Summary:

- Eli Lilly’s stock has seen significant gains due to the success of its GLP-1 franchise and the potential of donanemab for Alzheimer’s disease.

- The FDA’s Advisory Committee endorsed donanemab for Alzheimer’s treatment, but concerns remain post-approval requirements.

- Though competition in the Alzheimer’s market is limited, sales projections for anti-amyloid antibodies may be overhyped.

selvanegra

Thesis

Eli Lilly (NYSE:LLY) is a big pharma company that is riding on an ever-expanding pipeline of novel applications for its GLP-1 franchise.

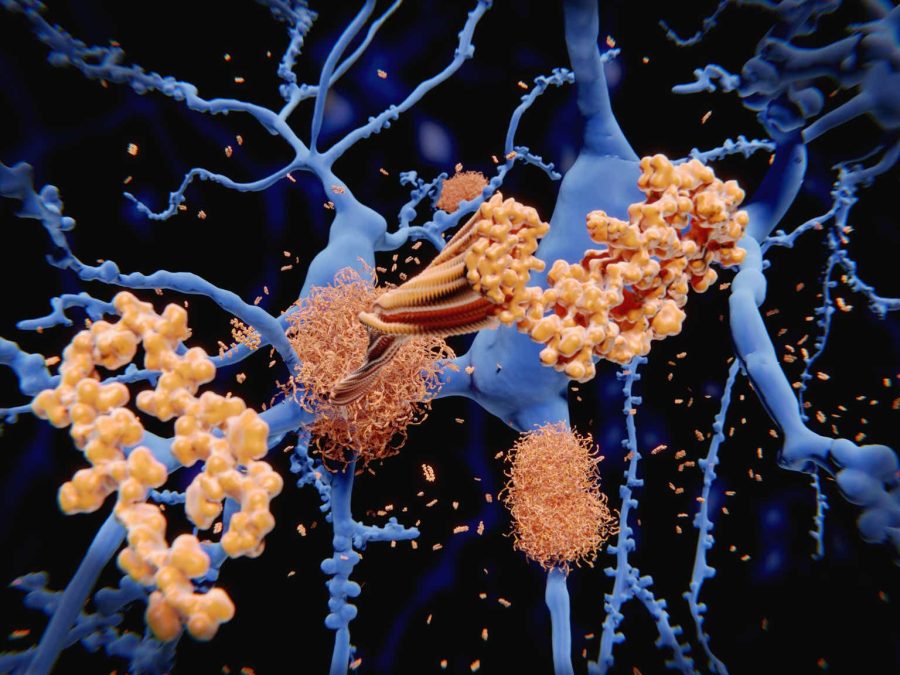

The current hot item in Eli Lilly’s pipeline seems to be donanemab, an anti-amyloid antibody for the treatment of Alzheimer’s disease. Two earlier anti-amyloid antibodies had been approved since 2021, one of which has now been voluntarily taken off the market. Biogen’s Leqembi is the only one on the market, and donanemab seems to outperform Leqembi.

On June 10, 2024, the FDA held an Advisory Committee meeting with regard to questions it had prior to considering whether or not to approve donanemab. The road to approval for donanemab had been a bit more bumpy than that of Leqembi so far, and the FDA’s briefing document included some explanations in that regard. The FDA has different concerns, some of which may impact the question whether or not to approve the drug, and others which may impact the post-approval requirements and process.

I give my thoughts on the process from the angle of the competitive space in Alzheimer’s, which I have covered frequently before.

Company

Introduction

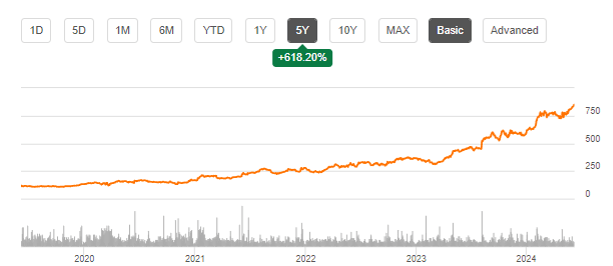

Eli Lilly is a large revenue-making biopharmaceutical company that has various treatments in its portfolio for, among others, weight loss, diabetes, cancer and inflammatory conditions. Lilly’s stock has been performing remarkably well over the past year, having seen gains of almost 100%. The stock price gains are, in my opinion, related to among other the success of GLP-1 agonists and the diversification of the indications they may work in, the company’s actual and potential revenue stream, and the blockbuster potential of donanemab.

This is Eli Lilly’s five-year stock chart, showing 618% in gains.

LLY five-year stock chart (Seeking Alpha)

Though I believe that the long-term potential for Eli Lilly may continue to be derived from its interesting pipeline, I believe history has shown that commercialization success of donanemab may be tough. For that reason, I believe right now may not be the appropriate time to buy the stock.

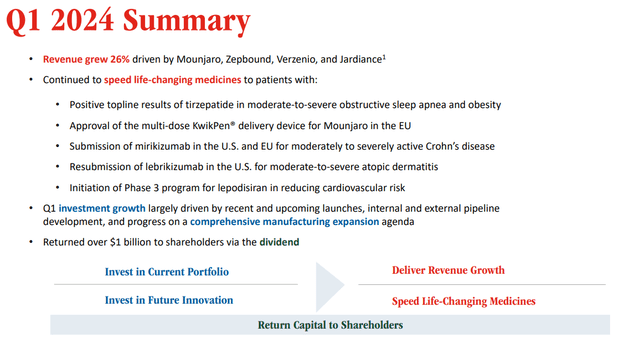

Strong earnings related to GLP-1 / GIP portfolio

To assess the true value of Eli Lilly, one has to look at the ongoing revenue stream and its potential on the one hand, and to pipeline potential on the other. With regard to revenue and earnings, Eli Lilly is doing very well. For the first quarter of 2024, revenue was $8.77 billion, a 26% increase compared to last year. Big revenue-generating drugs were Trulicity and Mounjaro for diabetes, respectively, accounting for $1.5 and $1.8 billion in revenue, even though their sales declined. Zepbound for weight loss, however, outperformed expectations.

On April 30, 2024, Eli Lilly once again posted great earnings. The company’s gross margin for Q1 2024 rose to 80.9%, and non-GAAP EPS improved to $2.58. The company also raised its prognosis for the rest of the year by $2 billion to $42.4-$43.6 billion in earnings, leading to non-GAAP EPS of $13.50-$14, and outperforming analyst expectations.

LLY Q1 2024 summary (Earnings call presentation)

The stock price has increased some 11% since then, which represents about $80 billion. At the time of writing, Lilly’s market cap is about $820 billion.

Similar to Novo Nordisk’s (NVO) story, the market has been focusing on Eli Lilly’s GLP-1 and GIP franchise, with Zepbound for obesity, and Mounjaro and Trulicity for type 2 diabetes. Whereas Mounjaro has a unique mechanism of action related to GLP-1 or glucagon-like peptide-1 (GLP-1) receptor agonism, Zepbound and Trulicity have a dual mechanism of action adding in a GIP or glucose-dependent insulinotropic polypeptide (GIP) receptor agonist.

There is currently a supply constraint for these drugs, which both companies are trying to solve as soon as possible. Additional supply, however, means additional manufacturing capacity, and building GMP-grade facilities requires time and money. For example, the recently announced additional facility in Indiana will only start production by end of 2026. Hims & Hers (HIMS) have decided to offer compounded versions of a GLP-1 agonist, due to the above-mentioned supply constraints, and will therefore be a temporary competitor for Novo Nordisk and Eli Lilly. Once the supply constraints are resolved, which Eli Lilly expects in the second half of the year but could last through 2025, HIMS should stop selling compounded GLP-1s.

There may be further room for growth, as the market for weight-loss treatments could reach $80 billion by 2030. But by that time, several competitors may have entered the market, either by themselves or through acquisition by Eli Lilly or any of its big pharma competitors. One such competitor could, for example, be Viking Therapeutics’ (VKTX) GLP-1/GIP agonist VK2735, which had reported excellent results in a Phase 1 trial in March 2024, making its stock soar. Other players such as Amgen (AMGN) or Altimmune (ALT) may equally one day become a competitive threat, though being the first to market and other factors may minimize such threat.

Interesting further portfolio

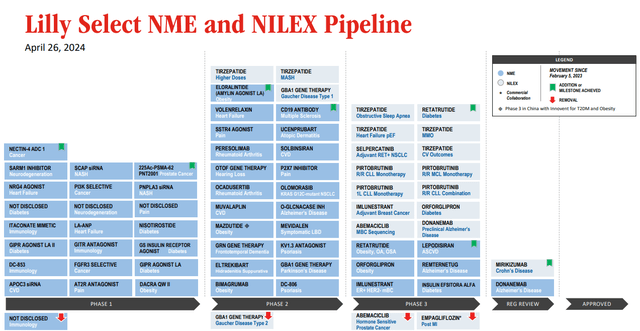

Eli Lilly has a strong further portfolio and pipeline.

LLY select pipeline (Earnings presentation)

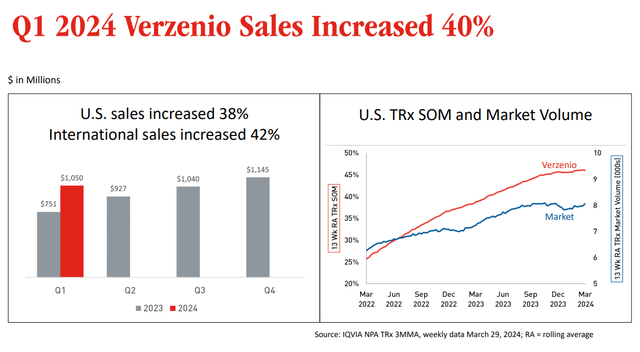

One of the drugs that was highlighted by Eli Lilly during the quarterly call was Verzenio, a CDK4/6 inhibitor for metastasized HR+, HER2– breast cancer, which saw US and international sales increase by 40%.

Verzenio sales increase slide (Earnings Presentation)

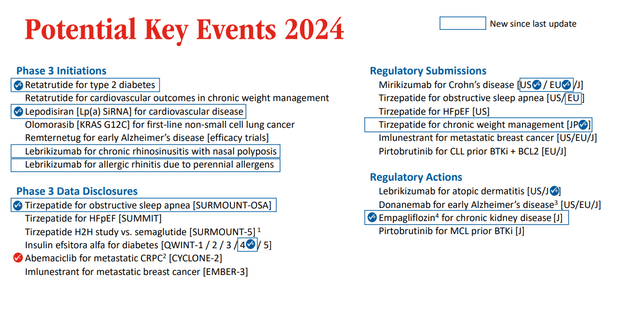

These are the potential key events for the year 2024.

Potential key events 2024 (Earnings presentation)

The company recently also announced positive topline results from a Phase 3 trial in obstructive sleep apnea and obesity, and has reported further positive results of tirzepatide in MASH, with more than 50% of patients on tirzepatide reaching the trial’s primary goal of MASH resolution without worsening of fibrosis at 52 weeks, compared to 13% on placebo.

The positive Advisory Committee vote for donanemab for Alzheimer’s disease

The current treatment landscape

For many neurodegenerative diseases, only symptomatic treatments and no disease-modifying treatments have existed for many years. For Alzheimer’s, those symptomatic treatments are provided by acetylcholinesterase inhibitors, their effects are temporary and they do not change the underlying neurodegeneration.

Approvals of disease-modifying drugs in the neurodegenerative space have been very scarce for many years, but the approval of Biogen’s anti-amyloid antibody Aduhelm in 2021 seemed to have changed that. The Alzheimer’s space has meanwhile also seen anti-amyloid antibody Leqembi approved. The ALS space has since seen two approvals, Biogen’s Qalsody and Amylyx’s (AMLX) Relyvrio, the latter having meanwhile been taken off-the-market due to a failed confirmatory trial. The space seems to be heating up, and many are considering that further approvals are to follow in the years to come.

Eli Lilly’s filings for approval of donanemab for Alzheimer’s disease

On June 10, 2024, the FDA held an advisory committee meeting on donanemab, Eli Lilly’s much-anticipated anti-amyloid antibody for the treatment of Alzheimer’s disease. The road towards approval for donanemab has been a little bumpier than usual. For reference, Aduhelm and Leqembi, two anti-amyloid antibodies commercialized by Biogen (BIIB), had initially been approved by way of the FDA’s accelerated approval process because they had been able to show a reduction of amyloid plaque in the brain, the typical hallmark of Alzheimer’s. Leqembi had also been able to show that treatment was linked to a 27% slowing of cognitive decline on the CDR-SB rating scale.

Eli Lilly had subsequently reported a 35% slowing of cognitive decline on the iADRS rating scale, and had first requested accelerated approval, which was denied by the FDA, following which Eli Lilly filed for full approval, which it expected to be granted by the end of 2023. However, the FDA then decided an Advisory Committee would be convened to guide the FDA’s as to whether or not to approve donanemab. Advisory Committees are by no means uncommon in the neurodegenerative space. In fact, many of the recent approvals were preceded by Advisory Committees. Remarkably, however, the FDA’s briefing document showed that the FDA had different concerns, some of which were trial- and trial-design-related, whereas others related to possible post-approval requirements and process.

Donanemab appears to have comparable efficacy to Biogen’s Leqembi

In January 2023, Biogen’s Leqembi had been approved on an accelerated basis for having slowed cognitive decline by 27% over 18 months on the CDR-SB scale. On May 3, 2023, Eli Lilly had reported that donanemab slowed cognitive decline by 35% on the iADRS scale. That seems to indicate that Leqembi considerably outperforms Leqembi.

However, the FDA’s briefing document included the change from baseline at week 76 on the CDR-SB scale, which showed a percentage slowing of 29% in the overall population group. From that perspective, I believe donanemab’s efficacy is comparable to that of Leqembi, when using the same rating scale.

One of the FDA’s concerns, moreover, was Eli Lilly’s use of the iADRS rating scale. Initially, Eli Lilly’s Phase 3 trial had used the CDR-SB rating scale, and when the company wanted to change that, the FDA had apparently repeatedly advised against doing so. Eli Lilly nonetheless went ahead with that change.

The FDA’s Advisory Committee has on June 10, 2024, voted unanimously in favor of donanemab’s efficacy.

Donanemab is sufficiently safe and gets FDA panel backing

Another one of the concerns the FDA had related to donanemab’s safety. Anti-amyloid antibodies are administered by continuous infusion and share the common concern that they lead to amyloid-related imaging abnormalities or ARIA. ARIA comes in two forms, ARIA-E which stands for edema and ARIA-H which stands for hemorrhage. One of the causes of ARIA could be the disintegration of the blood-brain-barrier, as the large aggregates of amyloid referred to as amyloid plaques are being removed from the brain. Deaths related to ARIA have been reported in all trials of anti-amyloid antibodies. In the case of donanemab’s pivotal trial, the number of ARIA-related deaths was three.

In its briefing document, the FDA had expressed concerns related to the levels of ARIA seen from treatment with donanemab, as well as the higher mortality rate.

The FDA had also expressed concern related to Eli Lilly’s trial design, which allows discontinuation of treatment once the amyloid threshold in the brain returns to normal levels. This is different to Biogen’s Leqembi, which provides for continuous treatment. The FDA, in fact, lacked follow-up data on patients’ mortality once they are removed from treatment in light of their lowered amyloid threshold.

The FDA’s Advisory Committee has on June 10, 2024, finally green-lighted the safety concerns surrounding donanemab, considering that treatment with donanemab is sufficiently safe. If the FDA follows that position, then full approval of donanemab is likely.

Potential post-approval requirements

The next step is then what to do after approval. Due to Eli Lilly’s different trial design, amyloid threshold and additionally a tau threshold which also appeared to be related to efficacy, the question arises which patients should be allowed treatment, how to test for amyloid and tau levels, and for how long patients should remain on treatment. The FDA has mentioned during the meeting that in its briefing document that if donanemab is approved, its labelling will include ARIA risk, there should be recommendations for MRI monitoring, and Lilly should report among others deaths in ongoing studies and deaths from cerebral hemorrhages larger than 1cm size post-marketing. The FDA would also require Eli Lilly to develop a test for ApoE ε4 genotype, which increases the risk of developing ARIA.

Valuation

Introduction

The Alzheimer’s market is large. Alzheimer’s disease is the most common neurodegenerative disease in the world. It affects 5.8 million people in the US alone, with the potential to triple by 2060.

The Alzheimer’s global market size was valued at $7.6 billion in 2022 and could grow to $13.7 billion by 2030, so that could leave a lot of room for upside. Bloomberg Intelligence projected that both donanemab and Eli Lilly’s remternetug, in Phase 3 trials, could dominate the Alzheimer’s market and lead to $6.5 billion in revenue by 2030. That would be a dream scenario for Eli Lilly, but I am considerably less convinced.

Competition is limited, as Leqembi is currently the only disease-modifying treatment on the market. Eli Lilly could market donanemab as outperforming Leqembi with less burden on the patient given the limited time on treatment.

Nonetheless, if lessons can be learned from the past, then one should conclude that anti-amyloid antibodies’ sales projections should not be overhyped. Aduhelm was a complete failure. Biogen had spent $600 million dollars to support its launch, and in the first three quarters of 2023, the drug’s revenue was $11 million. Though Eisai (OTCPK:ESALF) projects worldwide Leqembi sales to be $6.8 billion by 2030, actual sales for Q3 2023 and Q4 2023 were only $11 and $19 million respectively, with only 2,000 people actually receiving the drug as of January 2024. Hurdles such as amyloid testing and Medicare coverage are quoted as hurdles. Nonetheless, Biogen and Eisai expect sales for the coming year to amount to roughly $361 million, and have filed for approval of an injectable form of the treatment.

If donanemab now joins Leqembi as approved anti-amyloid antibody, I do not expect sales of the total Alzheimer’s market to easily double. In any case, I do not see how donanemab could suddenly lead to massive sales compared to Biogen’s Leqembi in the coming years.

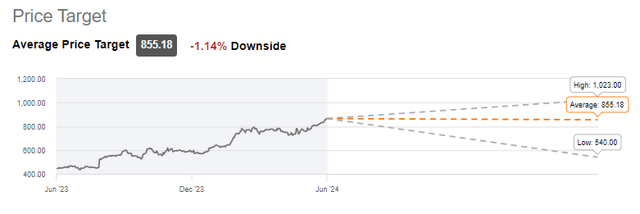

At this point, the average of analyst projections is neutral on the stock.

LLY Average price target (Seeking Alpha)

A large part of Eli Lilly’s current valuation is based on revenue increases like we have seen last year, showing a 29% year-over-year revenue growth. An $880 billion market cap is high for a company generating $35 billion in trailing twelve-months revenue, even with sustainable growth expectations and a gross profit margin of 80%. Seeking Alpha’s F valuation grade and underlying metrics indicate that Eli Lilly could be overvalued. In my eyes, looking at Biogen’s sales for Leqembi, donanemab may not be able to deliver on further growth expectations.

Also, I believe – with David Einhorn and others – that now is the time to invest in neurodegenerative diseases, as other more efficacious treatments may be forthcoming.

Further competition

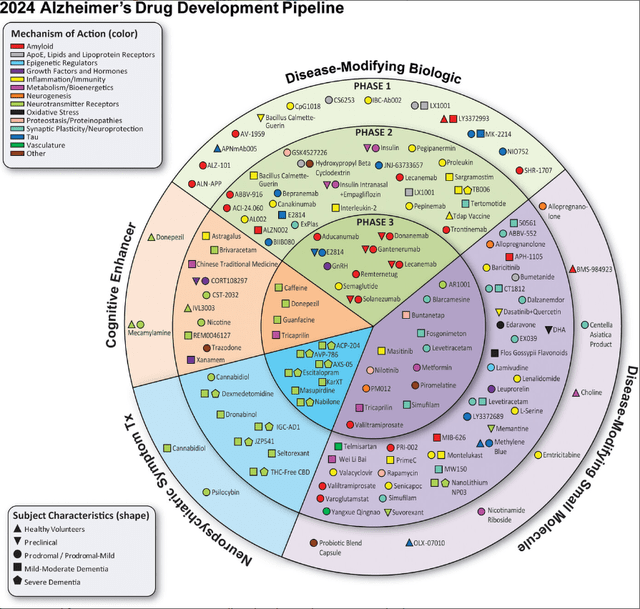

Also, the Phase 3 trial pipeline of disease-modifying Alzheimer’s treatments is rather limited, as can be seen below.

Alzheimer’s pipeline 2024 (Alzheimer’s disease drug development pipeline: 2024, Alzheimer’s Dement (N Y) . 2024 )

On the side of the disease-modifying biologics, aducanumab has meanwhile been taken off the market, lecanemab’s Phase 3 trial is confirmatory for Leqembi, Lilly’s solanezumab failed repeatedly in the past, Roche’s (OTCQX:RHHBY) gantenerumab has already failed in 2022, and remternetug is also Lilly’s property. On the disease-modifying small molecule side, I do not have high hopes for Buntanetap, although the company reported results as a win, nor for Anavex’s (AVXL) blarcamesine. However, I do not exclude chances for much-debated Cassava Sciences’ (SAVA) simufilam and Athira Pharma’s (ATHA) fosgonimeton to outperform anti-amyloid antibodies on efficacy and/or safety.

In earlier stages than Phase 3 trials, some very promising treatment candidates are progressing through the Alzheimer’s pipeline with a shot at accelerated approval. I am thinking particularly of INmune Bio’s (INMB) Xpro and Coya Therapeutics’ (COYA) COYA 301 and COYA 302 treatment candidates. I have covered the latter just recently. Remarkably, in a public statement following the Advisory Committee meeting on donanemab, the Alzheimer’s Drug Discovery Foundation among others referred to Coya Therapeutics, as a high-potential anti-inflammatory treatment focused on the biology of aging.

This milestone comes at a critical time when drug development is now largely driven by the biology of aging approach. In the current pipeline, nearly 75% of Alzheimer’s drugs in development are exploring novel targets related to the various aging pathways like inflammation, metabolic disturbances, and vascular dysfunctions. Some of the promising drugs are from ADDF-funded companies such as Coya Therapeutics, which is developing a combination therapy targeting neuroinflammation, as well as Therini Bio, which is developing a drug to target vascular dysfunction, and PharmatrophiX, which recently completed a phase 2a trial for a neuroprotective drug now ready for phase 2b trials.

Some of the drugs of the above-mentioned companies have led to cognitive stabilization or even improvement, remarkable efficacy on biomarkers such as NfL, ptau-217 and GFAP, and no safety issues, yet so far, only on in small open-label studies. That may however change in the near future. In my personal opinion, the future of Alzheimer’s treatments lies there.

Risks

I am of the opinion that Eli Lilly’s stock may suffer a potentially temporary overvaluation due to the hype around donanemab approval.

The most important risk to that thesis may be that I underestimate the company’s commercialization potential, and expected uptake by patients. In that framework, I may also wrongly assess the chances of one or more other drugs that may be approved for Alzheimer’s disease in the coming years, either by way of full approval or accelerated approval.

I may also underestimate the impact of the rest of Eli Lilly’s portfolio and pipeline.

Conclusion

Eli Lilly’s stock has been performing marvelously against the backdrop of ever-improving revenues and an interesting portfolio and pipeline, with the GLP-1 portfolio as the big driver of recent successes.

On June 10, 2024, the FDA’s Advisory Committee has endorsed donanemab, Eli Lilly’s treatment candidate for Alzheimer’s disease. As a result, chances of full approval of donanemab by the FDA for the treatment of early symptomatic Alzheimer’s disease are quite high. However, the FDA still has the final word, and may impose a number of boxed warnings and restrictions with regard to commercialization.

If the commercialization history of Aduhelm and Leqembi can teach us a lesson, then it is that uptake and sales numbers of anti-amyloid antibodies may prove tougher to achieve than initially prospected. Aduhelm has been taken off the market, and a year after its accelerated approval, Biogen still only had 2,000 patients on Leqembi treatment. The commercialization cost may also be quite high, and the FDA may still require Eli Lilly to develop an ApoE ε4 genotype test, because ARIA risk is higher in ApoE ε4 positive patients.

Additionally, Eli Lilly’s GLP-1/GIP portfolio may continue to suffer from supply constraints near-term, and from the temporary generic competition for GLP-1 agonist for weight loss coming from HIMS.

In conclusion, I believe donanemab’s chances of bringing in substantial profits may be overhyped, and Eli Lilly’s stock already seems to be priced firmly high at this time.

For me, it would seem logical to issue a Hold rating in light of the above.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COYA, INMB, SAVA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.