Summary:

- Mounjaro may rake in $25B of annualized sales by 2026, exceeding ABBV’s Humira. This naturally explains Mr. Market’s optimism surrounding the LLY’s stock thus far.

- The same has been witnessed with NVO, with accelerating annualized obesity related revenues of $4.64B by the latest quarter, well exceeding its long-term goal of $3.72B by 2025.

- However, with a P/E of 49.69x, against the pharmaceutical peers’ median at 14.40x and NVO’s at 30.38x, we believe LLY’s valuations are over-stretched, reminiscent of a ticking time bomb.

- Investors must also note that any whisper of earnings miss and decelerating Mounjaro sales may potentially trigger a steep sell-off moving forward.

- Long-term LLY investors may consider taking half of their profits here, since we expect to see another correction to $360s in the near term, based on the stock’s stepped cadence thus far.

Yagi Studio/DigitalVision via Getty Images

We Are Too Late For LLY’s Investment Thesis

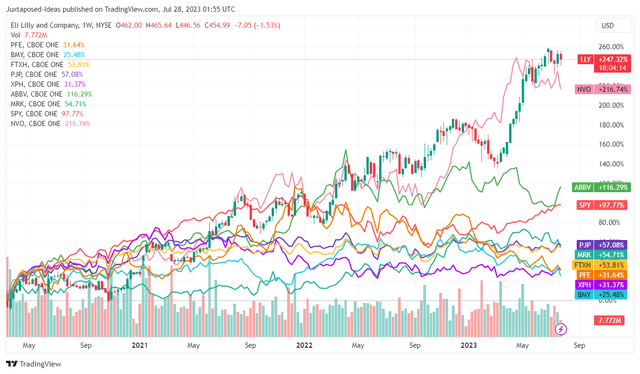

LLY 3Y Stock Returns

Trading View

Eli Lilly and Company (NYSE:LLY) has had an impressive run up by +247.32% since the pandemic bottom, easily eclipsing many other mature pharmaceutical stocks, such as AbbVie (ABBV), Merck (MRK), Pfizer (PFE), and Bristol-Myers Squibb Company (BMY), though nearing Novo Nordisk A/S’ (NVO) +216.74%.

The former has also outperformed the wider pharmaceutical market, such as Invesco Dynamic Pharmaceuticals ETF (PJP), First Trust Nasdaq Pharmaceuticals ETF (FTXH), and SPDR S&P Pharmaceuticals ETF (XPH).

While the recent optimism is mostly attributed to the diabetes therapy, Mounjaro (with the added benefit of weight loss) and Alzheimer’s pipeline, donanemab, we must also highlight that LLY execution has been stellar thus far. This is exemplified by its well-diversified portfolio, promising pipeline, and expanding profitability.

For example, the pharmaceutical company’s diabetes portfolio has single handedly been responsible for $16.76B in annualized revenues by the latest quarter (+5.2% QoQ/ +23.9% YoY), easily comprising 60.2% of its global revenues (+9.6 points QoQ/ +17 YoY).

Given the importance of Trulicity in LLY’s diabetes portfolio, commanding $7.88B (+2% QoQ/ +13.2% YoY) or the equivalent of 28.3% (+1.9 points QoQ/ +6.1 YoY) in annualized sales, it is unsurprising that market analysts are increasingly bullish on the company’s prospects.

This is significantly aided by the therapy’s lack of biosimilar competition through 2027, with the closest option from Boan Biotech only available in China at the time of writing.

Therefore, due to Trulicity’s immense top-line growth at a CAGR of +24.13% since FY2019 or +63.90% since FY2015, we are not surprised by the therapy’s long runway indeed.

LLY’s prospects are now further boosted by the fervent demand for obesity therapy, with many options available in the market, such as Ozempic and Wegovy from NVO. The latter has already reported accelerating annualized obesity related revenues of $4.64B (+84.6% QoQ/ +127.4% YoY) in the latest quarter, well exceeding its long-term goal of $3.72B by 2025.

Perhaps this is why market analysts are increasingly bullish on LLY’s Mounjaro, with the therapy now in Phase 3 clinical trials for obesity with promising results. For now, Mounjaro already records $2.27B in annualized revenues by the latest quarter (+103.5% QoQ/ +203.5% from $749.2M reported in FQ3’22), demonstrating its high-growth cadence.

Assuming a similar success as NVO’s, we may see the LLY’s top and bottom line growth further boosted by the increase in its applicable indication, especially due to the weight loss market size expansion from $212.97B in 2022 to $430.37B in 2030.

This is on top of the immense TAM from the global Alzheimer’s market, which is expected to expand from $4.05B in 2022 to $17.4B in 2030, thanks to LLY’s candidate Donanemab. This is despite the notable controversies in this space, attributed to the US FDA’s atypical approval of Aduhelm from Biogen (BIIB) and the short sellers’ attack on Simufilam from Cassava (SAVA).

With both therapies potentially exceeding ABBV’s Humira sales of $21.23B in FY2022 and market analysts projecting Mounjaro to rake in $25B of annualized sales by 2026, we understand the market analysts’ optimism surrounding LLY’s stock indeed.

This is on top of LLY’s sustained acquisitions to expand its pipeline, with multiple candidates already in Phase 2/3 clinical trials.

Then again, this comes with the counter effect of increasing the pharmaceutical company’s reliance on long-term debts to $18.97B (+27.5% QoQ/ +24.8% YoY), annualized operating expenses to $14.44B (+1.9% QoQ/ +14.2% YoY), and annualized capex to $2.67B (+33.5% QoQ/ +82.9% YoY).

Nonetheless, with a debt to EBITDA ratio of 2.29x and robust balance sheet of $3.72B (+52.4% QoQ/ +44.7% YoY) by the latest quarter, we remain highly convinced about the safety of LLY’s dividends and its liquidity ahead.

So, Is LLY Stock A Buy, Sell, or Hold?

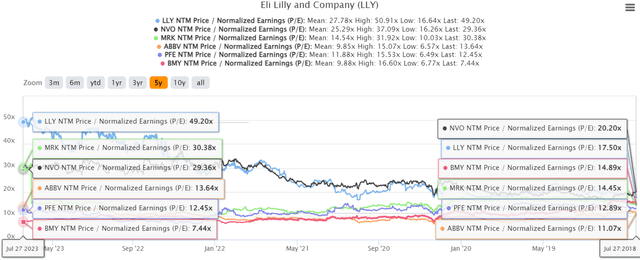

LLY 5Y P/E Valuations

As market analysts increasingly turn optimistic on the stock, LLY’s valuations have also unfortunately turned bloated and “fat” at NTM P/E 49.20x, compared to its 1Y mean of 42.93x and 3Y pre-pandemic mean of 19.00x. Most importantly, the stock also trades higher than NVO at NTM P/E of 29.36x.

Against the pharmaceutical peers’ median NTM P/E of 14.40x, I think it is apparent that there is too much premium embedded in LLY’s stock prices, since the company is only expected to record a top-line expansion at a CAGR of +26.7% through FY2025, against NVO’s at +22.7% and the former’s 3Y pre-pandemic levels of +19.7%.

With most of the upside already pulled forward, we believe LLY is unlikely to sustain these stock prices, potentially signaling more volatility in the intermediate term.

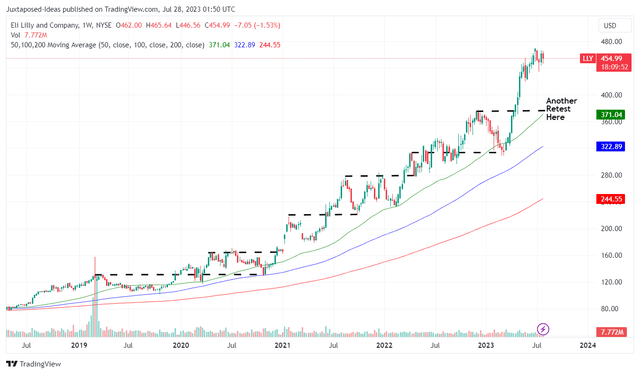

LLY 5Y Stock Price

These inflated levels also suggest impacted forward dividend yield of 0.98%, against its 4Y average of 1.53% and sector median of 1.43%, despite LLY’s dividend aristocrat status.

Therefore, we do not recommend new investors to chase the stock here, due to the reduced margin of safety to our long-term price target of $310.08, based on its normalized P/E and the market analysts’ FY2025 adj EPS projection of $16.32.

Therefore, long-term investors that have yet to cash out LLY may consider taking half of their profits at these levels, since we expect to see another correction to $360s in the near term, based on the stock’s stepped cadence thus far.

While LLY’s portfolio and pipelines remain highly promising, investors that continue holding a full position here must be ready for drastic stock movements ahead, since the mature pharmaceutical stock’s overly stretched valuation reminds us of a ticking time bomb.

Investors must also note that any whisper of earnings miss and decelerating Mounjaro sales may potentially trigger a steep sell-off moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.