Summary:

- Eli Lilly and Company triggered a Buy signal after a price pop from the latest earnings report.

- Technical Buy signals, including Full Stochastic and MACD crossover, indicate upward momentum and potential test of the recent high in price.

- Portfolio managers may need to sell Eli Lilly stock due to high exposure, potentially slowing bounce in a bear market.

JHVEPhoto

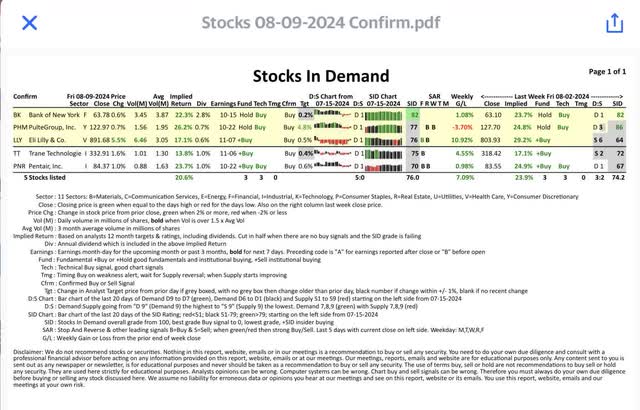

As you can see on our “Confirm” report below, Eli Lilly and Company (NYSE:LLY) has triggered our Buy signal in the Cfrm column. This is no surprise after the price pop created by the latest earnings report. It took the market by surprise.

It took or proprietary Stocks In Demand, or SID score by surprise as you can see in the far right column that it jumped from 64 to 76 out of 100 where 80 is a Buy Signal. We expect that Buy Signal to return because it had our green bar, Buy Signal during the last 20 days as shown by our 20-day bar chart. Therefore, we are giving LLY our Buy rating. It is usual for our Buy rated stocks to drop to Hold and then back to Buy. Such pullbacks usually trigger our Timing, buy on weakness signal shown in the Tmg column.

In addition, you can see a Buy signal in the Fundamental or Fund column. Likewise, our computer is calculating a 17% return for 12 months and shown in the Implied Return column. Obviously, this calculation is after the big pop in price and includes the dividend. Our Model Portfolio just went to cash, so we can’t add LLY until the market turns back from bear to bull.

As you can see, all the stocks on the report below have a Buy signal in the Confirmed or Cfrm column.

LLY triggers our Confirm buy signal and appear on our daily “Confirm” report (StockCharts.com)

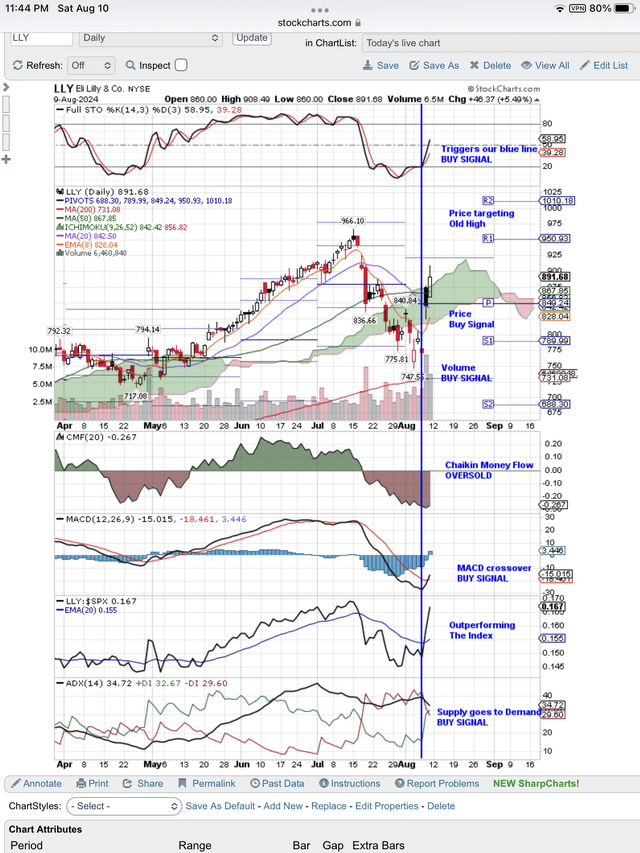

As you can see on the daily chart below, LLY has all of our technical Buy Signals. At the top of the chart is the signal that triggers our blue, vertical line, Buy Signal that goes down the whole chart. This is the Full Stochastic signal that we use to trigger our Buy Signal. Then we look for confirmation in the other signals, price being the most important.

The chart below shows the enormous pop in price, and that upward momentum is confirmed by volume. We think price is targeting a test of the recent high in price.

Below price is Chaikin Money Flow and you can see how the profit taking sent the price down to deeply oversold. Now money flow is turning up, and we expect price to now swing to becoming deeply overbought again.

Next is the MACD crossover Buy Signal. The bar chart shows the beginning of a Buy Cycle that we expect will last for weeks as price reaches for its old high.

Then comes the most significant signal for portfolio managers, and that is Relative Strength. It tells them whether LLY is back to beating the Index. The big jump up, tells you it is. However, because of the big price increase, many portfolio managers have too much LLY in their portfolio. When that happens, they have to sell stocks they love to reduce risk. That could slow this bounce, just as a bear market can.

At the bottom of the chart is the ADX signal. It gives you a color coded crossover Buy Signal. You can see Demand has taken control and is taking price higher. Likewise, Supply is dropping.

Here is the daily chart with all these Buy Signals:

LLY has all our technical Buy Signals and the bounce is targeting the old high (StockCharts.com)

Small investors, ETFs, hedge funds and traders are taking the price higher, and portfolio managers are selling into strength.

In all my years on Wall St., I never met a portfolio manager who did not do the due diligence, fundamental research and that is why our scoring system uses both fundamentals and technicals. However, we also have to do our fundamental due diligence by checking with SA analysts and the SA Quant scores.

The SA analysts have a Buy rating and also the Wall Street analysts according to SA. The SA Quant score is a Hold, but I expect with the latest earnings there might be an improvement in their Revisions score. We will see if that overcomes the poor SA score for Valuation. Of course, our SID score agrees with the SA Quant Hold rating, but we expect our SID score to go to a Buy again, just like our technical buy signals.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

To understand completely our fundamental and technical approach to making money in the stock market read my book “Successful Stock Signals” published by Wiley. This is the method that I taught to professional portfolio managers on Wall St. and now I share these secrets with you with 50 stock picking programs picking winners every day. You receive our daily email of stocks with Buy Signals before the market opens.