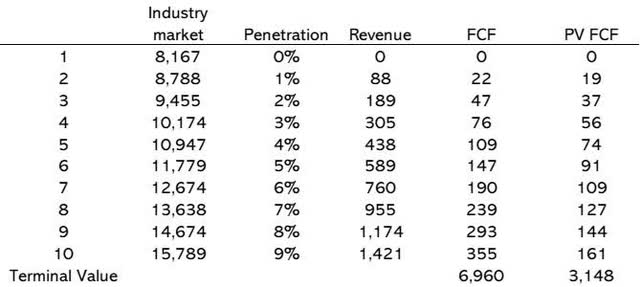

Lilly is entering this market with the acquisition of Sigilon Therapeutics for $35 million. The Type 1 diabetes market was valued at $7.59 billion in 2022 and is projected to reach $13.64 billion by 2030, growing at a CAGR of 7.6% during the forecast period 2023-2030 (Figure 6).

I estimate Lilly will penetrate the market by 9% in 10 years, adding $4/share to the stock price.

Summarizing the factors, we arrive at a valuation of $1,093/share, as you can see in Figure 7.

Figure 7: Author

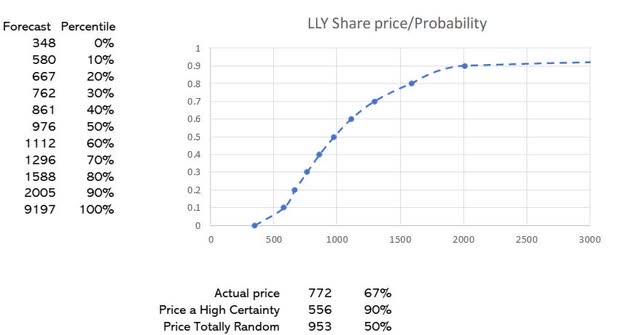

Risk modeling

I have set several assumptions to address the significant uncertainties I see. Ultimately, I seek to explore a range of outcomes by considering the various uncertainties I oversee.

I have stated that free cash flow over revenue margin is 25%, but my uncertainty is reflected in a lognormal distribution with location at 5%, 25% mean, and standard deviation at 7%.

In the obesity market, I established a 60% growth rate over ten years. My uncertainty can be modeled with a lognormal distribution with location at 20%, mean at 60%, and standard deviation at 10%.

In the Alzheimer’s market, we have used three key parameters. We are establishing market penetration and modeling a 3pp increase every year. This variable risk is a lognormal distribution with location at 0%, 3% mean, and 4% standard deviation. Starting from $26,500, we estimate a 20% reduction each year. This variable is modeled on my uncertainties as a triangular function with a lower limit at 10%, a higher limit at 50%, and the most probable at 20%. Lastly, I have set a market share of 30%, modeled as a normal distribution with a standard deviation of 7%.

In the immunology market, the main variables are the industry’s growth at 8% and increment penetration after the third year at 1pp. Uncertainty in the first variable is based on a normal function at the standard deviation of 0.8%. The uncertainty on the second variable is also expected at the standard deviation of 0.8%. It is like the Diabetes Type I with a 7.6% growth rate and increment of 1%

Once the model is run (Figure 8), the main conclusion is that we have a probability of nearly 70% that the price will be greater than the current price. So, considering those uncertainties, I think it is a good deal to bet on Lilly’s future.

Conclusion

Eli Lilly is a company with multiple growth options. The market has priced most of that growth in its stock price. In this article, I have tried to answer the following question: Is there still room for growth in the stock price?

My thesis is affirmative based on my estimation of the different markets that are supposed to offer growth opportunities for Lilly. Considering the obesity market and the base case, the stock price would be $881 per share, which is higher than the actual price. I foresee more opportunities to get a price of $1,093 per share, so I recommend buying the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.