Summary:

- Eli Lilly’s key growth product tirzepatide (Mounjaro/Zepbound) continues to deliver on both fronts.

- Increased supply visibility led to a $3 billion increase in the full-year total revenue guidance range.

- After strong Q2 results, Eli Lilly reported positive long-term data from the SURMOUNT-1 trial, showing long-term treatment with tirzepatide significantly reduced the risk of onset of type 2 diabetes.

- The rest of the business delivered mixed performance in Q2, but could get a boost from the launch of Kisunla (donanemab) in the second half of the year.

- The next clinical catalyst is the phase 3 readout of tirzepatide versus Novo Nordisk’s semaglutide.

Scott Olson/Getty Images News

Eli Lilly and Company‘s (LLY) tirzepatide (Mounjaro/Zepbound) continues to produce commercial and clinical wins. After a stellar second quarter earnings report and a $3 billion revenue guidance raise, Eli Lilly announced positive topline results from the SURMOUNT-1 trial where tirzepatide reduced the risk of progression to type 2 diabetes in adults with pre-diabetes and obesity/overweight compared to placebo.

These results once again show the significant benefits of the incretin drug class, come on top of two prior wins this year in obstructive sleep apnea and heart failure with preserved ejection fraction, and further solidify Eli Lilly’s position in obesity, type 2 diabetes, and adjacent markets.

Improved supply visibility leads to a significant increase in the full-year revenue guidance range

In my May article, I said that the market is still underestimating Eli Lilly’s growth potential in 2025 and 2026 since supply constraints are keeping a lid on the growth of tirzepatide. However, I was surprised by the magnitude of the guidance raise for 2024 as I did not anticipate this kind of supply constraint resolution this year.

The second quarter performance of Mounjaro and Zepbound was positively impacted by increased inventory levels which management said accounted for up to 25% of total Q2 net sales, but this should be burned through relatively quickly as demand continues to significantly exceed supply.

The demand is, in fact, so high, that Eli Lilly is not even promoting Mounjaro and Zepbound. CEO David Ricks said the following in his recent CNBC interview:

We just see unbelievable demand, and we aren’t even trying that hard to promote this drug. We’re not advertising, we told our sales reps, basically, just service customers, and don’t promote, and what you’re seeing is consumer, organic demand here as we ship more products and bring more supply online here in the United States, building six plants, hiring thousands of workers, ramping up production.

That leads me to believe there is so much more growth to unlock with Mounjaro and Zepbound, and this is just the growth opportunity in the United States. Zepbound is not even available outside the United States yet.

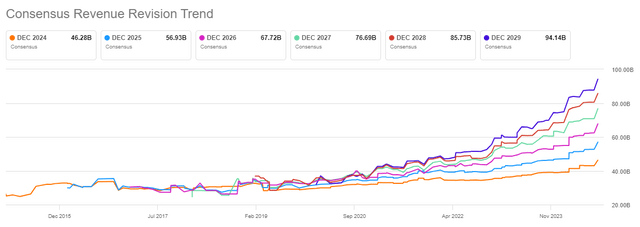

Revenue estimates for 2024, 2025, and 2026 have risen since the Q2 beat, but I believe there is more room for outperformance going forward, and it appears management is conservatively guiding how fast it can address the supply issue.

Seeking Alpha

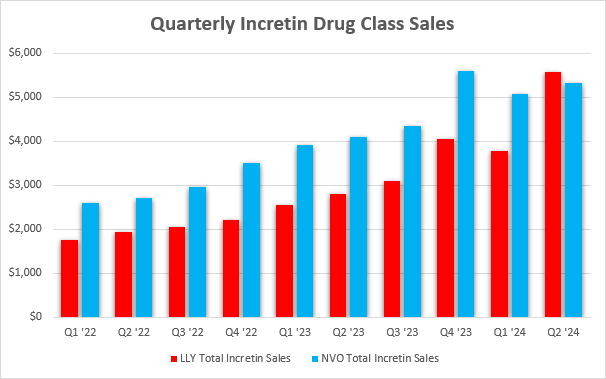

Competitor Novo Nordisk A/S (NVO) is having the same problems and has been slower to address them. As a result, Eli Lilly’s incretin business has overtaken Novo Nordisk as the class leader in terms of quarterly net sales in the second quarter, albeit with the help of the mentioned increase in inventory levels.

Eli Lilly earnings reports, Novo Nordisk earnings reports

These market dynamics will only be governed by how much product each company can produce in the near- and medium-term, and it will take several quarters before the market position of each company becomes clear. Provided there is enough supply, the next few years could favor Novo Nordisk due to it being ahead in terms of the broader product label for semaglutide, but I believe tirzepatide is a better drug as it produces better weight reductions, helped by its dual GLP-1/GIP mechanism and that it could overtake Novo’s semaglutide (which is only a GLP-1 agonist) in the second half of the decade.

Going back to this year’s business performance, the strong Q2 performance of Mounjaro and Zepbound and improved supply visibility have led to the $3 billion increase in the full-year total revenue guidance range to $45.4-$46.6 billion and an increase in the full-year non-GAAP EPS guidance range from $13.50-$14.00 to $16.10-$16.60.

Clinical trial winning streak continues for tirzepatide – prediabetes patients are seeing significant benefits in the SURMOUNT-1 trial

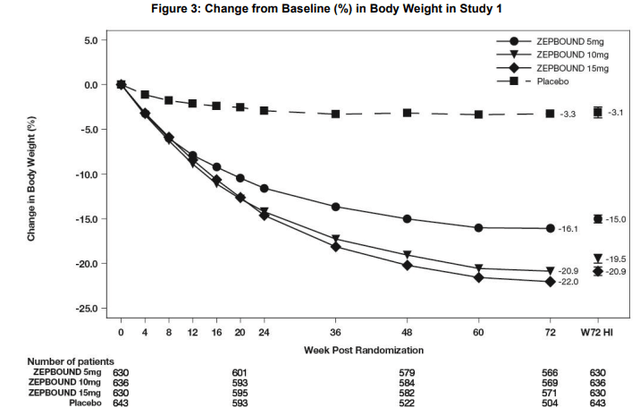

This week’s 176-week results from the SURMOUNT-1 trial of tirzepatide did not disappoint. Weekly tirzepatide injections “significantly reduced the risk of progression to type 2 diabetes by 94% among adults with pre-diabetes and obesity or overweight compared to placebo.“

Tirzepatide also demonstrated sustained weight loss at week 176 with 15.4%, 19.9%, and 22.9% average weight reductions for the 5 mg, 10 mg, and 15 mg doses, respectively, compared to a 2.1% reduction in the placebo group.

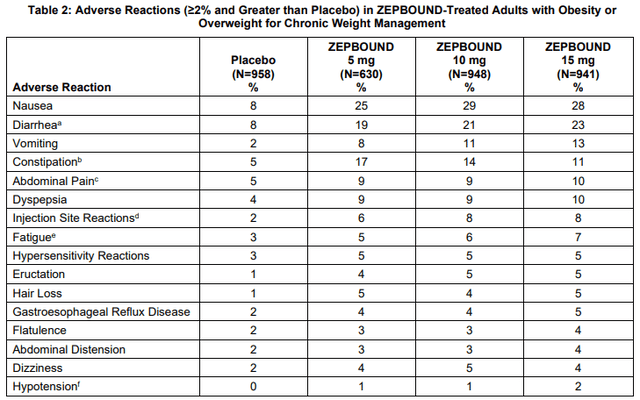

The results were achieved with safety and tolerability that were consistent with previously published primary results at 72 weeks and other clinical studies. The most frequent adverse events were gastrointestinal and mild to moderate in severity – diarrhea, nausea, constipation, and vomiting.

These results add another win for tirzepatide in 2024 – Eli Lilly previously reported positive results in obese patients with obstructive sleep apnea and in patients with heart failure with preserved ejection fraction, or HFpEF.

Head-to-head trial versus semaglutide is next

The next trial to report data is the SURMOUNT-5 trial which should show whether tirzepatide is superior to semaglutide in a direct head-to-head trial.

All the available data point to tirzepatide showing weight loss superiority, and as I mentioned earlier in the article, it is not exactly a fair fight since tirzepatide is a dual GLP-1/GIP agonist while semaglutide is a GLP-1 agonist.

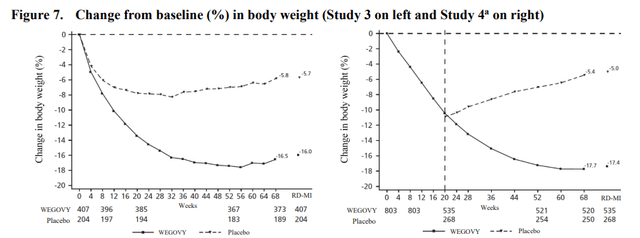

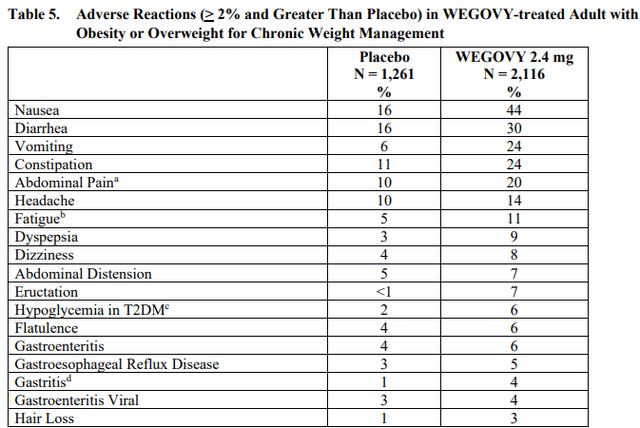

According to their respective product labels, tirzepatide (Zepbound) is generally able to generate absolute weight reductions in the high teens and up to the low 20s in obese patients and semaglutide’s (Wegovy) maximum is in the 15-16% range.

Zepbound (tirzepatide) product label

Wegovy (semaglutide) product label

It will also be interesting to see how the two compare on safety and tolerability and whether more patients stay longer on one drug versus the other. Cross-trial comparisons indicate tirzepatide could win on tolerability as well, but the data could be deceitful when compared across trials, and it looks like the placebo group in tirzepatide’s trial had lower rates of gastrointestinal side effects which could indicate a different way these adverse events were collected or measured in the trials.

Zepbound (tirzepatide) product label

Wegovy (semaglutide) product label

Mixed performance of the rest of the business, Kisunla (donanemab) now approved for the treatment of Alzheimer’s disease

The rest of the business is not exactly thriving, but management said it too has slightly contributed to the $3 billion increase in the full-year revenue guidance range.

Verzenio continues to be the standout performer in the oncology segment with 46% Y/Y growth in Q2, up from 40% Y/Y in Q2 and has reached quarterly net sales of $1.33 billion.

The non-diabetes business could get a boost in the second half of the year from Kisunla (donanemab), which was approved in early July for the treatment of Alzheimer’s disease. However, my expectations are not too high as I do not see the risk/benefit profile of Kisunla as very favorable, and the uptake of Biogen Inc.’s (BIIB) and Eisai’s Leqembi has so far been disappointing with net sales reaching $40 million in its fourth quarter on the market.

Conclusion

Eli Lilly’s obesity business continues to produce strong net sales growth and positive clinical data, and I expect this to lead to continued improvements in the long-term growth outlook. The upcoming results from a head-to-head trial comparing tirzepatide and semaglutide could further improve the sentiment around Eli Lilly as I expect the trial to show superior weight reductions of tirzepatide with similar or better tolerability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.